Personal finances can be overwhelming to most people when things are going well. All of the different accounts, saving options and investment vehicles can be confusing especially when you consider you’re completely on your own when it comes to learning about this stuff.

If personal finances are confusing during normal times, they can paralyze people during an economic crisis.

It’s hard to offer blanket advice to people during the best of times but right now there is such a wide range of financial hardship going on that it’s even more difficult to offer rules of thumb.

No piece of advice or perspective can help everyone but here are some thoughts on navigating your personal finances through what will likely be the worst economic collapse of our lifetimes:

Consider yourself lucky if markets are your biggest worry. If your biggest stress point at the moment is figuring out which asset classes or market sectors to invest in you’re doing better than most. I know there are retirees who are impacted by the stock market sell-off but every portfolio should be built with the understanding that bear markets are a fact of life when investing in risk assets.

I’m not certain about anything at the moment, but it’s possible the carnage is far worse in the economy than the stock market during this crisis. The vast majority of financial worries for most households have nothing to do with the S&P 500 right now.

Understand where your job stands. There may have been a 3 day window or so early in the quarantine where we all thought this could be a V-shaped recovery once we all went back to work. That is definitely not happening anymore.

Even when the stay-at-home orders are lifted, life will not go back to normal. It might be a long time until that happens. The economy may be “open” in the next few months but that doesn’t mean people resume their pre-quarantine lifestyle.

Many industries, businesses, and jobs are going to be impacted for the foreseeable future. Everyone needs to perform an honest assessment of where their job stands and how their business could be impacted by an economy that will continue to operate at less than full capacity for many months.

Some people won’t know for sure but chances are if your job has been disrupted by the shutdown, it could stay disrupted in some ways for a while.

Build up more cash. If your job falls in the zone of uncertainty you’re going to need a backstop. For most people an emergency fund with 6-12 months of expenses is a pipe dream. If you managed to pull that off beforehand you’re probably better off than 85% of the population right now.

For everyone else who is behind or starting from scratch, there are a few options.

One side effect of the stay-at-home orders and large number of business closures is the fact that many people aren’t spending as much money as they did before. If you have a good handle on where you were spending your money before, you can find ways to save that money now.

All of the money you’re not spending on clothes, shoes, gas, bars, restaurants, concerts, sporting events, travel, gyms, and other outside activities can be funneled into back-up savings.

We’re all likely spending more on groceries right now but the majority of variable, discretionary spending has ground to a halt for most people. Avoid cash leakage elsewhere beyond necessities and save this money if you can. If this thing lasts another 12-18 months you’re probably going to need it at some point.

Some people may need to cut back on their investing. Your future self may hate you for this but it doesn’t matter how your investments perform if you can’t put food on the table or pay your rent right now.

Some of us have less time on our hands now that we’re working from home and homeschooling our kids. Others have nothing but time. Either way, you need to get a better handle on your various fixed and variable costs to better understand where your money is going, but more importantly, where it’s not going anymore so you can use those areas to shore up any holes in a leaking ship.

Negotiate EVERYTHING. If you’re hurting financially at the moment, you should be negotiating every fixed cost in your budget. That means going through every bill you pay on a regular basis and calling those companies up to ask for some form of relief.

This list could include:

- Rent

- Mortgage (many banks are working with consumers to suspend payments for up to 3 months)

- Credit cards (ask for a lower monthly payment or interest charge)

Student loans(these are already suspended through September 30 so those savings should help)- Car insurance (many insurers are offering rebates or discounts on monthly payments)

- Car payments (a number of automakers are offering payment delays)

I’m sure I missed a few but these are the big ones. Find the contact numbers necessary and plead your case. You would be surprised how many of these places will work with you during this time.

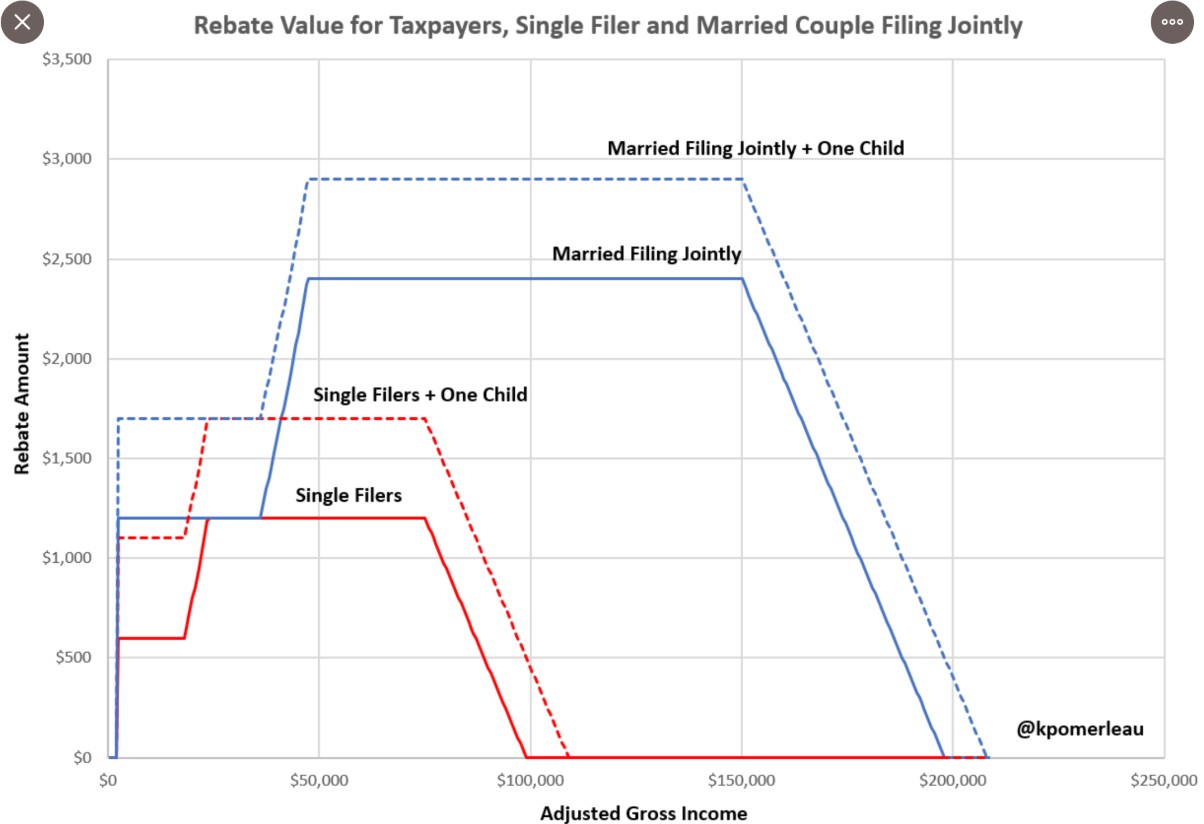

Unfortunately, you’re mostly on your own in many respects. The fiscal rescue checks for many people should be arriving this week. They won’t be enough for most people. I’m hopeful the government will send reinforcements but here’s what the outlay looks like depending on your circumstances:

Higher unemployment benefits (an extra $600/week for up to 4 months) should help but these are temporary stopgaps not long-term solutions.

Everyone’s financial situation is different right now ranging from devastation to difficult times to minor annoyances to little impact at all.

How you respond when it comes to your finances will have a lot to do with your personal circumstances. Having no plan going into the crisis puts you at a huge disadvantage but this could be with us for a while.

There are no easy answers in some cases but for others there is still time to get your finances in order to ride out the remained of the storm.

Further Reading:

Creating an Overreaction Plan for the Coronavirus