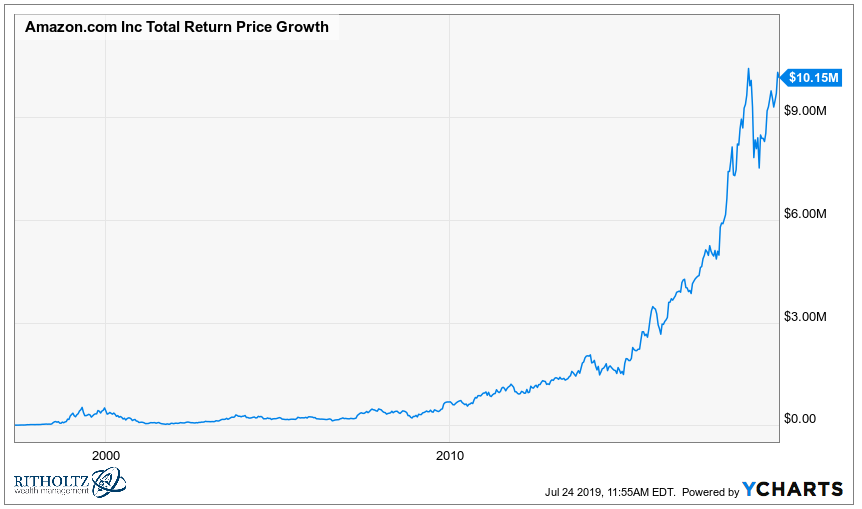

Old financial porn:

If you would’ve invested $10k in the Amazon IPO…

New financial porn:

This couple retired w/$3 million at age 30 and own 7 houses outright. Here’s how they did it

— Ben Carlson (@awealthofcs) July 17, 2019

With few barriers to entry, every few years there are flash-in-the-pan companies that seemingly come out of nowhere, only to more or less go away after their 15 minutes have faded.

Groupon is one of those companies that I’m reminded of every once and a while when I still get an email from them about discounted Sugar Ray concert tickets or a cheap pair of pleated khakis.

A recent email from the online discount seller also reminded me that Groupon is a public company. So I pulled up a chart to see how they’ve fared since going public in late-2011 and…

It looks obvious in retrospect that Groupon got crushed because those same low barriers to entry that allowed them to come out of nowhere also made it easy for increased competition in that space.

But people forget Groupon was up 31% over the IPO price the first day it went public. They raised $700 million. Since Groupon went public, the S&P 500 is up 180% while GRPN is down nearly 90%.

I don’t get any joy out of pointing out failed stock investments but this is a good counterargument to the financial porn that’s often spewed along the lines of If you would have just invested $10,000 into the Amazon IPO…

Yeah, it kind of goes without saying, that if you would have invested in one of the biggest, most successful companies of all-time when they were small and unsuccessful, you would be rich.

Not only does this miss how hard it would have been to hang on to this stock, but the analysis is riddled with survivorship bias. What if you saw the insane returns from investing $10,000 into AMZN when it IPO’d and tried to pull that off with newer companies?

Groupon’s chart is a trainwreck but what about Twitter?

I love Twitter the service and spend way too much time on the social media site. Even though Twitter is basically the greatest news-breaking platform in the world right now and the main form of communication for the President of the United States, the stock is still underwater since going public:

Even after soaring more than 70% the IPO, TWTR is still down almost 15% since going public while the S&P 500 is up 90%.

(I’m not going to lie, after Twitter and Groupon I went down a rabbit hole on this.)

Remember Zynga? They had that Farmville game people played for like 6 weeks?

The stock is down big since the huge pop following the IPO but they’ve actually staged a little comeback this year. Still, since going public, ZNGA is down almost 34%% while the S&P is up 183%.

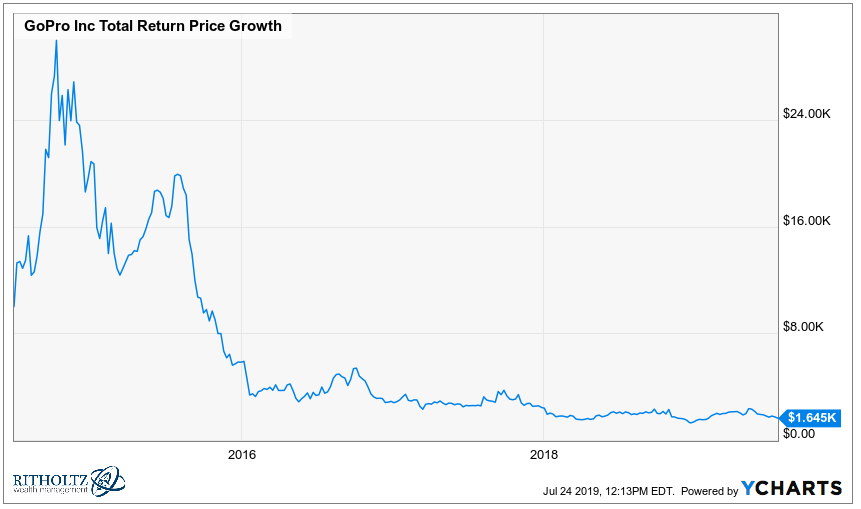

GoPro is the adventure sport attachable camera company that went public in 2014:

After rising 200% or so out of the gate, they’re down nearly 95%.

I still hold a minor grudge against GoPro because I was scheduled to appear on CNBC 3 or 4 years ago but got bumped so their CEO could go on air to defend his stock’s massive sell-off. So I just sat in the green room with my make-up on all ready to go as he did the “Listen, everything is fine” routine that CEOs do when their stock is getting crushed.

I’m not mad, I swear. I’ve totally moved on.

How about Fitbit? Seems like everyone counted their steps for a week or so then conveniently lost theirs. I don’t see how the company can compete with the Apple Watch and apparently neither does the market:

Snap (the artist formally known as Snapchat) has seen a nice bounceback recently but they’re still underwater from IPO day as well:

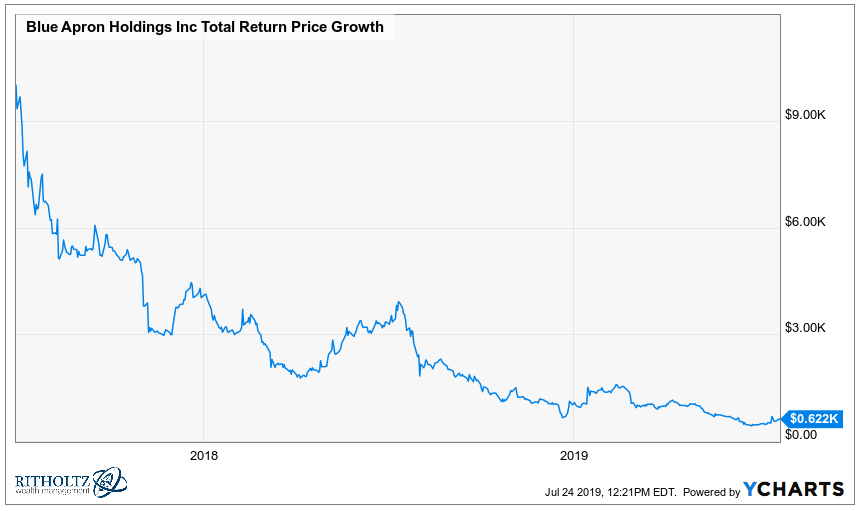

Here’s podcast darling Blue Apron, another company where the increased competition was a killer:

Each of these companies is relatively well-known by the investing public. I’m sure more than a few people pulled a Peter Lynch and tried to “invest in what you know” with these companies.

There is something to be said for becoming familiar with a company’s products and services before you invest in the stock. That’s one reason people likely feel so comfortable investing in Apple, Amazon, Netflix, Google and the like. We all know and use their products.

But simply using a product is not always enough. There are plenty of great products and services that make life more efficient but turn out to be terrible stocks or businesses.

The massive losses in these companies provide a good reminder that even in a powerful bull market, certain stocks can still get crushed.

And picking the winners from a pool of IPOs is much harder than it may appear.

The Amazons of the world are fun to dream about but you’re far more likely to get stuck with a Groupon or Blue Apron.

Further Reading:

Why Are IPOs Oversubscribed?