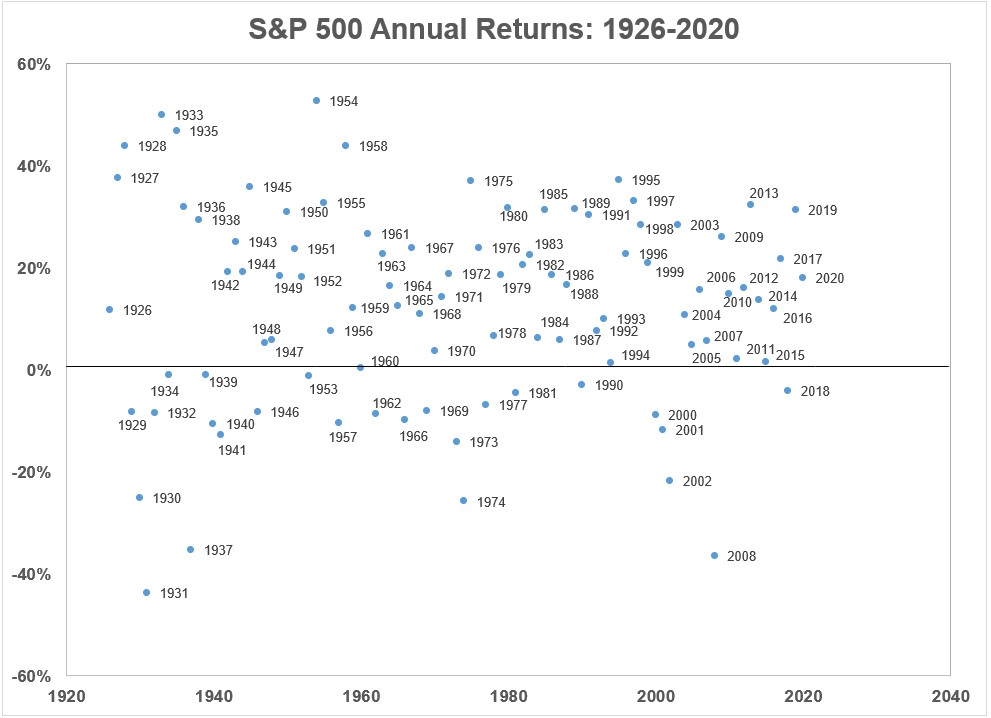

A reader asks: Ben, I believe you have written at least once about how surprisingly few times the stock market has grown near its long-term average in a given year. In other words, its typical annual returns are well above its long-term ~10% average, or well below. I’m searching for it on your blog site…