I did a radio interview this week.

I don’t do a lot of these things because it’s just easier and more comfortable to talk about stuff on my podcast but this one sent me a great list of questions ahead of time that I liked.

Here are 6 of the best questions with some thoughts on each:

(1) What is your reaction to the latest CPI report and your outlook on inflation?

Inflation was basically flat from June to July.1

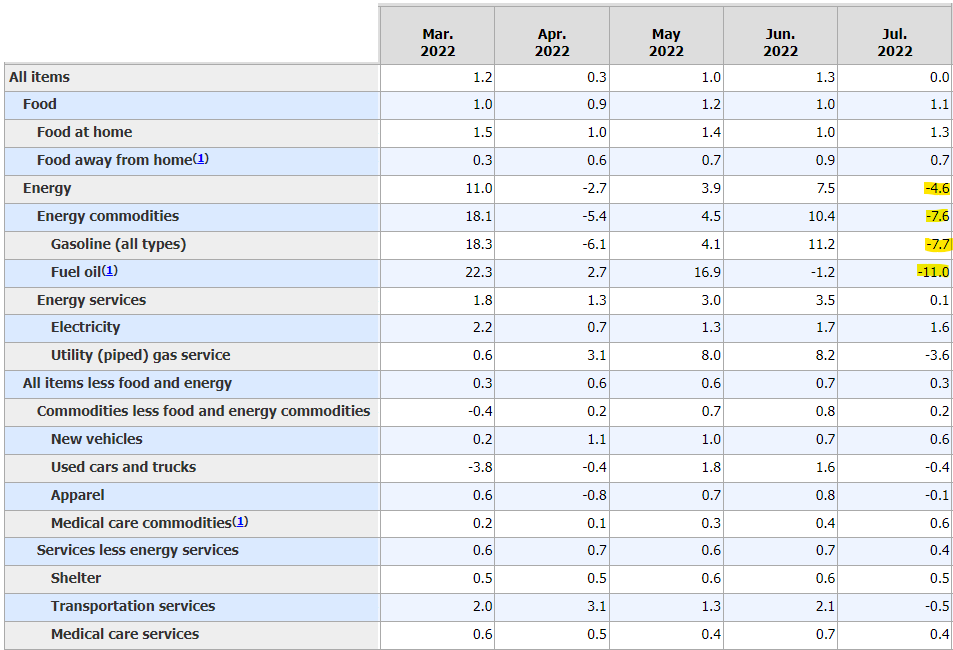

This is the first good news we’ve gotten on the price front in a while. You can see the energy components finally softened in a big way (via the BLS):

Inflation of 8.5% over the past 12 months is still uncomfortably high but it’s going to take a while for that rate to subside, even if prices do continue to slow in the months ahead.

Obviously, one data point does not make a trend but it does seem like the Fed’s moves along with some easing of supply chains have helped stop the uninterrupted rise in prices.

Gas prices are down like 60 days in a row. Oil prices are down. Used car prices are finally falling.

We can build on this (I hope).

(2) Where does the Fed go from here?

It’s difficult to know exactly what the Fed will do without knowing what the inflation data will look like in the coming months.

Back in the summer of 2020, the Fed said they were comfortable letting inflation run hot for a while if it meant a more robust recovery for the labor market.

The labor market is certainly in a better place than it was in 2020 but inflation is running just a smidge higher than their 2% target.

Fed officials say they’re not done hiking rates just yet and I tend to believe them (for now):

Minneapolis Federal Reserve Bank President Neel Kashkari on Wednesday said he is sticking to his view that the U.S. central bank will need to raise its policy rate another 1.5 percentage points this year and more in 2023, even if that causes a recession.

The Fed is “far, far away from declaring victory” on inflation, Kashkari said at the Aspen Ideas Conference, despite the “welcome” news in the consumer price index report earlier in the day that inflation may have begun to cool.

Kashkari said he hasn’t “seen anything that changes” the need to raise the Fed’s policy rate to 3.9% by year-end and to 4.4% by the end of 2023. The rate is currently in the 2.25%-2.5% range.

The Fed waited too long to act and they don’t want to look like idiots again.

They care more about inflation than the job market right now so they’ll likely keep raising rates until we get a number of lower inflation prints.

If they go too far that has to be a risk to both the stock market and the economy.

(3) What does a soft landing look like?

Let’s start with what a hard landing looks like and work backwards.

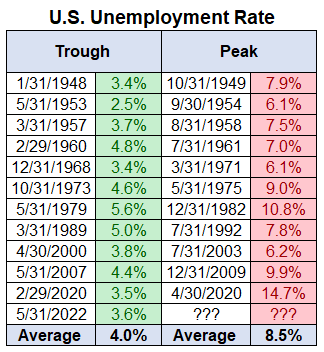

A couple of months ago I looked at what has happened to the unemployment rate during past recessions:

The average increase is more than a doubling off the lows. That would take us to more than 7% from the current 3.5% unemployment rate.

To me, a soft landing would see inflation below 4% or so without a commensurate rise in the unemployment rate. The lowest it’s ever increased to during past slowdowns is just over 6%.

I’d say anything 5% and under for the unemployment rate would be a win if we could get inflation back to 3% or so.

What’s the scenario that could make this happen?

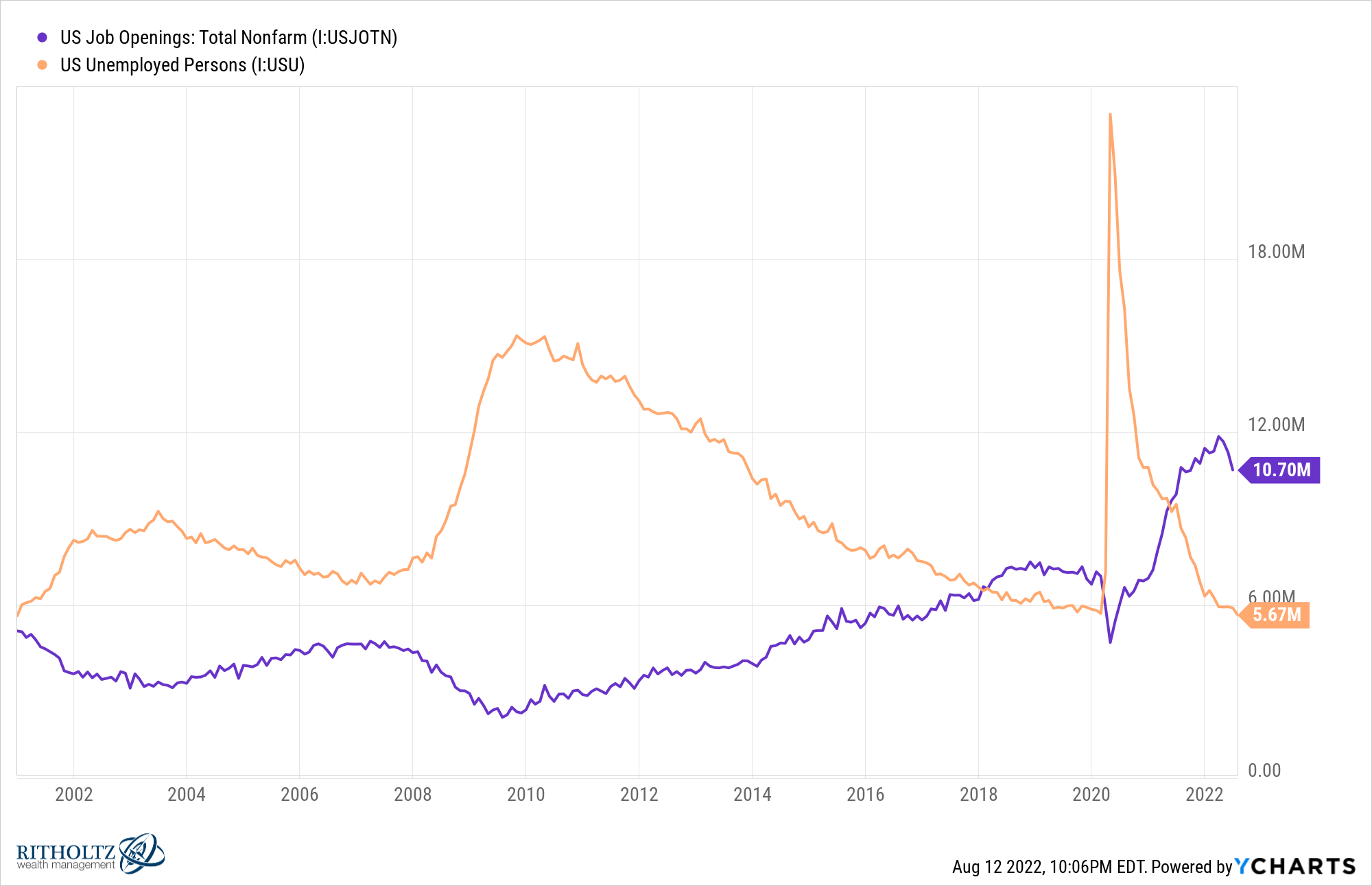

The labor market is in a weird place right now since there are more jobs available than people who are looking for one:

Those openings have come down a bit from 11.7 million to 10.7 million. The dream soft landing scenario for the Fed would see these openings fall by 4-5 million but the unemployment rate doesn’t go much above 4-5%.

Is this actually possible?

History says no but employers have been dealing with a challenging hiring market since the start of the pandemic.

Sam Ro wrote a thought-provoking piece this week about the concept of labor hoarding that’s worth considering:

So what explains the current reluctance to shed workers?

Maybe recent experience has something to do with it.

Much of the ongoing economic recovery has come with persistent labor shortages. Employers haven’t been able to hire fast enough to keep up with the booming demand for their goods and services.

At least some of the employers seeing business slow right now remember how hard it was to recruit talent over the past two years and would rather just hang on to employees, even if it comes with carrying costs.

As a matter of convenience, of course it’s easier to just hang on to workers during a slowdown or recession if you expect the downturn to be brief and shallow.

Millions of people were either let go or put on the shelf in 2020 and that made it more difficult to re-staff once demand came back faster than companies are used to.

What if employers hold onto more employees than in past recessions if they assume the next one will be mild?

What if companies don’t want to go through the hiring process all over again following a recession?

That’s probably the best-case scenario for a soft landing if the Fed does cause a meaningful downturn in economic activity to get inflation under control.

(4) What is your general outlook on the markets and/or a recession?

I wish I had a good answer for this one. I don’t.

We could go into a recession while the stock market hits all-time highs.

Or we could see the stock market tank even if the economy improves from here.

Sometimes these things don’t make sense.

My macro outlook has never really helped my portfolio all that much.

Sometimes my thoughts on the economy/markets would have served me well. Other times my thoughts on the economy/markets would have destroyed my portfolio.

Here’s a little secret about investing the pros will never admit — you don’t have to predict the future to be successful in the markets.

Outlooks are more helpful for your ego than your performance in most cases as long as you have a reasonable investment plan in place.

(5) What can we learn from this downturn?

Since the start of 2020, the U.S. stock market has fallen 34%, risen 120%, declined 24% and now gained almost 17%.

In less than 3 years, it’s felt like we’ve lived through every cycle imaginable — 1918, 1929, 1999, the 1970s, maybe the 1960s and some other parallel I’m probably missing.

Everything in the markets is cyclical.

Stuff that has never happened before happens all the time.

The biggest risks are always the things you’re not thinking about or preparing for.

(6) Have we hit a bottom in the markets?

I took a stab at this one a couple of weeks ago and markets are up even more since then.

If inflation keeps improving and there isn’t some outside shock to the system it wouldn’t surprise me to see new highs by 2023 (maybe earlier?).

But the risk of a Fed policy error has probably never been higher so I wouldn’t be surprised to see more volatility in the months ahead either.

If that was the bottom, it will feel obvious once we know for sure.

If stocks roll over again, that will seem obvious too.

That’s the kind of market we’re in.

If stocks fall further that could present a good opportunity to rebalance into the pain.

If stocks keep rising you’ll just have to wait for the next correction to buy at lower prices.

Bottom or not, volatility is a feature of the stock market and it will return at some point.

Further Reading:

Every Time Out it’s a Guess

1Technically it was 0.02% lower but I’m not a fan of decimal points with economic data.