My column for Bloomberg this week looked at how the lump sum vs. dollar cost averaging decision may be impacted by the current higher-than-average valuation levels. Investing a large slug of cash is never an easy decision. Investors worry about investing all their cash right before a market crash or not investing it all at…

The Tyranny of Benchmarking

A number of years ago the firm I worked for went through a lengthy review process of the compensation policies for our investment team. Management was trying to make sure our pay was aligned with industry averages but specifically, they were overhauling our bonus pool. A compensation consultant was brought in. The process took a…

Animal Spirits Episode 25: Some Things We Learned

On this week’s Animal Spirits with Michael & Ben we discuss: Why the next recession won’t look like the last one. Why investors are always fighting the last war. Is it now contrarian to predict higher expected returns? What could cause the future to look better than the past in the markets? The staggering growth…

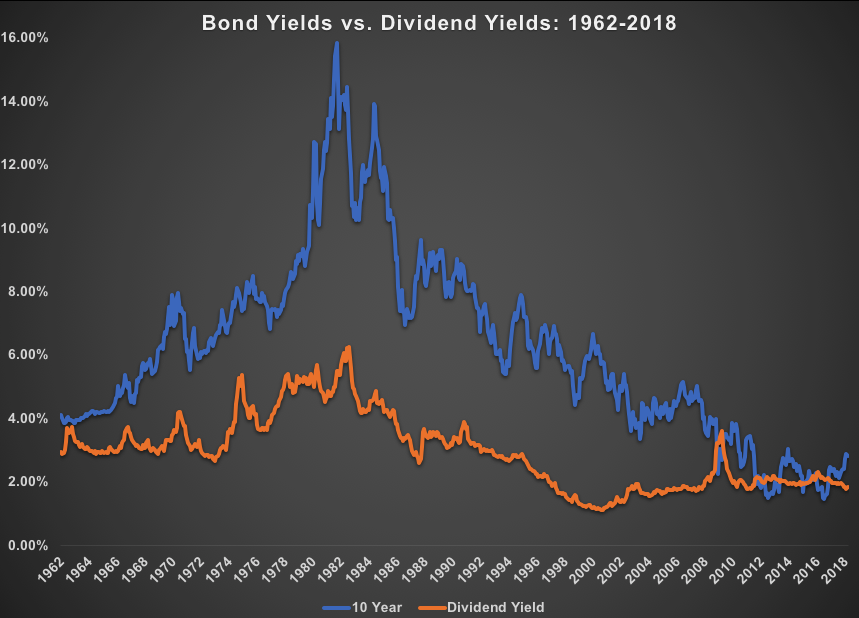

Why It Makes No Sense to Compare Dividend Yields to Bond Yields

Investors have a funny relationship with yield. Retirees tend to prefer an income-based strategy, even at the expense of total returns. Plenty of investors (and politicians) have a poor understanding of share buybacks. Another area of confusing stems from making yield comparisons across stocks and bonds. You could certainly make the case for comparing bond…

3 Ways to Make Up For a Retirement Savings Shortfall

The growing disparity between the haves and the have-nots in this country means that while the top wealth-holders have more than enough money to do what they would like in retirement, a majority of Americans are massively underprepared for their non-working years. It may seem bleak for the large group of people who have little…

More Than Never. Less Than Always.

In the latest Jack Reacher book, The Midnight Line by Lee Child, Reacher is forced to make a decision without having all of the facts. He’s trying to track down the owner of an Army ring and has to make an educated guess about how to find her. He lays out the best case scenario…

Animal Spirits Episode 24: The False Breakdown

On this week’s Animal Spirits with Michael & Ben we discuss: How to solve the horrible financial literacy in this country. How much money people think they need to retire. The struggles of hedge fund managers Bill Ackman and David Einhorn. Why it’s so difficult to determine when to pull money from an underperforming money…

Stocks Are More Similar to Bonds Than You Think

Last week I looked at the impact of high inflation on the stock market. In summary, it’s typically not a great thing. In this follow-up piece I go over some of the reasons why this is the case. ******* Historical data show that stocks tend to post strong performances during periods of rising interest rates but only…

Is College Worth the Cost?

Reddit co-founder Alexis Ohanian gave some advice to young people in a recent interview with the New York Times: What’s your advice for college grads? Do you really need to go to college? There is a huge student loan debt problem in this country. I think there’s going to need to be a drastic change…

Price Discovery in Bitcoin

In October I pondered what could send the price of bitcoin into the stratosphere. My theory was that a flood of institutional capital could propel cryptocurrencies to the moon. The buy-in from the endowment, foundation, pension, family office space hasn’t quite happened just yet but bitcoin and the alt cryptos did see a huge ramp over the next…