Some thoughts on housing and Black Friday.

Some thoughts on housing and Black Friday.

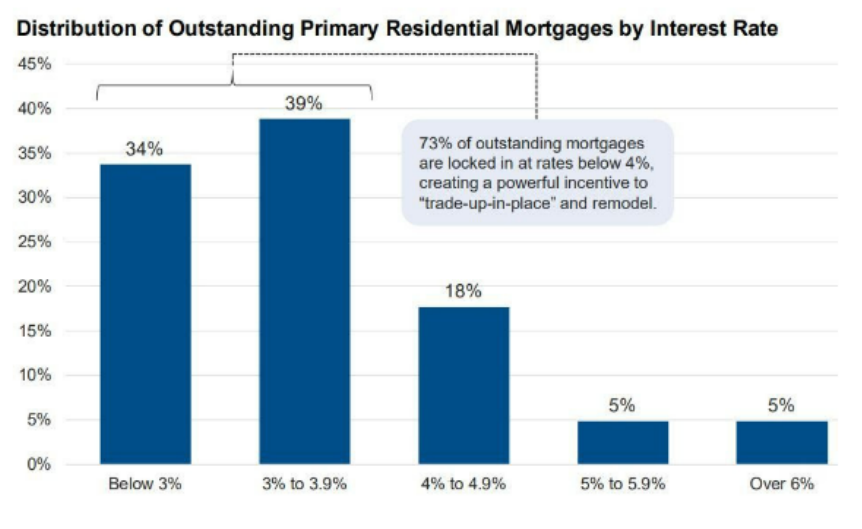

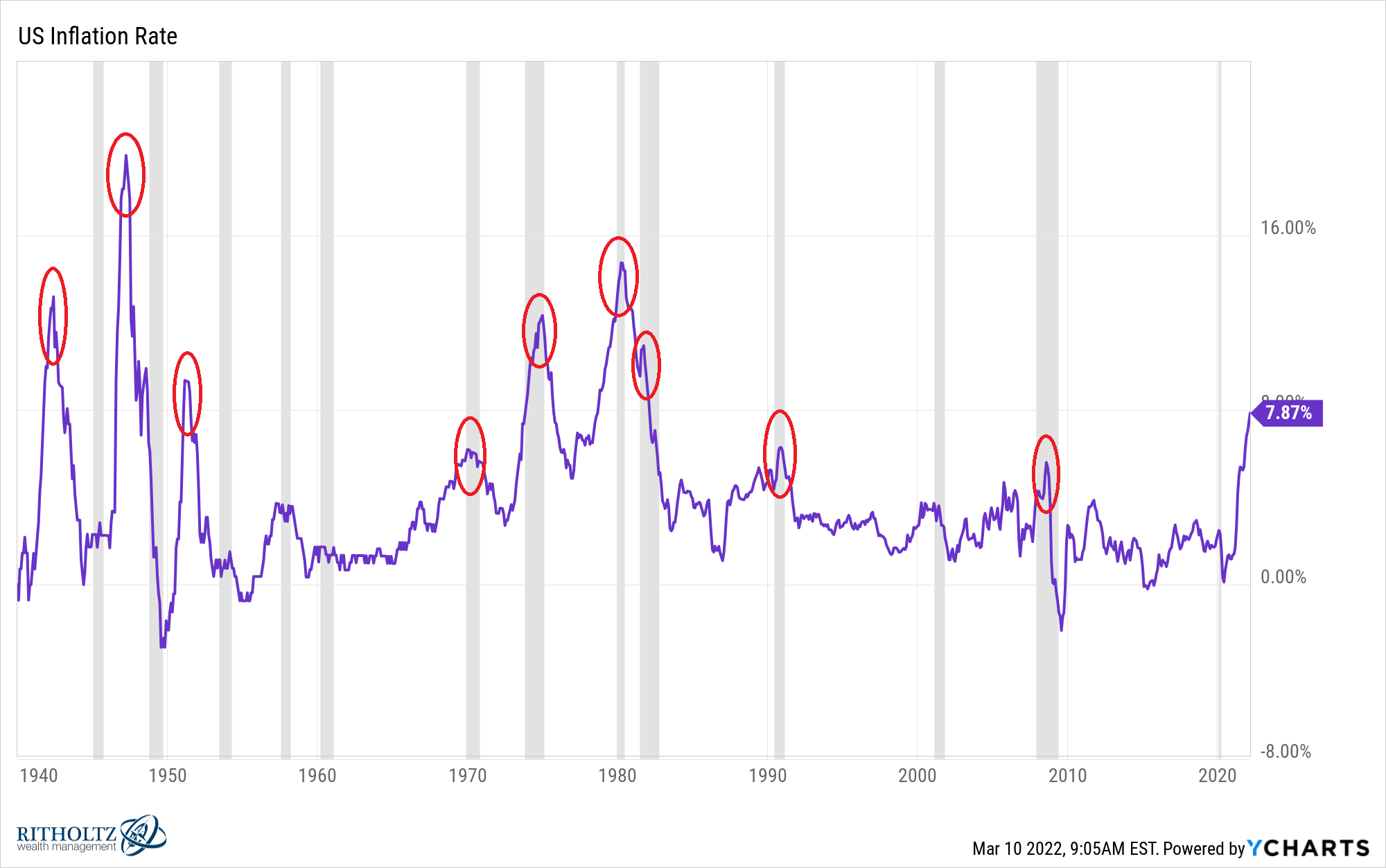

Why are TIPS down this year?

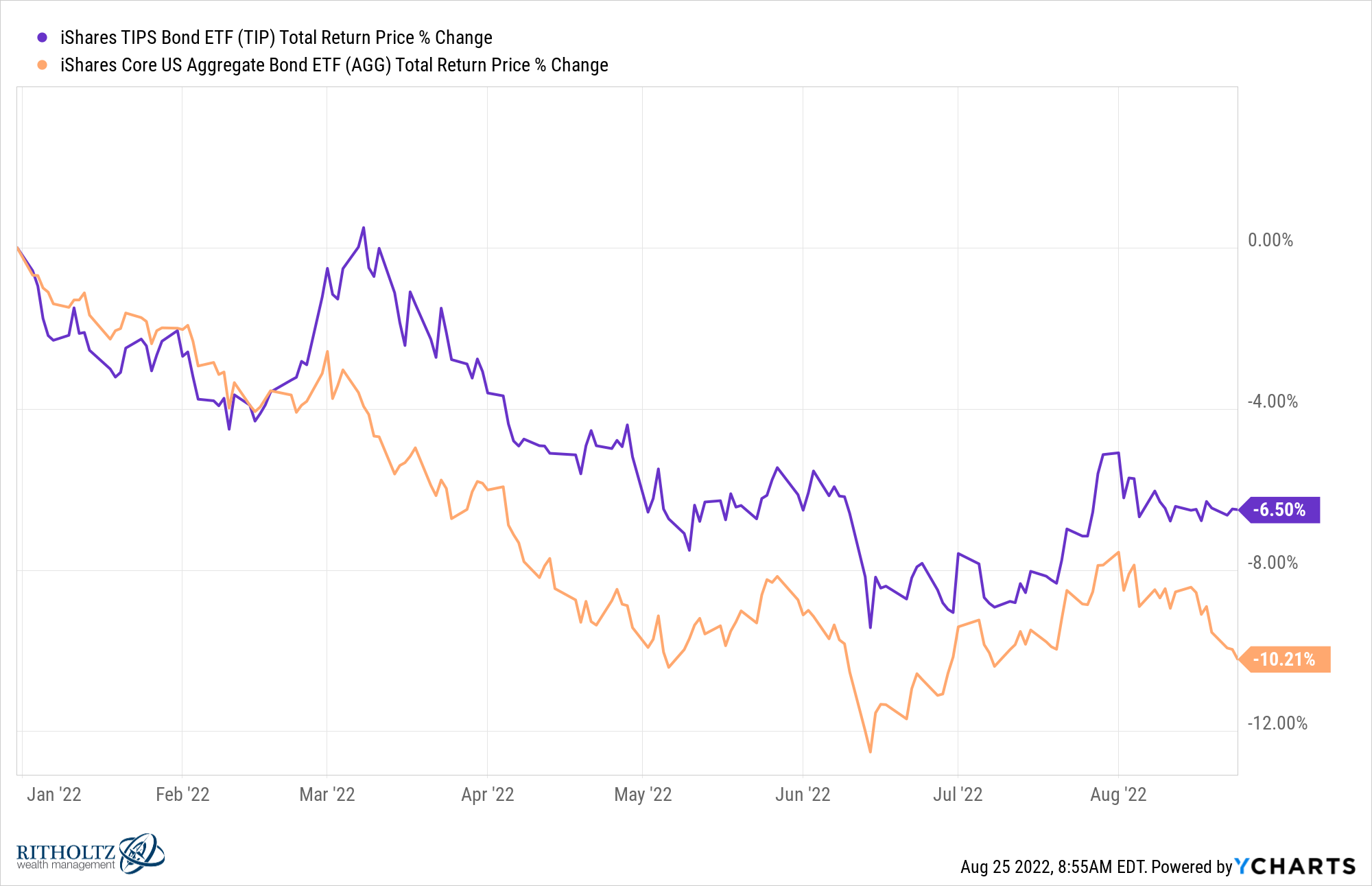

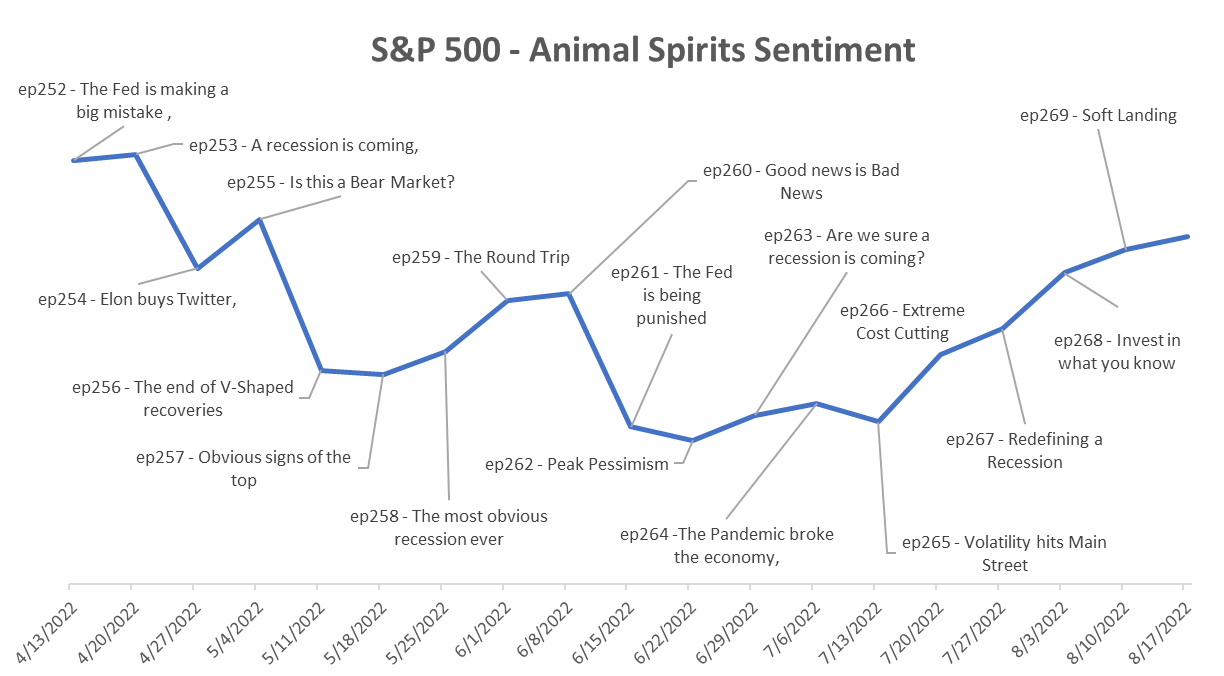

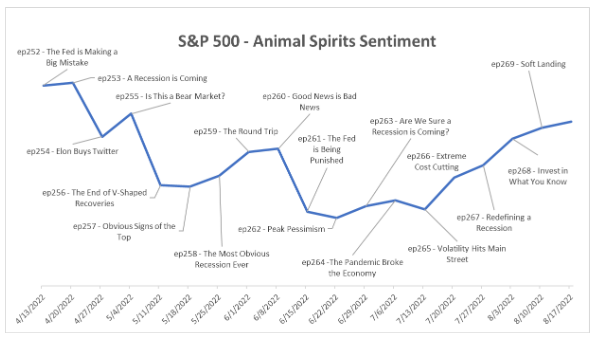

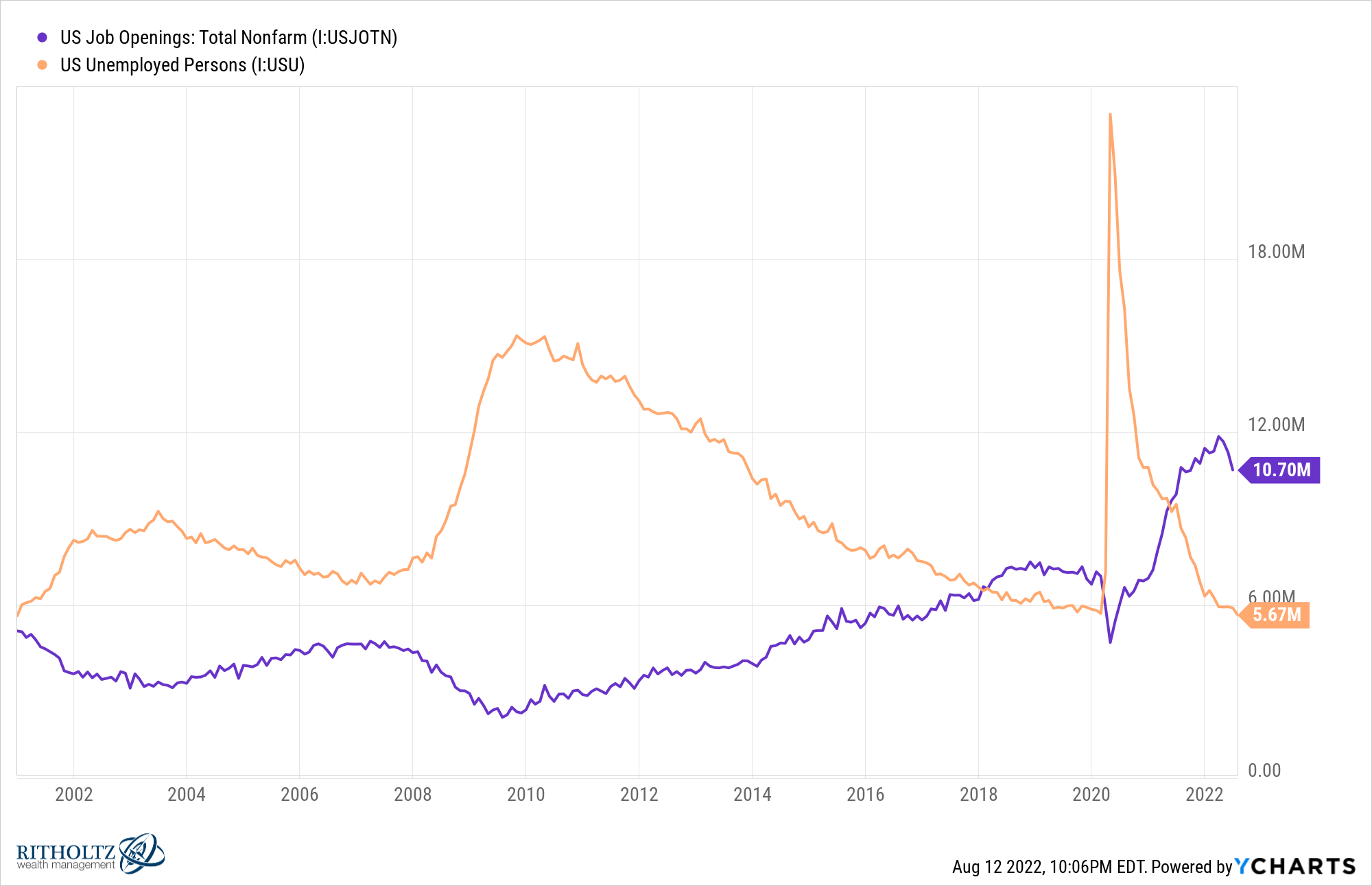

On this week’s show, we discuss the ever-changing narratives in the stock market and economy, iron-clad rules of investing, why markets are so confusing right now, a wider bid-ask spread in the housing market, crypto’s LTCM moment, and much more.

What do you do when your market signals disagree with one another?

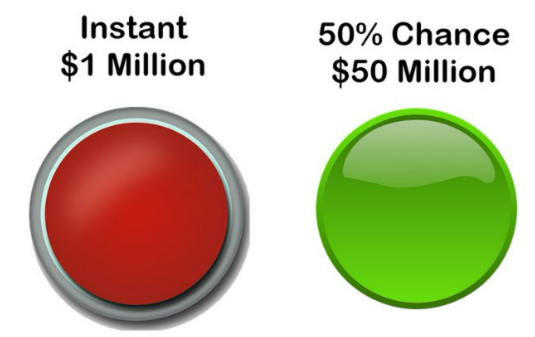

Probabilities vs. the real world when it comes to big money decisions.

Similarities between magic and the stock market.

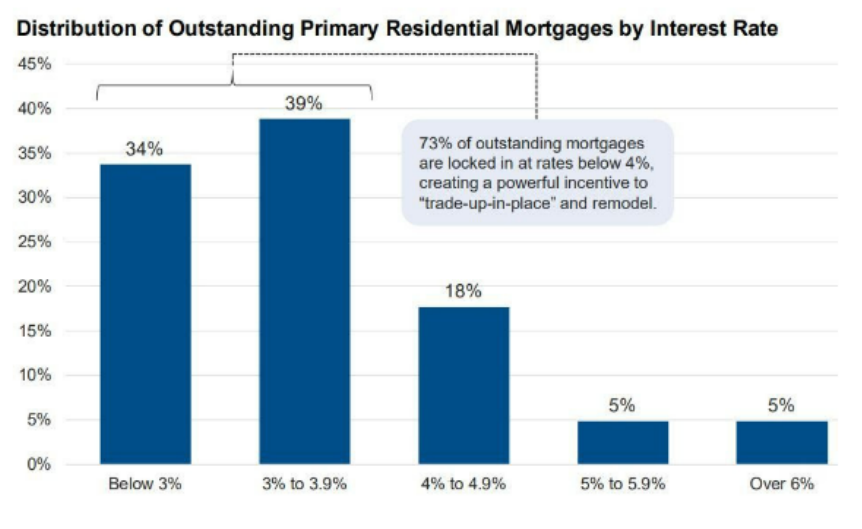

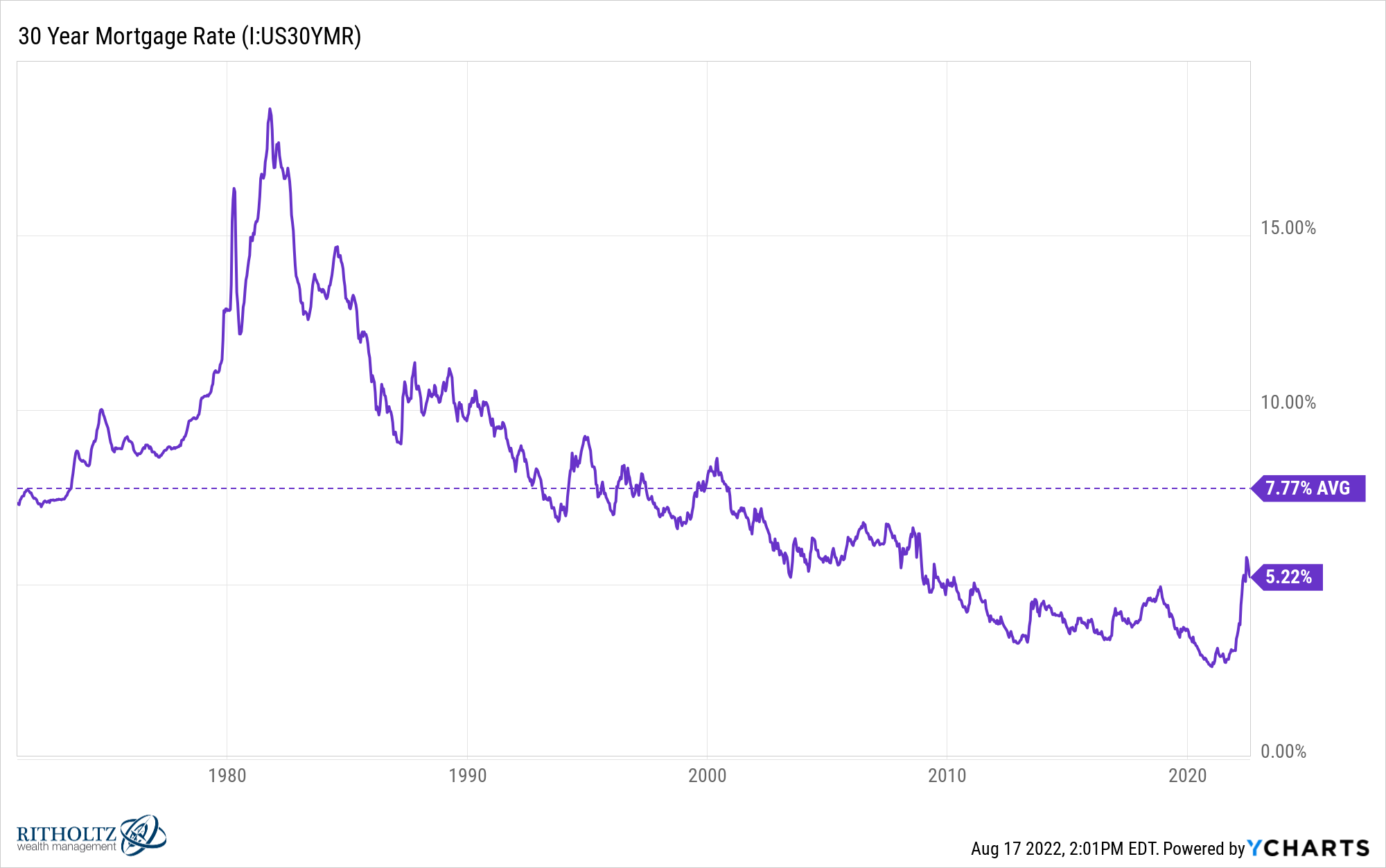

The cost/benefit of buying a new house when you already have a low mortgage rate.

On this week’s show, we discuss Ben’s trip to Long Island, some good news on inflation, Disney’s sky-high inflation, confusing signals in the economy, and much more.

4 simple rules for investing.

6 questions from a radio interview I had this week.