Today’s Animal Spirits is presented by Masterworks:

Go to Masterworks.io to learn more about investing in the art market.

We discuss:

- The roommate theory of the Internet

- The 5 big tech stocks are unbelievable companies

- Why the stock market should be in a bubble right now

- Would the stock market be higher if crypto didn’t exist?

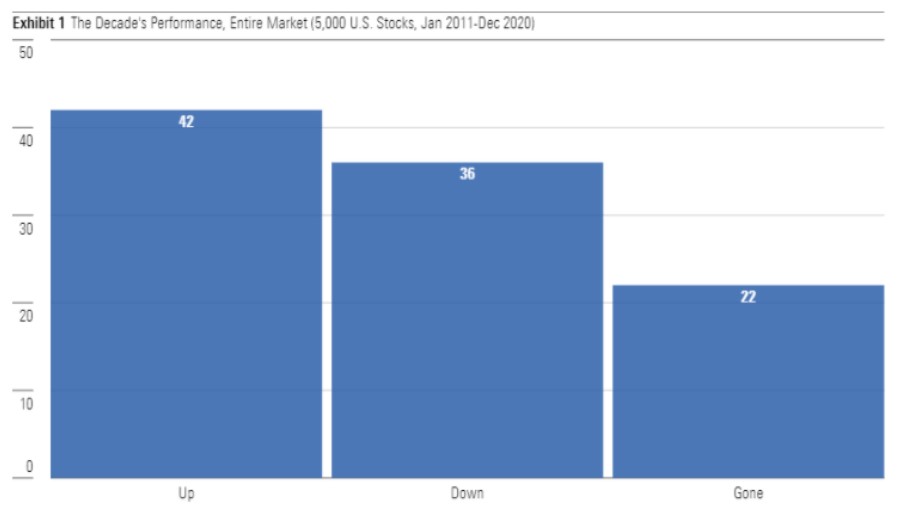

- Picking stocks is harder than you think

- The pros and cons of Robinhood

- Will Robinhood be bigger than Coinbase? How about Charles Schwab?

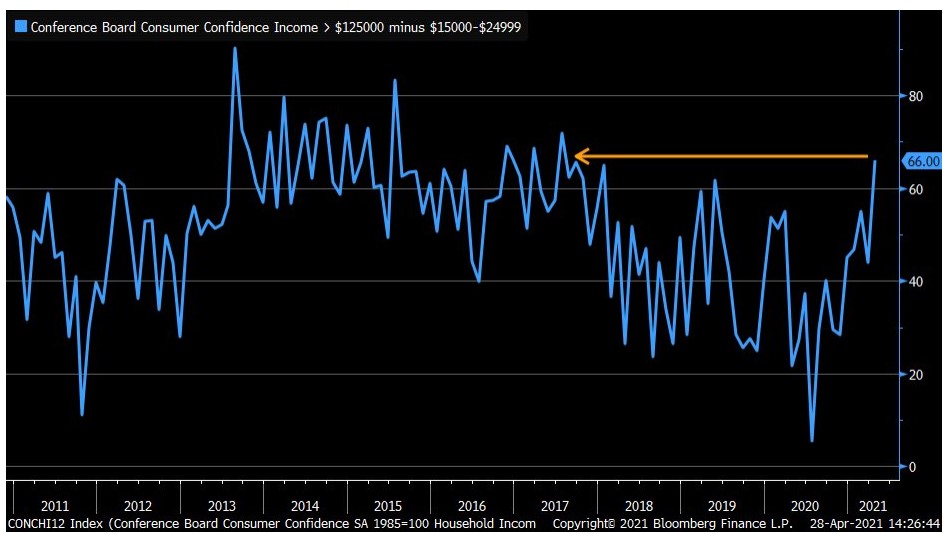

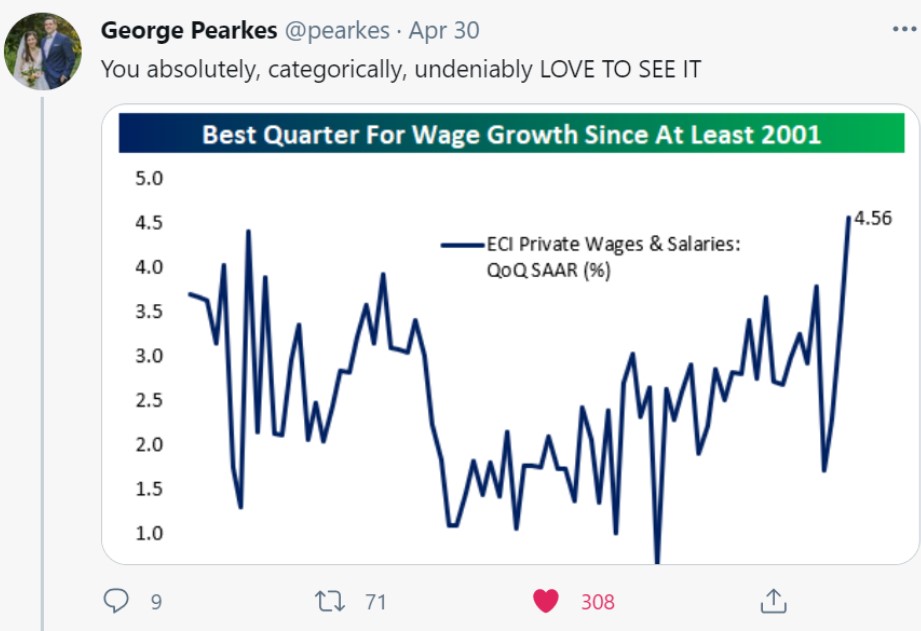

- If you want people to save more money then pay them more money

- Restaurants are going to be forced to pay higher wages

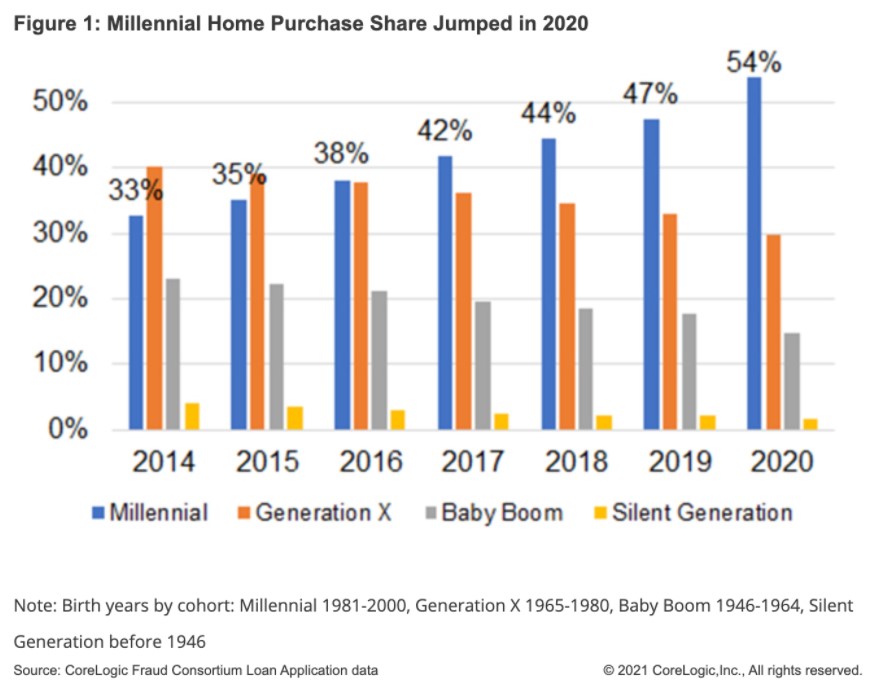

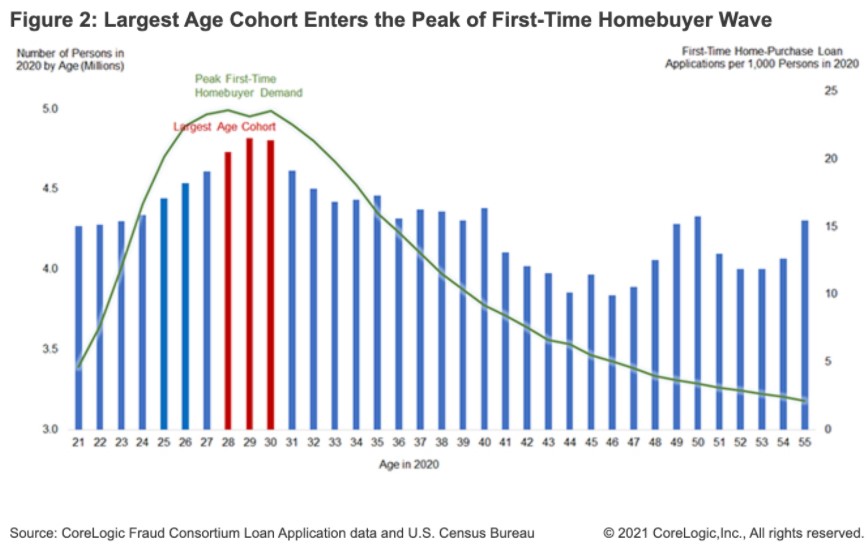

- Millennials are buying houses

- Why aren’t banks doing HELOCs right now?

- Will it be harder for millennials to get rich than their parents?

- Where to park your savings for a house down payment

- Bill Murray stories and more

Listen here:

Stories mentioned:

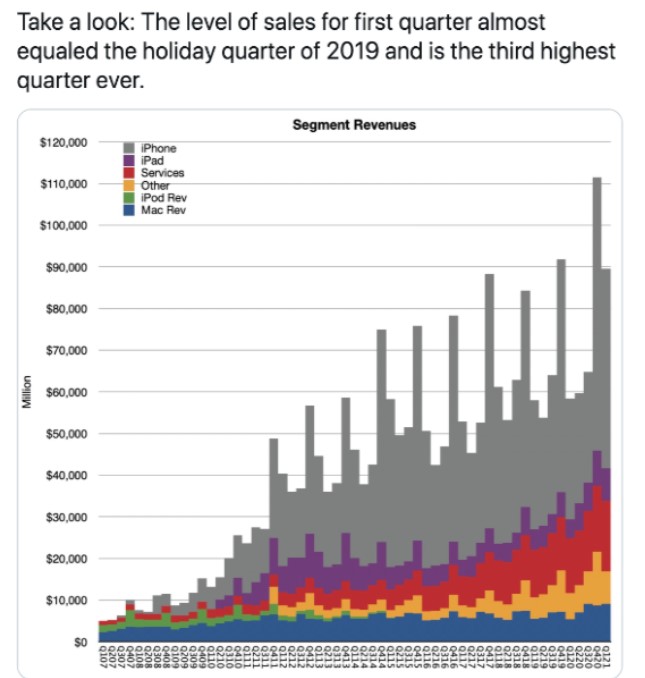

- Apple is on fire

- Bonkers dollars for big tech

- Do stocks outperform t-bills?

- The worst year ever for trading

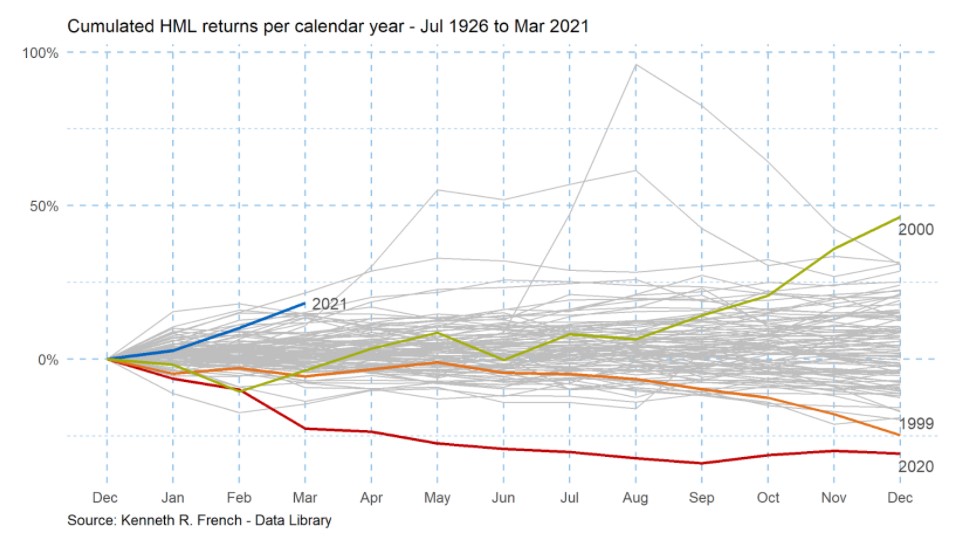

- How many stocks beat the indexes?

- Robinhood has a customer service problem

- Robinhood is snapping up financial advisors

- Investors are still returning to movie that defined 2008 crisis

- Verizon explores the sale of media assets

- TikTok is the place to go for young adults for financial advice

- U.S. companies scramble to meet demand

- Pokemon card crisis

- Millennials lead the pack for home purchases

- Homeownership rate pulls back from 11 year high

- The most important number of the week

- Why home equity loans are still hard to come by

- Rush to retire by affluent Americans

- A year of disruption in private markets

- Fried chicken shortage

Books mentioned:

Podcasts mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: