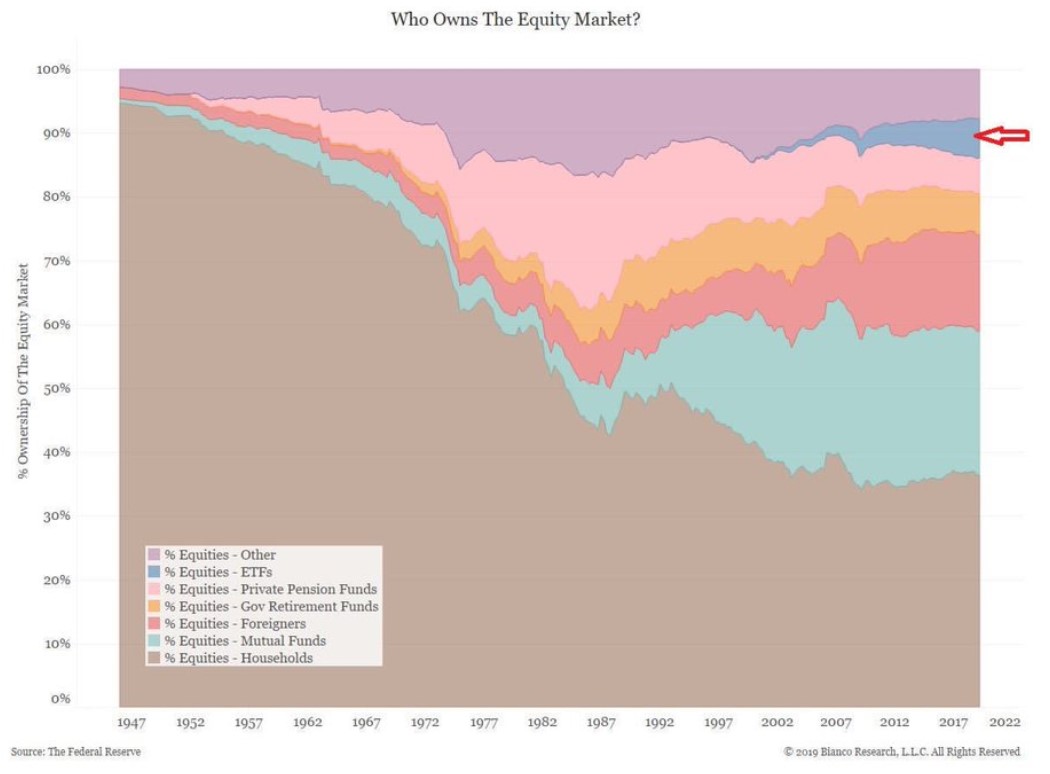

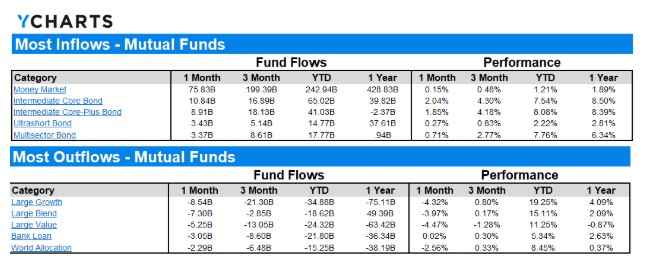

Does it matter if investors keep buying regardless of valuations?

Does it matter if investors keep buying regardless of valuations?

On this week’s Animal Spirits with Michael and Ben we discuss: Passive bubble feedback What are some legitimate concerns about the rise in indexing? Slack, Uber, Lyft and WeWork all getting smoked Is the private markets bubble bursting? An intro to rewards credit cards Should all the big tech companies have their own credit cards?…

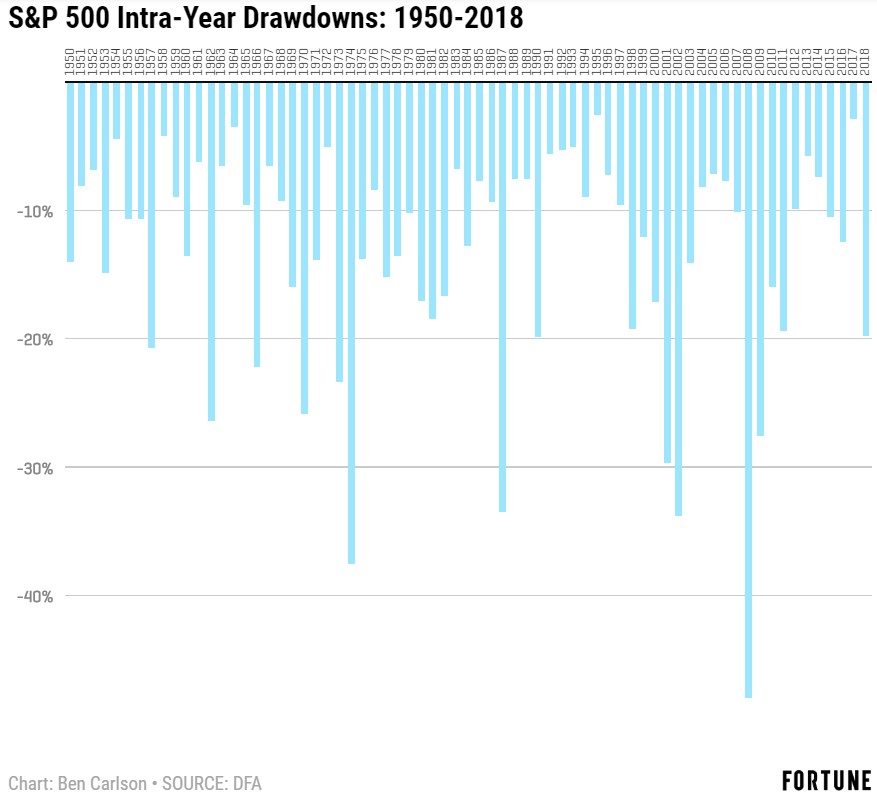

Recent stock market performance is odd in that 2019 has gone gangbusters but since the start of 2018, stocks have basically gone nowhere. The obvious culprit here is the fact that stocks fell roughly 20% in the 4th quarter of 2018. Here’s a Fortune piece I wrote to put this performance into context. ******* The…

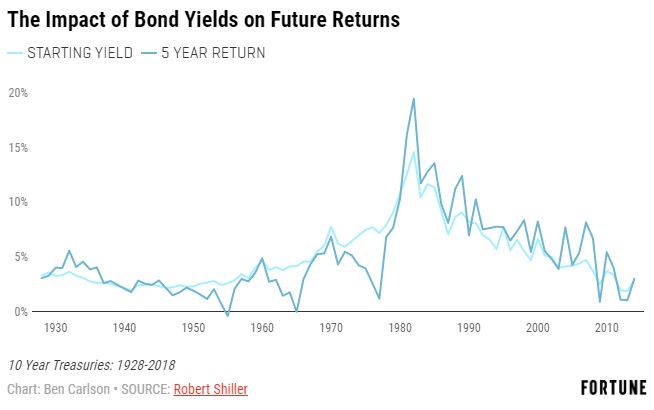

There are a few different paths bonds could take in the years ahead depending on the path of interest rates.

The new Brad Pitt movie Ad Astra that comes out in a few weeks looks like it has potential: Pitt talked with Kyle Buchanan at the New York Times for a piece that came out this week about the movie, working with the director of the film, and his personal life. You never really…

This passive bubble talk makes no sense.

Michael and Ben discuss passive bubbles, fund flows, the best Disney song, targetdate funds, behavior gaps & much more.

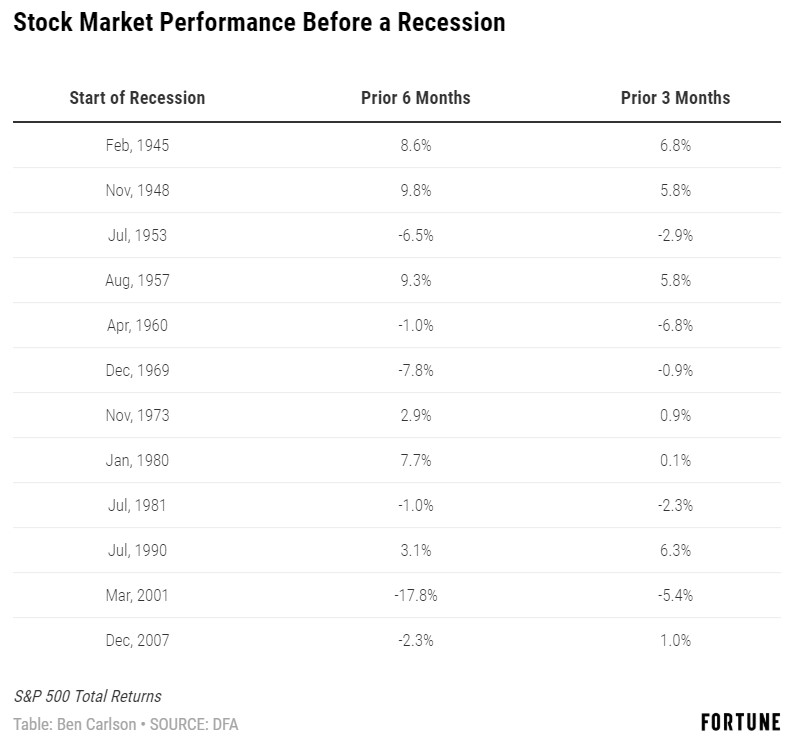

It feels like people have been worried about the next recession every day since the last one was over. I get it. Recessions aren’t fun. But you can’t constantly remain in the fetal position simply because you know the economy and markets eventually have a downside. Here’s a piece I wrote for Fortune to provide…

Why budget is a four letter word in the personal finance world.

2019 has been a good year for pretty much everything in the financial markets. U.S. stocks, long-term government bonds, and gold are all up big this year: I can’t remember a year when all three of these very different assets were all up so much at the same time. So I looked back at the…