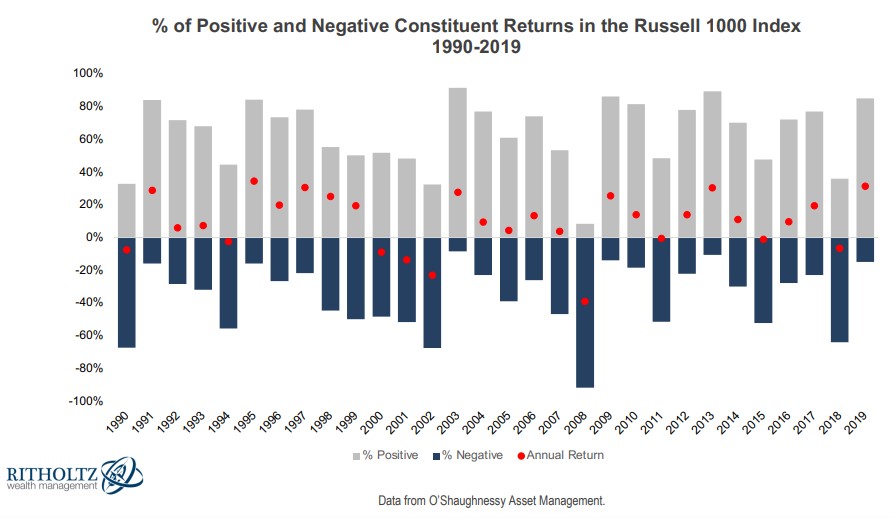

When the stock market is at all-time highs but the stocks you own are getting crushed.

When the stock market is at all-time highs but the stocks you own are getting crushed.

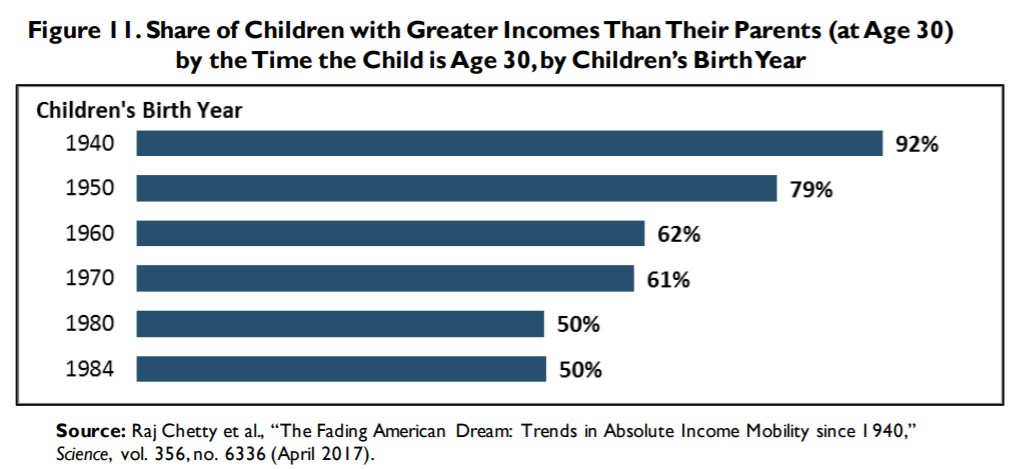

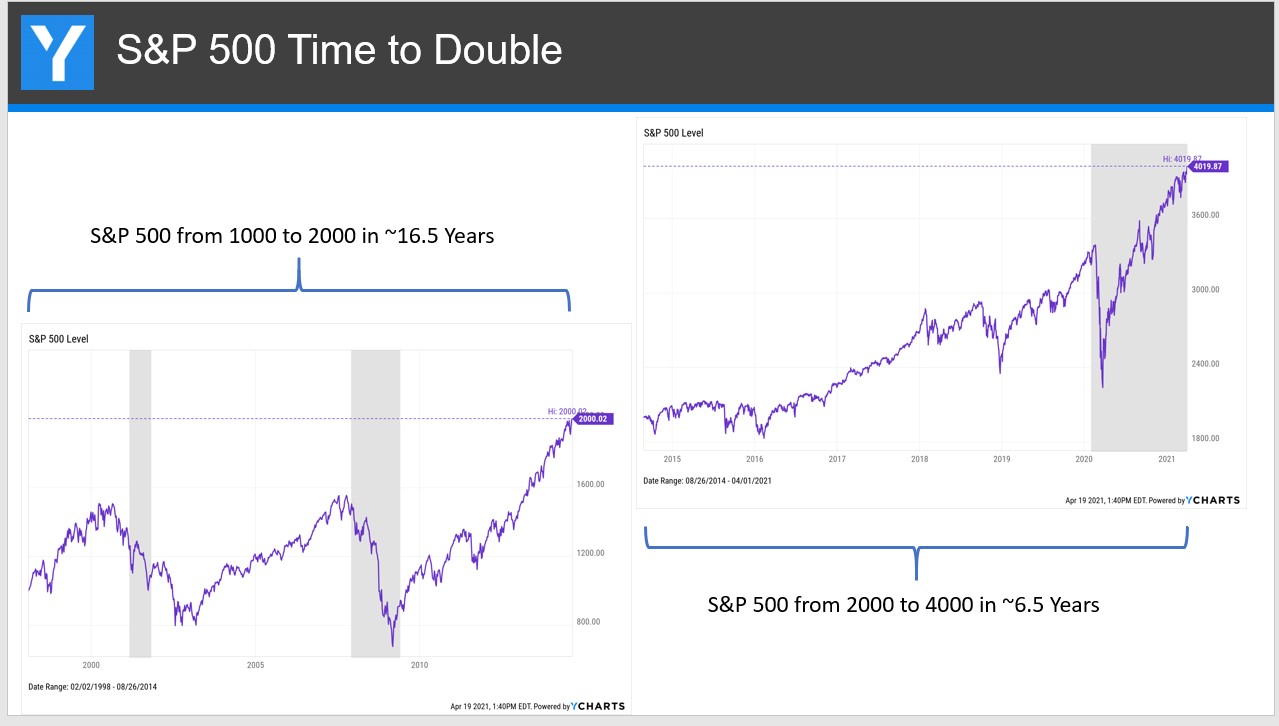

Is Charlie Munger right about it being harder for millennials to get rich?

10 things investors spend too much time worrying about.

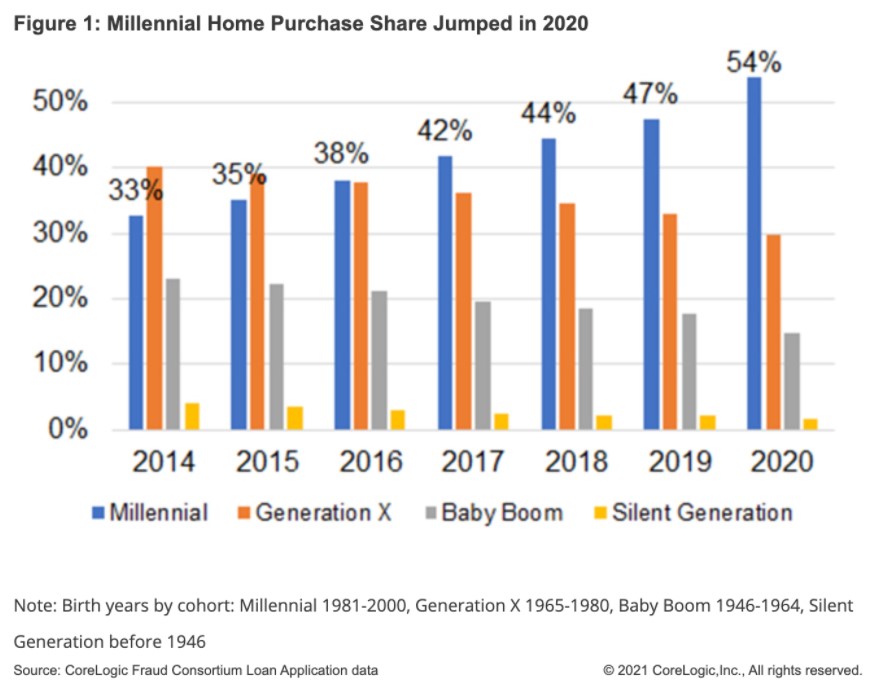

Michael and I discuss unreal results from the tech giants, millennials buying more homes, Bill Murray stories and more.

5 questions to ask yourself if you’re sitting on big gains in your portfolio.

What if your advisor is waiting to buy the dip on your behalf?

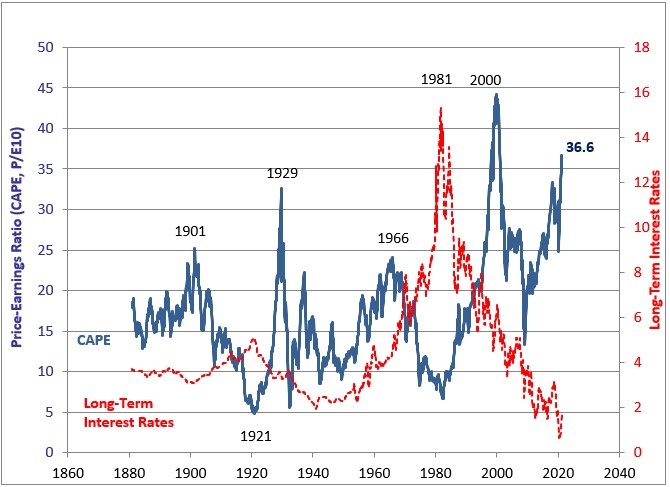

Why valuations are even harder than ever to use to handicap markets.

Why I lease my car.

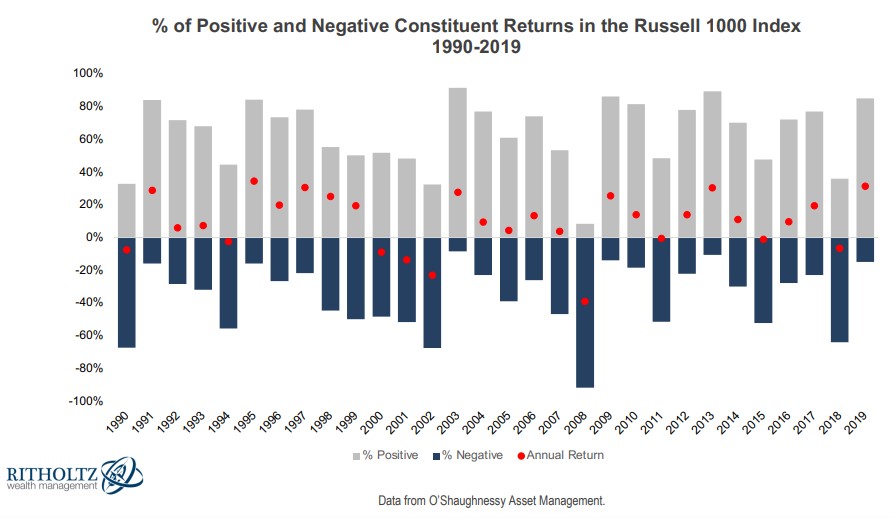

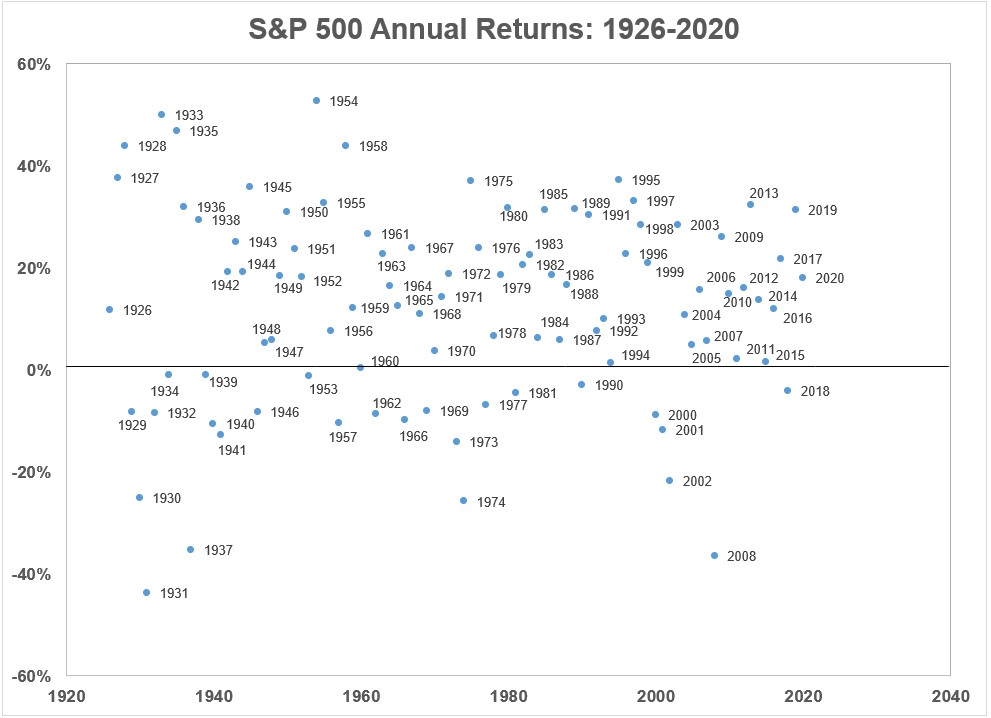

A reader asks: Ben, I believe you have written at least once about how surprisingly few times the stock market has grown near its long-term average in a given year. In other words, its typical annual returns are well above its long-term ~10% average, or well below. I’m searching for it on your blog site…

This week’s Animal Spirits with Michael & Ben is supported by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. If you’re looking for a new job at a fast-growing investment research firm, YCharts is hiring. We discuss: Why would you use leverage to trade crypto? Why making a…