This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

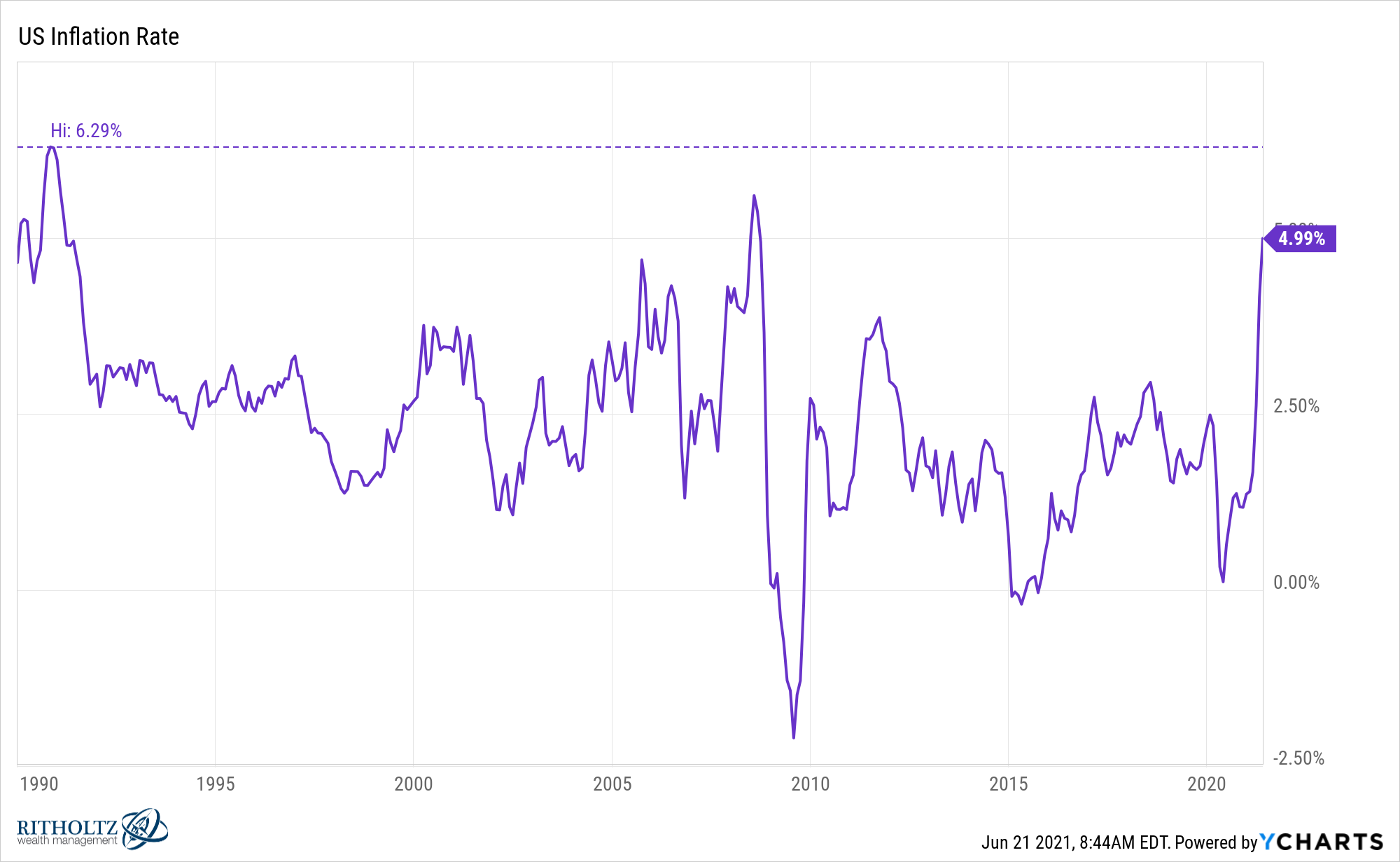

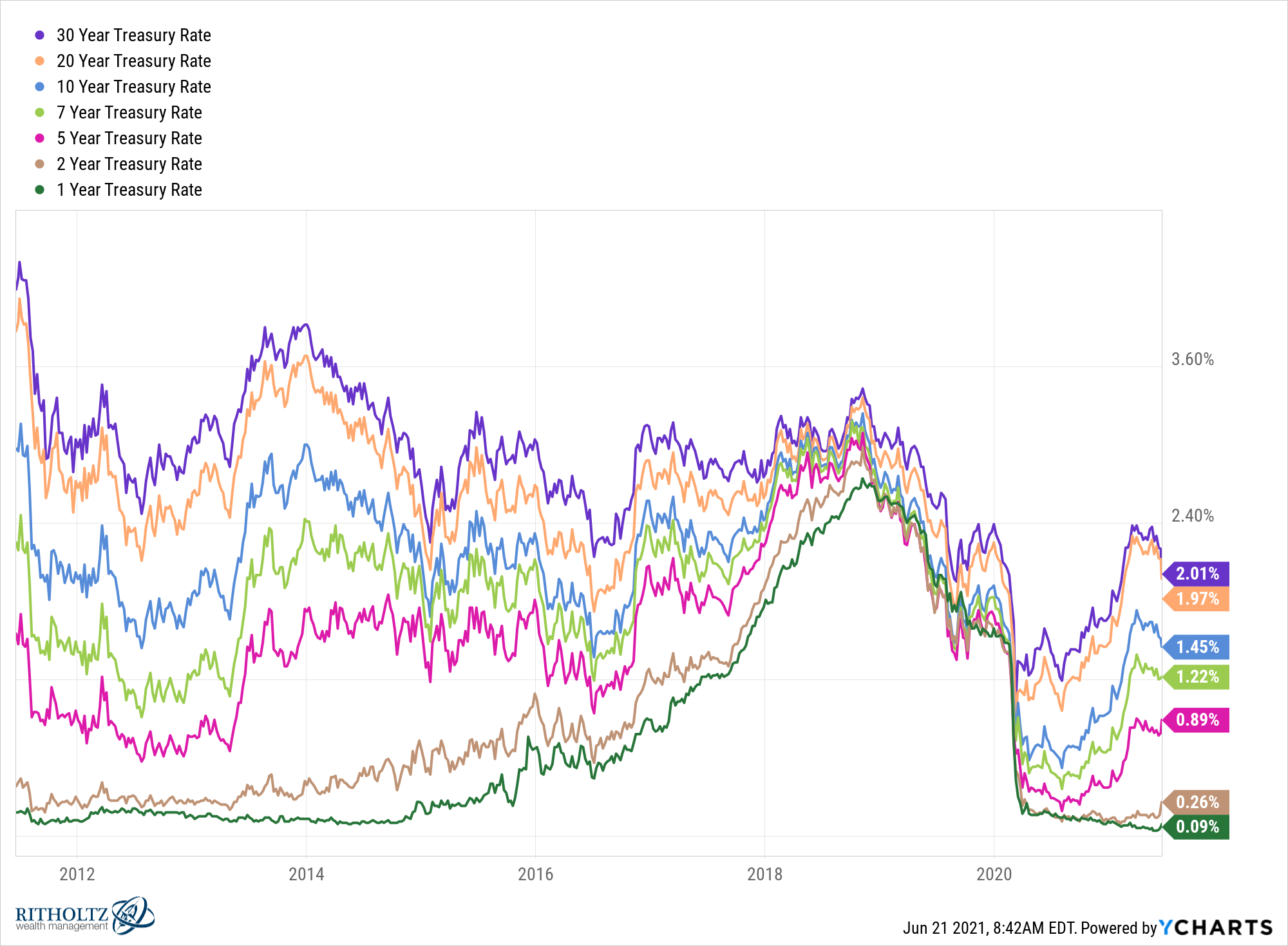

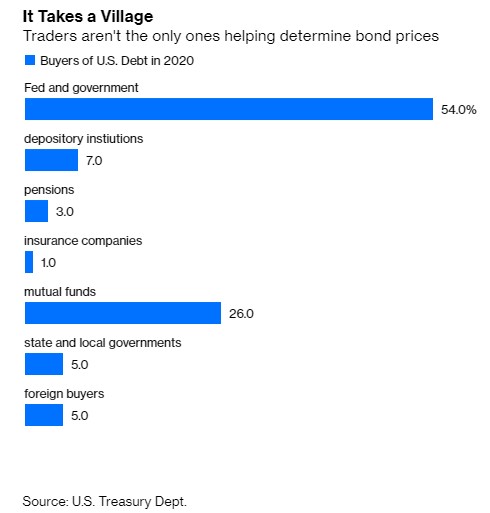

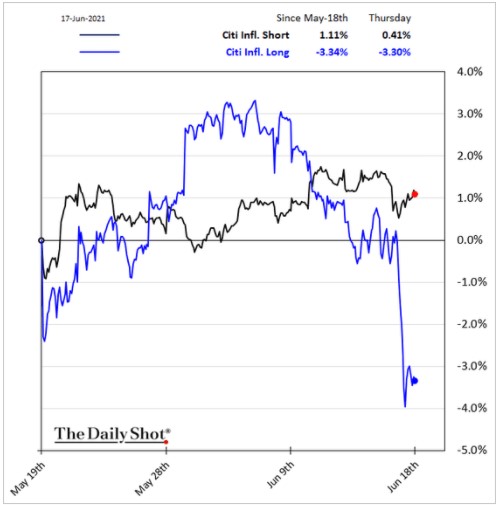

- Why are interest rates falling if inflation is rising?

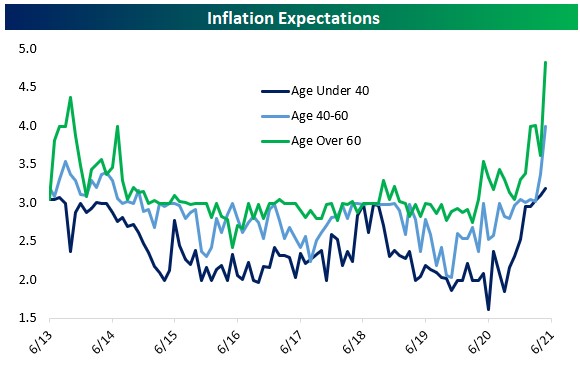

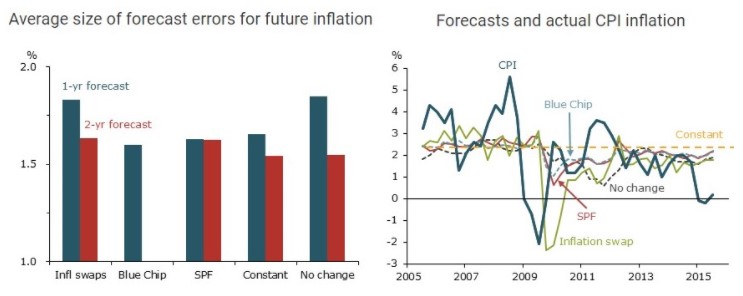

- No one can predict inflation, not even markets

- Inflation is personal and depends on your lifestyle

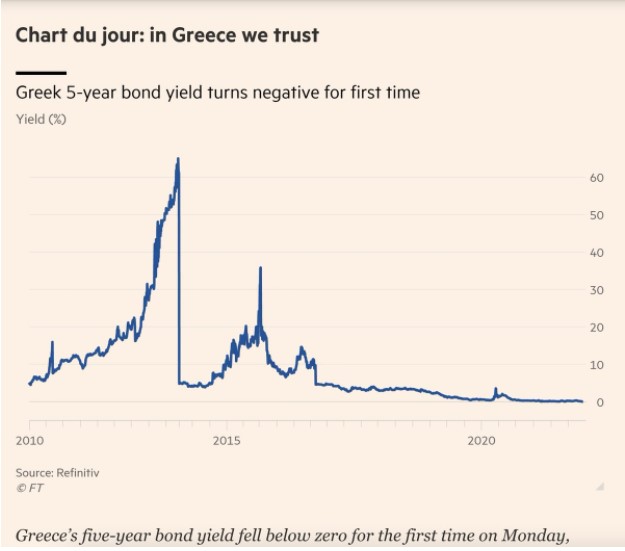

- Remember when people were worried the United States would become the next Greece?

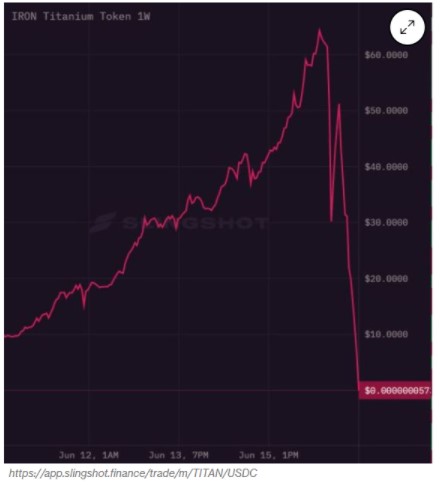

- Mark Cuban got wrecked in DeFi

- Is Coinbase correlated to the price of bitcoin?

- How to have an economic boom with low inflation

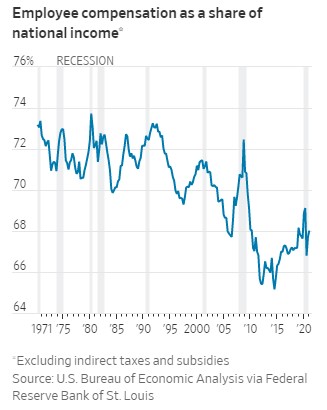

- Workers finally have the upper hand

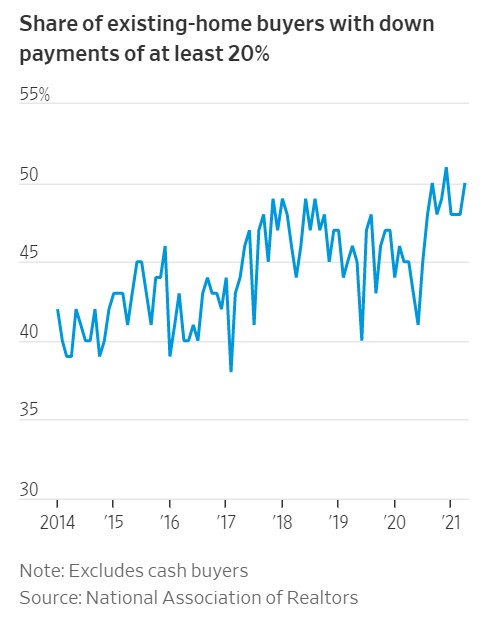

- How much do you need for a down payment?

- The pros and cons of taking a mortgage out from a family member

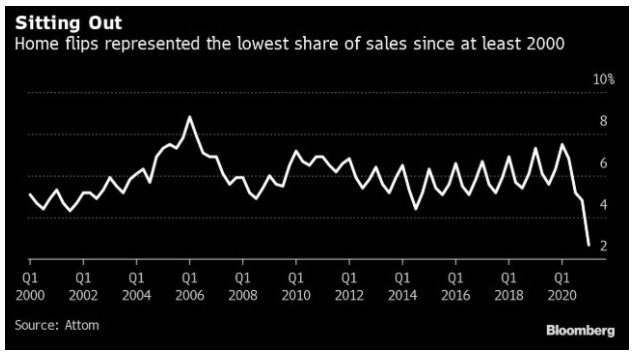

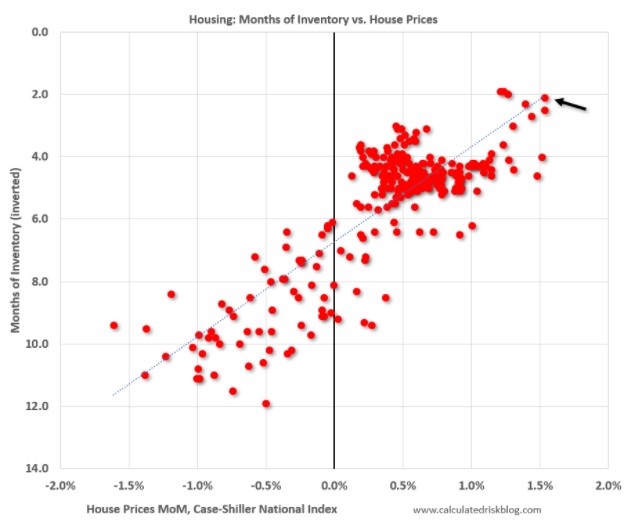

- Is rent about to explode higher?

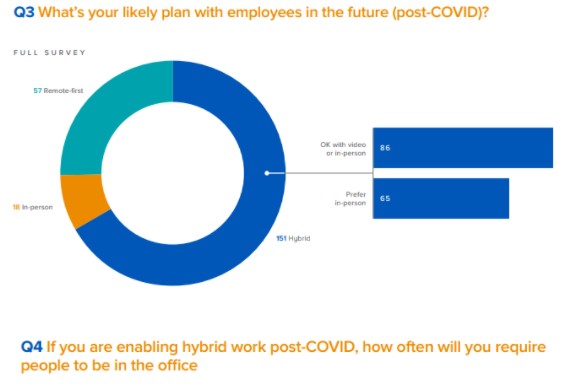

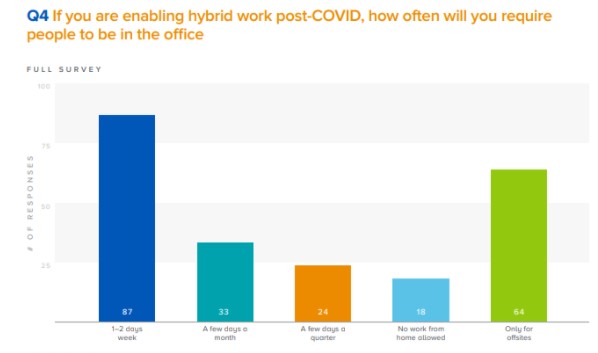

- Are we underappreciating the changes WFH is going to bring about?

- Why the journey is more important than the destination with your finances

- Paycheck-to-paycheck now has a new meaning

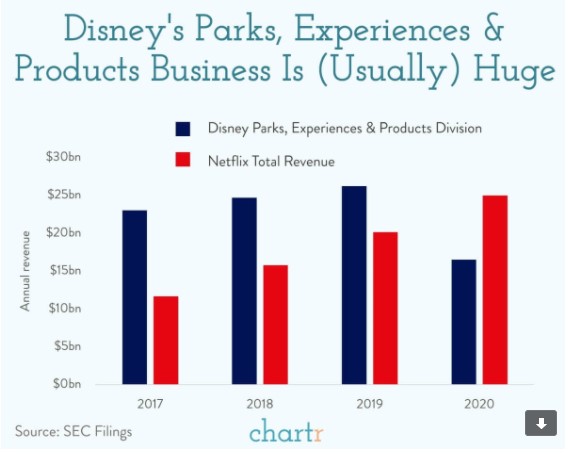

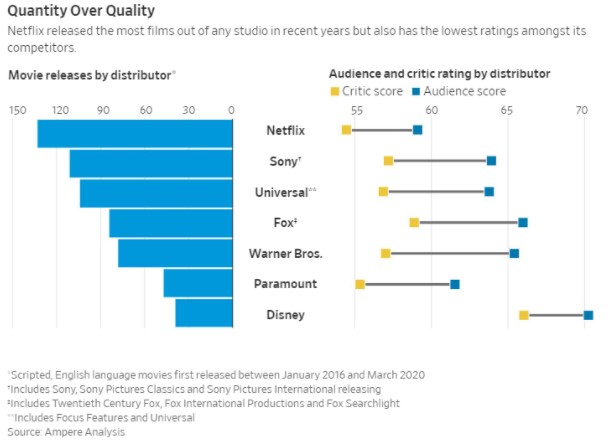

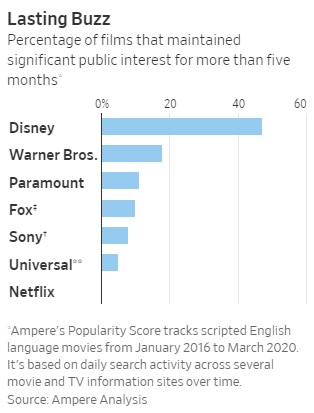

- Are iPads going to kill movie theaters?

Listen here:

Stories mentioned:

- Not even bond traders can predict the future

- Predicting inflation is hard

- There is no inflation. Yes there is

- Tight labor market returns the upper hand to workers

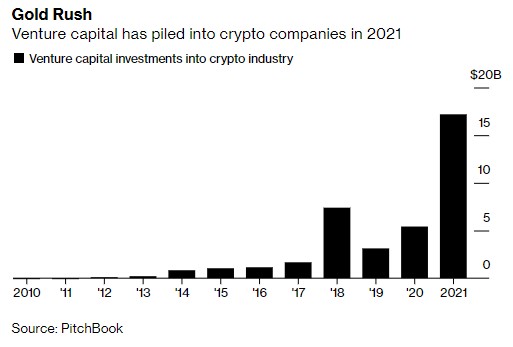

- Meme investing

- Mark Cuban missile crisis

- How to have a roaring 20s w/o wild inflation

- For many homebuyers a 5% down payment isn’t enough

- The best ways to tap your home equity

- Technology saves the world

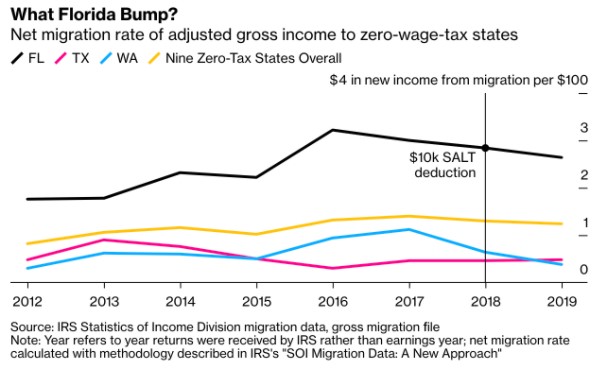

- SALT cap confounds doomsayers

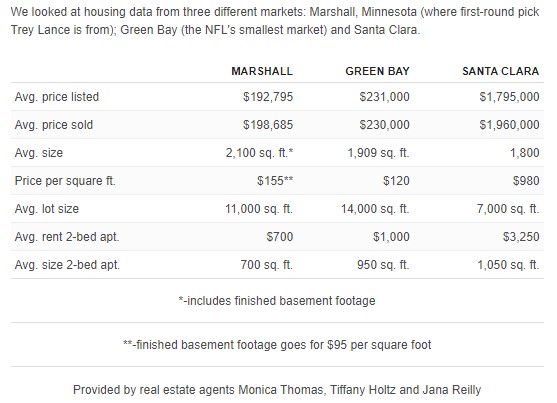

- 49ers rookies warned about bay area housing

- The United States isn’t going back to February 2020

- The housing conundrum

- Don’t win the game too early

- 60% of millennials earning over $100k say they’re living paycheck to paycheck

- Movie studios are making more movies than ever

Podcasts mentioned:

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: