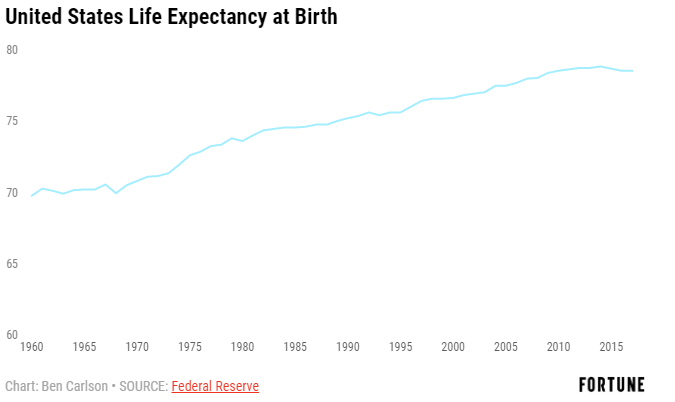

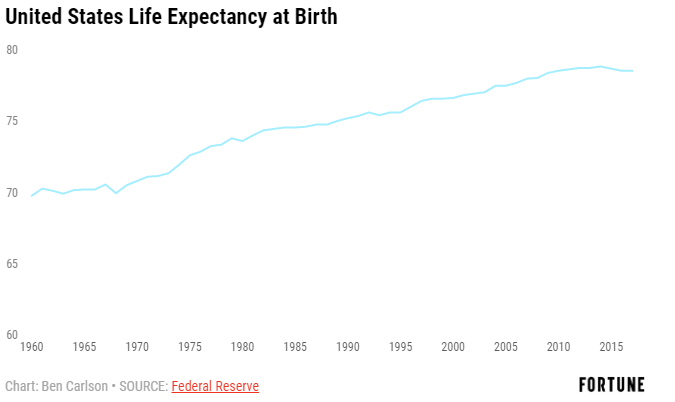

Why your time horizon is likely longer than you think.

Why your time horizon is likely longer than you think.

“Stay the course” and “ignore the noise” sound like great advice but there’s a lot of work involved to follow through with this advice.

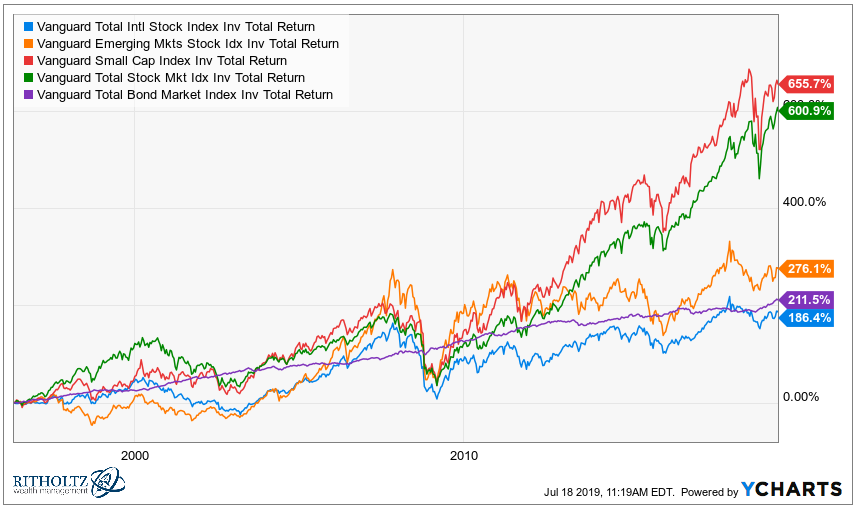

This year has been kind to stock and bond markets around the globe: But I’m sure there are some investors who hate to see the bond performance holding their portfolio back when stocks are doing so well. If we zoom out to the past year — which includes the brief bear market in late-2018 —…

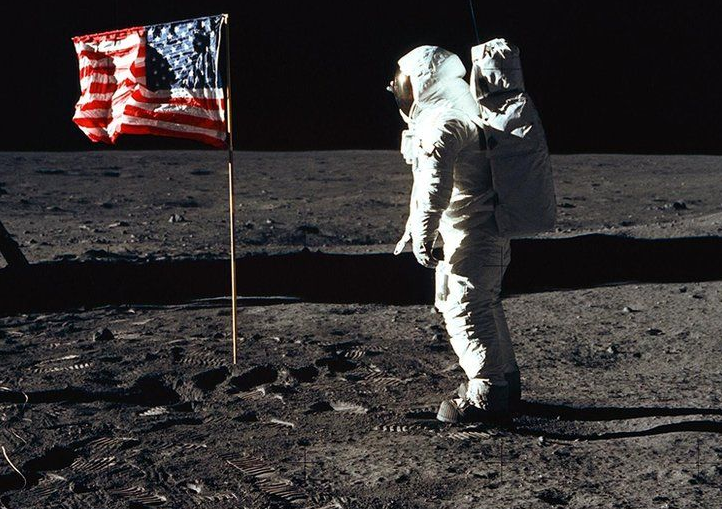

Why history is not always what you think.

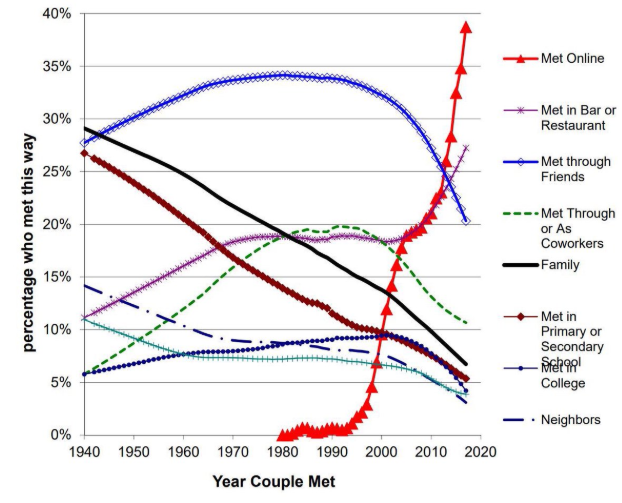

On this week’s Animal Spirits with Michael and Ben we discuss: The upside to social media Zombie VC companies Podcasting at Wealth/Stack Bubbles and career risk Growth and value cycles Using credit card reward points Congress is coming for your IRA Translucent ETFs Could you win a point off Serena? Where couples meet these days…

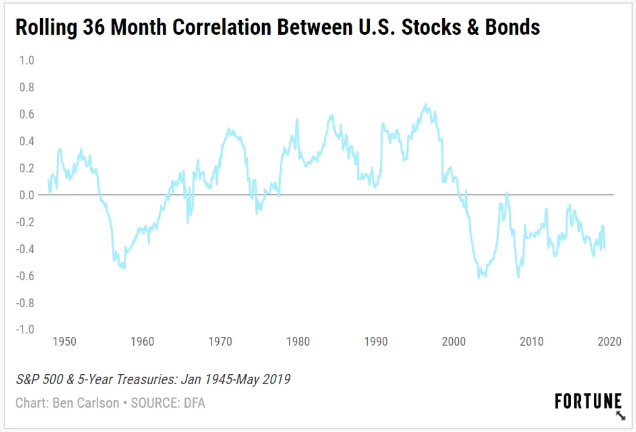

Stocks and bonds have a long-term correlation close to zero. Why that’s a good thing.

This week’s Animal Spirits: Talk Your Book is sponsored by Teucrium: We discuss: How ETFs work when futures are involved ETFs vs. ETNs Why commodities are typically better for tactical trades Where commodities fit within a portfolio How commodities can offset shocks to a stock portfolio The number one use for corn Who trades futures…

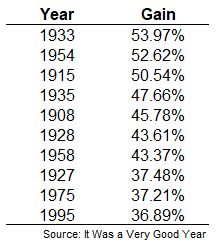

What the 10 best years in U.S. stock market history can teach us about investing.

Josh Brown, Michael Batnick, and Ben Carlson go through the litany of mistakes you can make with your money using the seven deadly sins as a jumping off point.

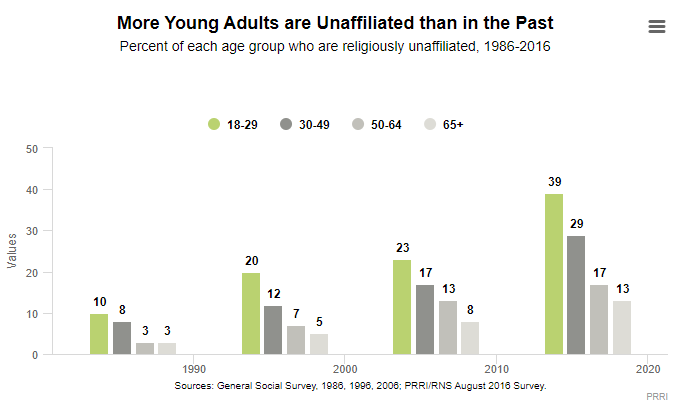

Which trends will deline in popularity as younger generations slowly take over for the baby boomers?