Today’s Animal Spirits is brought to you by Masterworks, sign up here. See important Disclaimer here.

We discuss:

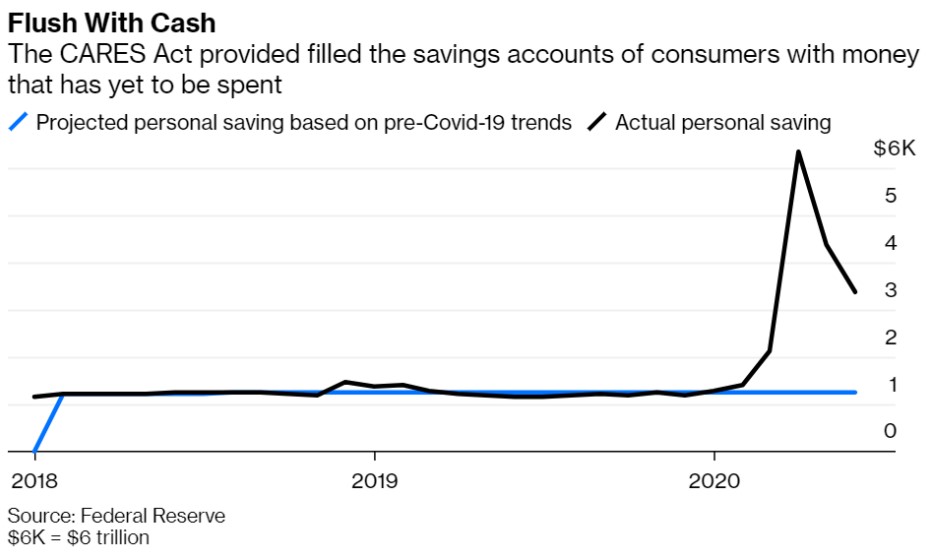

- Could we see a boom after this is all over from pent-up cash?

- How many people will truly alter their behavior post-pandemic?

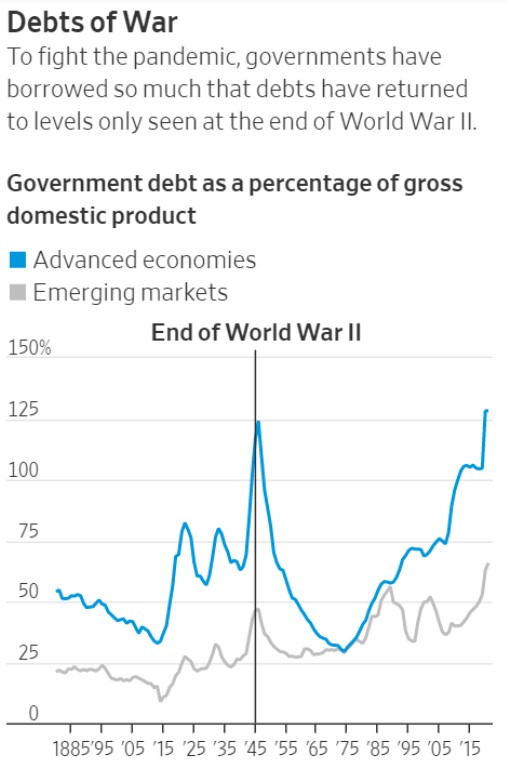

- What if we just don’t pay down our government debt?

- More likely: debt-to-GDP rises or falls in the coming decades?

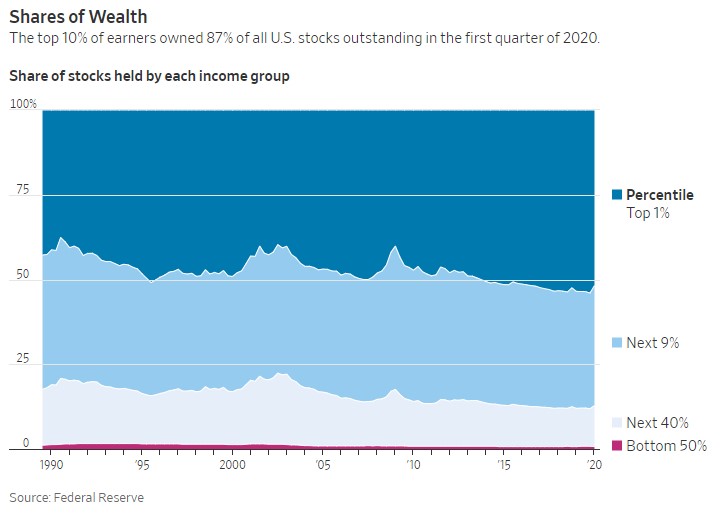

- Why we need to get more people involved in the stock market

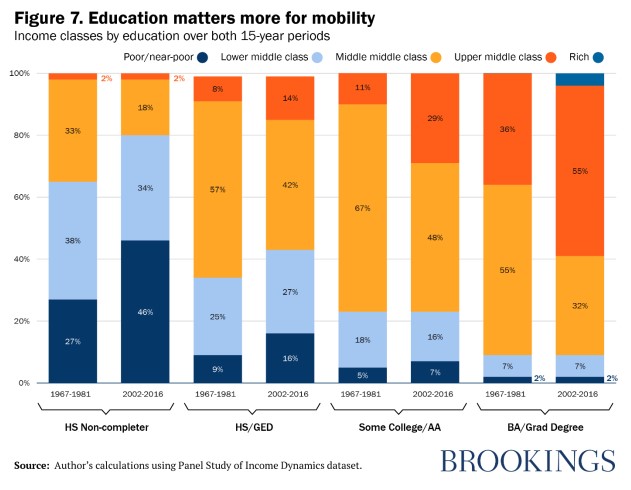

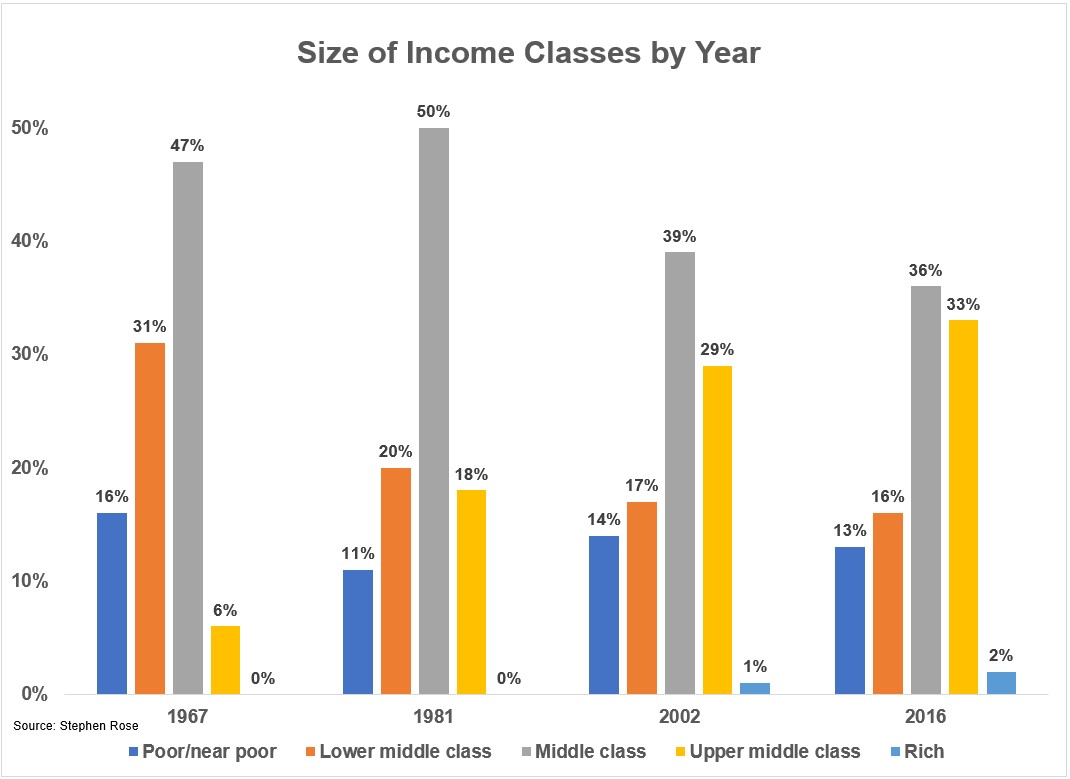

- How the middle class became the upper middle class

- Prepare yourself for lots of weird investment advice in the coming years

- Why the current tech stock run is one of one

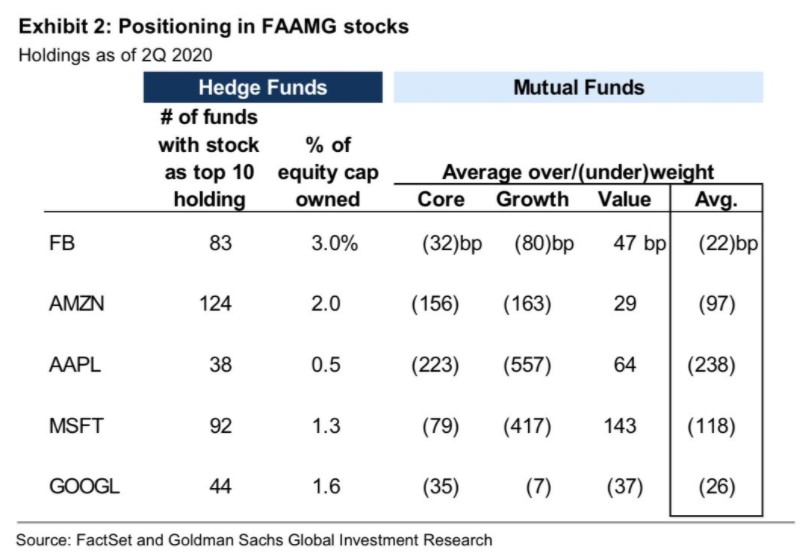

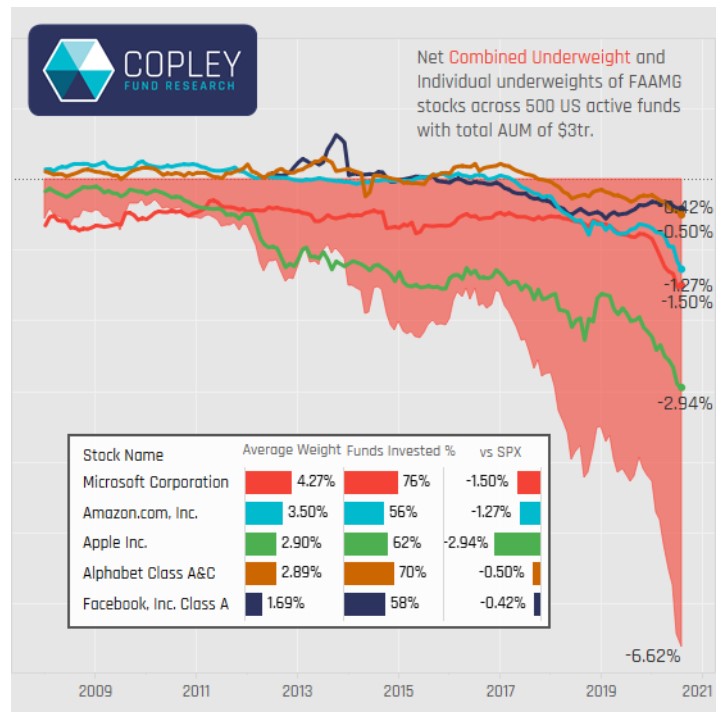

- How underweight are professional investors in the biggest tech stocks?

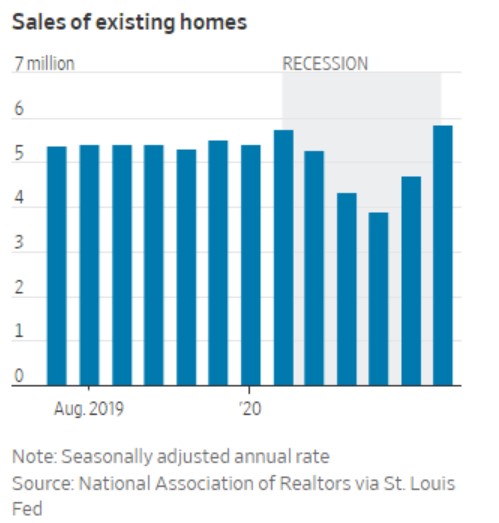

- Real estate is on fire

- Outrage marketing

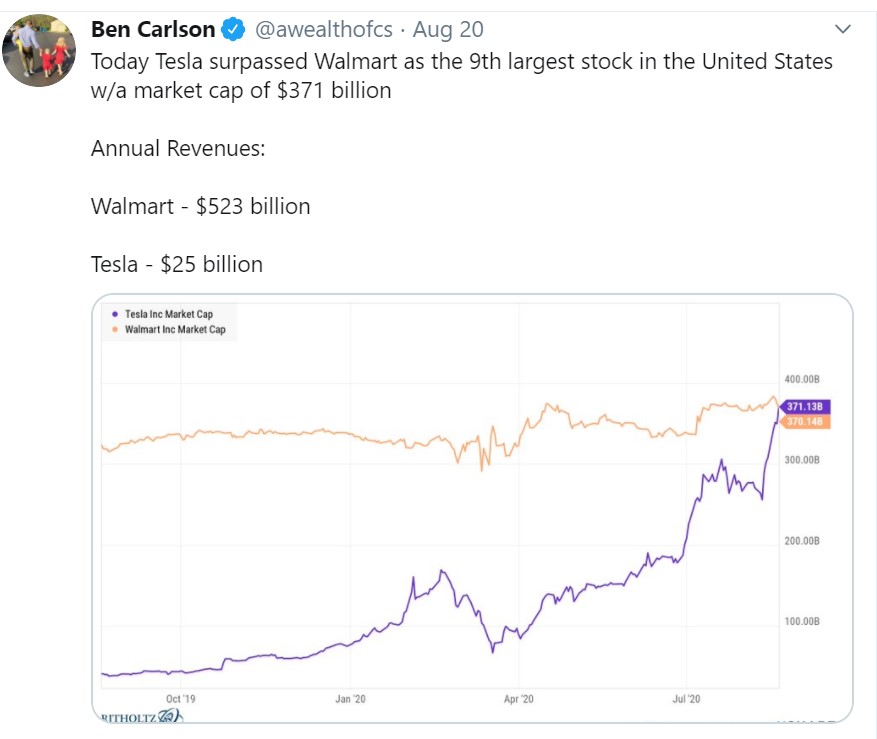

- Tesla is bigger than Walmart

Listen here:

Stories mentioned:

- The forgotten $1 trillion supporting the economy

- Coronavirus lifts government debt to WWII levels

- When the stock market and economy seem disconnected

- What happened to the middle class

- Squeezing the middle class

- Covid-19 is dividing the American worker

- The markets are not the economy

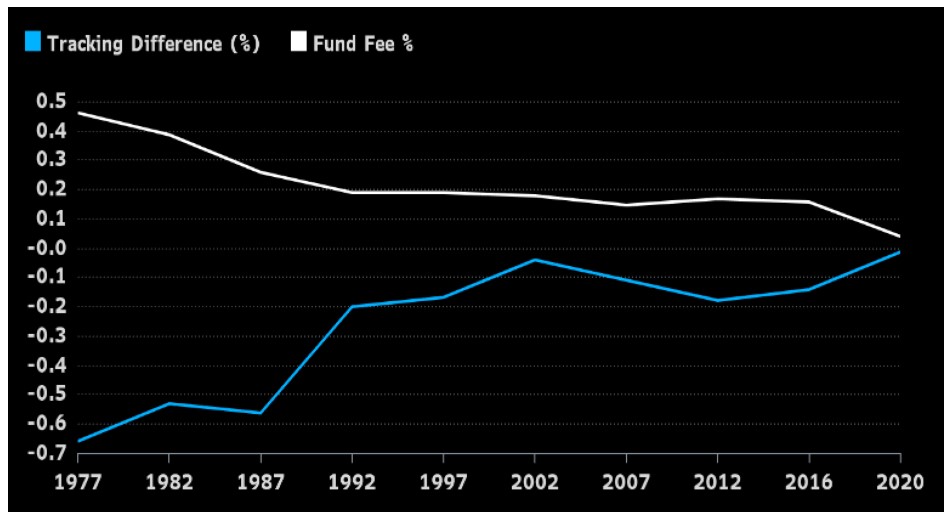

- Investors are clinging to an outdated strategy

- Invest in tech indexes but hedge with fine wine and stamps

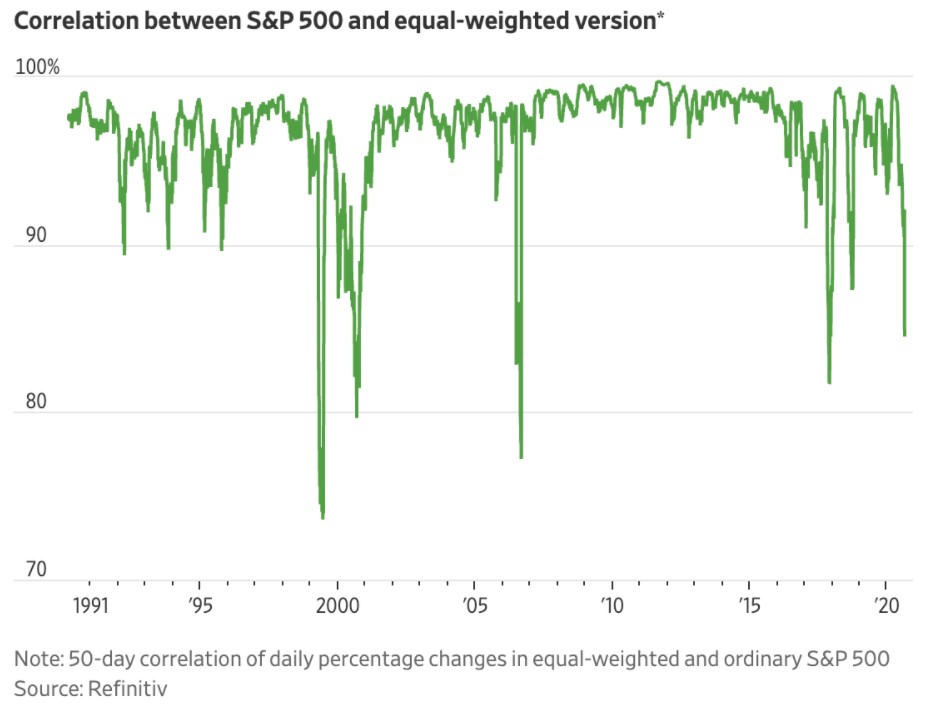

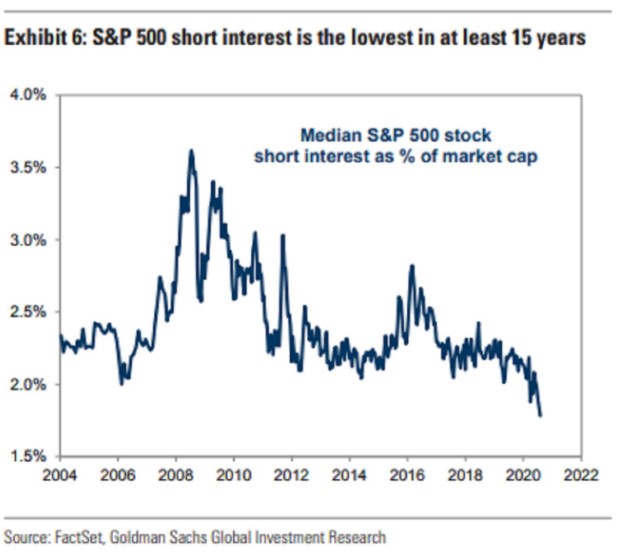

- Has the market changed at all since the bottom?

- The market is a tech market

- Fewer stocks are participating in the market’s rally. Why that’s not a disaster

- US existing home sales up 25% in July

- So you think New York is dead

- Parents brace for go it alone school year

- The longest unprofitable short I’ve ever seen

Books mentioned:

- Leadership in Turbulent Times by Doris Kearns Goodwin

- Fewer, Richer, Greener by Laurence Siegel

- D-Day by Stephen Ambrose

Charts mentioned:

Podcasts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: