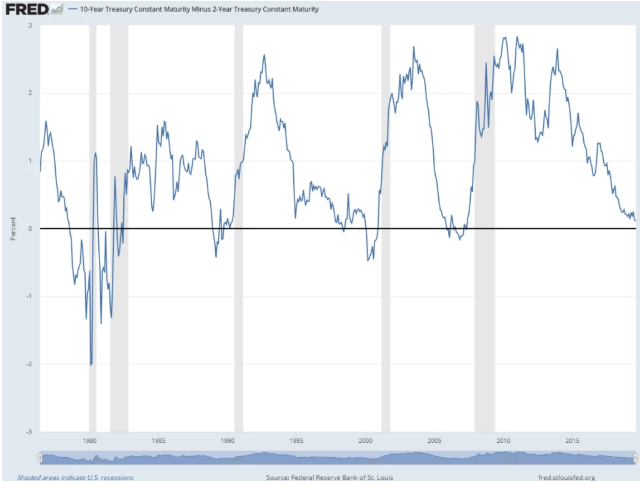

2019 has been a good year for pretty much everything in the financial markets. U.S. stocks, long-term government bonds, and gold are all up big this year: I can’t remember a year when all three of these very different assets were all up so much at the same time. So I looked back at the…