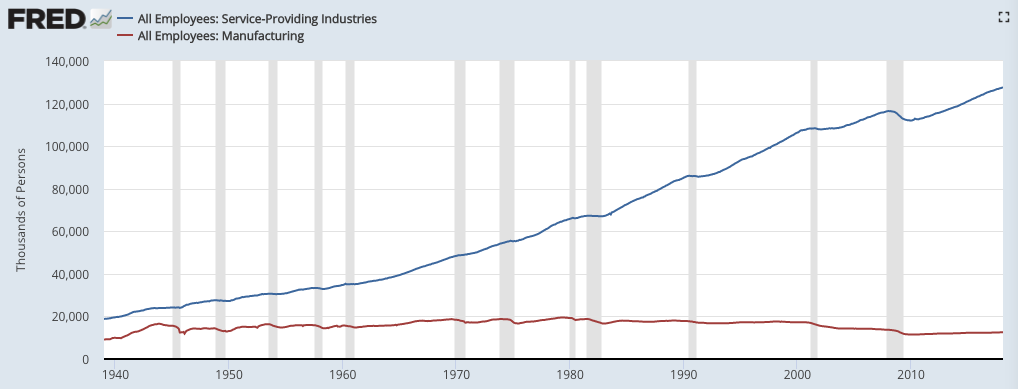

Manufacturing is not exactly dead in the United States but it certainly doesn’t have as much of an impact on the employment front as it once did:

Many in the older generations are unwilling to accept this fact but we are a service-based economy and that’s not going to change anytime soon.

The difficult part about working in a service profession is that you’re not selling a finished, manufactured product. You’re selling yourself or your firm’s ability to deliver on promises.

Uncertainty is unavoidable in this scenario so, in many ways, trust is the main differentiator in almost any service business.

When Italian clients were asked what made them trust their financial advisor, one-third of respondents claimed it was their advisor’s competence while two-thirds listed their personal relationship with the advisor.

Clients would rather work with people they like. The same tends to be true in a work setting.

In a study at a tech company, researchers found when employees were looking for everyday advice, help on a project, or ideas on how to solve a problem, they would go to the colleagues they liked the most, regardless of their competence.

Another workplace study found when nurses wanted a second opinion on a diagnosis, they often went to the colleagues they felt most comfortable with instead of seeking out the true experts.

The question is: How do you build this kind of trust?

Adam Grant discussed this topic in a recent episode of his new podcast Work Life. Grant tells the story of three astronauts — a Russian, an Italian, and an American — who were forced to come together in just three days to build rapport for an emergency space mission.

The three were tasked with going to a space station to capture a supply ship, which would be hurtling through space, with a robotic arm, something that had only been done on one prior occasion. It’s imperative in these missions that the crew has a certain level of trust in one another because the stakes are so high.

The problem with this group is they were all from different cultures and backgrounds so trust was an issue. To get over these cultural differences, their training focused on creating a group identity so the crew could find common ground. To foster this type of environment, they discussed shared experiences.

They talked about why they wanted to become an astronaut. Instead of focusing on their differences, they played up their similarities. We tend to trust people who are similar to us (whether that’s right or wrong).

Of course, competence does come into play eventually. The American on this space crew was a woman and the Russian on the trip had no experience working with female astronauts. For him, trust was based exclusively on competence but at first, he didn’t trust her abilities.

So she had to prove her competence to him. And she did this in their first simulation when the Russian and Italian miscalculated something to do with the engines. But she was spot on with her calculations so, from that point on, trust was no longer an issue since she proved how competent she was as an astronaut.

But trust is a two-way street. For her to trust him, she needed to know he cared about others. She learned more about his family and saw the relationships he had with them, which showed her how much he cared about other people (something that wasn’t easy to see in their daily interactions).

Working in a service profession isn’t as high stakes as an emergency space mission but many of the lessons apply to this world. When selling a service there are no guarantees, so uncertainty is always a huge variable and potential sticking point.

Here are a few things I’ve learned about building trust in the wealth management industry:

Prove your differentiation. There’s no shortage of competition in financial service so you need to be able to accentuate your differences. Being a generalist is extremely helpful in portfolio management, but to gain clients it helps to have a niche.

Understand people and situations. One of my mentors in business school was a consultant to privately owned businesses. He was basically a fixer of any problems or disputes that would come up between the management teams he worked with. His first question to new clients was always, “If I had the ability to wave a magic wand and solve all of your business problems, what would that look like?” He understood that his job was to make people’s lives easier. Understanding people, incentives, and pain points can help build trust.

Be yourself. To earn trust, sometimes you have to show trust in others by opening up and being yourself. There will be plenty of robots and algorithms in the years ahead so being authentic will go a long way towards building lasting relationships.

Know your stuff. Our CEO Josh Brown likes to say, “Be so good they can’t ignore your message.” Sure, people want to work with someone they like and respect, but you also have to be an expert in your field. You need an answer to every question before it’s even asked. It doesn’t matter how delightful you are as a person if you can’t deliver the goods. Eventually, clients will come around to the fact if you can’t answer their questions or solve their problems.

Source:

How Astronauts Build Trust (Work Life)

Further Reading:

Everyone is in Sales