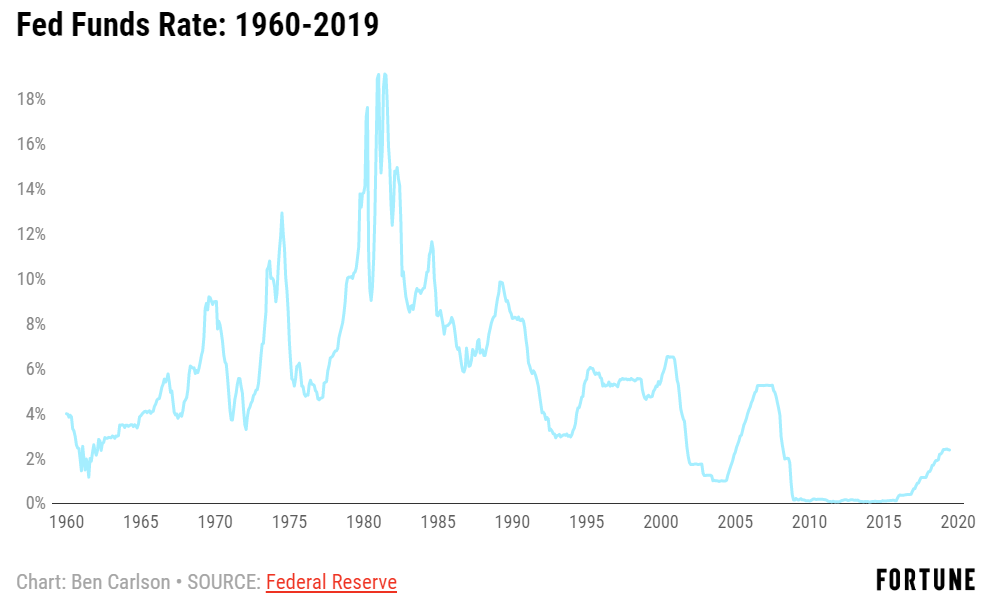

One of the biggest misconceptions about the Fed’s monetary policy is that low interest rates immediately cause investors to speculate or take on more debt. It would be silly to argue there hasn’t been any yield-chasing or excess risk-taking in recent years but there is a big difference between interest rate levels and credit (or…