On today’s show, we discuss:

– Why so many people hate this economy

– Anecdotes vs. data

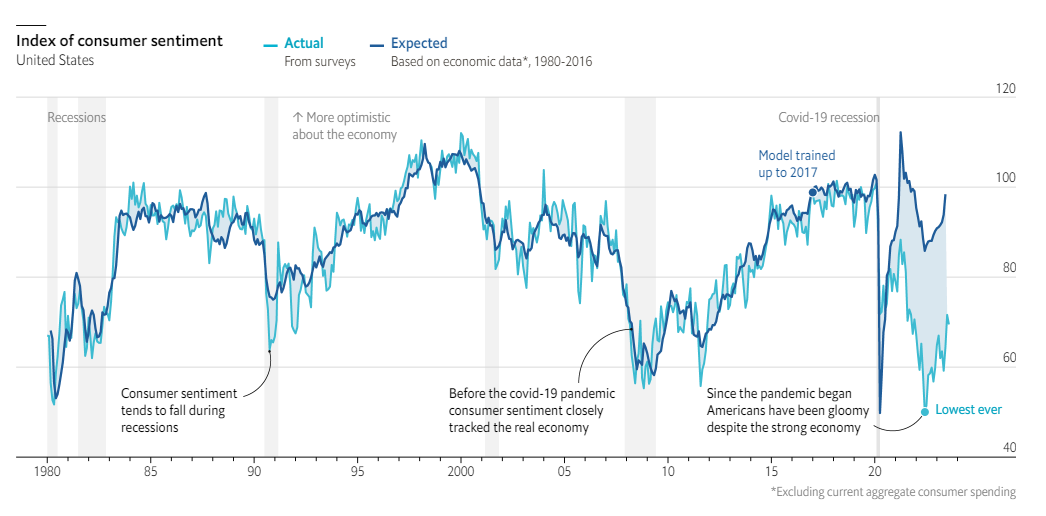

– A depression in the mortgage industry

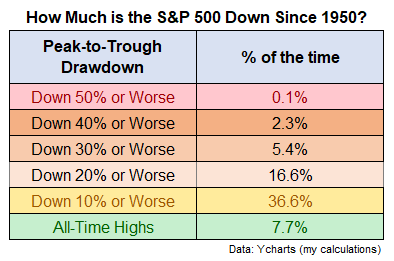

– The good news about falling stock prices

– Small caps look cheap

– Consumers need a recession, and much more!

On today’s show, we discuss:

– Why so many people hate this economy

– Anecdotes vs. data

– A depression in the mortgage industry

– The good news about falling stock prices

– Small caps look cheap

– Consumers need a recession, and much more!

Recessions don’t happen nearly as often as they used to. Maybe we’ve become complacent about econmic volatility.

On today’s show, we are joined by Brendan Ahern, CIO of Kraneshares to discuss:

– The creation of Kraneshares Luxury ETF

– Demographic trends and utilizing the wealth affect

– Challenges in investing in international markets

– Luxury dynamics in a recession, and much more!

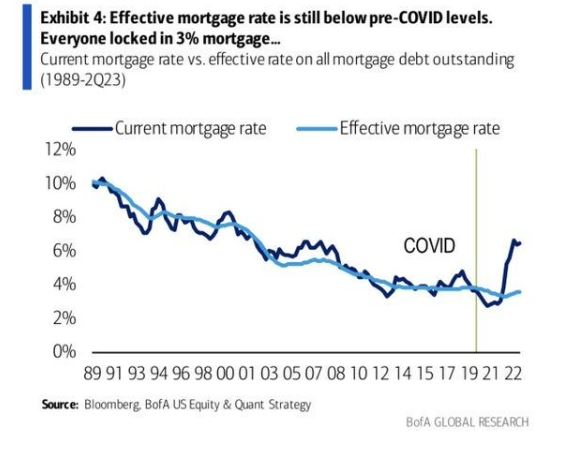

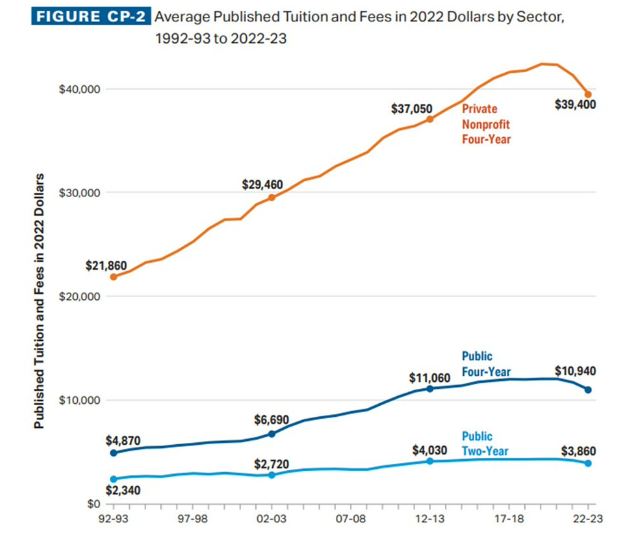

Consider yourself lucky if you locked in a low price and mortgage rate on your house.

Revisiting some predictions from Henry Blodget and John Hussman about a stock market crash.

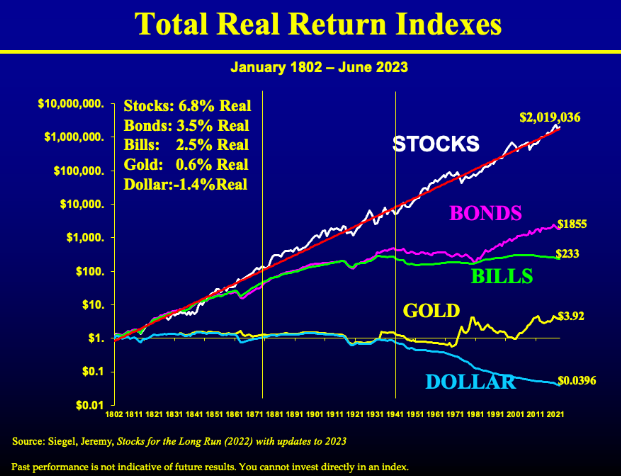

How to think about future returns in the stock market.

On today’s show, we discuss:

– Higher growth and higher rates vs. lower growth and lower rates

– Why there is so much focus on 60/40 portfolios

– Bears vs. doomers

– The annoyance economy

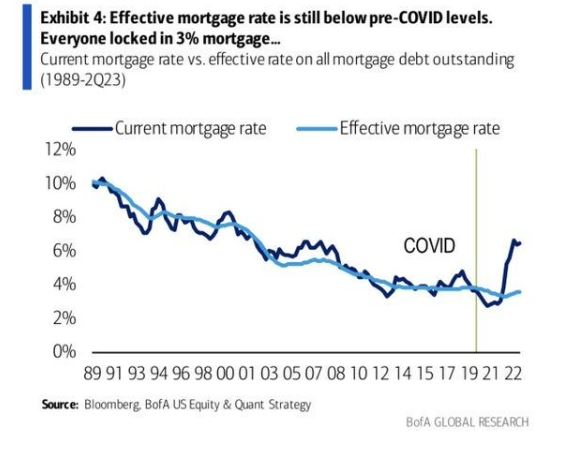

– Why no one is happy about the economy right now (or ever)

– A record jump in net worth

– Renting vs. buying, and much more!

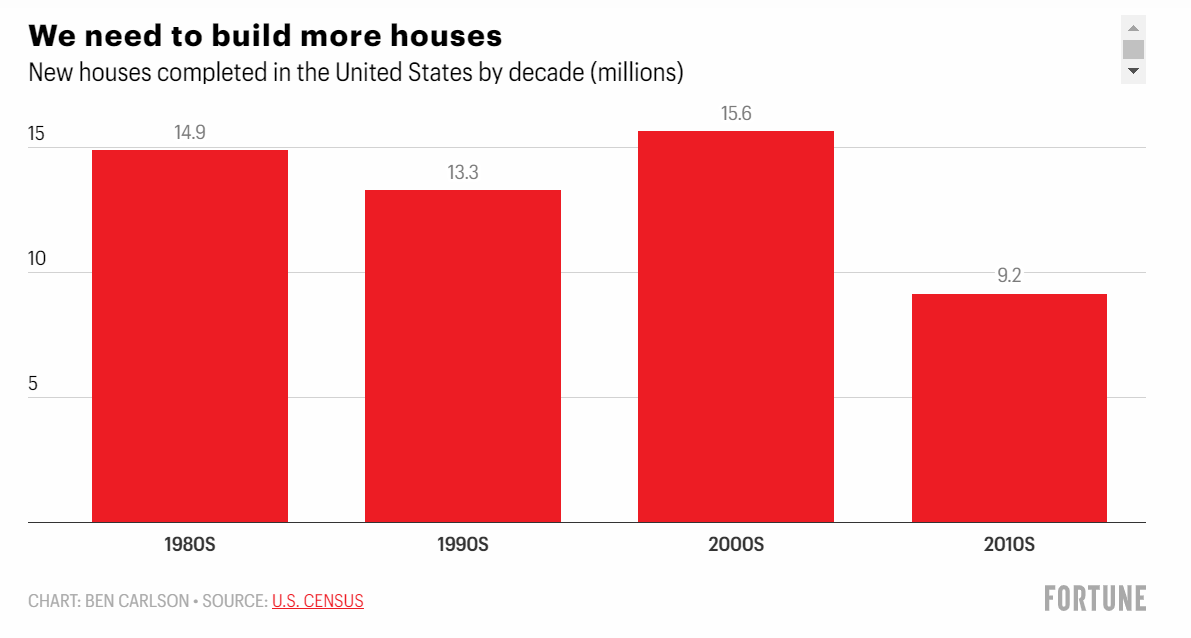

Four reasons the housing market is such a mess right now.

On today’s show, we had Hamilton Reiner, MD, PM, and Head of US Equity Derivatives at J.P. Morgan Asset Management back on the show to discuss:

– How hedging ladders provide downside protection

– The goal of the HELO ETF

– Hedged equity strategies vs traditional 60/40 portfolios

– The impact of volatility on the strategy, and much more!

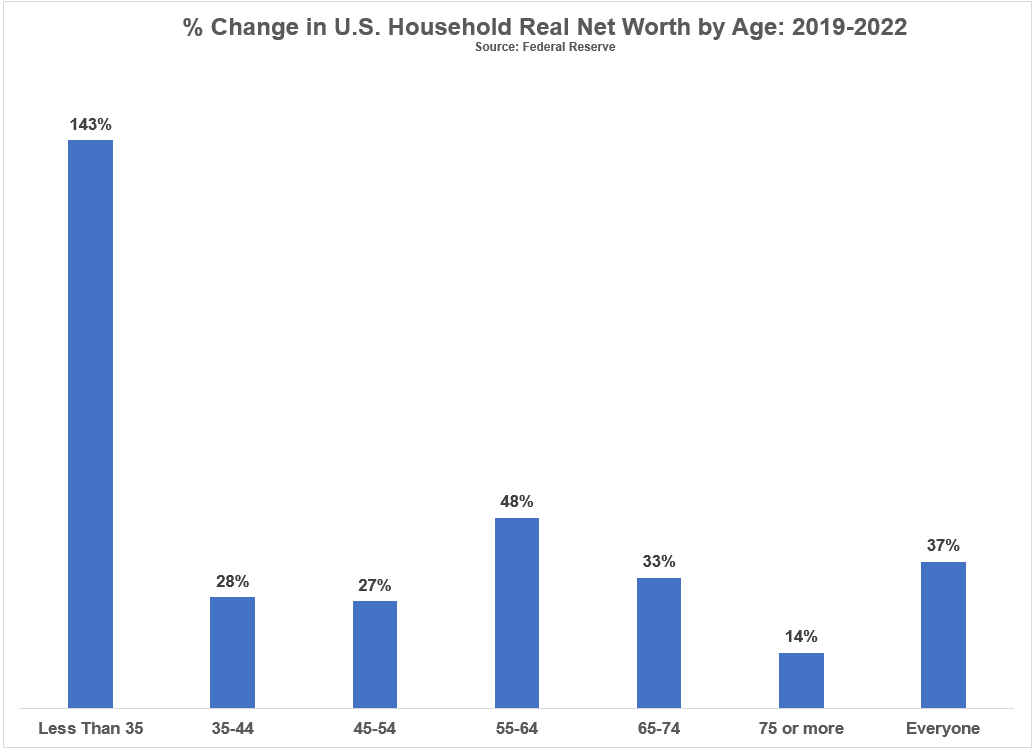

The median real net worth of American households was up 37% from 2019-2022.