Every three years the Federal Reserve puts out a report that summarizes the changes to family finances in the United States.

I know averages, aggregates, medians and such never tell the entire story but directionally this stuff can be helpful in terms of understanding where things stand.

Let’s dig in.

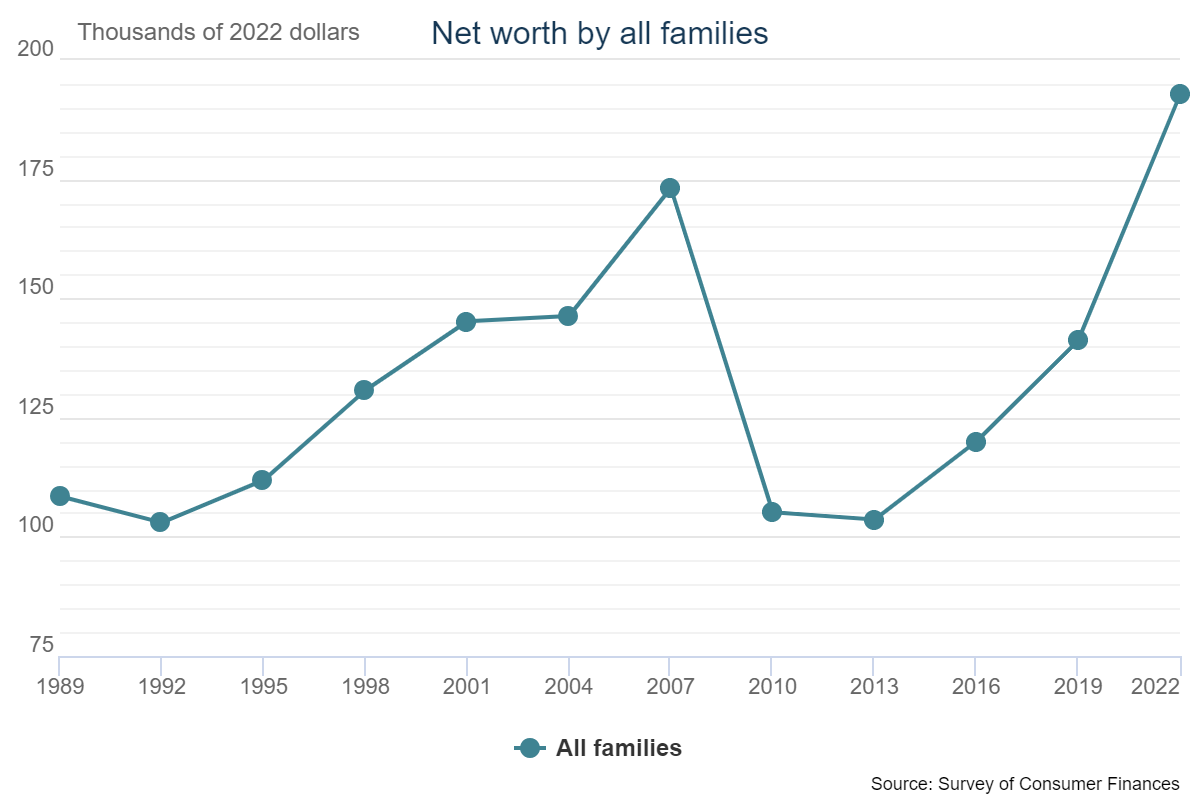

Real median net worth for U.S. households was up a stunning 37% from 2019-2022.

This is just a massive increase in wealth considering the fact that 2022 was one of the worst years ever for a diversified portfolio of stocks and bonds.

But Ben what about inflation?!

To be clear, these numbers are inflation-adjusted.

And while net worth grew 37%, total household debt grew less than 4% from 2019-2022. Sign me up for that every three years, please.

This is what the change in net worth looks like every three years going back to 1989:

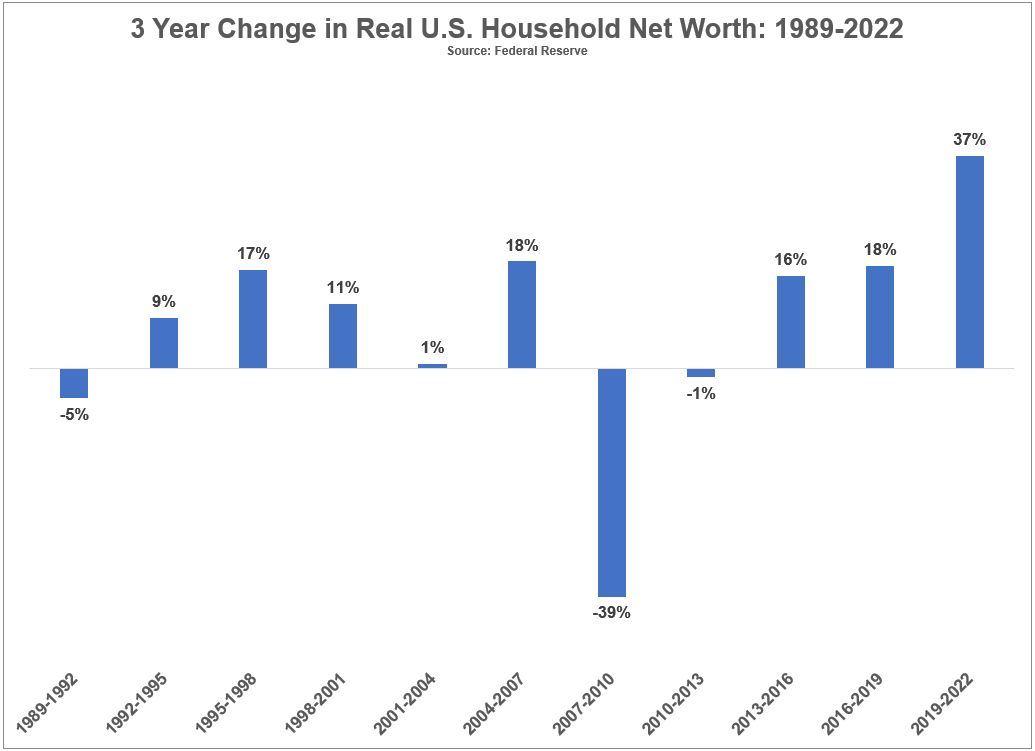

Now look at the relative change every three years to put the most recent move into perspective:

You can see this is by far the biggest increase and there isn’t a close second.

The 2019-2022 increase is off-the-charts good and this was after we already had a strong snapback in 2013-2016 and 2016-2019 from the 2008 financial crisis.

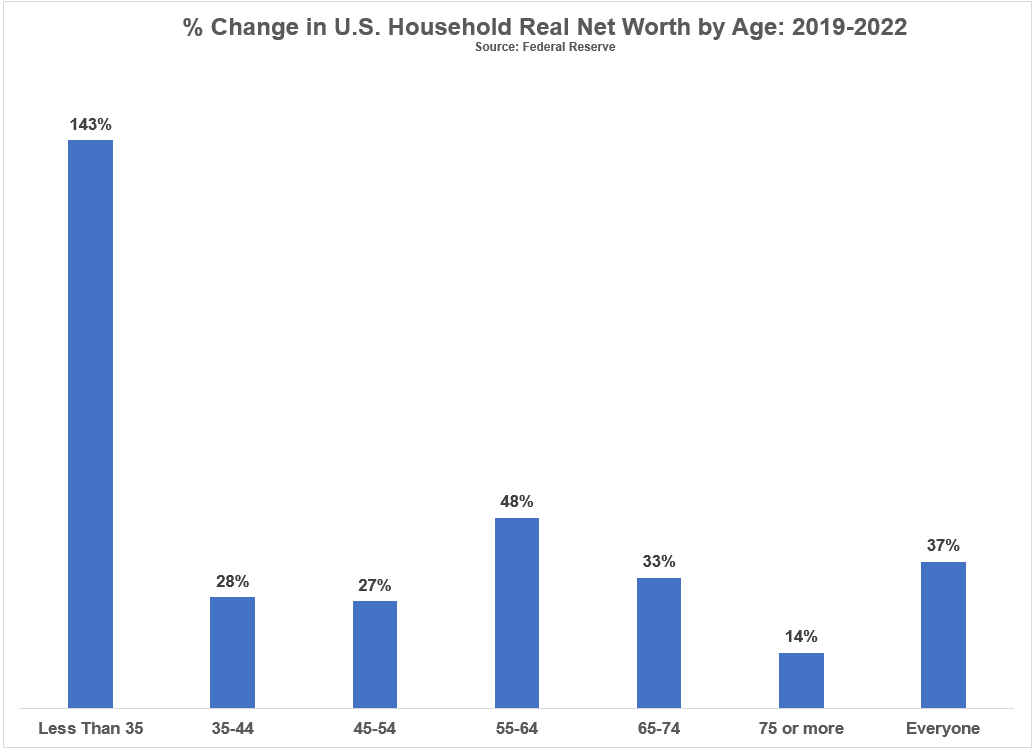

Now let’s look at the relative changes by age bracket:

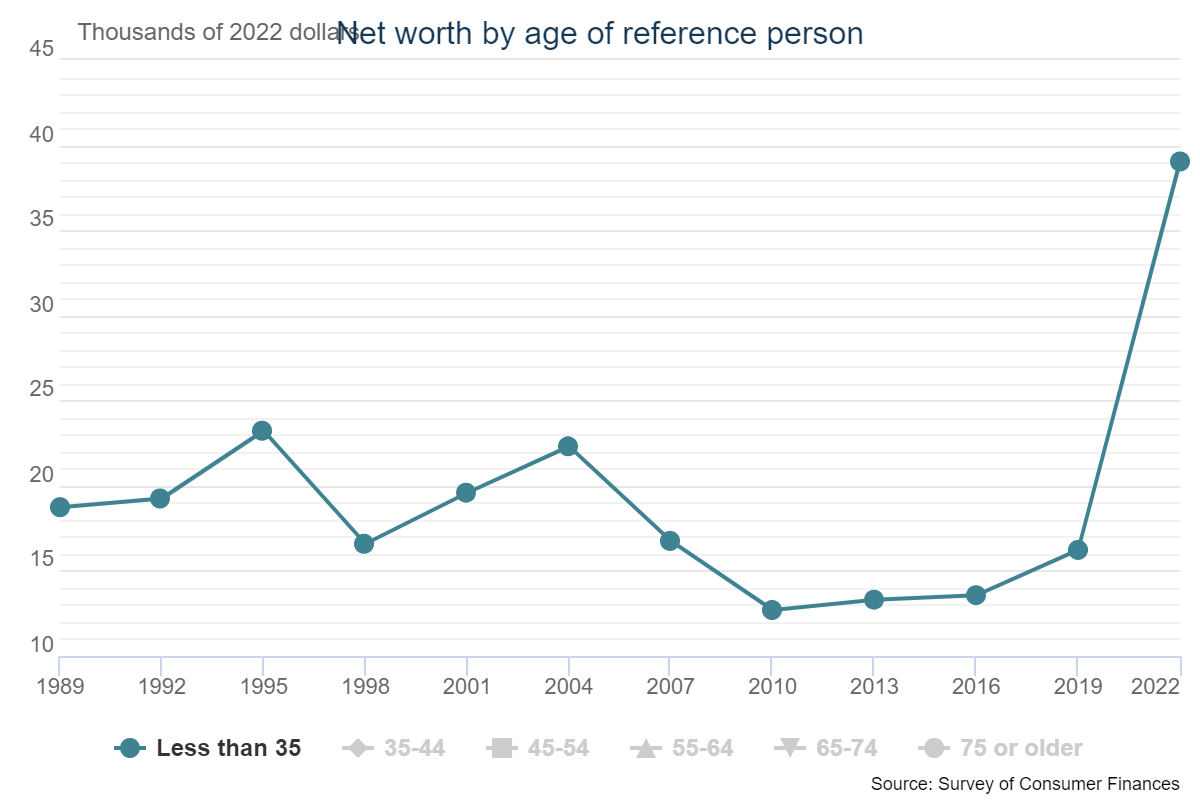

Look at the increase in wealth by the under 35 cohort.

It’s another off-the-charts increase:

Young people as a whole are in a much better place now than they were just a few short years ago.

Of course, this enormous increase in wealth had to be all housing-related, right?

The rise in housing prices certainly played a role here. Nationwide, housing prices were up 40% from 2019-2022.

But renters actually experienced an even bigger increase in their real net worth than homeowners. The gains were 43% and 34%, respectively.1

There are always going to be winners and losers in this system, but the financial position of American households improved substantially across the board.

So why does it seem like everyone is miserable? Why is sentiment about the economy so dire?

People hate inflation and economic volatility. Americans love to borrow money so higher rates are likely hurting morale. The housing market is broken at the moment so that’s not helping either.

There are also psychological reasons everyone seems to hate the economy.

The pandemic played head games with us.

It was a crazy period of time for everyone but financially people were in a weird place.

There was way more cash on hand because people weren’t spending as much and the government was handing out money. Prices were actually going down for a short time while incomes were rising.

Going from that situation to one of rapidly rising prices and rates has surely messed up our equilibriums.

Plus, there’s the media element.

The media has always loved bad news but it feels like we’re addicted to it now.

If it bleeds it leads. The higher the VIX the higher the clicks.

This is a real phenomenon.

The media spent the past 18-24 months bashing us over the head with recession predictions and talking about how bad inflation is. They don’t show counterprogramming when inflation falls or the economy improves.

There are always headlines about layoffs. We rarely hear when companies go on hiring sprees.

We simply cannot enjoy good economic news anymore.

Don’t believe me?

Just look at this headline:

And this one:

And another:

Listen I get it.

This is all finance brain stuff where good news is actually bad news because it means the Fed will have to keep hiking or keep rates high to slow the economy.

I’m a glass-is-half-full guy but I’m not naive to the fact that things aren’t perfect in the economy.

There are plenty of things to worry about. A recession is still a real possibility. High inflation has made things more difficult for many households.

But it’s also worth pointing out how much progress we’ve made this cycle.

It may not feel like it but the finances of U.S. households have improved considerably in a short period of time.

That’s worth celebrating even if it can’t last forever.

Further Reading:

How Rich Are American Households?

1To be fair, the absolute level of wealth for homeowners still dwarfs the level of wealth for renters by a factor of roughly 38x. It’s still impressive. Renters saw higher growth over the previous 3 year period from 2016-2019 as well.