Show number 3 this week. Thank you for sticking with us.

We discuss:

- Will we get inflation or deflation from this crisis?

- When will you feel safe to fly again? How about a restaurant?

- Why life is going to be weird for a while

- The economy is going to be operating at partial capacity for a while

- When will sports stadiums have fans again?

- How bad have things been for millennials in their working lives?

- Are people better off than they were 4 decades ago?

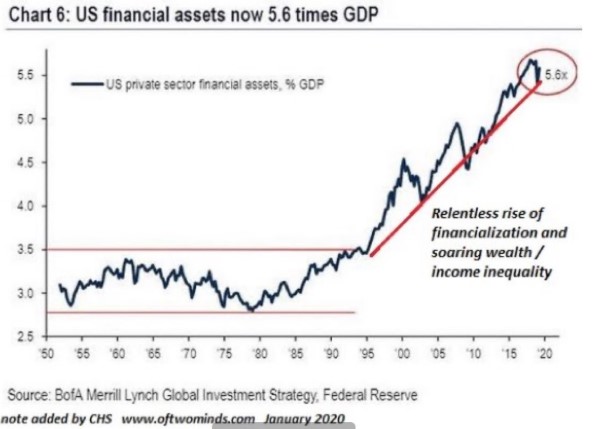

- Is there any way to fix wealth inequality?

- How many waves of layoffs will there be?

- Has the fiscal stimulus been a success so far?

- How does the gig economy get a bailout?

- Do we need to see the big tech firms get hit for another leg lower in the stock market?

- How do the corporate bailouts actually work?

- What if real estate prices don’t fall as much as we think?

- Why people should be negotiating all of their bills right now

- Are colleges in trouble?

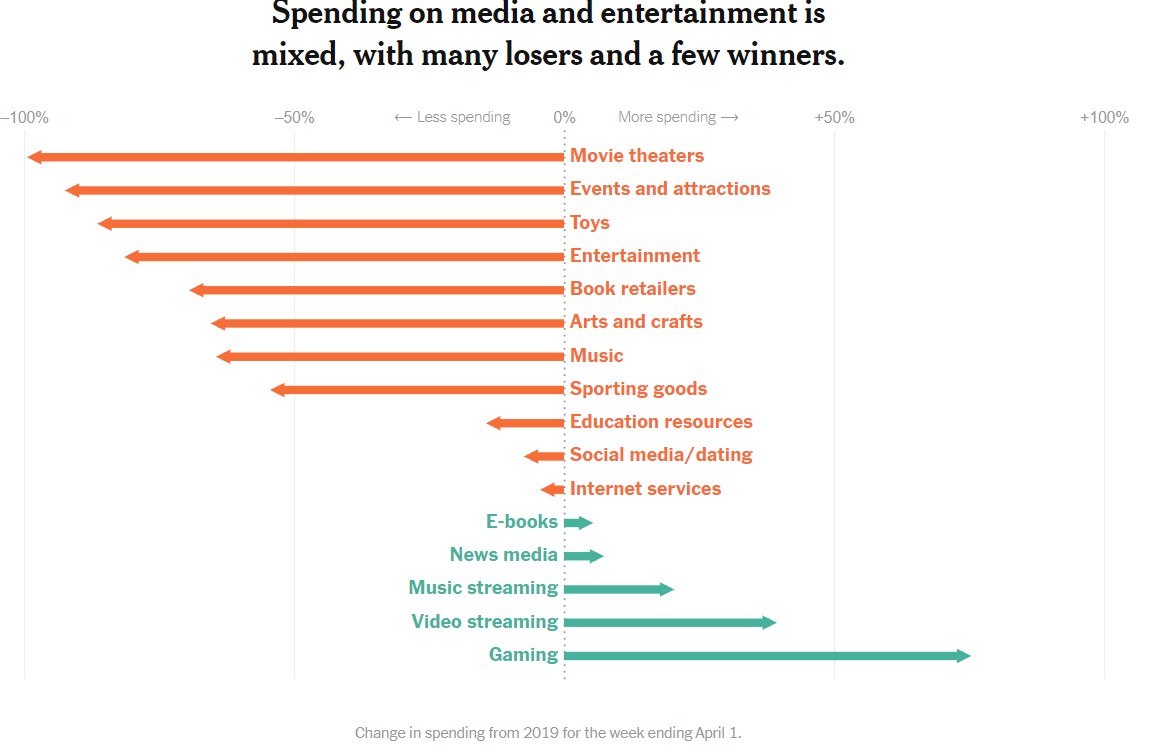

- Should Netflix be worth more than Disney?

- Why are we having weird dreams?

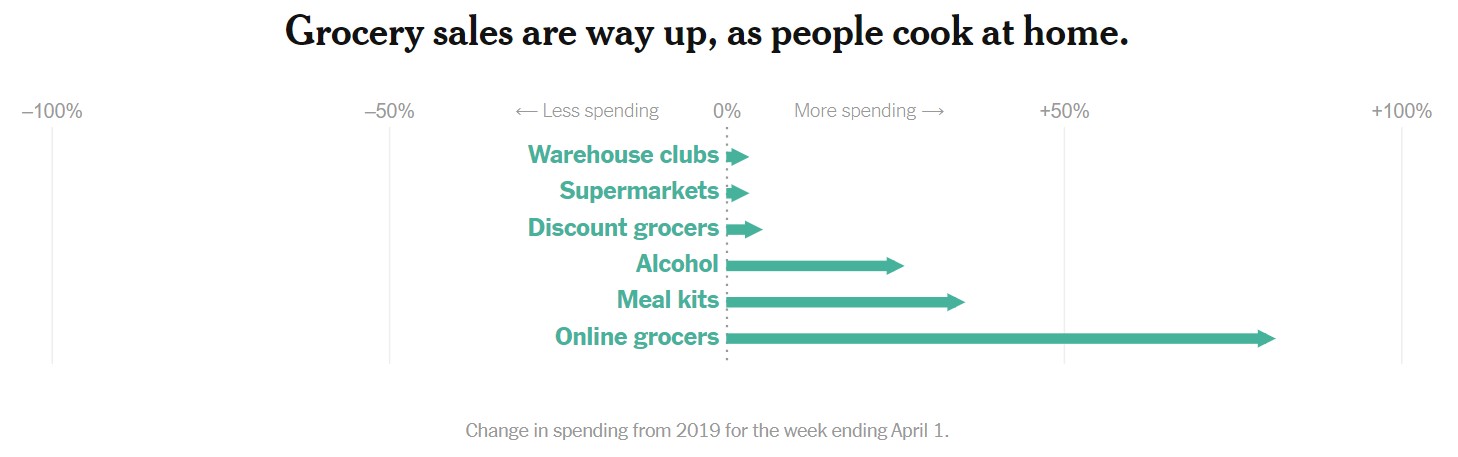

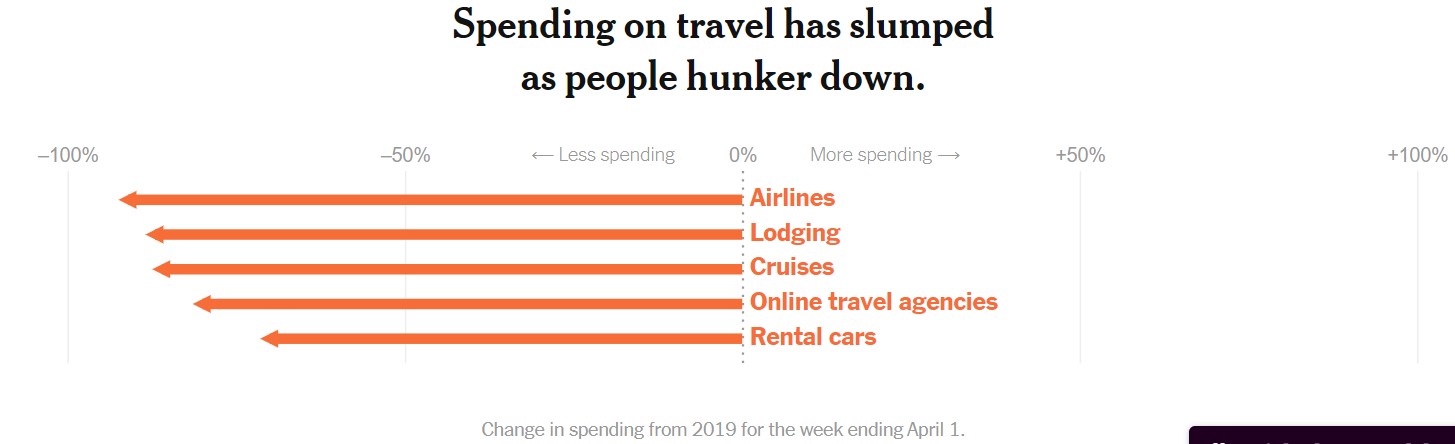

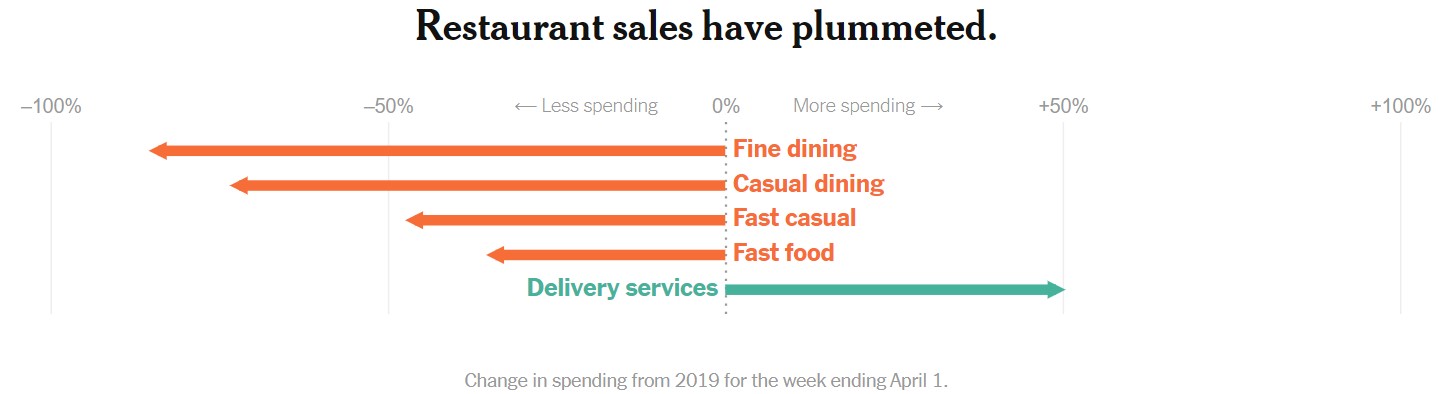

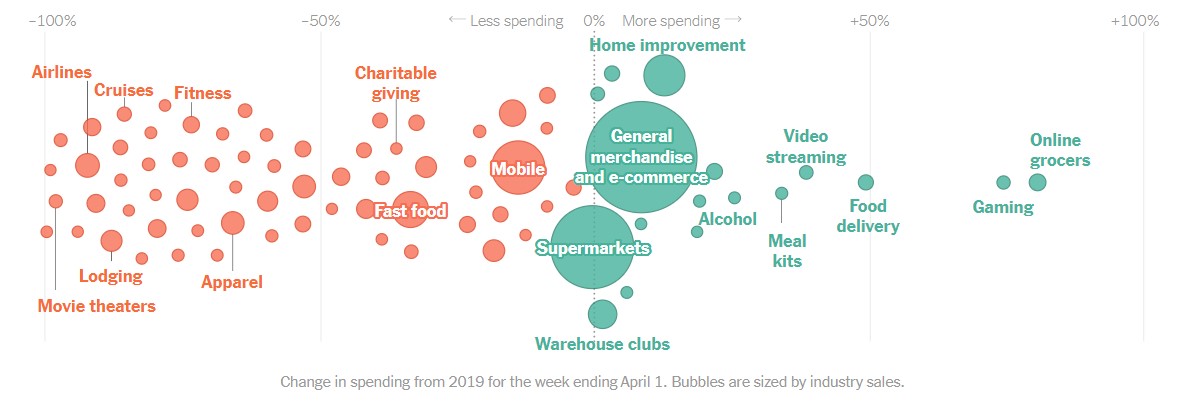

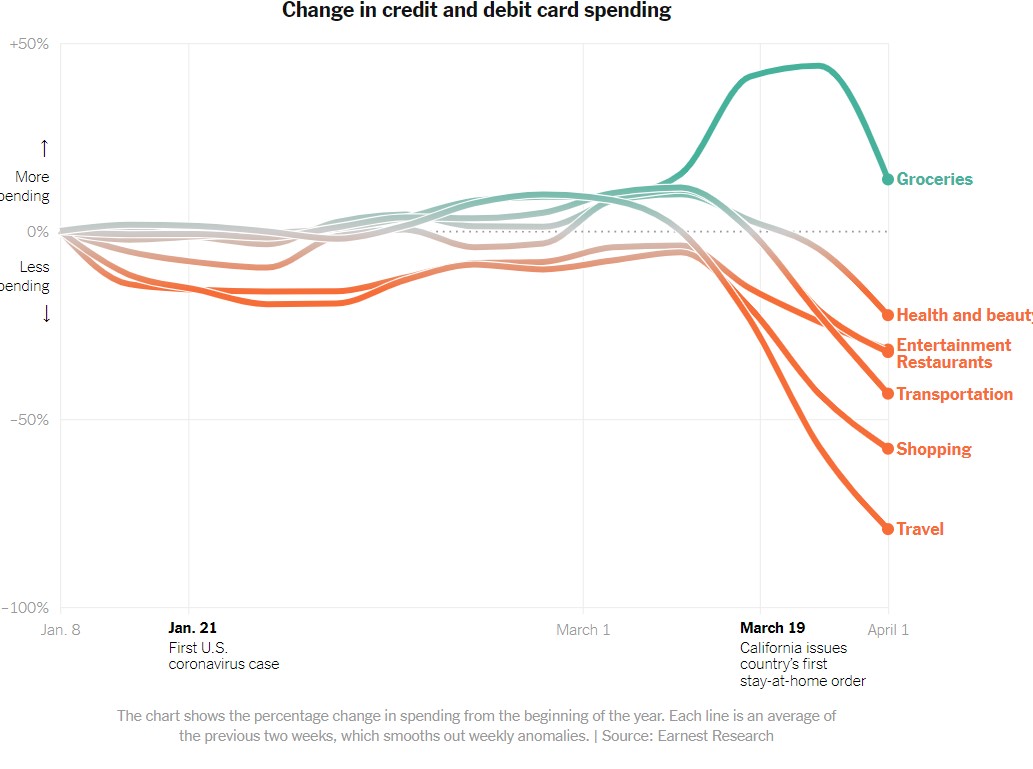

- How has the crisis impacted people’s spending?

- When will we feel safe to go back to the gym?

Listen here:

Stories mentioned:

- Knowledge of the future

- Millennials don’t stand a chance

- Even Facebook and Google may face an ad slump

- A second round of layoffs has begun

- American jobs collapse worsens

- Seattle’s real estate market continues to show up

- The sharp decline in housing activity

- College students demand coronavirus refund

- This is why we’re angry

- Rapid increase in missed mortgage payments

- Harvard nets nearly $9 million from CARES act

- The economy reopening will be fragile and slow

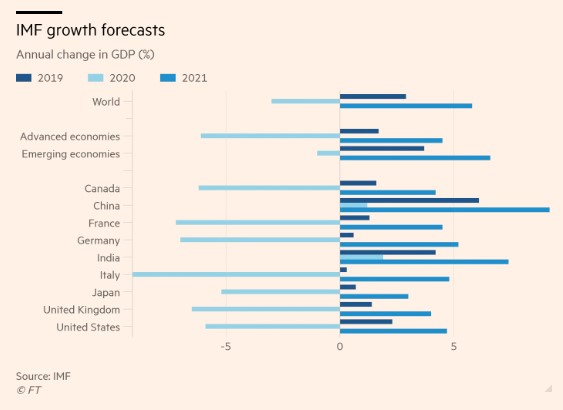

- Global economy to suffer worse than Great Depression

- Why people are having weird dreams

- How the virus changed the way Americans spend their money

- Airlines get billions in aid

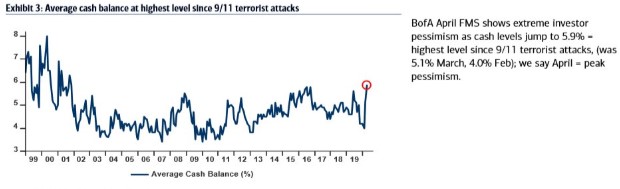

- Inside the story of CalPERs’ untimely tail unwind

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: