When the fear of being in morphs into the fear of missing out.

Bull Case / Bear Case

Looking at both sides of every asset class at the moment.

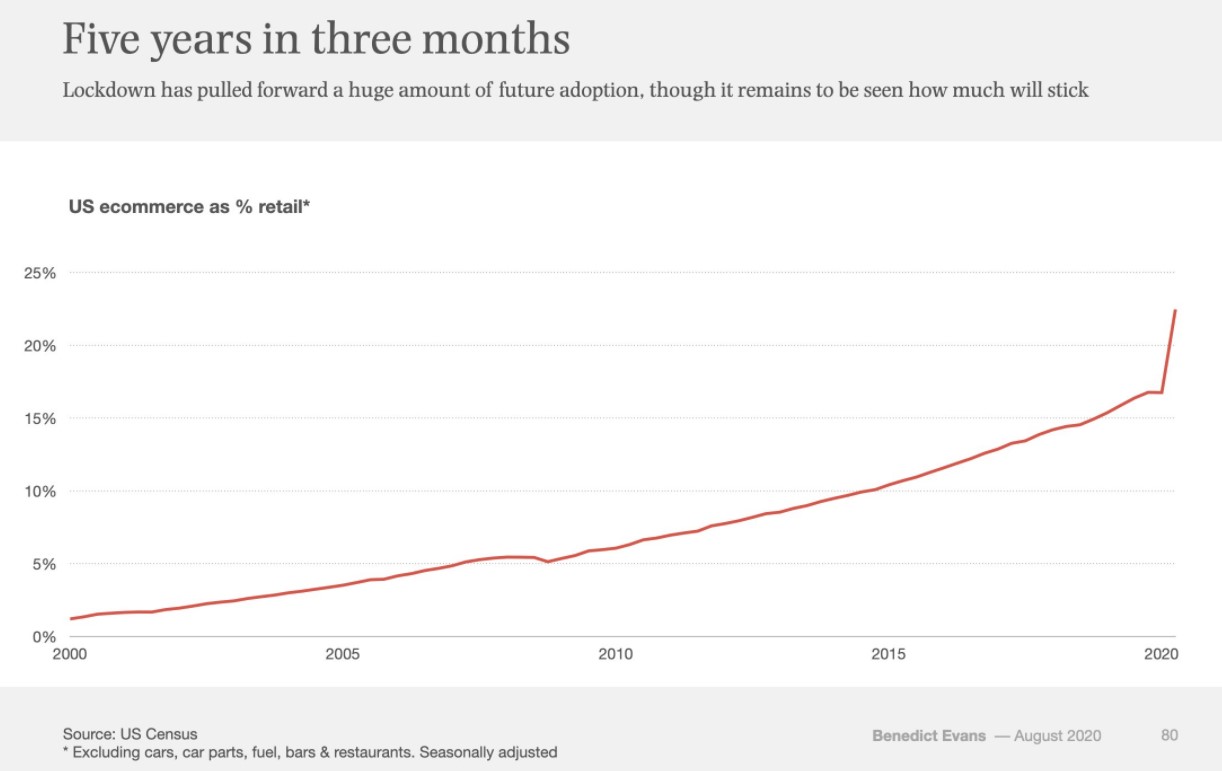

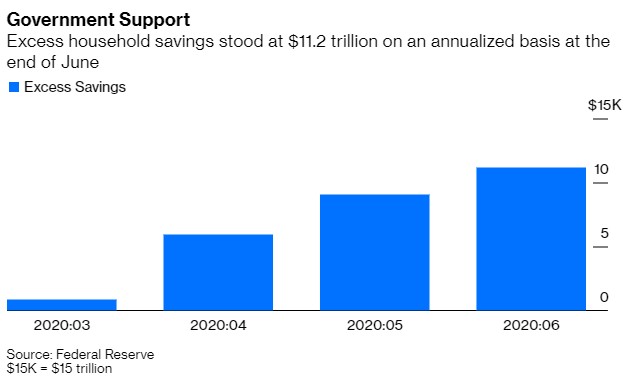

The Case For a Post-Covid Spending Boom

American’s are sitting on trillions in excess savings at the moment.

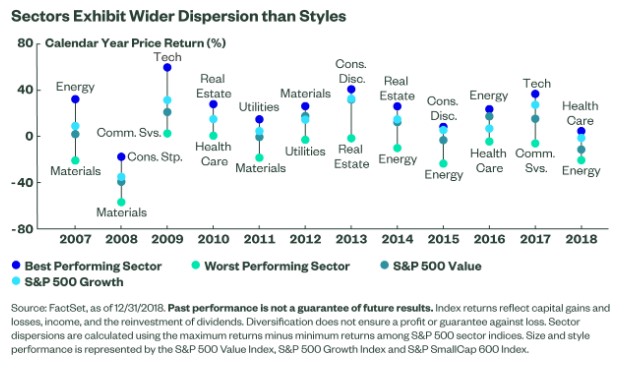

Talk Your Book: Sectors & The Business Cycle

Michael and Ben speak with State Street’s Matt Bartolini about the various market sectors.

The Problem With High Expectations

The tug of war between complacency and contentment.

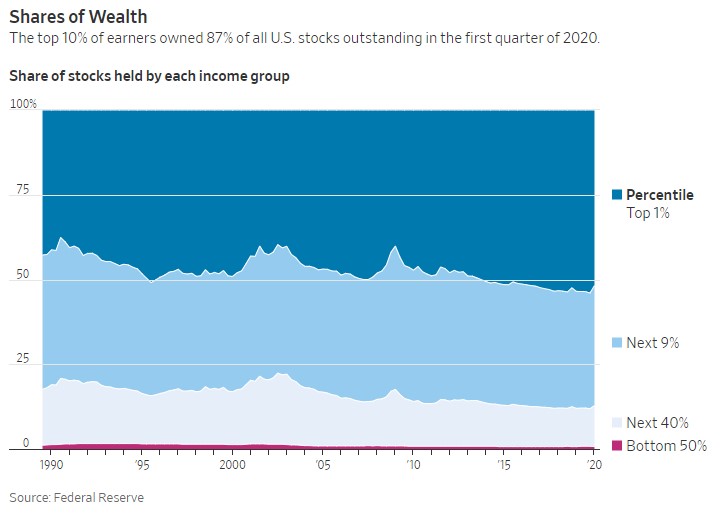

Animal Spirits: Trickle Up Economics

Michael and Ben discuss all the stuff they’re reading, writing, watching and thinking about.

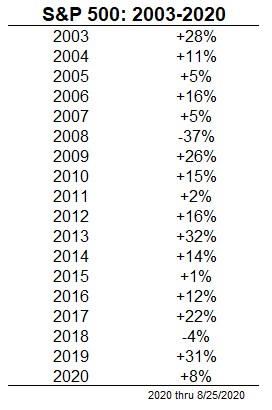

Risk and Return in the Stock Market Are Not Evenly Distributed

Risk and return are not evenly distributed in the stock market.

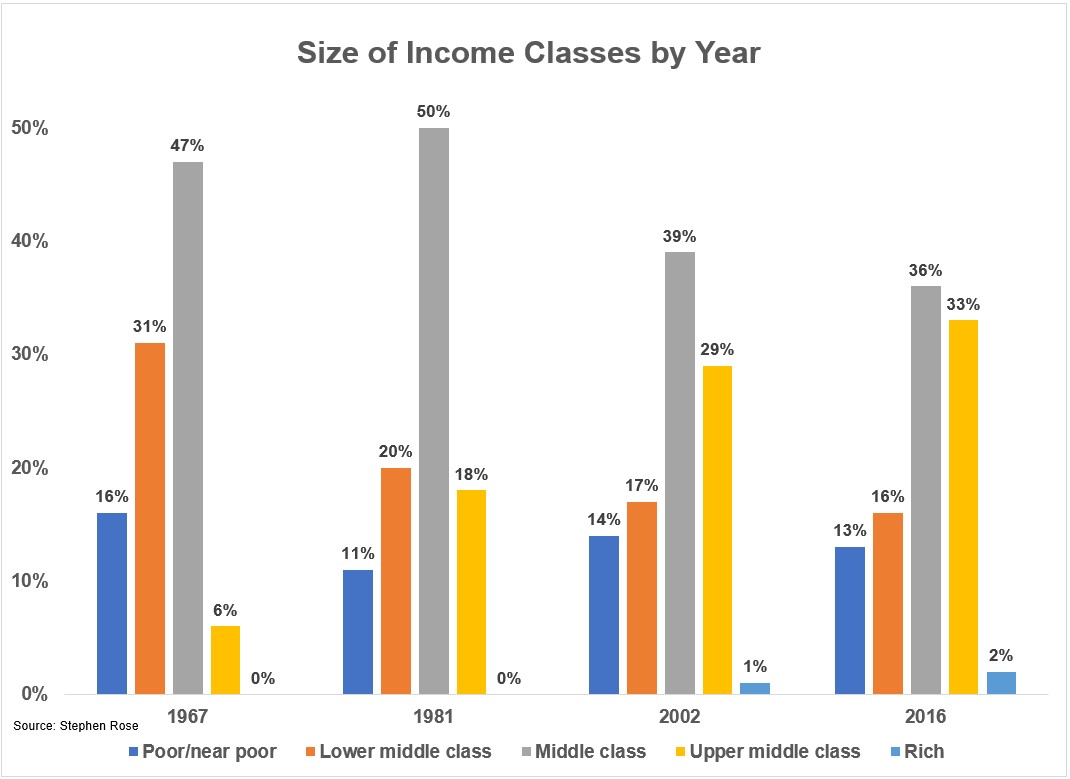

What Happened to the Middle Class?

The good news and bad news about a shrinking middle class.

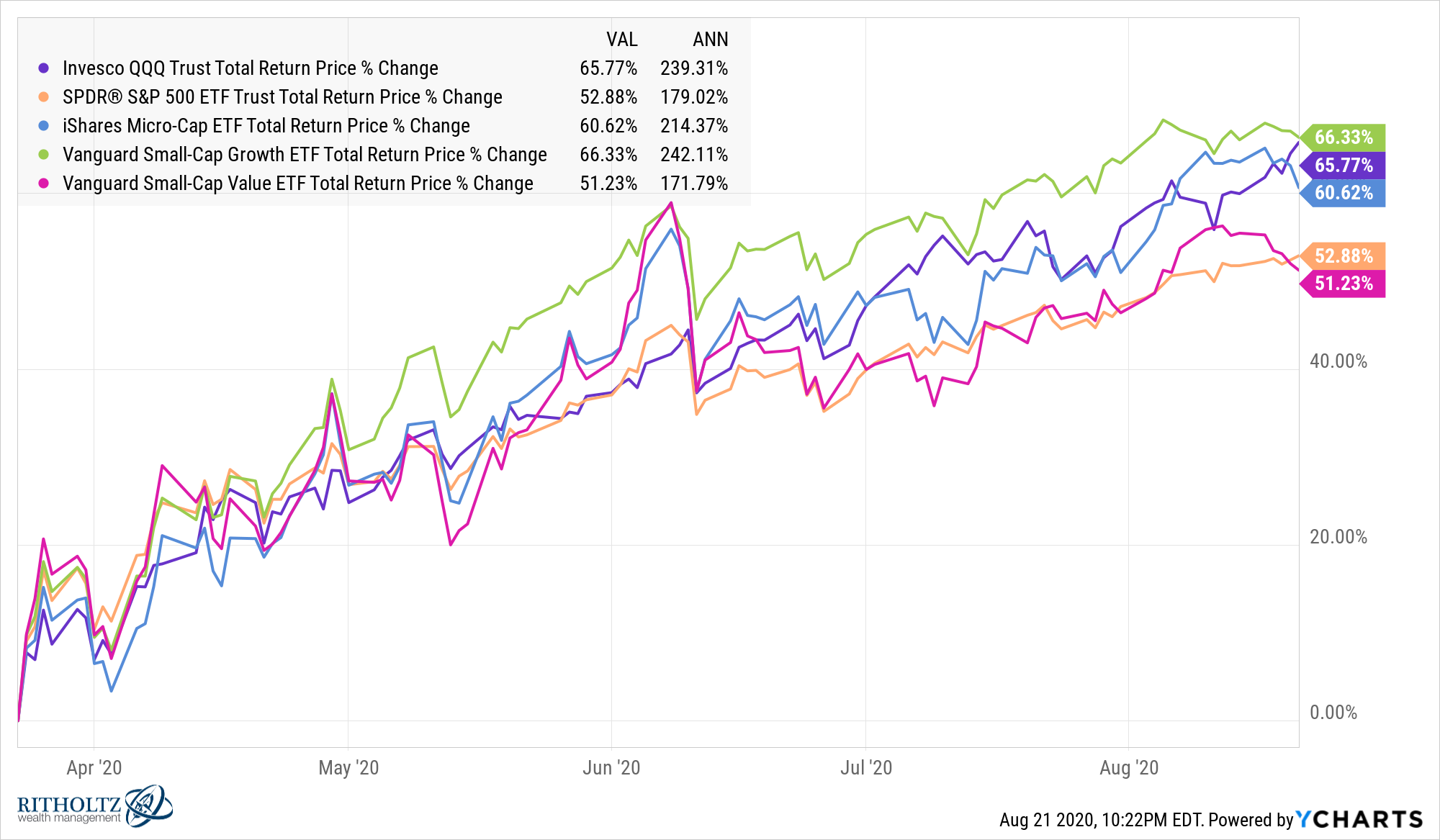

Has the Market Changed at All Since the Bottom?

A look at how stock markets around the globe have performed since the bottom of this bear market.

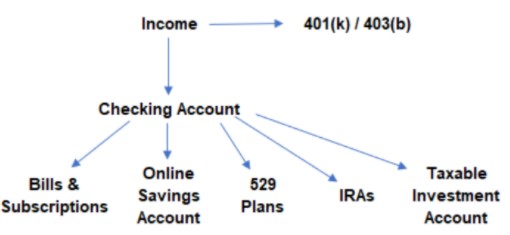

How to Spend Money

I love this story from Gene Hackman about lending some money to Dustin Hoffman in their younger days and how Hoffman used to budget his money: Hoffman’s mason jar strategy is probably better than 90% of the budgets in this country for the simple fact that many households don’t have one. You can find…