Markets felt like they were upside down last year. After the initial Corona plunge, the economy and the pandemic kept getting worse but the stock market kept going up.

Lo and behold, the stock market looked across the valley and it was right. By the time the vaccine was here we were already back at all-time highs.

Corporate earnings understandably took a tumble last year during the worst GDP quarterly print since the Great Depression. Now they’re roaring back just like stocks did.

Does this mean the stock market will follow? So far the market remains strong this year (the S&P 500 is up more than 13% through Friday’s close).

But just as last year markets were upside down, it’s not always a foregone conclusion stocks follow earnings growth in the short-term.

Here’s a piece I wrote for Fortune on the relationship between stocks and earnings growth.

*******

Legendary investor Benjamin Graham once said, “In the short-run the stock market is a voting machine but in the long-run it is a weighing machine.”

The basic idea here is the stock market can be wildly inefficient in the short-term but over the long-term it tends to follow fundamentals.

One of the most important fundamentals when it comes to the stock market is earnings. For instance, over the past 80 years the S&P 500 has returned roughly 11% per year. In that same time corporate earnings have grown at more than 6% per year. The remaining returns have come from the dividend yields and multiple expansion so earnings provide the bulk of returns for stocks in the long-term.

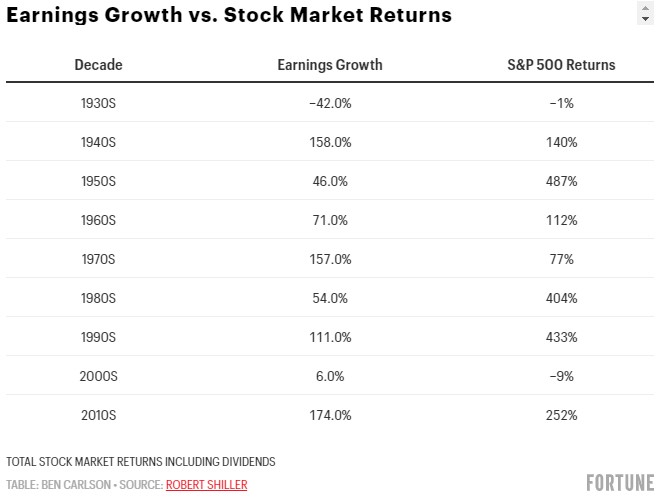

But this relationship is often inconsistent, even over decade-long periods. The following shows earnings growth and total S&P 500 returns by decade going back to the 1930s:

There are times where this relationship looks strong. The 1930s saw earnings get decimated and that was reflected in poor stock market returns. The same was true in the lost decade of the 2000s. In the 1970s, earnings handily outpaced the stock market because inflation was so high.

Then you have decades like the 1940s, 1960s and 2010s where earnings growth and stock market returns were in line with one another. This relationship breaks down even more the shorter your time frame. Earnings growth over any one year period may not tell you much about what’s going to happen in the stock market. That could be true more than ever in the current market environment.

JP Morgan recently put out a research note saying, “At the start of the year, 2021 US earnings expectations were $175 per share. They are now $196 per share and operating leverage suggests they may rise higher than that.”

This is a big leap from year-end 2020 earnings of around $94 per share. Granted, those earnings were depressed from the pandemic but $196 a share would still be more than 40% where things finished in 2019 before COVID threw a wrench into the economy.

When you combine massive earnings growth with perhaps the fastest economic growth in decades, the stock market should be primed for further gains, right?

Not so fast.

It is possible investors will continue to bid up stocks with fundamentals but it doesn’t always work so neatly in the markets. Look no further than last year to see this in action. Earnings fell more than 30% in 2020 yet the S&P 500 actually rose 18%. Or how about the opposite situation when earnings were up 20% in 2018 but the stock market fell more than 4% on the year. In 2015, earnings were down more than 15% yet stocks finished the year up nearly 2%. I could go on.

Going back to 1930, year-over-year earnings growth for the U.S. stock market has been positive in 60 out of 91 years. But the majority of the time when earnings were down, the stock market was actually up in that time. In 24 out of 31 years where earnings fell from one year to the next, the stock market was positive on the year.

Alternatively, more than 1 out of every 4 years which saw corporate earnings grow, the stock market finished the year with a loss.

Obviously, the stock market is meant to be a forward-looking indicator, so it would make sense earnings growth and stock market returns don’t always move in lockstep with one another.

It’s also interesting to note how the stock market has dealt with periods of high earnings growth in concert with high inflation in the past, since inflation is a topic on everyone’s mind right now.

From 1971-1974, earnings for the S&P 500 grew nearly 75% yet in that time the stock market actually fell 8% in total. Earnings were up 27% in 1973 while the S&P 500 dropped 15%. In 1974, earnings were up an additional 9% while the S&P 500 cratered almost 27%. Inflation was much higher in the 1970s than it is today but this shows how it’s possible for fundamentals to detach from the stock market in a big way at times.

Corporations could experience massive earnings growth in 2021 but there’s no guarantee the stock market will match those gains.

This piece was originally published at Fortune.