Does the debt ceiling stuff really matter?

Does the debt ceiling stuff really matter?

On today’s show, we discuss the stock and bond market rallies in 2023, why certain investors are so pessimistic all the time, housing market activity bottoming, the most hated economic expansion of all-time, context around tech layoffs, consumer spending is slowing, Michael’s first resume and much more.

The Best Time to be a Saver vs. The Best Time to be an Investor.

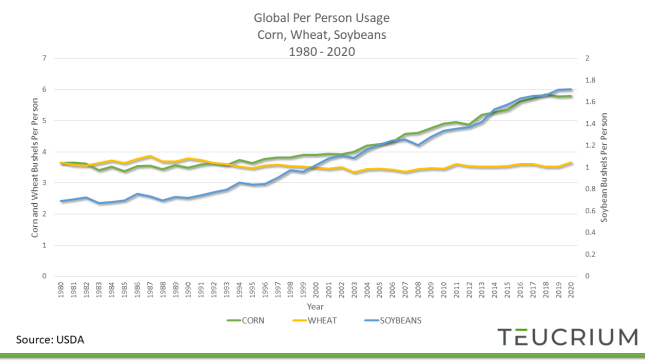

On today’s show, we are joined by Sal Gilbertie, CEO of Teucrium to give us an update on Oil & Gas, how supply chains are looking in 2023, Teucriums latest Long/Short fund, potential issues with China, and much more!

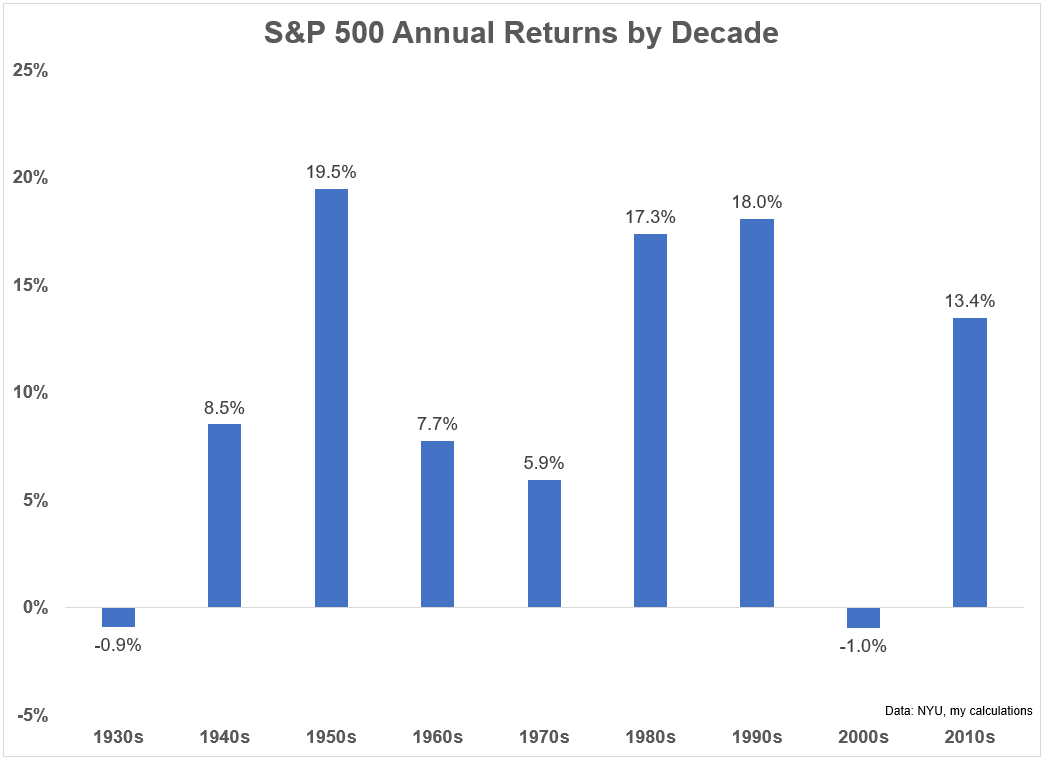

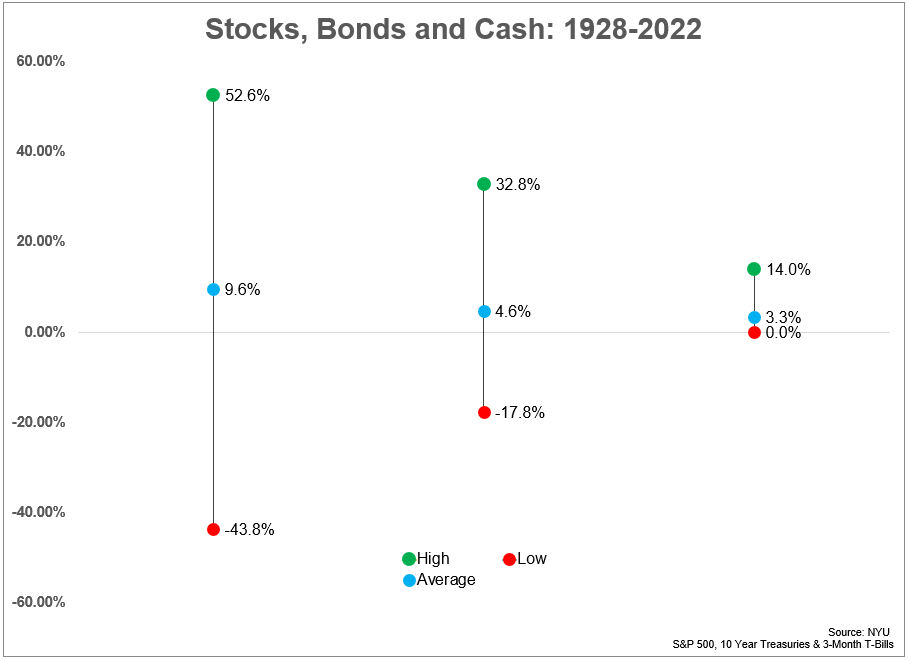

Each year Aswath Damodaran at NYU kindly updates the annual returns for stocks (S&P 500), bonds (10 year Treasuries) and cash (3-month T-bills) going back to 1928. I love this data because stocks, bonds and cash are the building blocks of asset allocation.1 Sure, you can add other asset classes and strategies but those three…

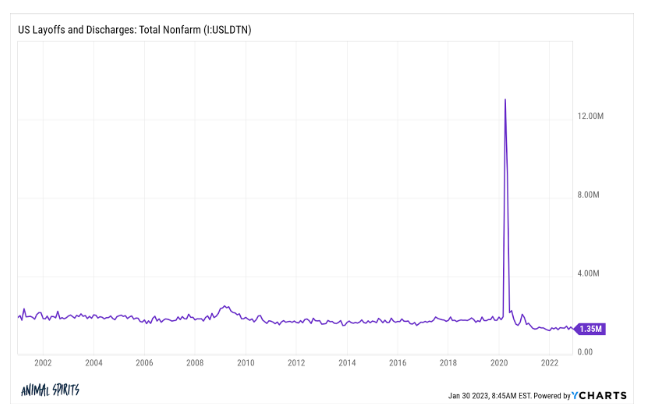

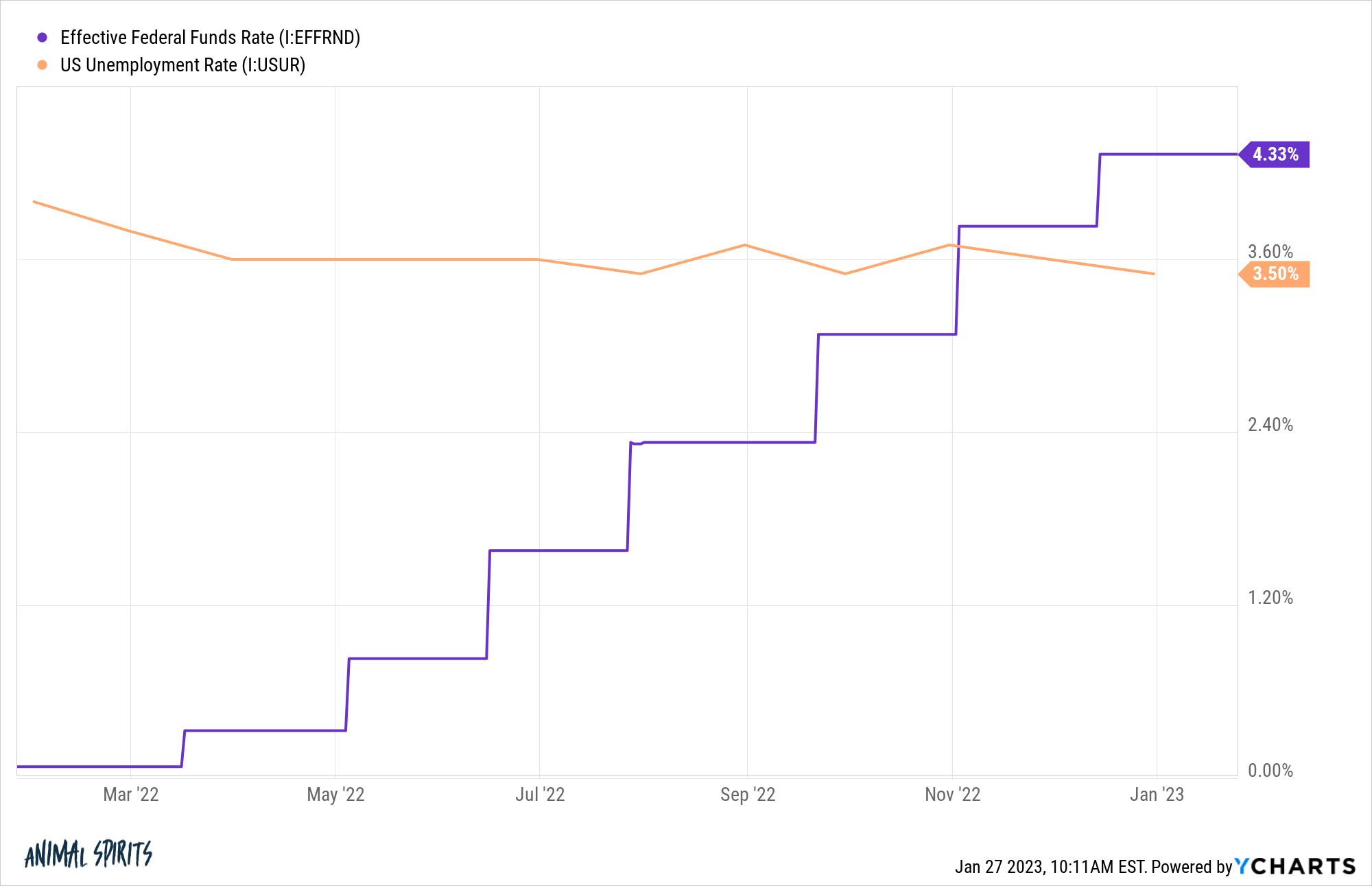

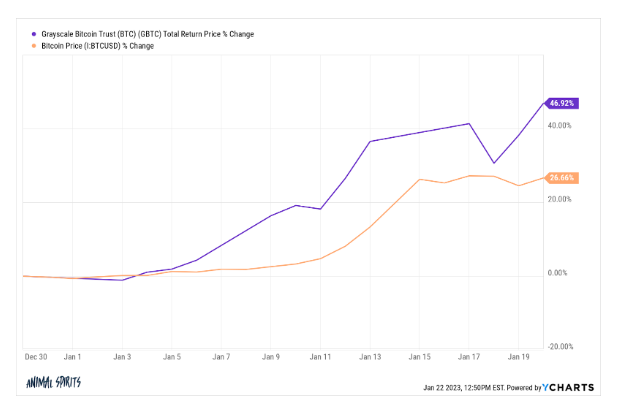

Some thoughts on inflation, the Fed, Bitcoin, tech layoffs and more.

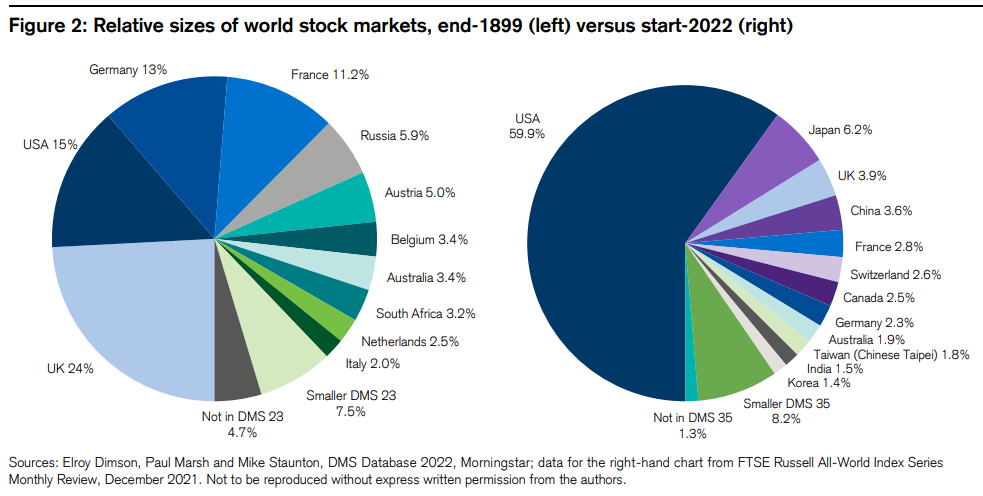

Can the U.S. stock market keep growing?

On today’s show, we discuss why the narrative changes for the economy on a weekly basis, the snapback rally in the stock market, trouble in the car market, the boom in entrepreneurship, putting tech layoffs into perspective, why the housing market might have a floor under it and much more.

Why certain movies and TV shows hit differently in middle age.

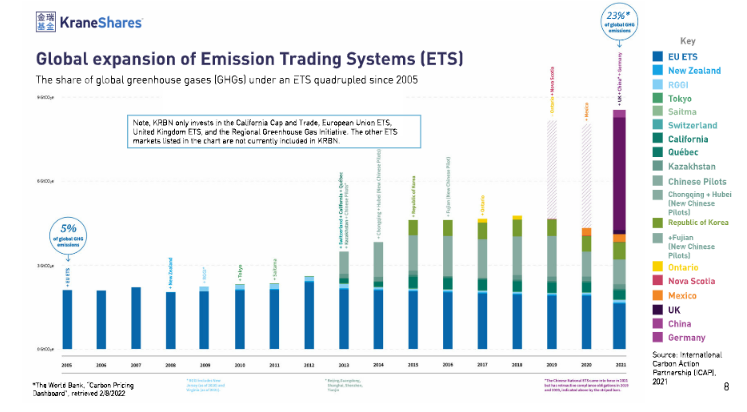

On today’s show, we are joined by Luke Oliver, Managing Director, Head of Climate Investments, and Head of Strategy at Kraneshares to discuss the biggest short of all time, how emissions are related to political risk, what drives carbon price, and much more!