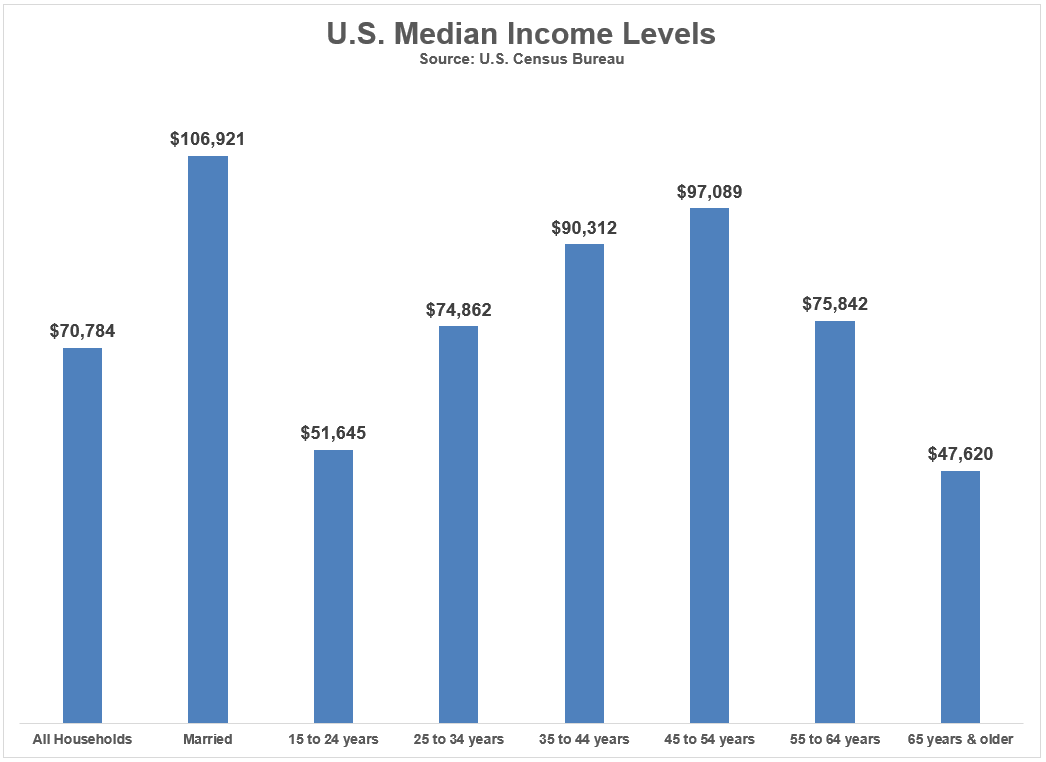

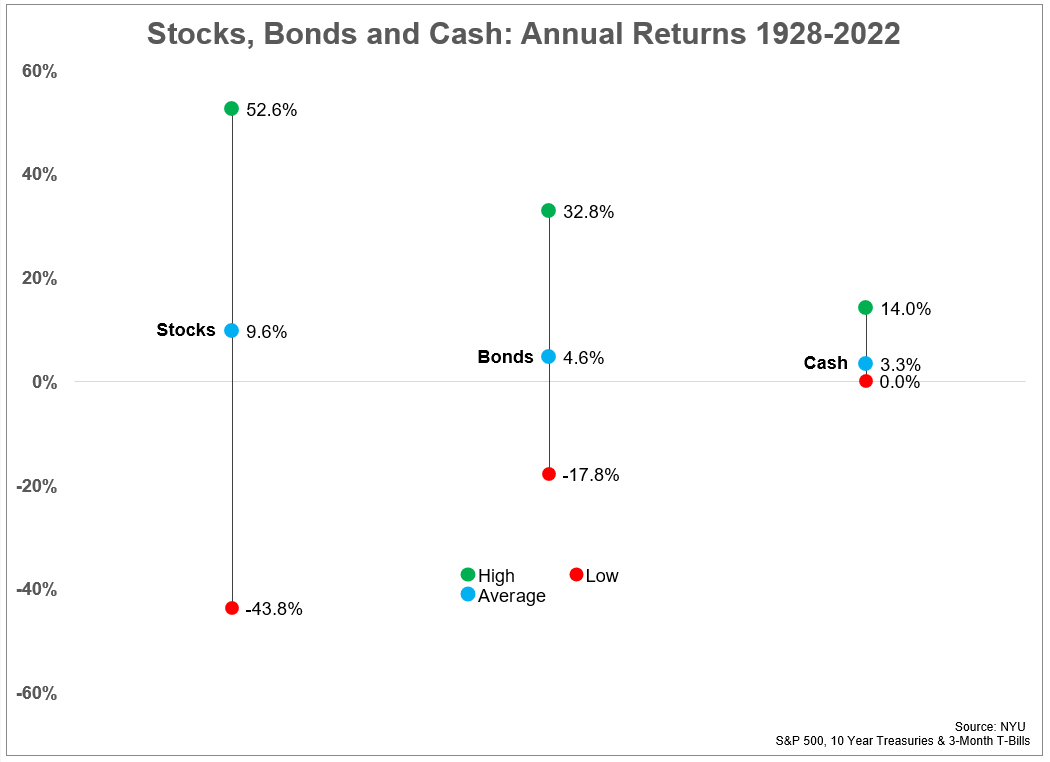

Income levels by age and percentile.

Income levels by age and percentile.

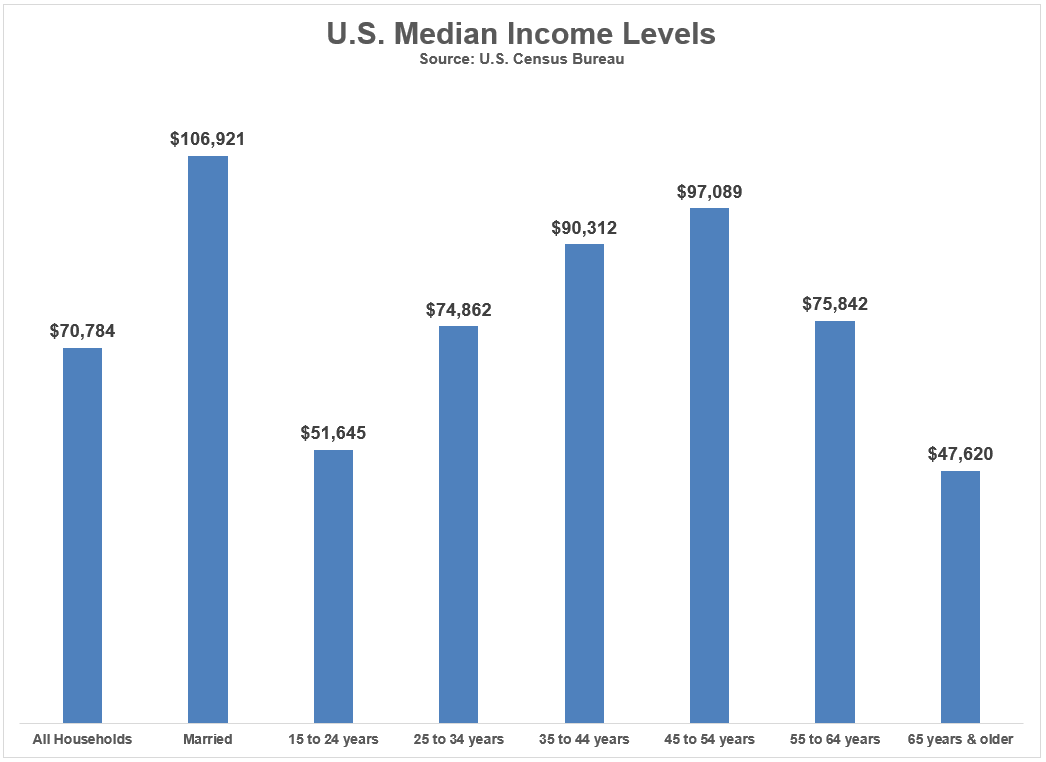

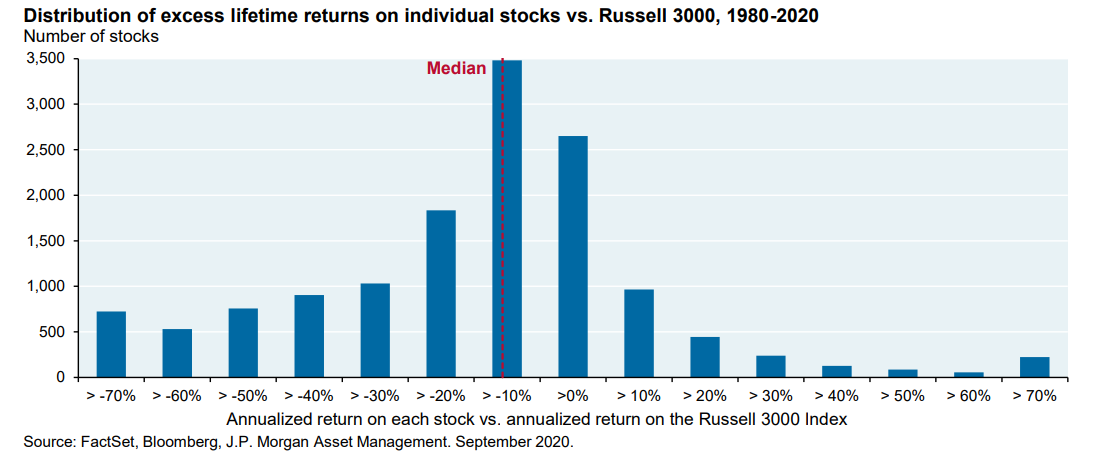

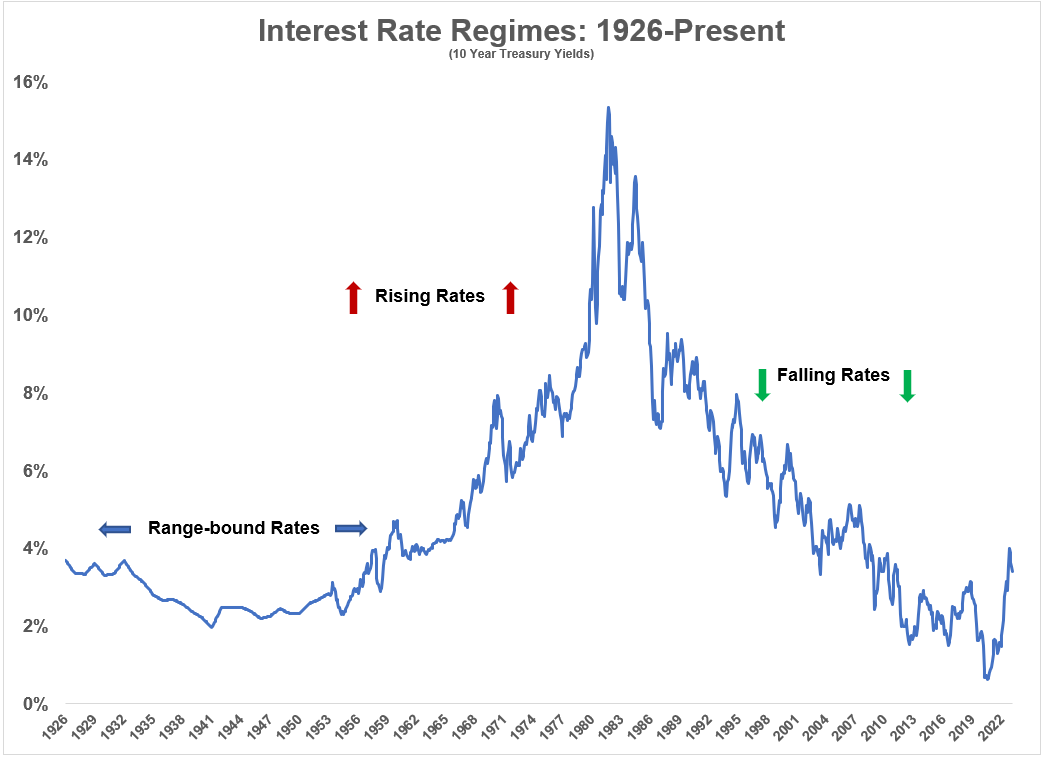

On the importance of financial market history.

Should you change your portfolio to account for 5% T-bill yields?

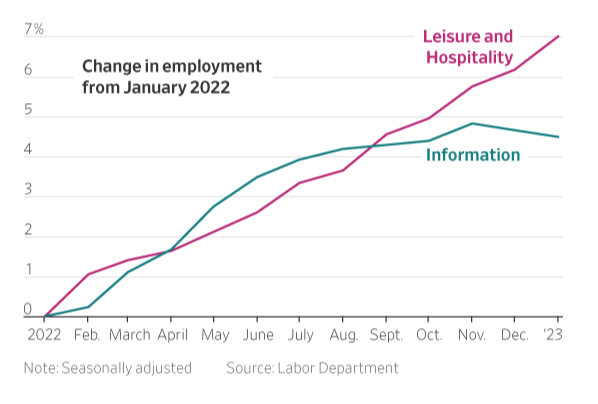

On today’s show, we discuss reaction to Powell’s testimony, richsession in chart form, Silvergate drama, Michael’s humble brags, Karen-Batnick, and much more!

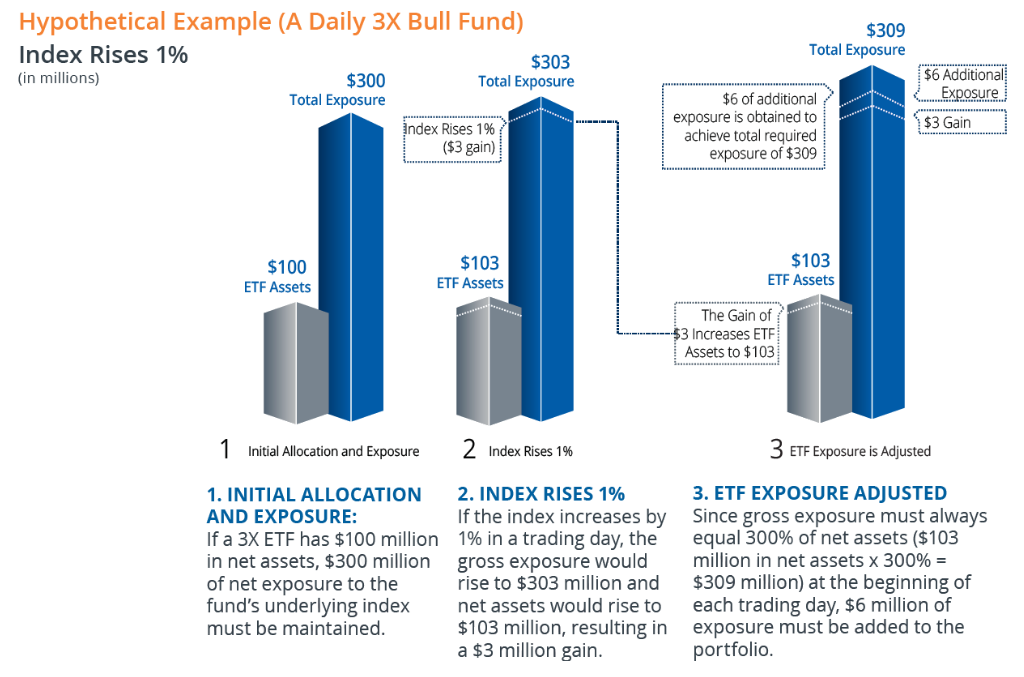

On today’s show, we are joined by Ed Egilinsky, Managing Director and Head of Alternatives at Direxion to discuss how to use leveraged ETFs, the cost of leverage, exciting thematics in 2023, and much more!

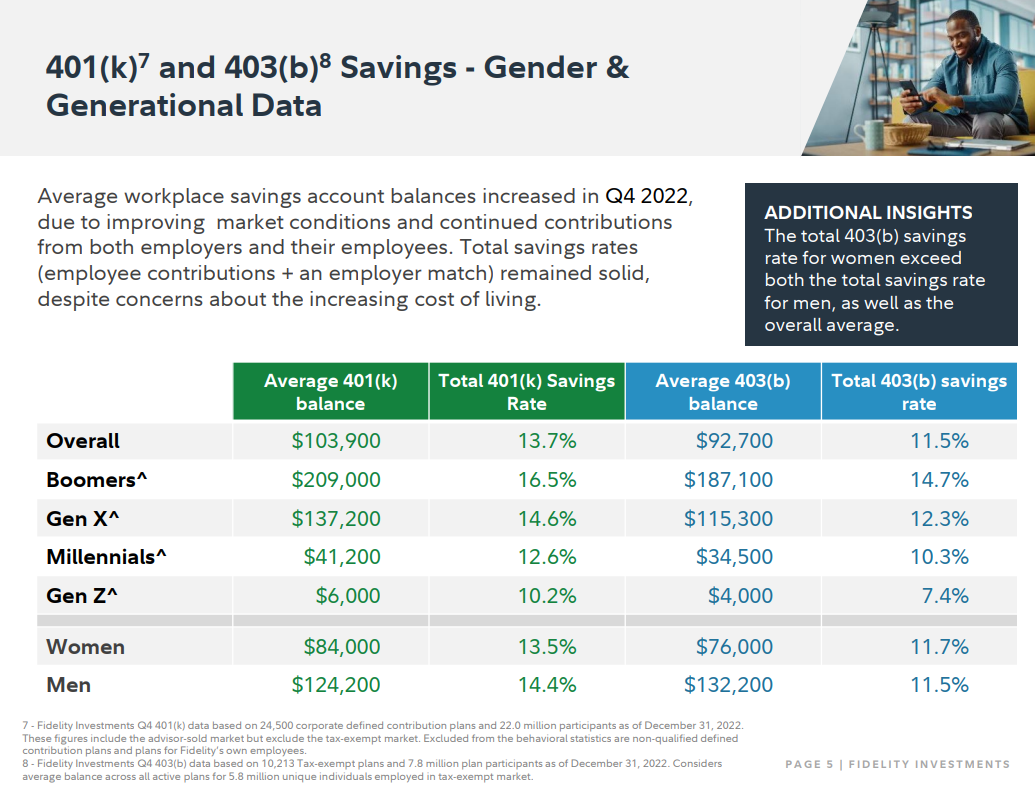

A deep dive into how much people save for retirement at Fidelity and Vanguard.

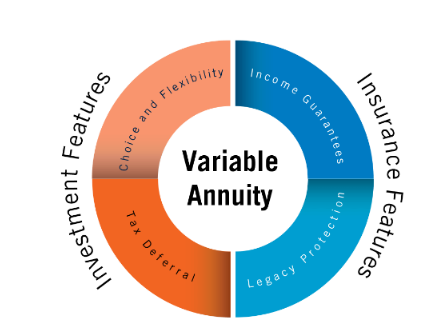

On today’s show, we are joined by David Blanchett, Managing Director and Head of Retirement Research at Prudential to discuss how advisors should think about incorporating annuities, what annuities make sense for clients, income strategies within 401Ks, and much more!

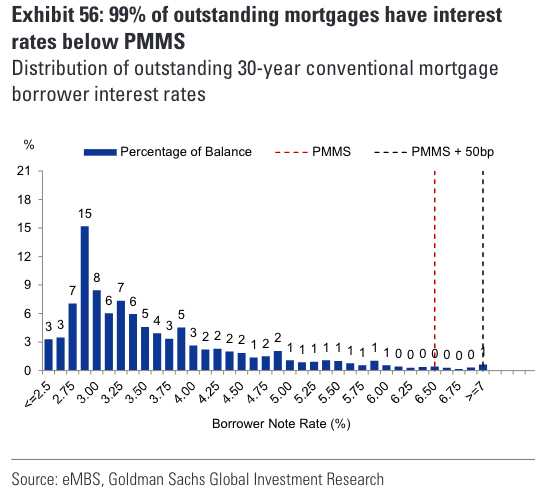

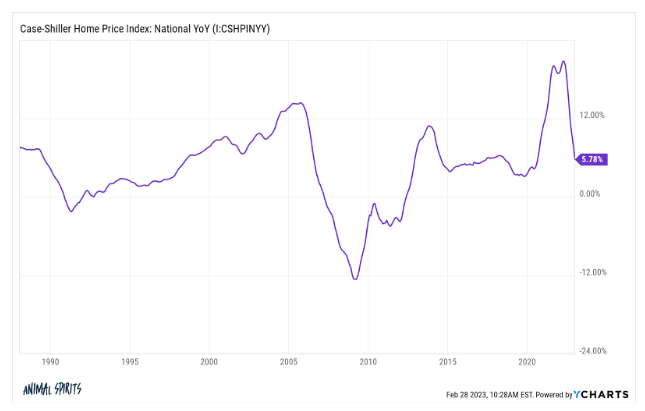

What’s taking so long for housing prices to fall?

Long-term bonds vs. short-term bonds.

On today’s show, we discuss Michael’s trip to Disney, the economy is too hot to not go into a recession, why inflation remains elevated, the junk stock rally, why housing prices aren’t falling faster, an appreciation for streaming, and much more.