A reader asks:

Without getting into the politics of throwing the U.S. government into default the threat is very real. How bout a discussion of how should retirees position themselves to protect their portfolio? Us old guys don’t have years to recover from a political sabotage of the markets and the economy. You know old folks read and listen to your stuff too!

Obviously, the markets don’t seem to care about the debt ceiling debate right now.

As of this writing, the S&P 500 is up almost 9% year to date. The Nasdaq 100 is up 17% in 2023. Bonds are also rallying.

I think part of the reason markets don’t seem to care is we’ve all been through this before and know that it’s mostly political theater.

The debt ceiling debate makes politicians feel important. They use it as a negotiating ploy to pass or block other legislation. It’s leverage.

Could we see some crazy politician take things too far at some point and force a default? It wouldn’t surprise me but that seems like a short-term problem that would be remedied fairly quickly once they see the problems it would cause.

Politicians want to get re-elected and wrecking the U.S. economy is not a great strategy for that.

But even if you knew how badly a politician could screw this up someday it still might not help you position your portfolio correctly.

Back in the summer of 2011, Standard & Poor’s downgraded the U.S. credit rating. It felt like a big deal at the time.

This is from a BBC story the day after it happened:

One of the world’s leading credit rating agencies, Standard & Poor’s, has downgraded the United States’ top-notch AAA rating for the first time ever.

S&P cut the long-term US rating by one notch to AA+ with a negative outlook, citing concerns about budget deficits.

The agency said the deficit reduction plan passed by the US Congress on Tuesday did not go far enough.

Correspondents say the downgrade could erode investors’ confidence in the world’s largest economy.

It is already struggling with huge debts, unemployment of 9.1% and fears of a possible double-dip recession.

The downgrade is a major embarrassment for the administration of President Barack Obama and could raise the cost of US government borrowing.

This in turn could trickle down to higher interest rates for local governments and individuals.

Sounds scary right?

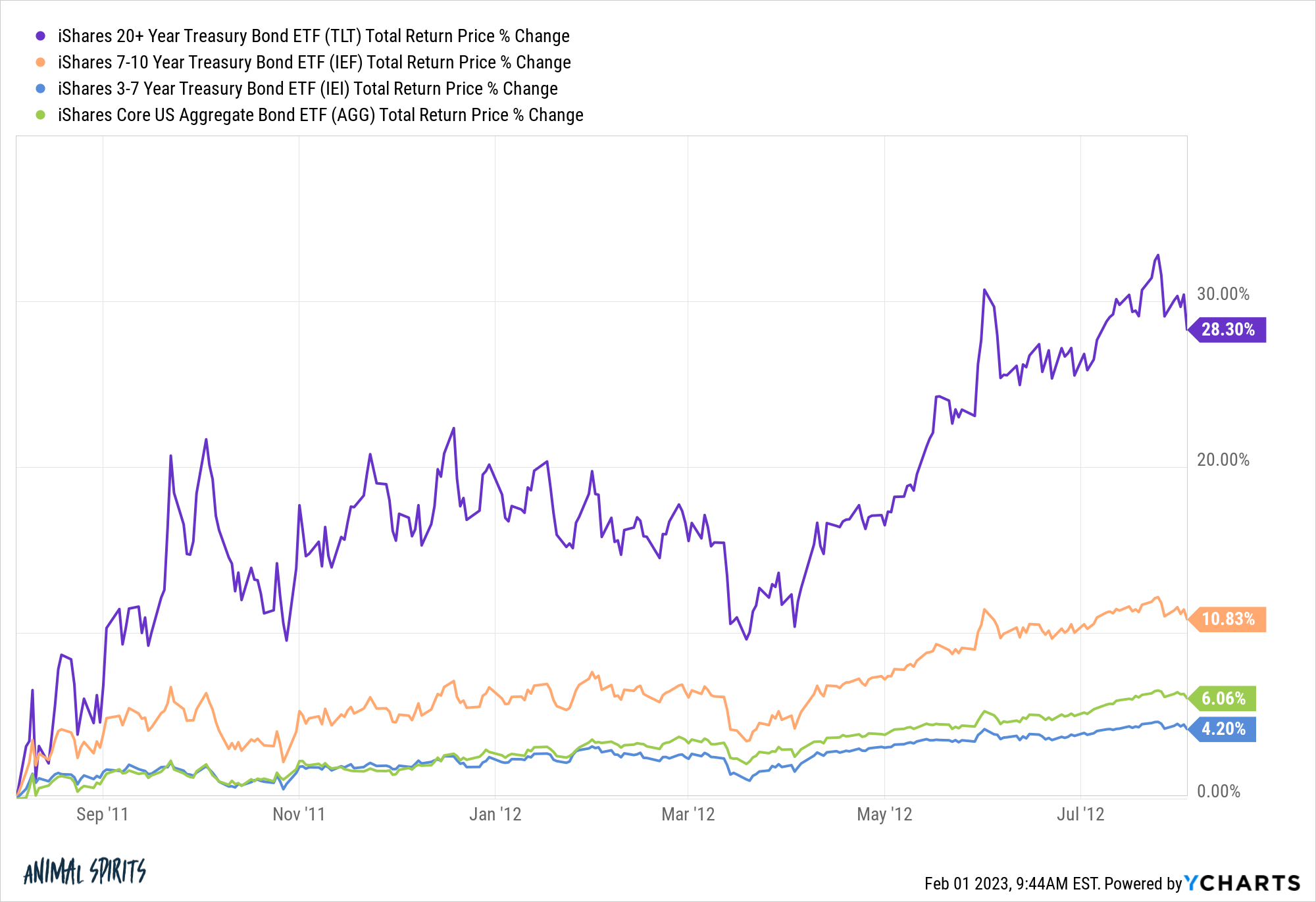

These were the returns for various segments of the bond market one year after this occurred:

Bonds staged a huge rally because interest rates actually fell.

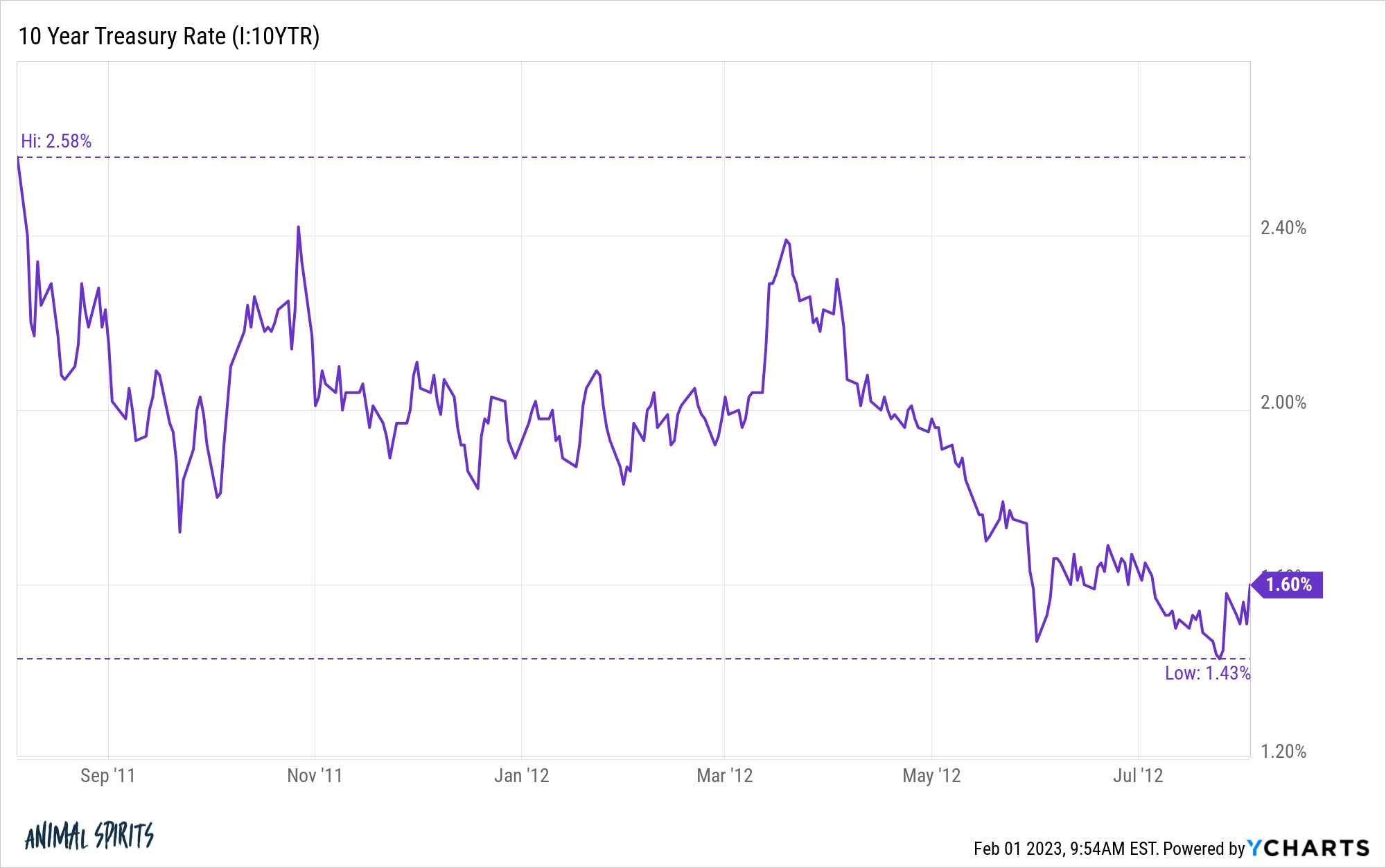

In fact, rates fell immediately, with the 10 year treasury dropping more than 1% in less than a year:

How about the stock market?

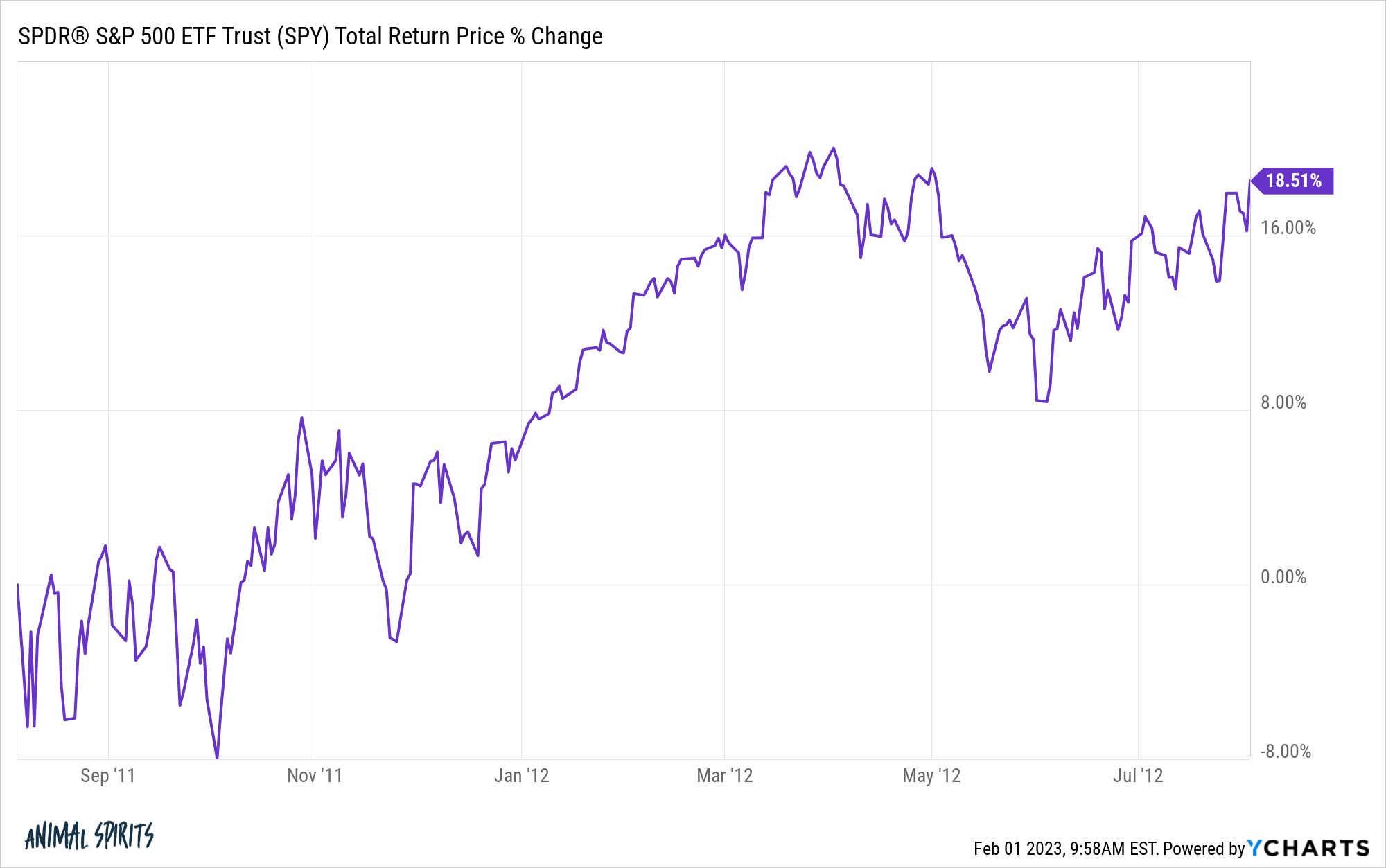

Things did get weird in the stock market in the short-term.

The Monday after the downgrade was announced the S&P 500 crashed more than 6%. That’s a big down day.

The next day it was up almost 5%. The day after that it was down more than 4%. And just for good measure the market ripped 5% the very next day.

So we had down 6%, up 5%, down 4% and up 5% back-to-back-to-back-to-back. It was a volatile time for sure.

However, even including that down 6% day, the S&P 500 was up almost 20% a year later:

It is worth noting that the stock market was already in the midst of a drawdown at that point from a combination of the European debt crisis and double-dip recession fears.

So we could see some short-term volatility with a debt ceiling debate even if it doesn’t come to an actual default.

But the current trends in rates, economic growth and the stock market matter more than the political theater we now see in Washington DC every few years when the debt ceiling is triggered yet again.

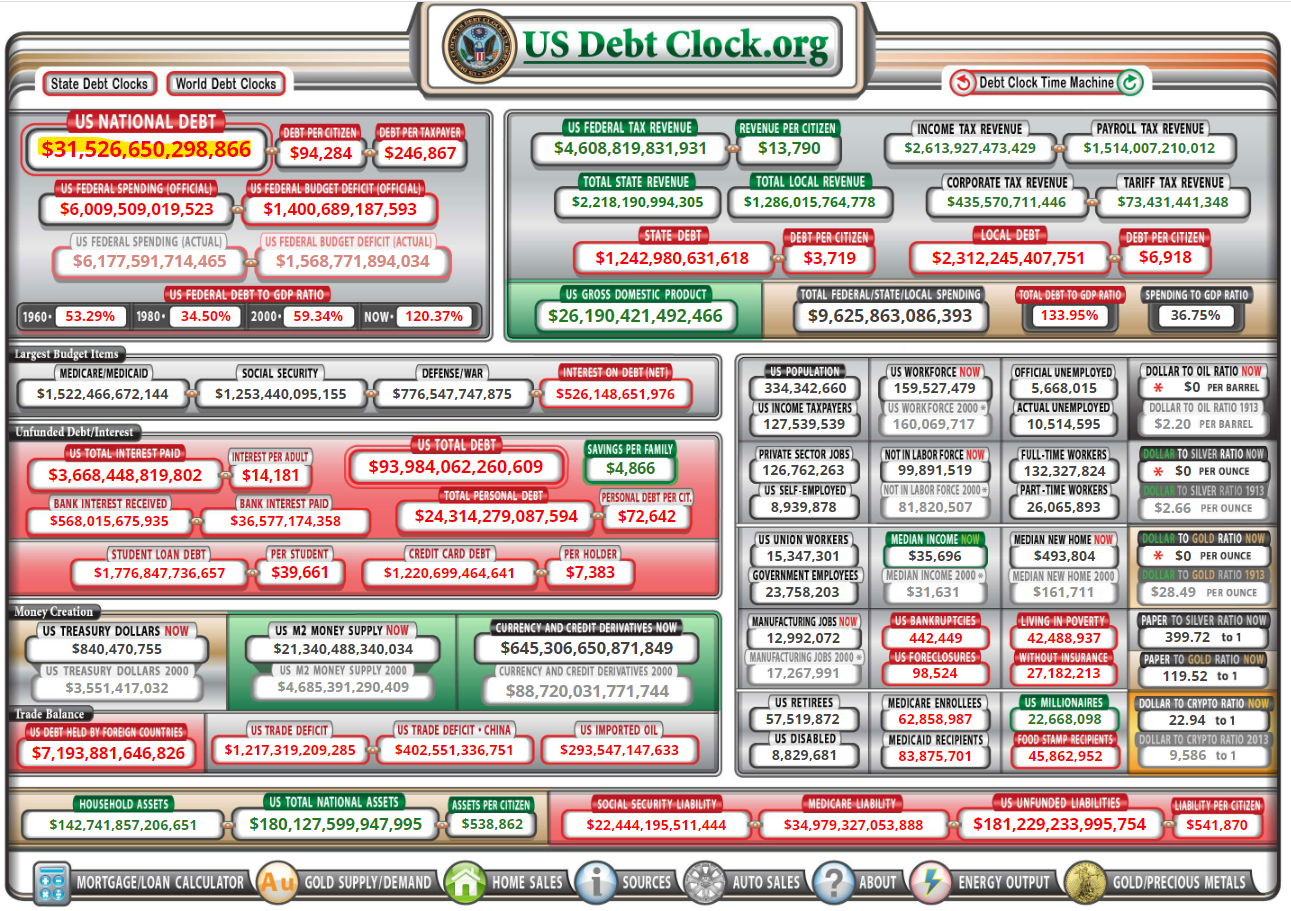

The other thing to mention here is that every time this happens people complain about how much debt we have in this country:

$31 trillion is kind of a lot of debt.

I’m not as worried about that debt as others.

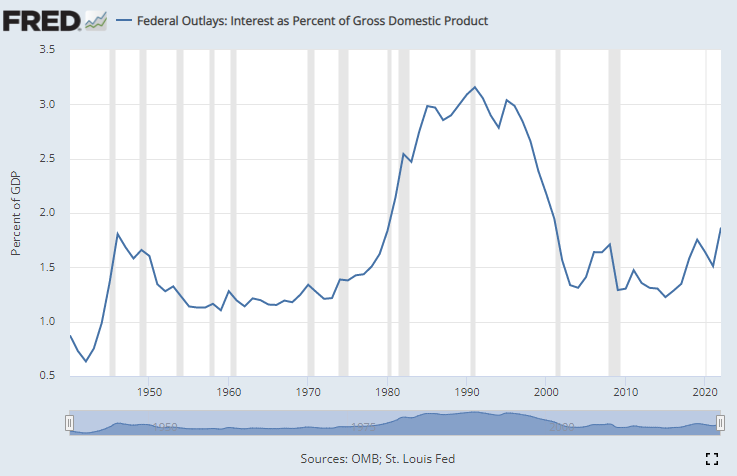

Let’s look at the interest we pay on that debt as a percentage of GDP:

It’s rising but is still much lower than the outlays in the 1980s and 1990s for interest expense. We can still afford to pay our debts even though rates and the amount of liabilities have risen.

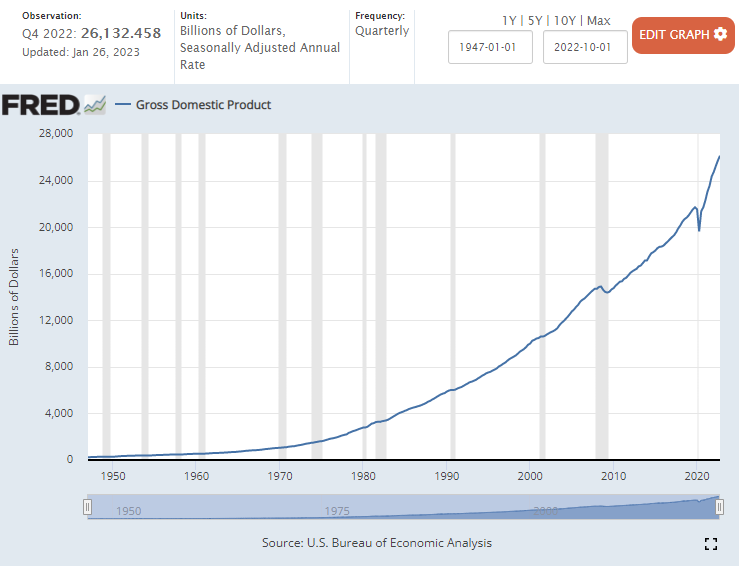

The debt was lower back then but rates were higher and GDP was obviously much lower as well. The latest GDP number came in at more than $26 trillion:

And that’s not an accumulated figure like the debt. This year the economy will likely produce a number that’s even bigger than that.

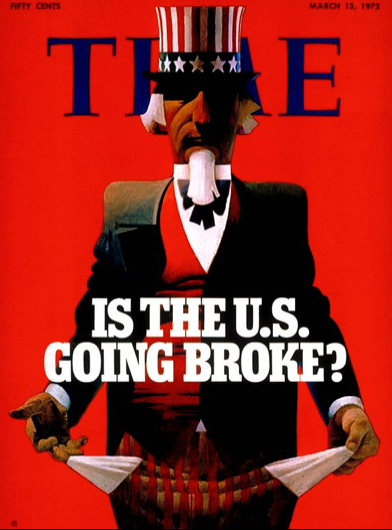

I know the debt number is scary but just know people have been worrying about government spending for a long time.

As long as the economy continues to grow, federal debt will grow as well as the pie expands.

And if our politicians fail to get rid of the stupid debt ceiling we’re likely going to be having this debate once every few years.

That debate might cause some short-term volatility in the markets but there is always the chance of short-term volatility in the markets.

We discussed this question and more on the latest edition of Portfolio Rescue:

Kevin Young joined me once again to answer questions about the yield curve, T-bills vs. online savings accounts, dealing with retirement portfolios as age sets in and the pros and cons of HSAs.

Further Reading:

The United States Has Been Going Broke For Decades

1Plus, it’s important to remember all of that government debt is an asset for investors in the form of bonds.

Podcast version here: