A reader asks:

You guys have been absolutely wonderful in teaching us some valuable lessons. Hate to admit this, I’m absolutely terrible at investing. My ability to withstand a down market is just awful. Don’t want to save cash my entire life but I also have such little risk tolerance. Age 31. Goals include getting married/buying a nice house, etc. In a weird position. Any thoughts?

This is the opposite tone of most questions I receive from young investors these days. For the past few years my inbox and DMs have been full of young people asking for my blessing to invest all of their money in crypto, growth stocks or 3x leveraged stock market funds.

It’s understandable young people want to take more risk considering the environment we’ve lived through. Before the recent correction there were insane gains across a wide variety of investments and markets.

Plus, young people these days seem to have a higher threshold for risk. I’m not saying that’s good or bad but how markets behave in your formative years can have an outsized impact on your relationship with risk.

Of course, there are a number of other factors at play that determine risk appetite.

Creating the right portfolio requires some balance between your willingness, ability and need to take risk.1 The hard part is sometimes these factors aren’t aligned with one another.

Our reader here is 31 years old. When it comes to retirement savings they have plenty of ability to take risk.

They not only have 30-40 years until retirement age but also an additional 20-30 years to invest during retirement. The time horizon for a 31-year-old could be 50-70 years.

A combination of a long time horizon and plenty of human capital in the form of future savings from your income growth makes investing in stocks a no-brainer.

However, sometimes your ability to take risk is at odds with your willingness to accept risk.

Some people simply don’t have the personality to live through bone-crushing stock market crashes. The good thing is this reader knows that. The worst thing you can do is invest your portfolio using someone else’s willingness to take risk.

To paraphrase George Goodman: The stock market is an expensive place to find out who you are.

Knowing yourself as an investor is a big first step. It takes many investors decades to learn this lesson. Some never do.

But you still have to invest your money in something. You can’t just bury it in your backyard and hope for the best.

Here are some thoughts on the different levers you can pull when you have a low tolerance for risk:

Asset allocation is important. At the onset of the pandemic in early-2020, the U.S. stock market fell roughly 35% in a little over a month.

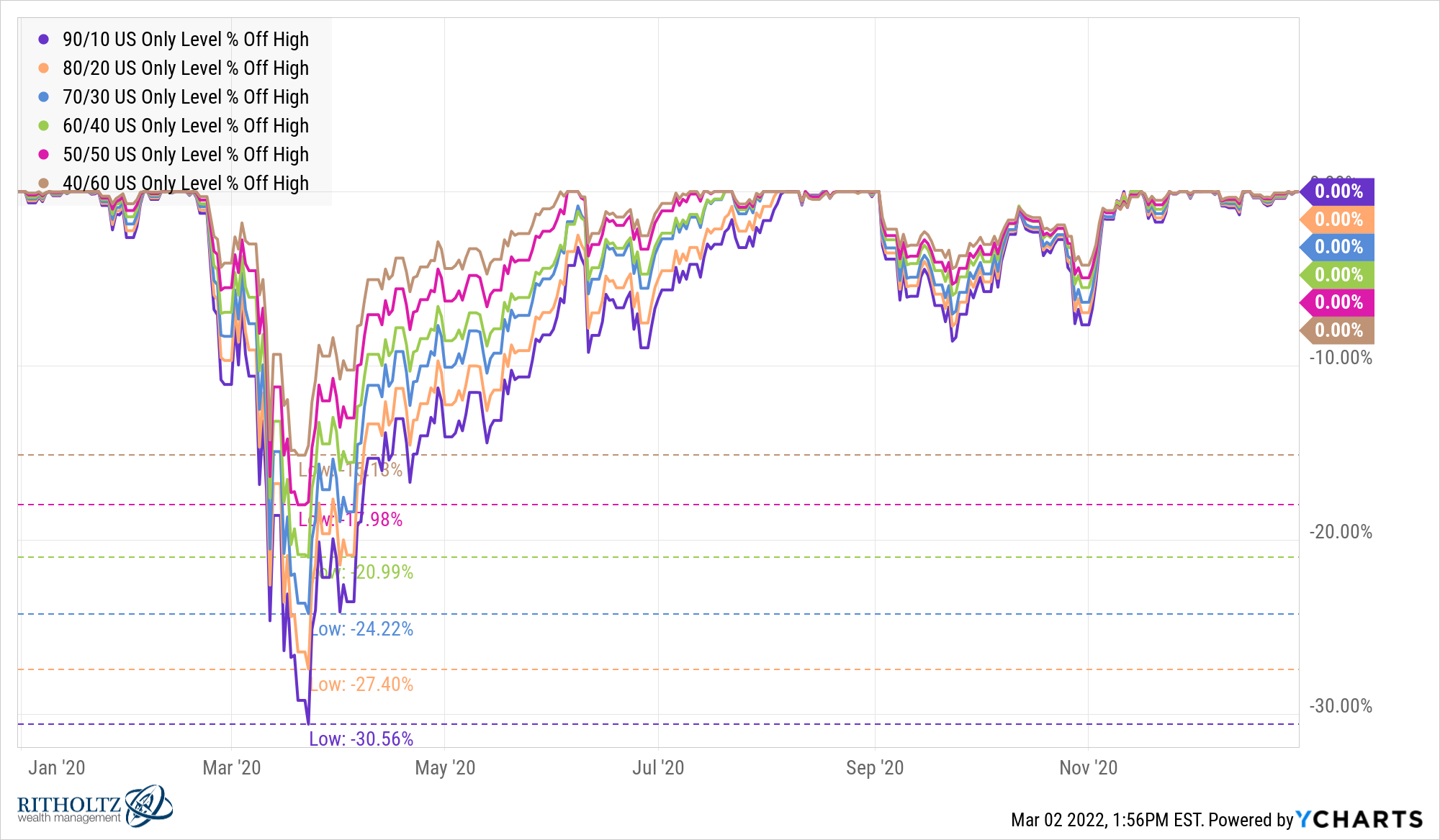

Adding some bonds to your portfolio certainly helped during this volatile period. Here’s a look at some simple asset allocations fared during the crash going from 90/10 stocks to bonds all the way down to 40/60:

A portfolio with 40% in stocks and 60% in bonds only lost 15% in this crash while a 50/50 portfolio fell nearly 18%. So these more conservative portfolios did a nice job protecting investors on the downside.

Of course, a more conservative portfolio misses out on some gains when stocks are rising. The S&P 500 is up around 96% from the March 2020 lows. Here are the asset allocation returns in that time:

This is the trade-off when setting your asset allocation.

The more conservative funds — like high quality bonds and cash — the lower your drawdowns but also the lower your returns.2

And with bond yields so low you can’t expect to earn much in terms of returns.

But investing in bonds and cash can potentially help you hedge emotional decisions caused by stock market volatility. And while they may not provide much in the way of returns going forward, if they help keep you sane when the stock market is losing its mind, they can help reduce the odds that you make a big mistake at the wrong time.

I kept things very simple in my asset allocation examples. You can obviously diversify more than the total U.S. stock and bond index funds I used here.

The main point is that your allocation between risk assets and conservative assets can help control the volatility in your portfolio and your investment decisions.

Save more money. A combination of low bond yields and an unwillingness to take a lot of risk means you’re probably going to need a higher savings rate.

A high savings rate is one of the best ways to reduce financial risk in your life. It’s also one of the best ways to reduce the stress involved with money decisions (many of which occur beyond your investment portfolio).

The great thing about having a higher-than-average savings rates is it decreases your need to take risk.

Consider your asset location. One way to balance your desire to take less risk with your need to grow your money over time is to consider where you stash your savings. The asset location of your risk can help here.

When saving for things like a wedding or house down payment, you’re not going to want to take a lot of risk anyway since that money will need to be spent in a matter of years, not decades. Those goals are perfect places for more conservative investments just like your emergency savings.

Then keep your riskier asset like stocks in a retirement account that has higher barriers to poor investor behavior.

If you stash all of your stock market investments in a tax-deferred account like a 401(k), just treat that money as out of sight and out of mind.

Jack Bogle once said, “This is one of the most important rules of investing. If you never peek from the age of 20 to the age of 70, you’ll rip that first 401(k) statement open at age 70, and I recommend you have a doctor on hand because you’ll go into a dead faint. Your heart might even stop. You’re going to have an amount of money you can’t even imagine.”

Not looking at your retirement balance is a bit of a pipe dream these days but the idea here is to create a barbell.

On one end you have your more conservative investments for shorter-term goals and volatility reduction. On the other end you have riskier investments that you’re not going to touch for decades because that would require paying taxes and a 10% early withdrawal penalty.

All you have to do is decide what your allocation is going to be for each end of the barbell and invest accordingly.

Avoid peer pressure. The last thing you have to do is avoid caring about how other people invest their money. Not caring is a financial superpower because it allows you to focus on your own risk profile and create a plan that fits your personality and circumstances.

Just remember, a good strategy you can stick with is vastly superior to a perfect strategy you can’t stick with.

We talked about this question on this week’s Portfolio Rescue:

I also had Barry Ritholtz on to discuss this question and offer some tips on becoming a better writer and communicator to your clients.

1This concept from my CFA Level III studies is probably the most important concept I learned from that godforsaken test.