It’s not difficult to find a bearish perspective during a bear market.

The bad stuff gets amplified and feels much worse when investors are losing money.

Although stocks have rallied this year we’re still well below the highs and remain in an economic environment that is increasingly hard to handicap.

Nassim Taleb has never been shy about voicing his bearish prognostications. The Black Swan author said in a recent interview with Bloomberg, “Disneyland is over, the children go back to school. It’s not going to be as smooth as it was the last 15 years.”

I would push back against the notion that the last 15 years have been smooth sailing for investors but Taleb’s point is that higher interest rates and inflation mean the stock market is still overvalued and the road back to normal could be painful.

Maybe he’s right.

It’s not out of the ordinary for periods of above-average returns to lead into periods of below-average returns.

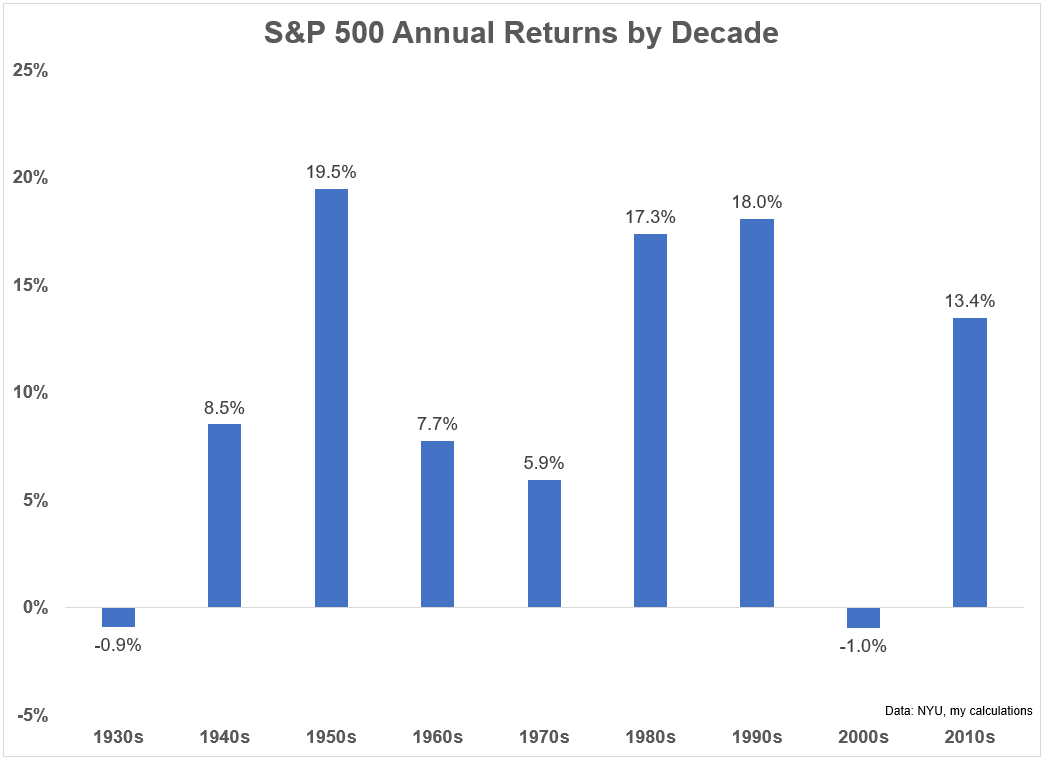

Just look at annual returns by decade for the U.S. stock market going back to the 1930s:

Cycles don’t start and stop every 10 years but these performance numbers do a good job at showing the boom-bust nature of the stock market.

Some decades gave investors extraordinary returns (1950s, 1980s, 1990s the 2010s) while others left a lot to be desired (1930s, 1970s and 2000s).

The returns themselves don’t tell the whole story though.

A lot of it depends on where you are in your investor lifecycle.

There are certain environments that are fantastic for those who are fully invested but not all that great for people who are saving on a regular basis and vice versa.

Let’s look at a very basic example that helps show what I mean here.

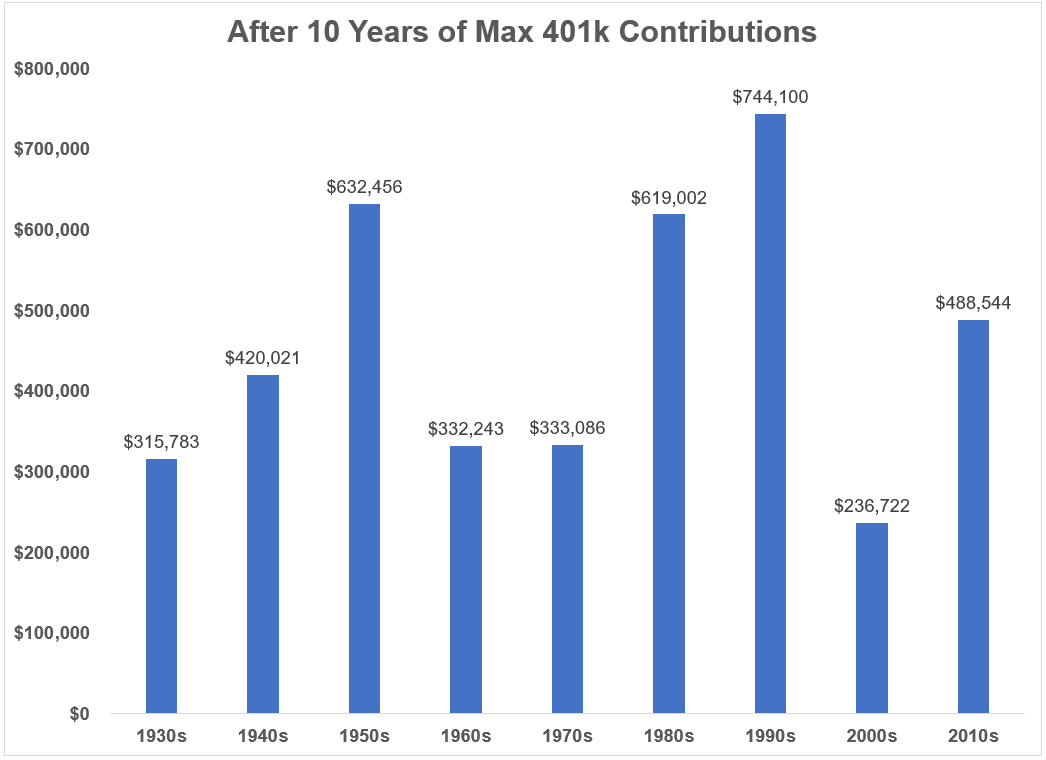

The maximum annual contribution you can save in your 401k is now $22,500 which is up from $20,500 in 2022.1

See, inflation has some silver linings.

I took that annual contribution and applied it to the returns for each of the past 9 decades to show the portfolio balances after 10 years of saving money in the U.S. stock market (S&P 500):

Investing during the 1930s and 2000s led to suboptimal outcomes. Investing in the 1950s, 1980s or 1990s led to phenomenal results in just a decade’s time.

These results make sense in the context of the annual returns for each decade.

But what if we looked even further out to see how these original 10 years’ worth of savings performed going further out?

I’m going to give an unrealistic example here but I’m doing so to make a point so bear with me.

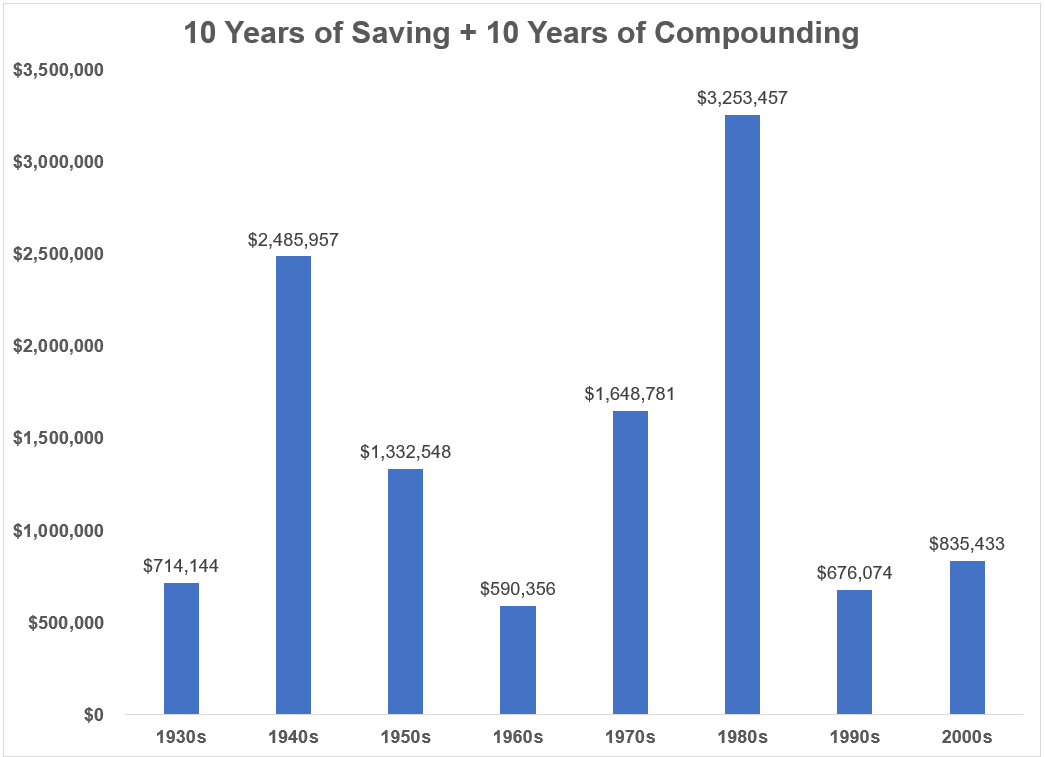

Let’s stick with those same ending values after 10 years of maxing out your 401k and assume you stop making further contributions. Now let’s see how things shake out when you add an additional 10 years of returns in the following decade:

The 1990s went from the top performer to second to last.

Why?

Because you would have been saving money in a market that almost never went down for a decade only to follow it up with a lost decade in U.S. stocks in the 2000s. A similar thing happened to a 1950s saver.

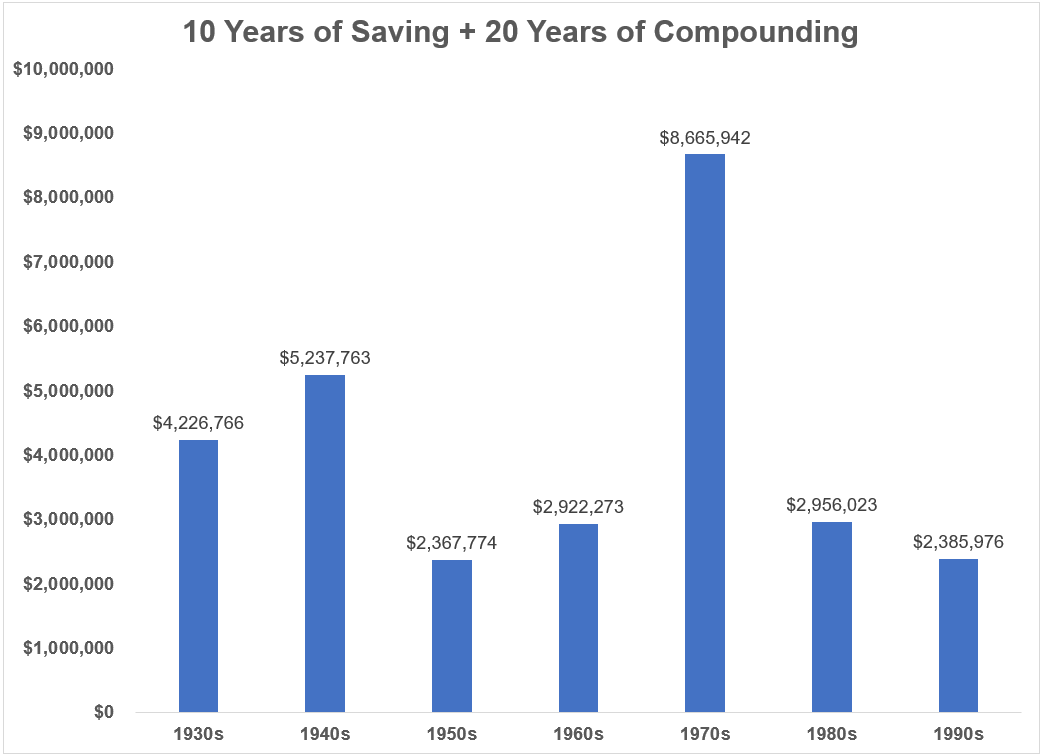

Now let’s add one more decade to the mix so we have an initial 10 years of max contributions followed by 2 decades of compounding in the stock market:

These results don’t match up with the original 10 years at all.

The 1970s was one of the worst decades ever for investors but it was a wonderful time to be a saver.2

You had an entire decade of volatility to put money to work at lower prices followed by one of the greatest 2-decade bull markets of all-time.

The 1930s were a similar story.

It was a dreadful time to be an investor but an awesome time to be a saver. You were able to put your money to work at generationally low prices. You had to be extremely patient to see the fruits of your labor but by the time the post-WWII boom hit you were handsomely rewarded.

The 1950s and 1990s are neck and neck for the best decades investors have ever seen. But if you started saving in those decades your results weren’t nearly as good as other starting points because the returns following those decades were underwhelming.

Starting in the 1980s feels like one of the best starting points in history but ended up at the same place as the 1960s. The 1940s was a middle-of-the-road starting point but finished strong.

Again, this is not a strategy anyone in their right mind would employ. Most people can’t max out their 401ks each year and no one saves for 10 years and then stops.

But this data goes to show that the best time to be an investor rarely lines up with the best time to be a saver.

The Black Swan guy might be right. We could be setting up for a painful time for investors. It’s always a possibility.

A painful time for investors is a glorious time for savers. That’s when you build a base at lower prices. Volatility is your friend if you are saving money on a regular basis and define your time horizon in decades as opposed to months or years.

It’s also important to understand how much luck is involved in the timing of your lifecycle as a saver and investor.

You can’t control the timing of bull or bear markets.

You can control how much you save, your level of diversification, the investment expenses you pay and how long you stay invested.

I cannot guarantee the future will be like the past. But even the worst outcome over 30 years would have turned low 6-figures saved into 7-figures in the stock market in my simplified example.

Saving and investing money on a regular basis while thinking and acting for the long-term remains the best strategy for the vast majority of investors.

Further Reading:

Surviving a Bear Market When You’re Done Saving

1I’m ignoring the company match here of course. You can also sock away an extra $7,500 (up from $6,500 in 2022) if you’re 50 or older.

2I could have adjusted these returns for inflation but the point here is not to show the best decade. The point is to show how the timing of returns can impact your results depending on where you are in your investing lifecycle.