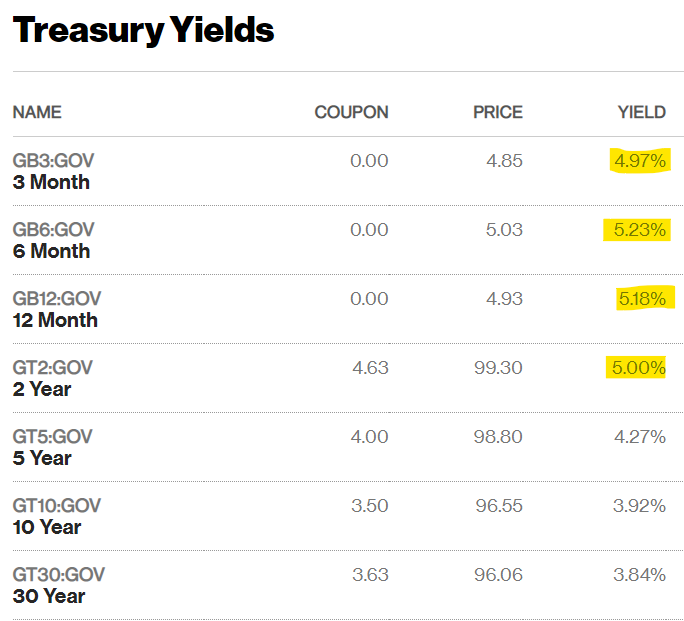

Short-term interest rates continue to charge higher as the economy remains stronger than anticipated.

We’re looking at 5% yields across the board for short-term government bonds.

Some people will still scoff at these yields by reminding you that inflation is still 6% but let’s be honest — right or wrong, most investors think in nominal terms, not real.

Short-term yields have been on the floor for so long that 5% interest rates are bound to grab the attention of investors.

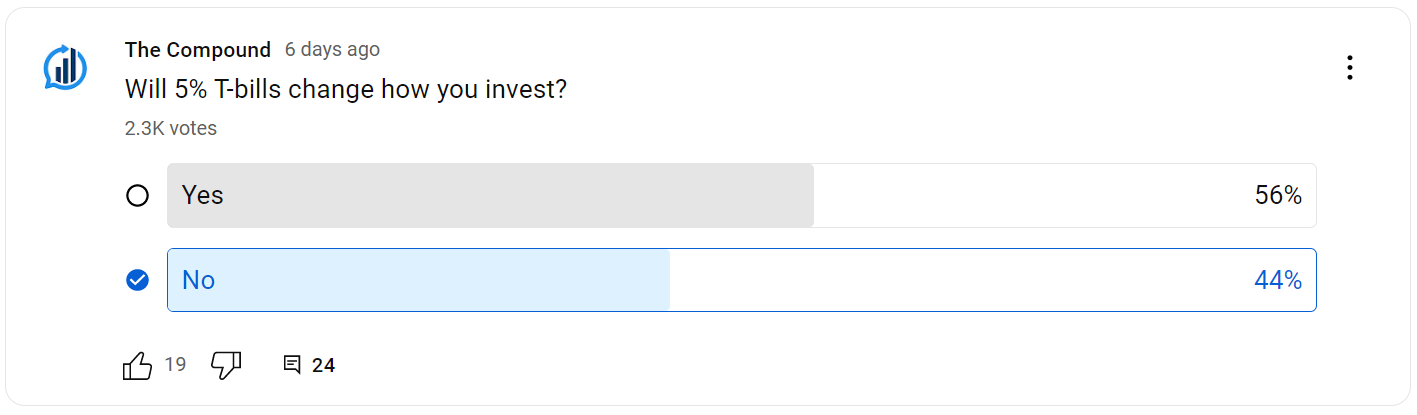

We asked our YouTube audience if 5% T-bills will change how they invest:

More than half of the respondents said this new world where relatively safe yields exist would change how they invest.

For a few years there rates were so low many investors were being forced out on the risk curve. I know plenty of balanced investors who preferred a 60/40 portfolio but opted for a 70/30 or 80/20 mix because bond yields were so pitiful.

The good news about 5% bond yields is that more conservative investors no longer have to stretch anymore.

Your expected returns are obviously much better when yields are at 5% than when they are at 1% or less.

Your asset allocation can change for any number of reasons.

Your financial circumstances or goals could change. Your willingness, need or ability to take risk could change. The markets could change.

But there is an important distinction between an asset allocation decision based on risk vs. reward trade-offs and market timing.

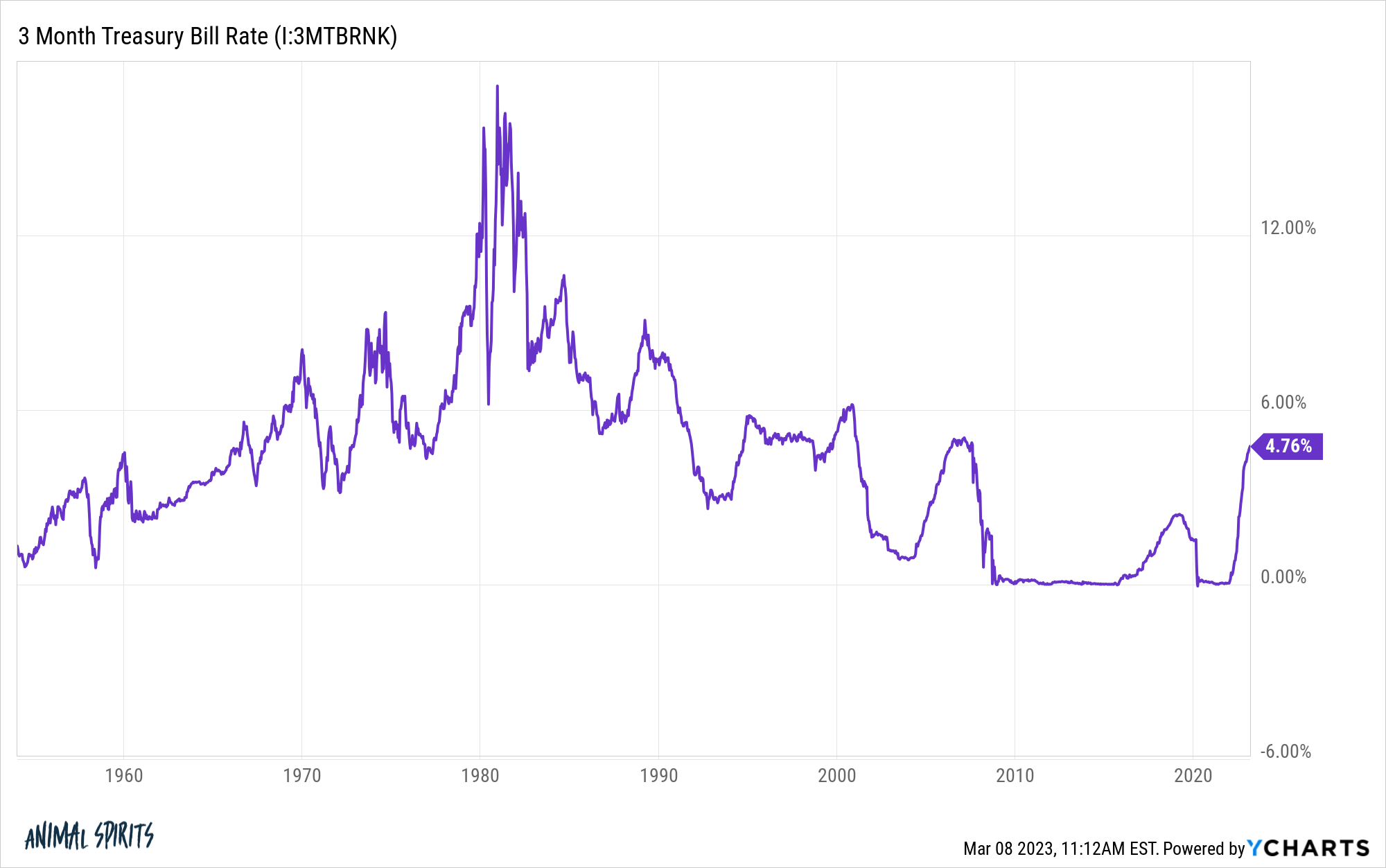

The biggest problem with making a huge shift in your portfolio from stocks to cash is that short-term interest rates are fickle.

They can go up quickly but also drop in a hurry.

Short-term bond yields could stay elevated for a while if the economy and inflation remain strong and the Fed battles high inflation.

But what happens if/when short-term rates go back down? If the Fed keeps raising rates eventually that’s going to slow things down.

When inflation slows and the economy weakens the Fed is going to cut rates. Unfortunately, T-bill yields won’t be 5% if inflation is 3%. Today’s 5% yields aren’t going to last forever.

I don’t know what’s going to happen in the short-term when it comes to interest rates or the stock market. No one does (not even the Fed). I prefer to make investment decisions based on my risk profile and time horizon rather than try to make forecasts about what will happen next.

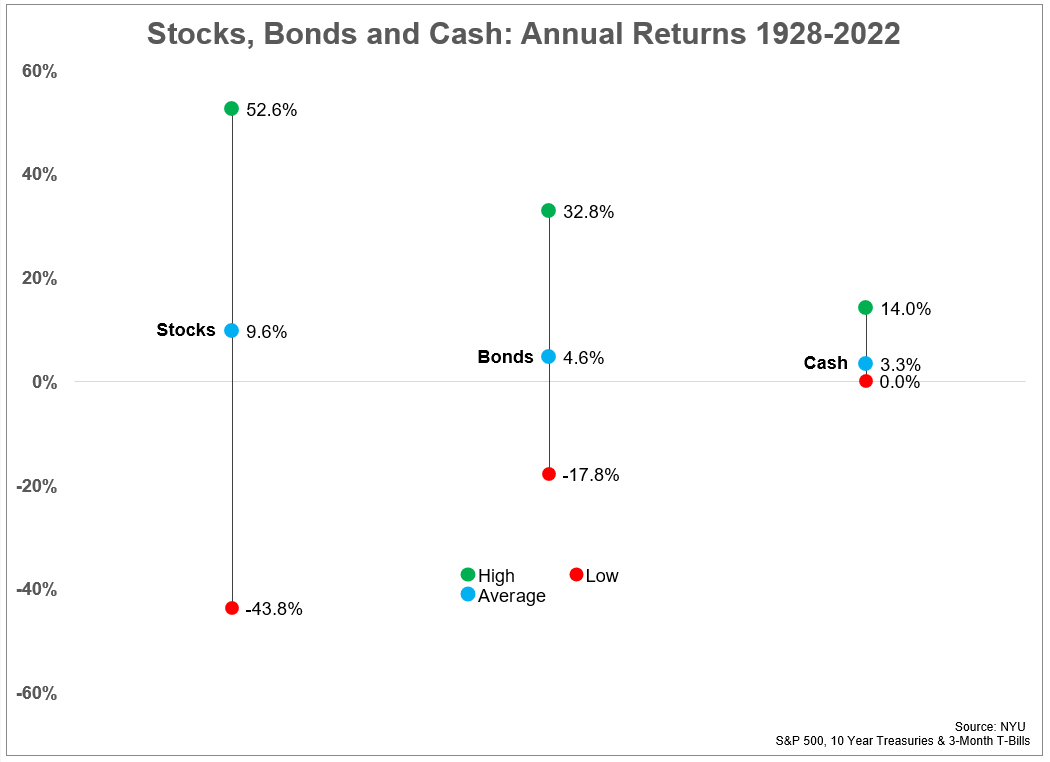

In the short-run cash can offer stability. At the moment it also offers pretty, pretty good nominal yields. Over the long-run you’ll barely keep up with inflation.

In the short-run stocks can rip your heart out. I don’t know if the bear market is over or if we are in for more carnage. But over the long-run the stock market remains the best bet for beating inflation and compounding your wealth.

Market timing requires you to be right twice.

Getting out is easy. Getting back is not.

The best case would be you move some or all of your portfolio into cash, the stock market drops, you clip your 5% and miss out on some losses, then shift back to stocks when yields fall.

The worst case is you move some or all of your portfolio into cash, yields fall, the stock market rips, you miss out on the gains and now you’re stuck in an asset class with low expected returns.

Don’t get me wrong — I like the idea of taking advantage of 5% yields. If your money is sitting in a bank account earning nothing you are missing out. And fixed income investors have better yield options than they’ve had in years.

I’m not trying to talk anyone into or out of any asset class.

Cash has a place in a portfolio for short-term liquidity needs and stability.

Bonds have a place in a portfolio to provide income and protection against deflation and disinflation.

Stocks have a place in a portfolio to provide higher expected returns and protection against the long-term impacts of inflation.

I just think it’s difficult to constantly shift your asset allocation into and out of these asset classes without causing some harm to your investment plan.

Asset allocation is for patient people.

Further Reading:

A Short History of Interest Rate Cycles