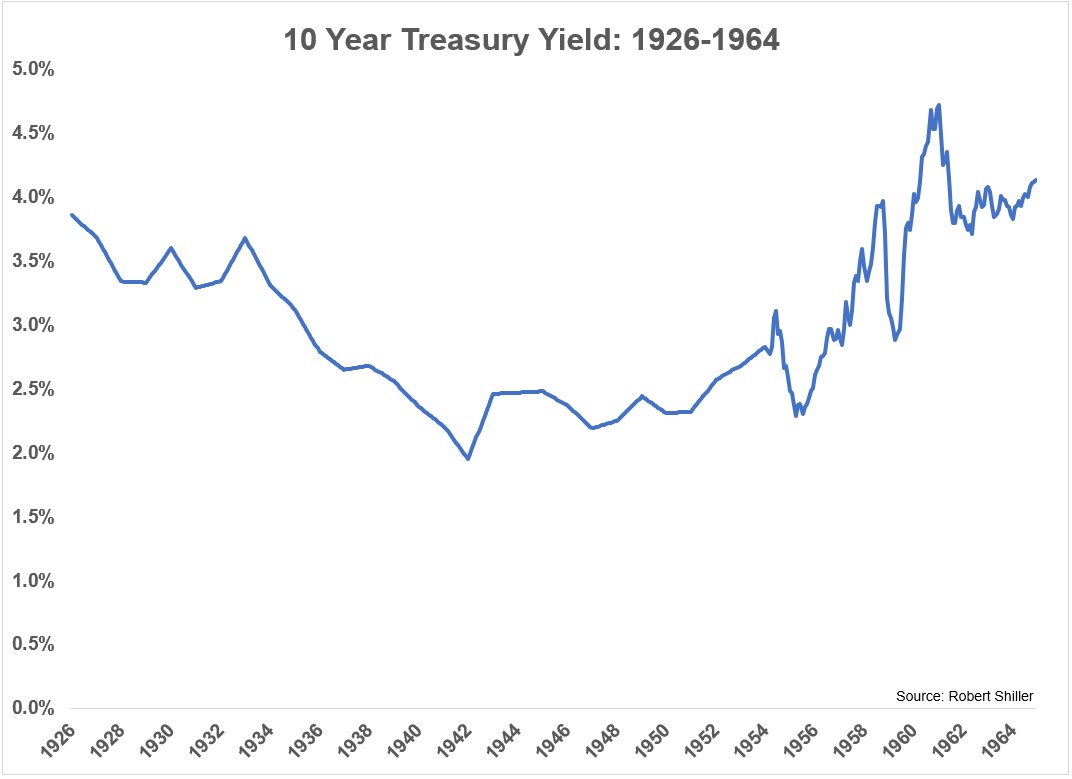

Why it’s going to be hard for the government to allow interest rates to rise substantially from here.

Why it’s going to be hard for the government to allow interest rates to rise substantially from here.

My theory on why bear markets could be different going forward.

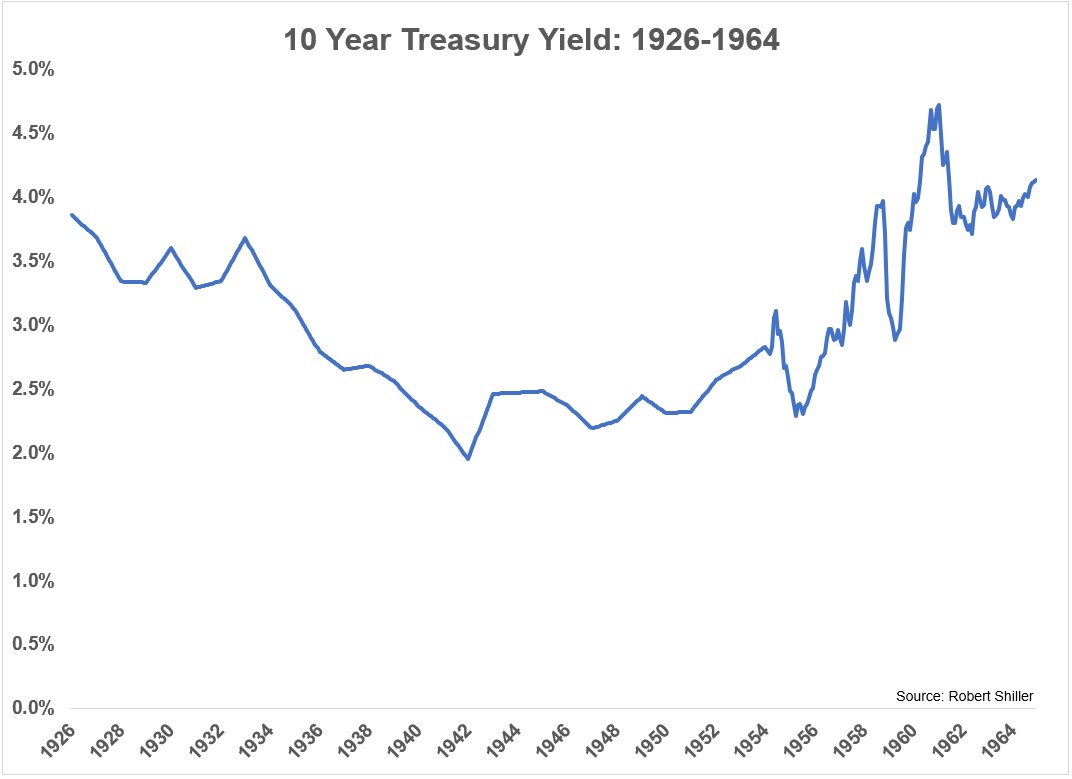

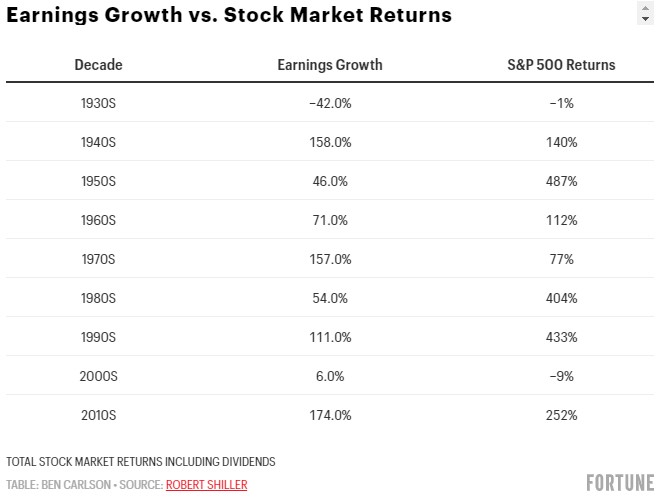

Does the market always follow earnings growth or lack thereof?

What the history of money market funds could have to say about stablecoins.

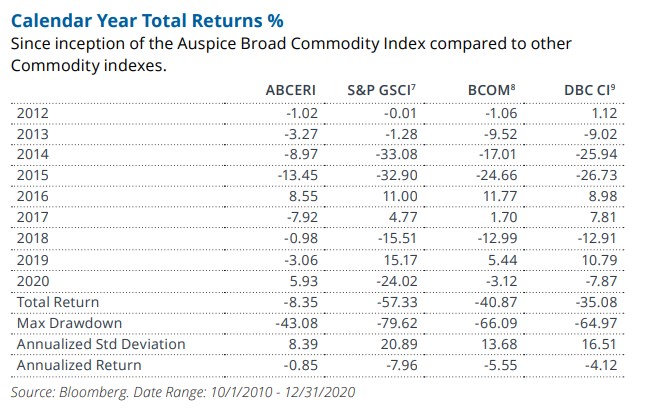

Michael and I spoke with Ed Egilinsky about the prospects for a commodity supercycle.

3 questions I’m thinking about this week.

Michael and I discuss SPACs, double bubbles, Mare of Easttown and more.

Wealth means different things to different people. Some people assume wealth is the amount of money you have in the bank or your investment portfolio. Others judge wealth based on the number of material possessions you’re able to buy. Then there are those people who figure only those with a high enough income can be…

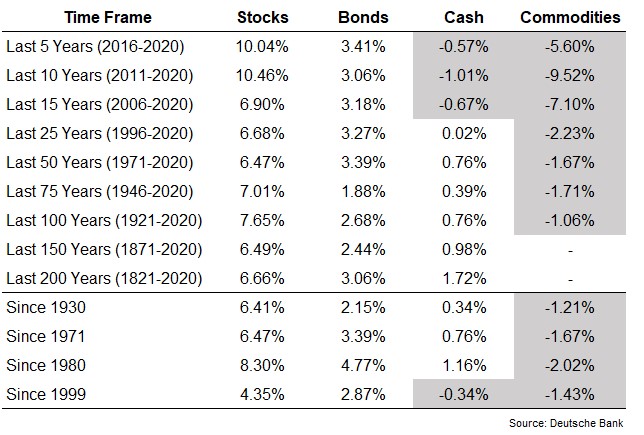

I’m a sucker for historical market data. I know, I know. It doesn’t help you predict the future but it can help shape your expectations to allow you to emotionally prepare for a range of outcomes. This week someone sent me this Long-Term Asset Return Study done by Jim Reid and team at Deutsche Bank that…

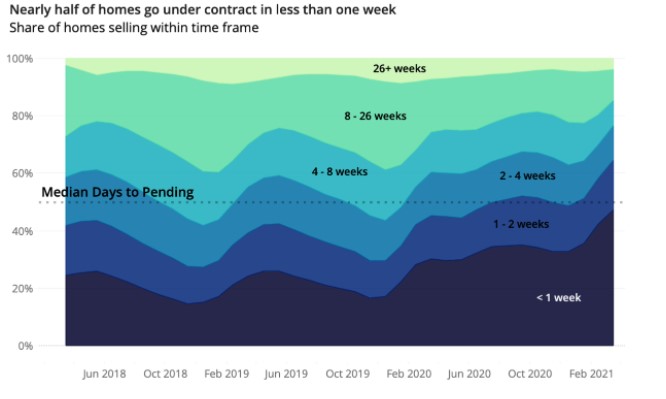

The worst buyer’s market in history.