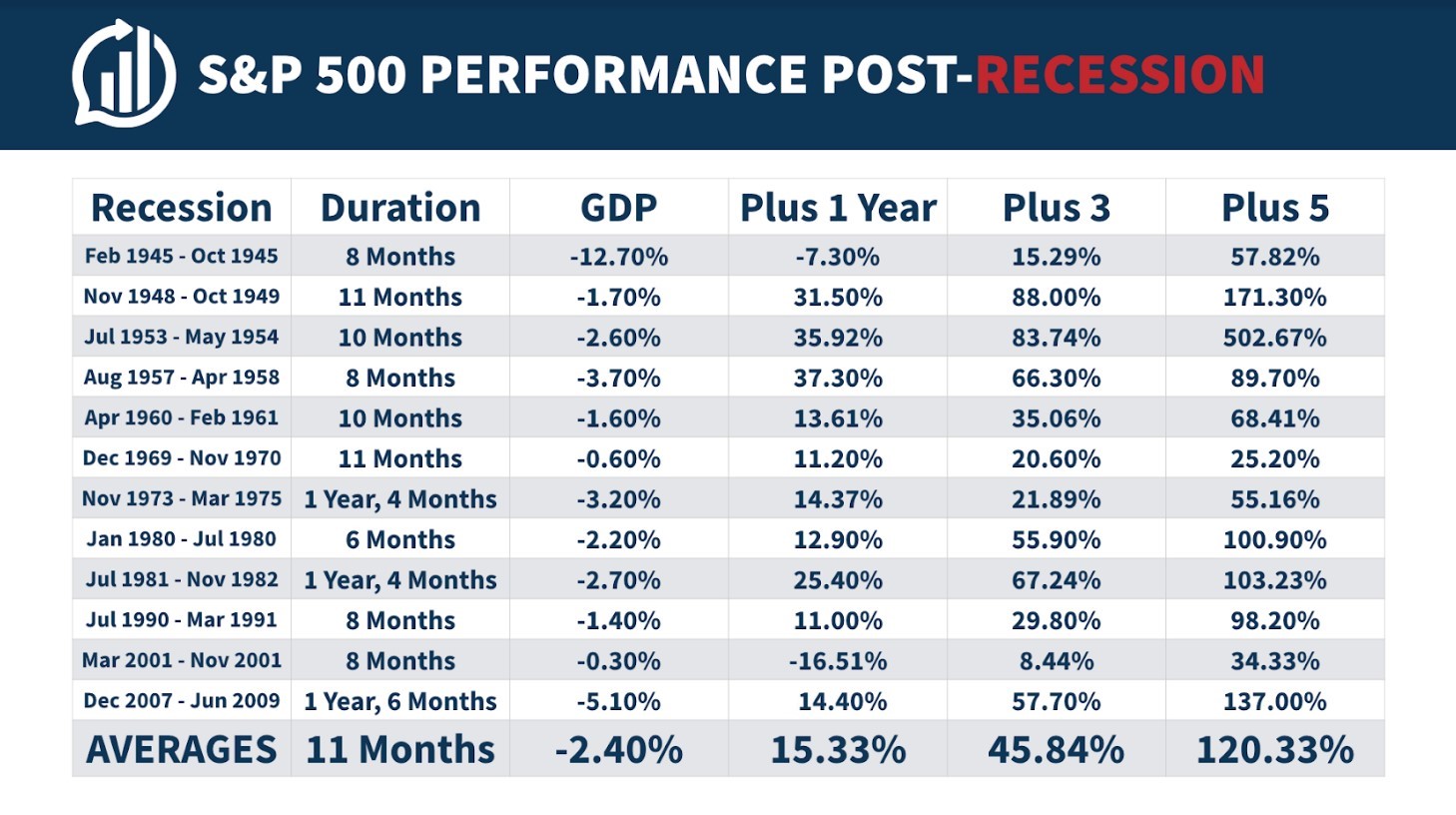

How you should think about recessions in the context of your portfolio.

How you should think about recessions in the context of your portfolio.

On this week’s podcast we discussed what would have to happen for stocks to continue doing well over the next 5 years or so: Short of an asteroid discovery that will change humanity and the stock market forever1 it would seem the most logical path from here would be lower than average returns….

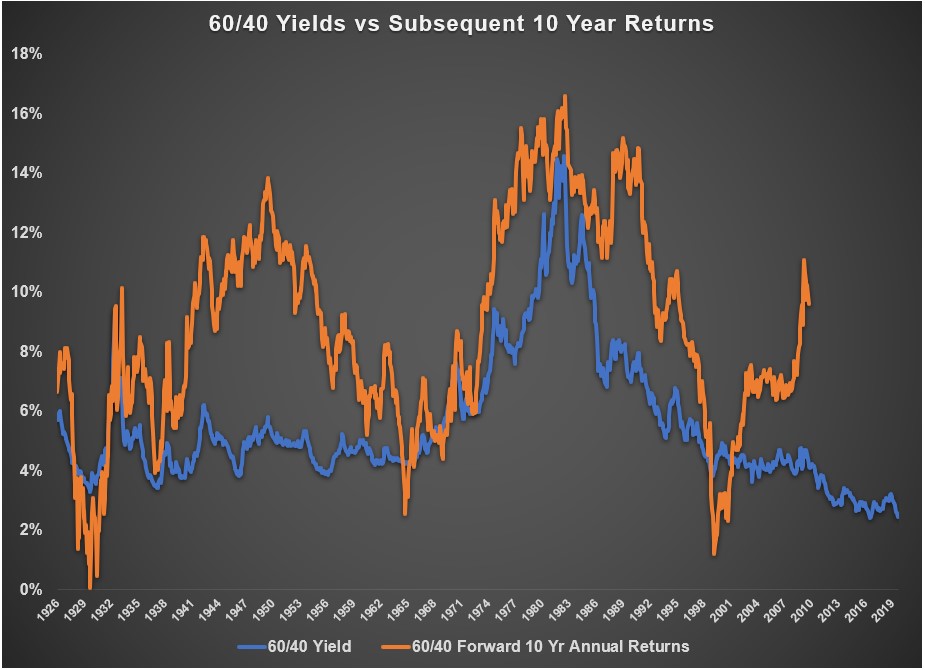

People spend almost 100x more time watching TV than planning for their finances.

Michael and Ben discuss the death of the 60/40 (again), QE forever, Paul Rudd and much more.

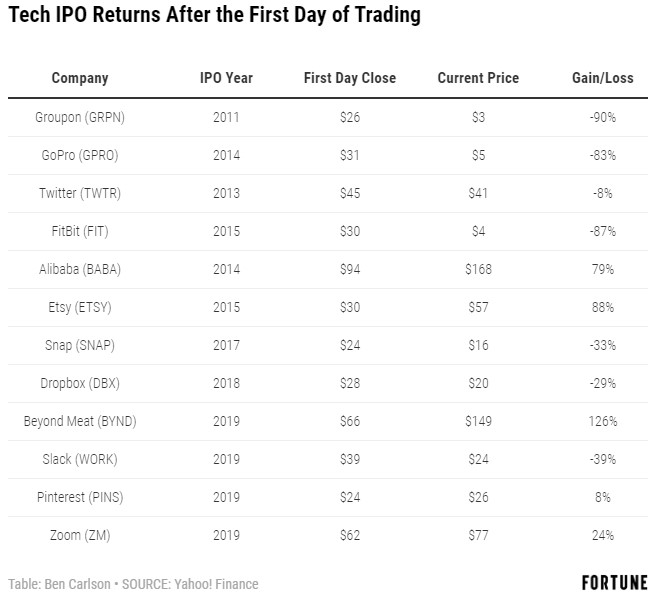

Why this cycle’s IPO class is nothing like the dot-com bubble.

Some random questions I’ve been thinking about lately.

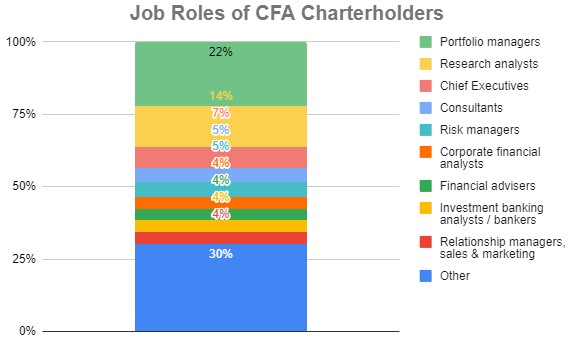

A podcast listener asks: What do you think the future looks like for people with the CFA designation/skillset? We’re hearing constantly that the investment management function is becoming commoditized. As a 30-year-old charterholder, it’s disheartening to not know where I fit in our industry. I’m effectively being let go from the small RIA I work…

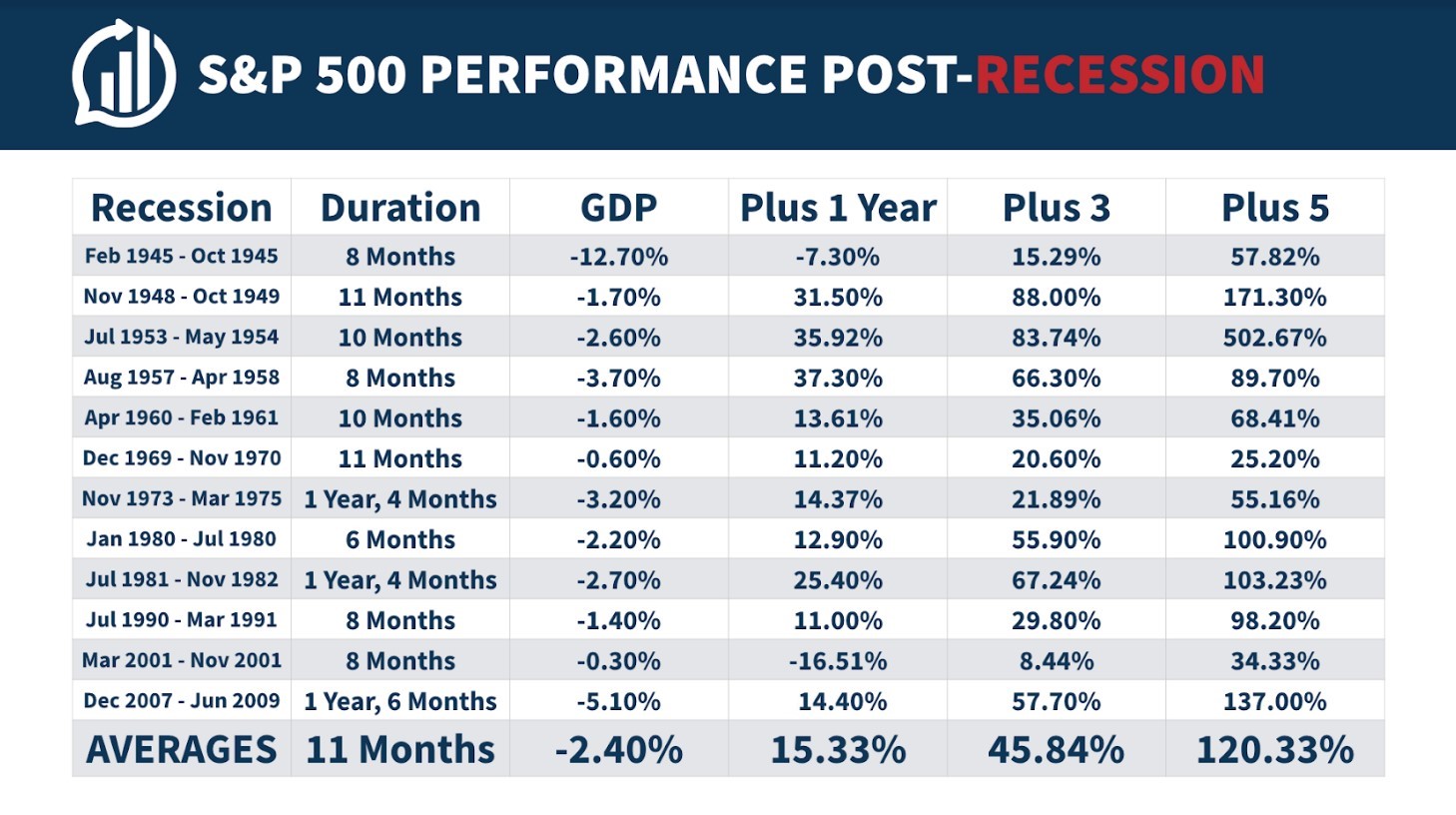

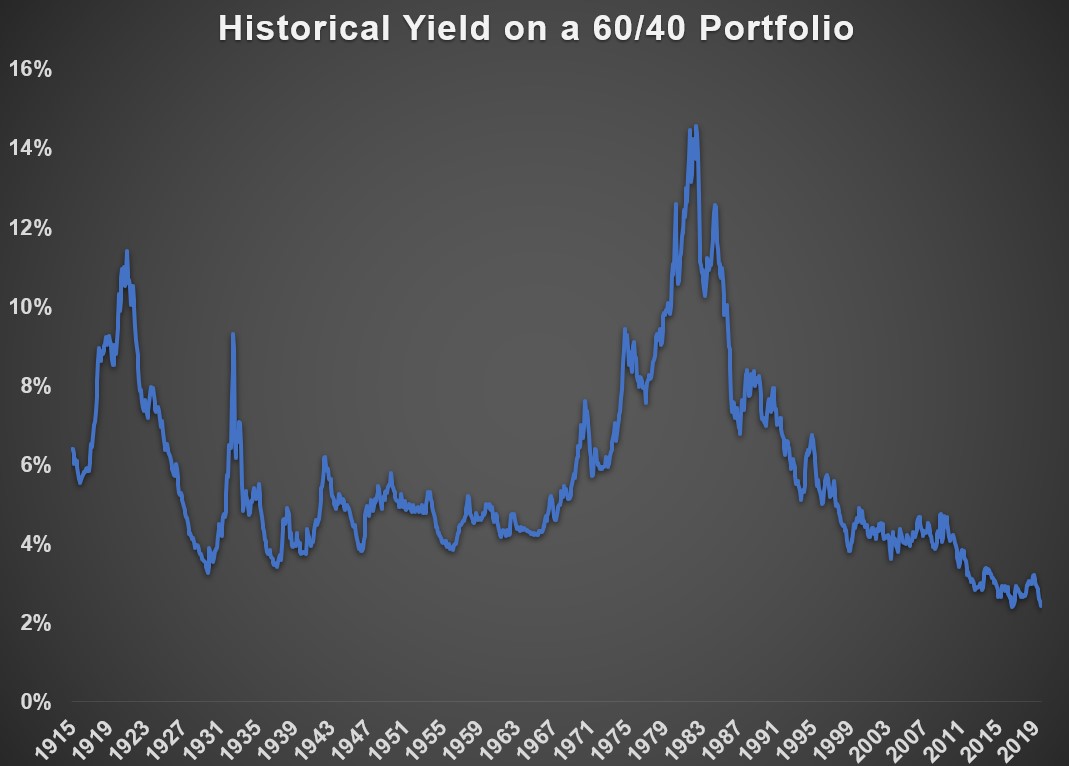

The 60/40 portfolio passed away on October 16, 2019, from complications of low interest rates and a bad case of Fed manipulation. This is the 27th time 60/40 has died in the past decade but enemies market timing, day traders, and alternative investments are hopeful it will stick this time around. 60/40 was 91 years…

Michael & Ben discuss the streaming wars, the NBA-China kerfuffle, what a CFA means today and much more.

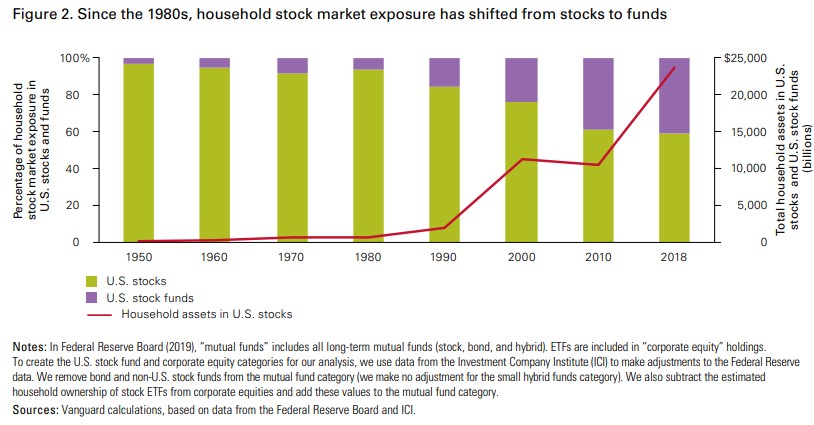

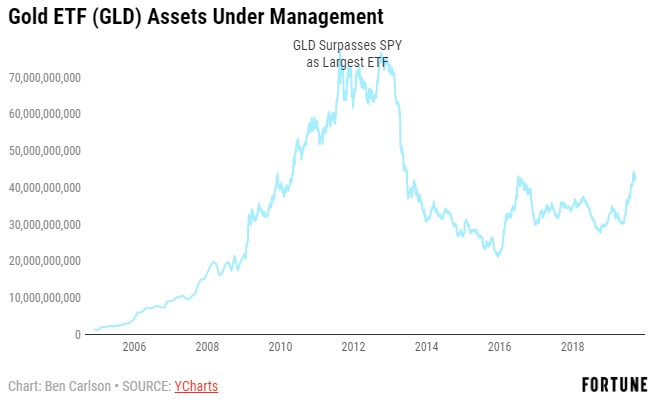

When performance causes outsized flows into and out of funds.