Why FOMO is at all-time highs.

Why FOMO is at all-time highs.

The latest edition of Portfolio Rescue with questions on ESOPs, interest only loans, baby boomers crashing the stock market & more.

Michael and I discuss rising interest rates, the different levels of FOMO, inflation vs. wages and much more.

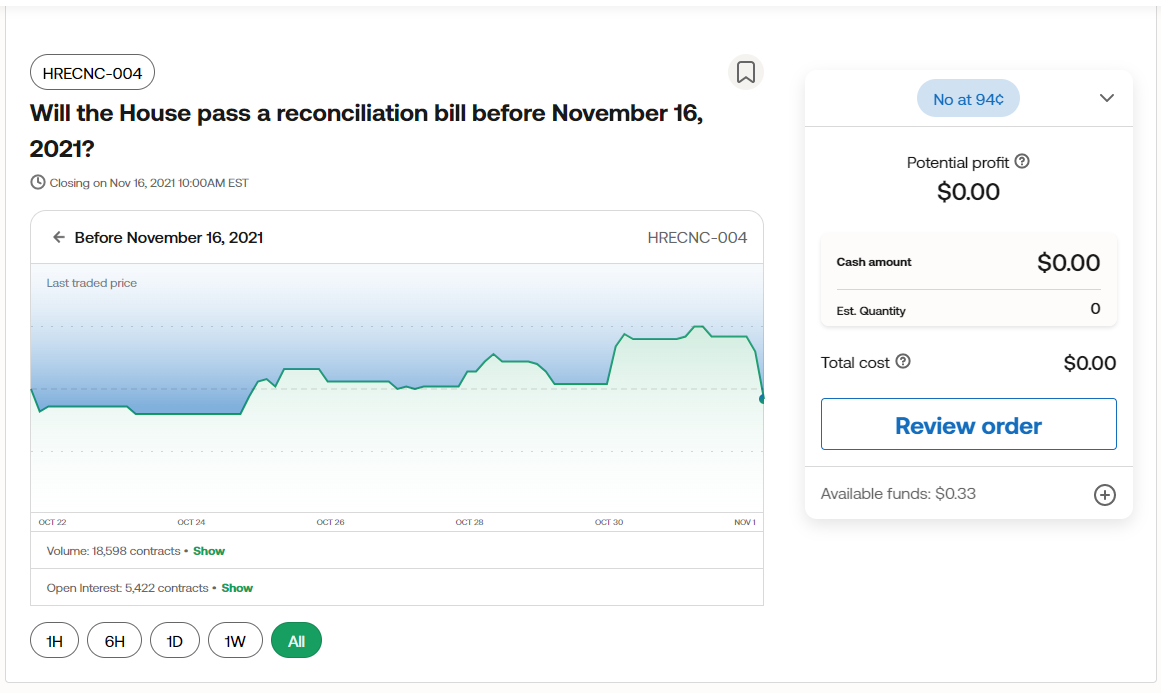

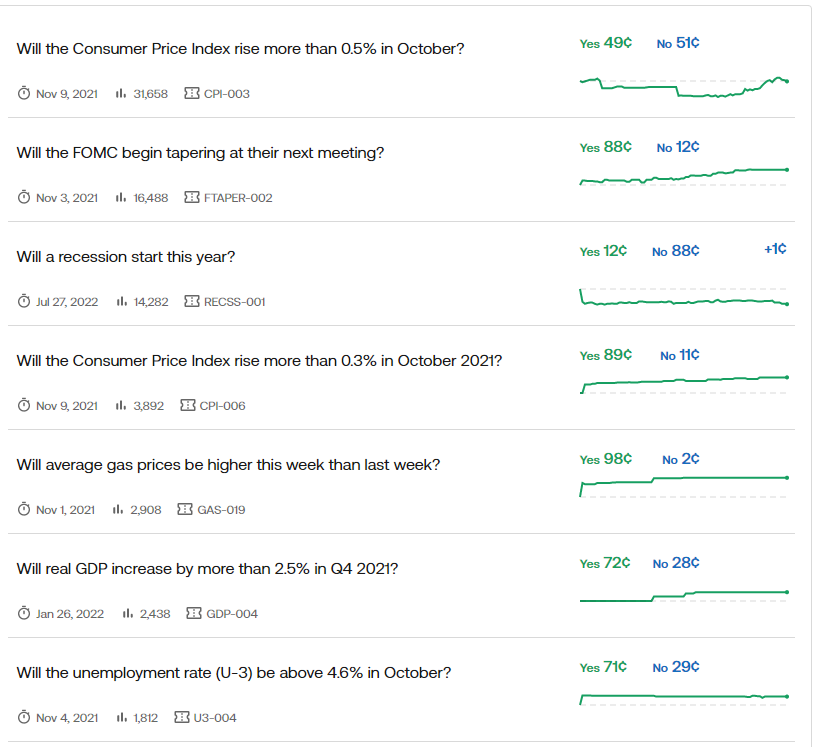

Why everything will be a market in the future.

We spoke with Kalshi CEO Tarek Mansour about betting on binary events in the real-world.

Why Social Security and Medicare are going to eat up so much of the government’s budget going forward.

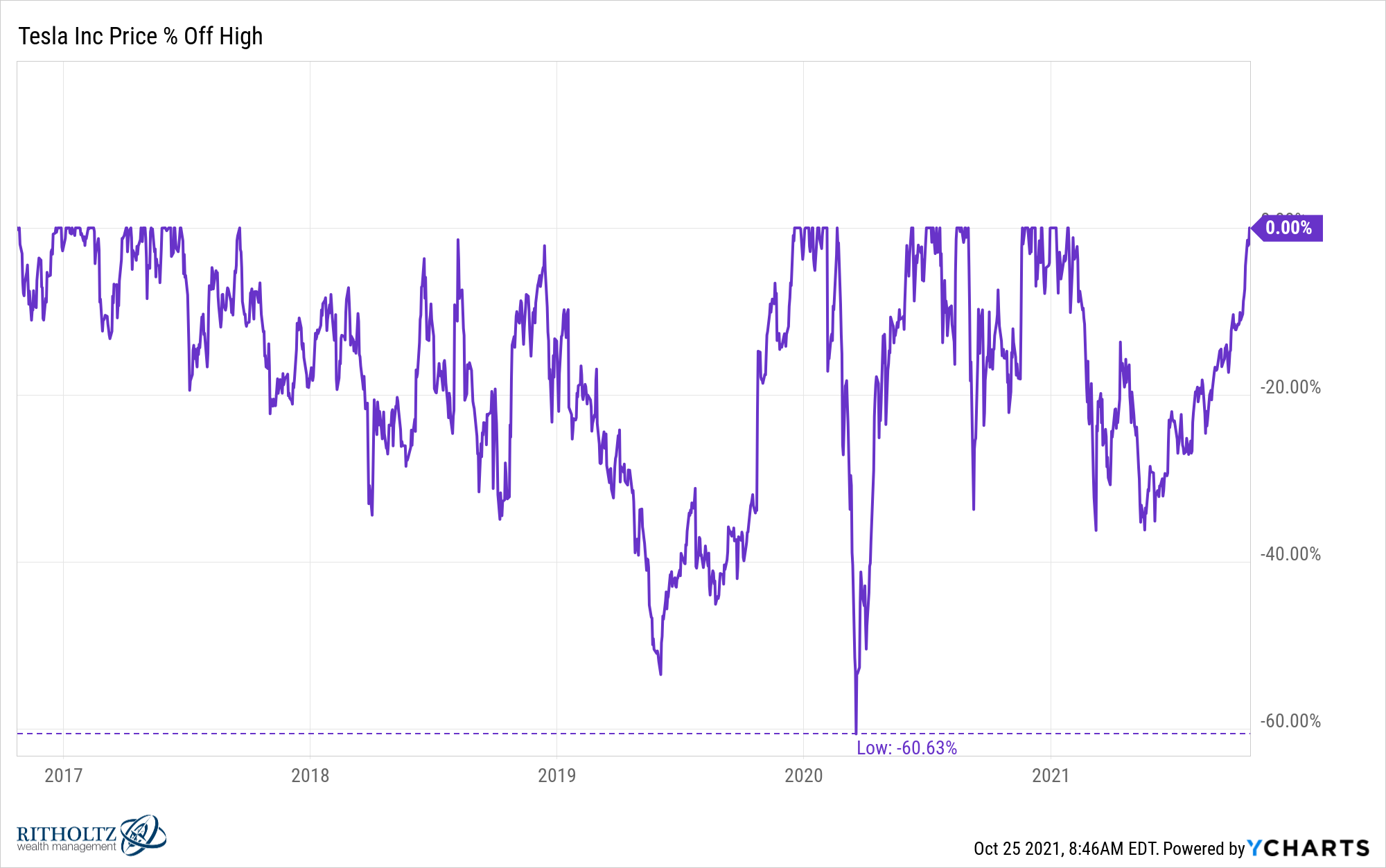

Kudos to Tesla investors who have held on.

My new Q&A show on YouTube!

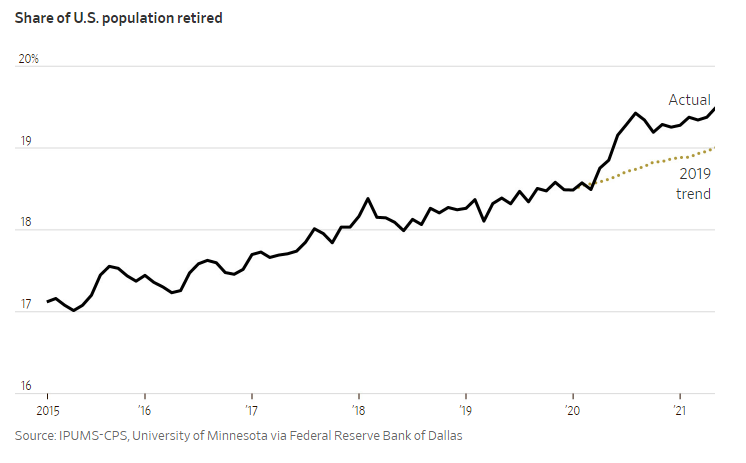

Michael and I discuss hyperinflation predictions, Tesla’s impressive run, worker shortages, how wages can rise while inflation stays subdued, Dune and much more.

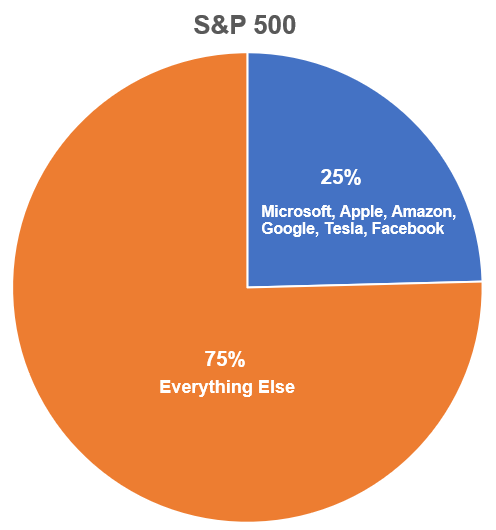

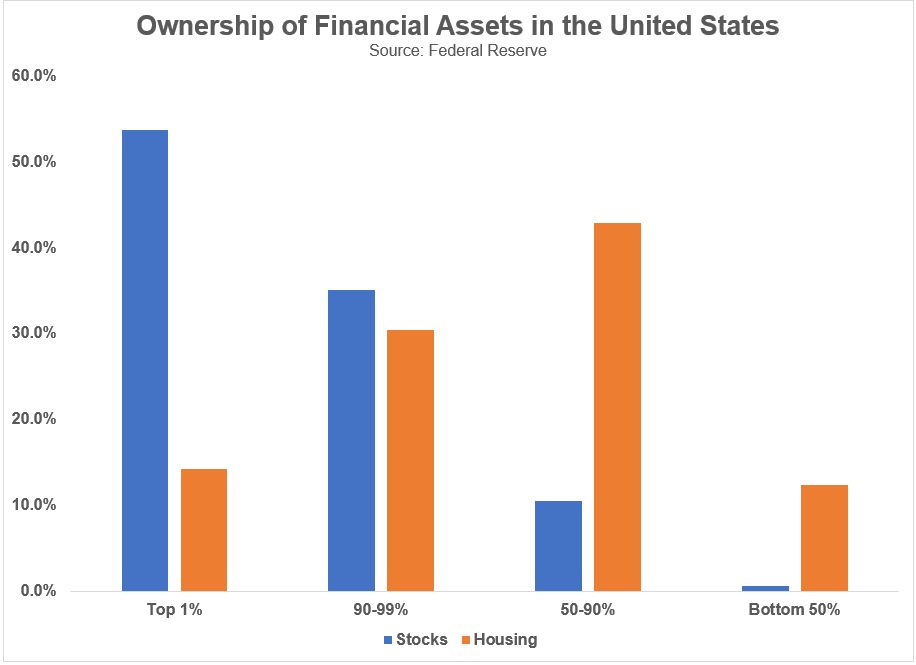

The top 10% own 89% of stocks in America.