This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

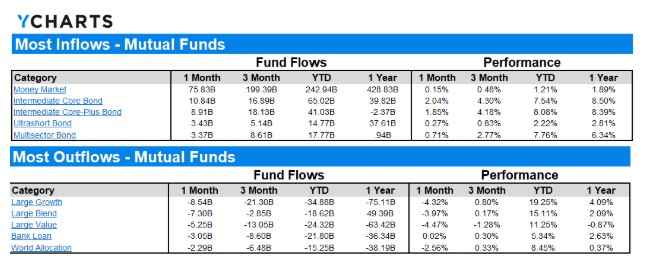

- How much do mutual fund flows really matter for the markets?

- Passive bubbles don’t make sense

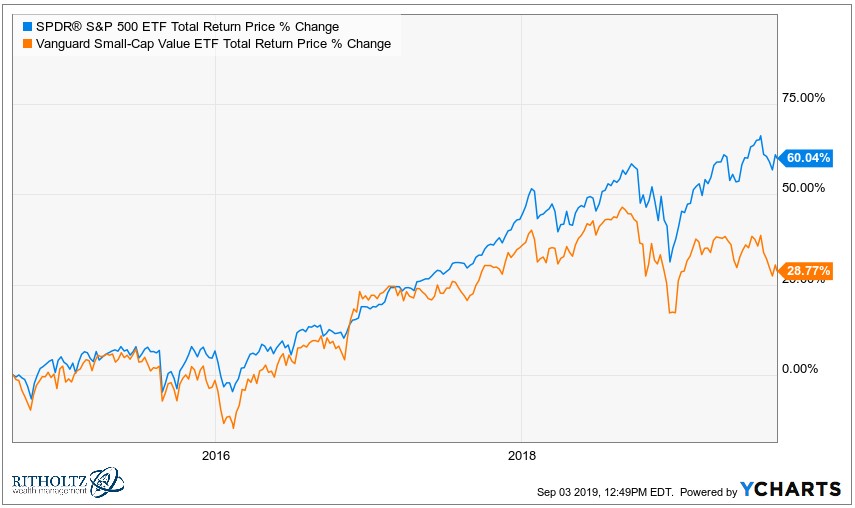

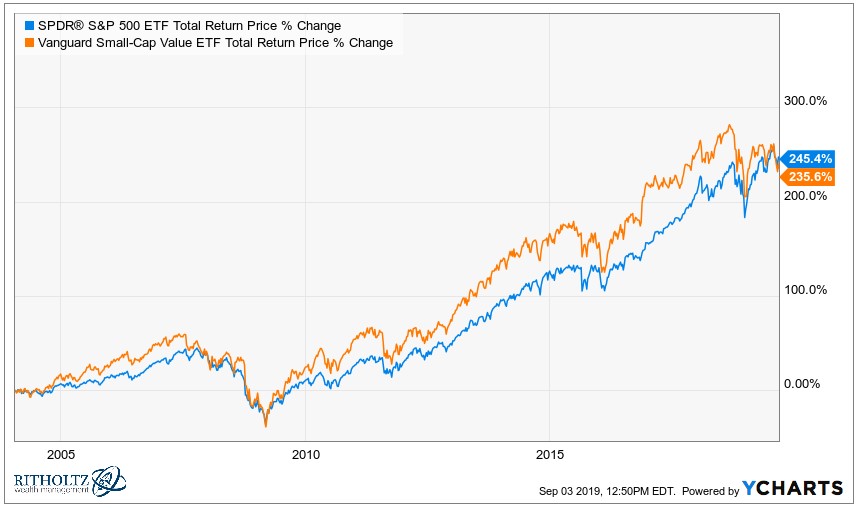

- Haven’t small cap stocks always been underfollowed?

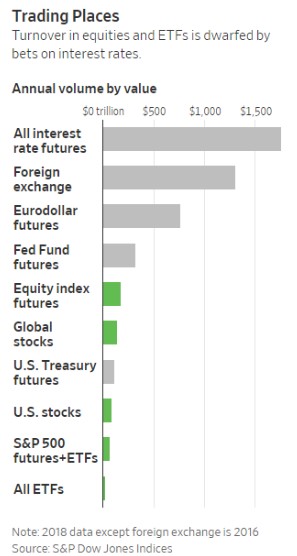

- Harder to predict: interest rates or the stock market?

- Financial literacy differences between men and women

- The Peloton IPO

- Who is the loser if Peloton is successful?

- What do “normal” interest rates look like?

- Why the Fed is not our savior

- Why good enough targetdate funds succeed

- Is the behavior gap overstated?

- A new measure of market volatility

- Why uncertainty is always high

- Will Smith and Jay Z get into the life insurance biz

- Subscriptions for everything (even a Porsche)

- Childcare costs more than most colleges

- What’s the worst that could happen to bonds?

- What’s the best Disney song ever and much more

Listen here:

Stories mentioned:

- The Big Short’s Michael Burry sees a bubble in passive investing

- Re-Kindled: The Big Short

- Adequate diversification

- How ETFs swallowed the stock market

- Women’s other economic gap: financial acumen

- The funds that make you buy low and sell high

- Mind the gap?

- Peloton’s IPO shows the company serves the wealthy

- Only the Fed can save us

- What causes stock market swings

- How Amazon’s shipping empire is challenging UPS and FedEx

- A life insurance start-up backed by Will Smith and Jay Z

- Porsche subscriptions

- Rent-to-own down payments

- When childcare costs more than a mortgage

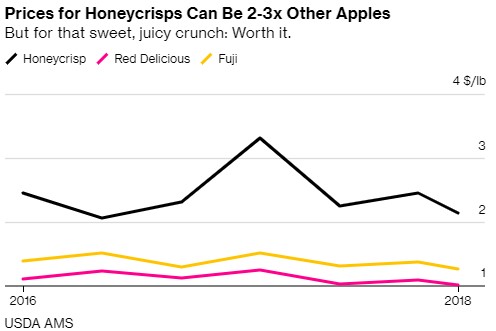

- The curse of the Honeycrisp apple

Books mentioned:

Charts mentioned:

Moana songs mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook and Instagram

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: