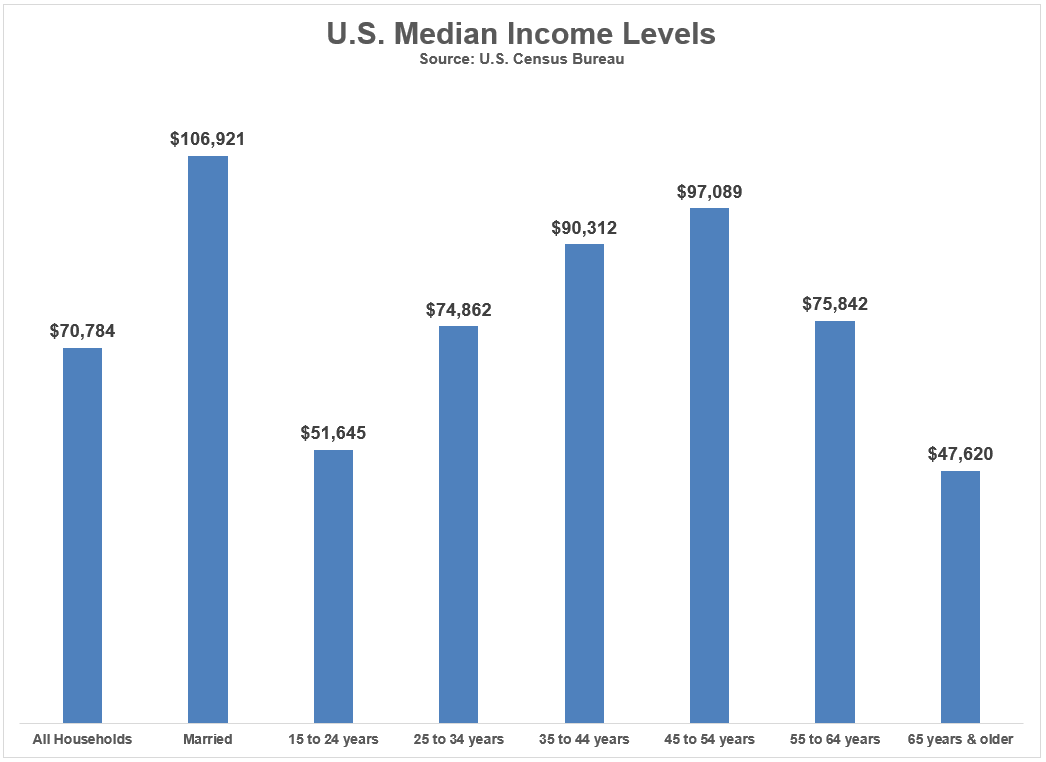

According to the U.S. Census Bureau, the median income in the United States is a little more than $70,000 a year.

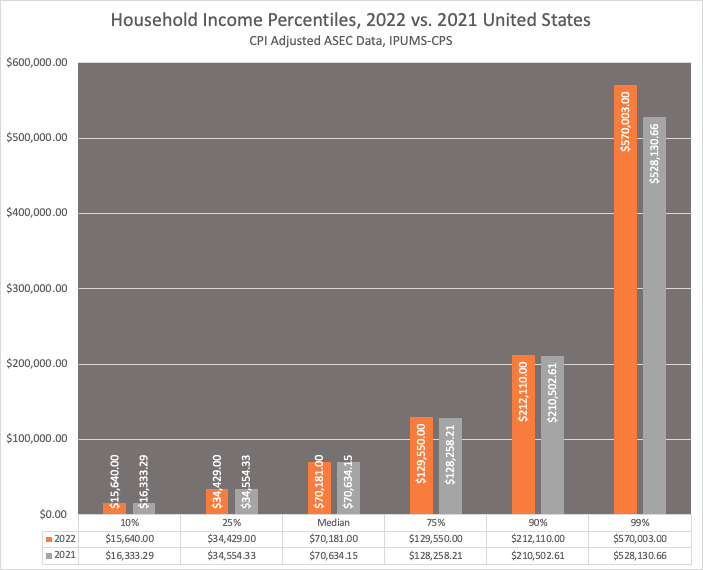

There is a sizable range of results around the median so it can help to break things down even further by percentiles.

DQYDJ has a good breakdown of the data that shows the bottom 10% of earners, the bottom 25%, median, top 25%, top 10% and top 1%:

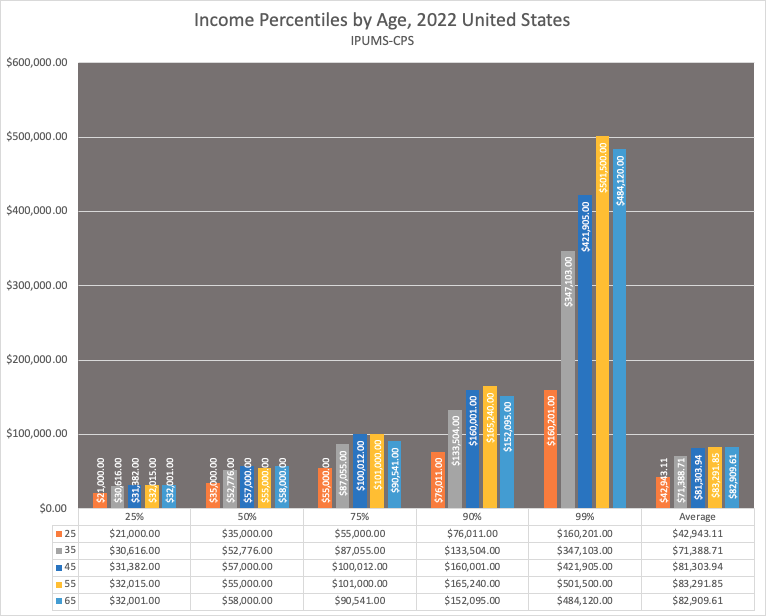

You can also see these breakdowns by age:

These figures can give you a good sense of where you stand in terms of earnings power but, as the old saying goes, where you stand is a function of where you sit.

Income is obviously different than wealth. It doesn’t matter how much money you make, if you don’t save any of it, you’re not really wealthy.

The person netting $40k a year but only spending $30k and saving the rest is building wealth. The person netting $2 million but spending $2.5 million and saving nothing is not actually wealthy.

But there is a perception that a high income makes you wealthy and perception is often reality when it comes to how people think about their finances.

There are a number of factors that determine how you feel about your income level.

Where you live. Your family situation (single, married, kids, etc.). Your level of spending. The relative incomes and wealth of those around you. The cost of living.

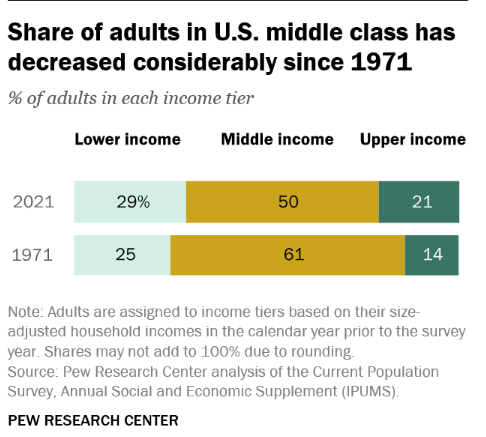

It also doesn’t help that there has been a move to the extremes when it comes to income levels over the past 50+ years. Pew Research compared the breakdown by lower, middle and upper class between 1971 and 2021:

The good news is more people are now in the upper-income bracket. The bad news is more people are also in the lower income bracket.

The strange thing about having more people in the upper-income tier is how many of them seem unhappy.

Making a little more than $200k a year puts you in the top 10% of all earners in the entire country. That seems pretty well-off to me.

Yet someone living in Manhattan or San Francisco who makes that much money might try to argue that kind of salary only puts them in the upper middle class, not the wealthy elite.

And even those who are objectively wealthy might have a difficult time being content with what they have in places that are swarming with rich people.

There was a story in the New York Magazine last month that profiled people in New York City who are wealthy but don’t feel like it based on their peer groups:

“It’s so crazy how rich you have to be in New York to live comfortably, just comfortably,” she tells me, slightly out of breath, while she runs to a meeting. “There’s this very subtle heartbreak that perhaps people made better life choices than you and their houses are bigger and they are happier.”

It’s understandable to feel inadequate in a city that houses some of the richest people on the planet. But here’s the kicker for the person quoted here:

The crazy thing is that this friend, at 45, has not only an apartment in the city but a weekend house outside it — one that she bought with earnings from her successful career and enjoys with her partner and kids. She is happy, yet she is undeniably worn out from trying to stay that way in a city where exorbitant wealth — two-nannies-and-a-chauffeur wealth, spring-break-in-St.-Barts wealth — is everywhere. “If you find yourself in your 40s still living in New York, still hustling, still striving, there’s a part of you that is completely beat down and a little bit unwell,” she says.

This person is definitely rich but they don’t feel rich because their benchmark is people who are even richer and more successful.

No one should feel sorry for wealthy people who are unsatisfied but it makes sense why this is the case. The research on happiness shows that the more often you compare yourself to others — good or bad — the less happy you are.

In today’s world, it’s never been easier to compare yourself to others. And there are always going to be people who are richer, smarter, more successful or better-looking than you are.

Rich is a subjective term so there is no right or wrong answer to the title of this blog post. There are plenty of ways to live a rich life that have nothing to do with income or the amount of money you have in the bank.

The problem with using any number to judge yourself by is once you get there you’re probably going to move the goalposts or find it unsatisfying.

A lack of income or wealth can certainly make you miserable but after a certain point they’re not guaranteed to make you happier either.

The only thing I really read this week was a book on my flights to and from Chicago. It’s called The Good Life: Lessons from the World’s Long Scientific Study of Happiness. I thoroughly enjoyed it.

I’ll have some thoughts on it next week as it pertains to what actually does make us happier.

Michael and I debated income levels and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further reading:

Perfect is the Enemy of Good