Prosecuting a chart crime.

Prosecuting a chart crime.

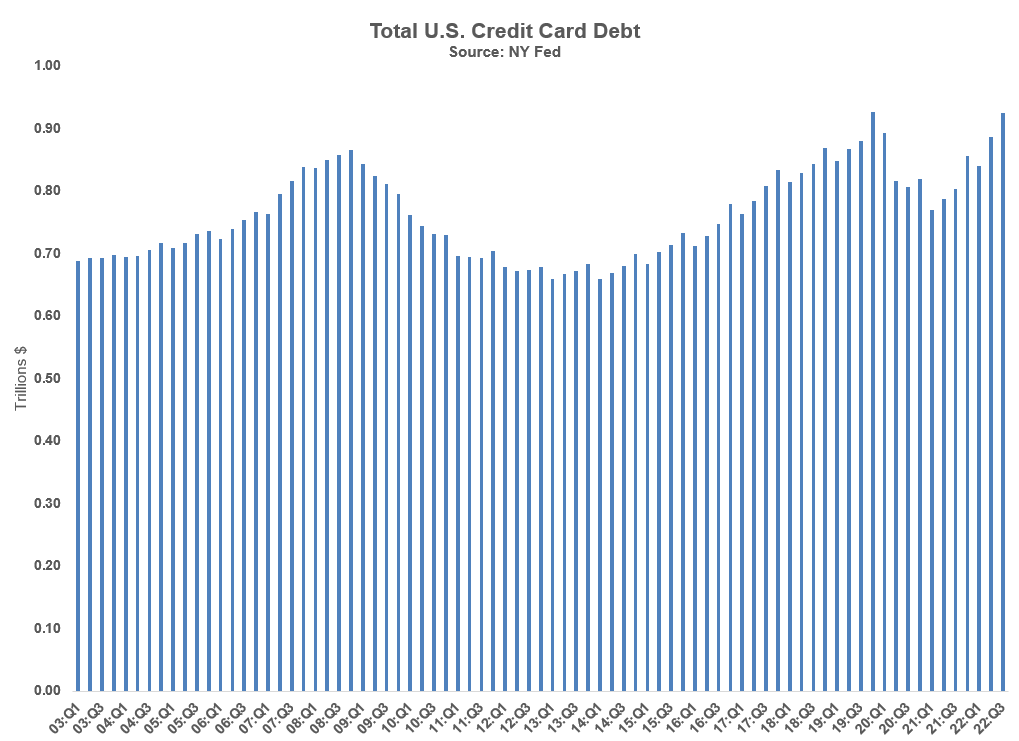

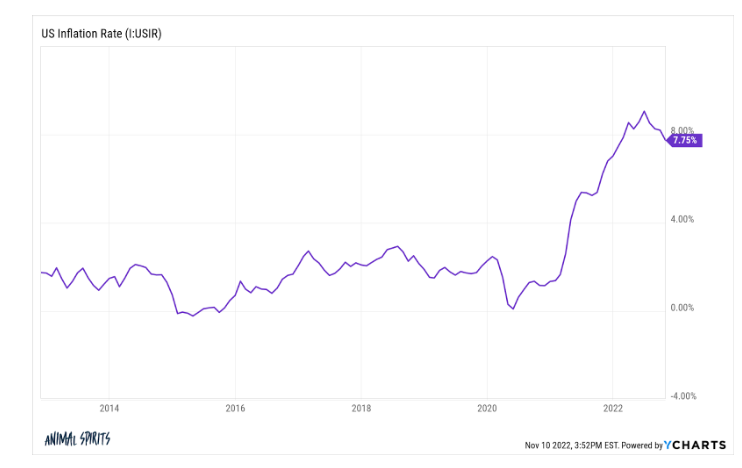

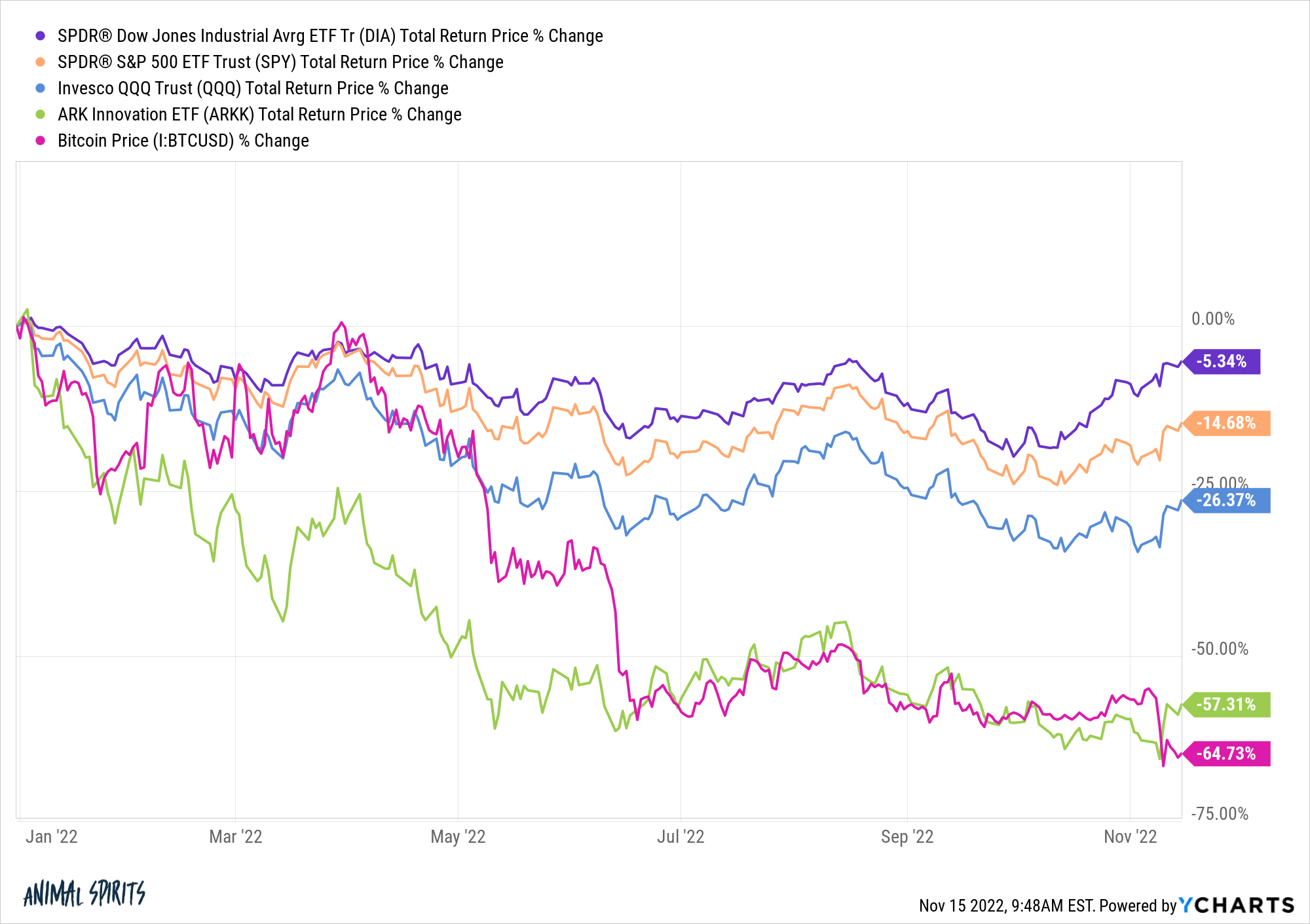

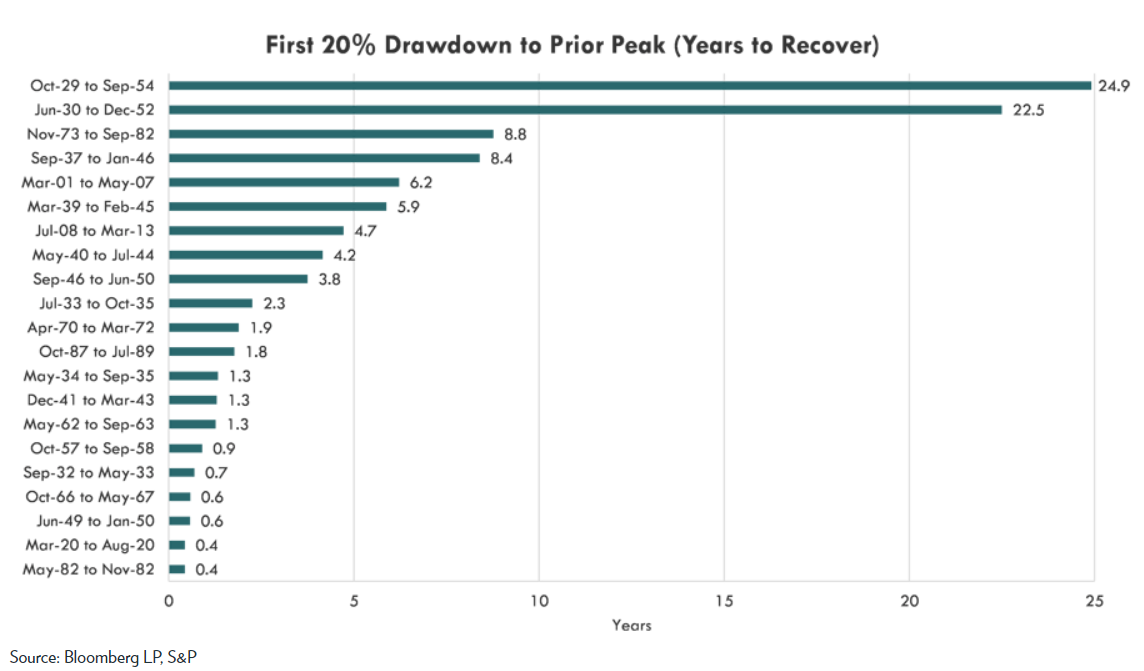

A 60/40 portfolio of U.S. stocks and U.S. bonds has only finished the year down double digits just 5 times in the past 94 years through year-end 2021.1 With stocks and bonds both down around 15% each in 2022 so far, it appears this year will be the 6th time in 95 years: If we…

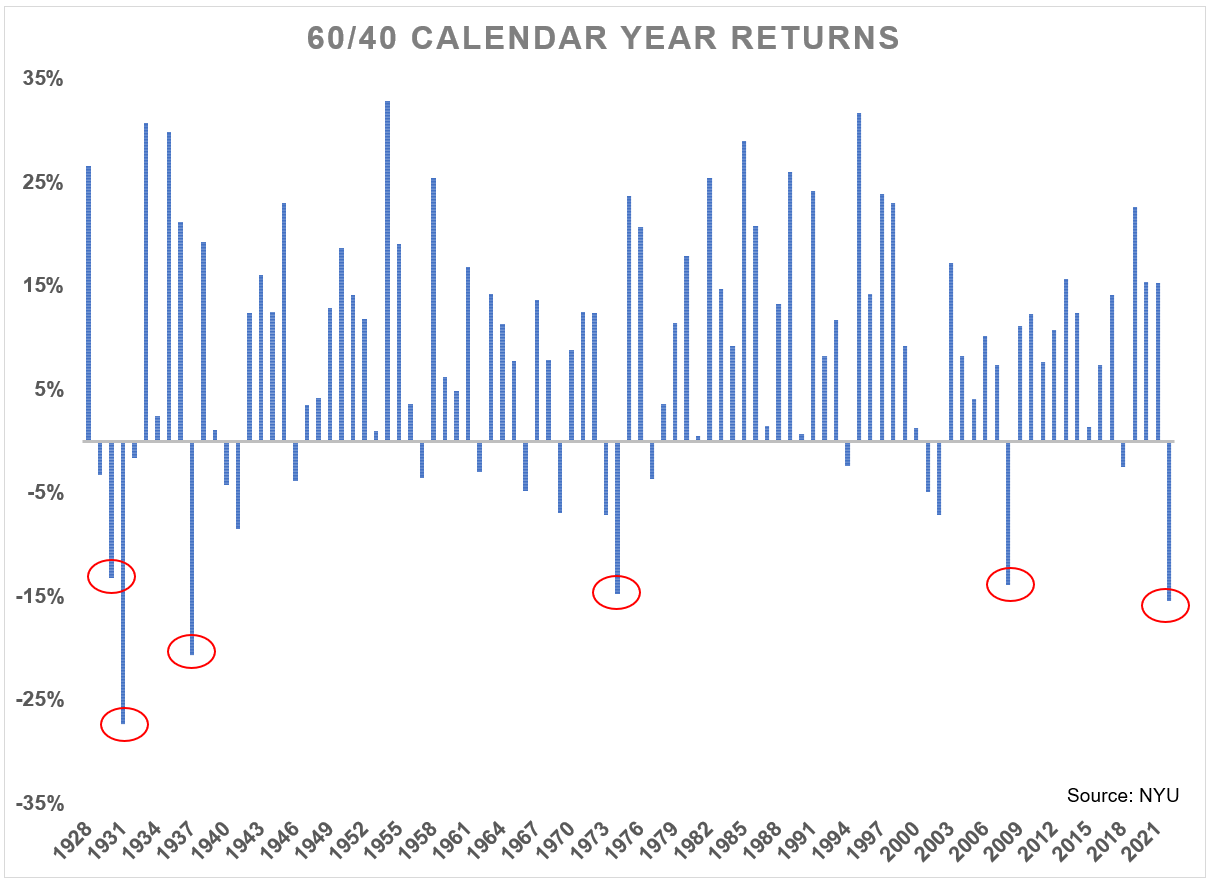

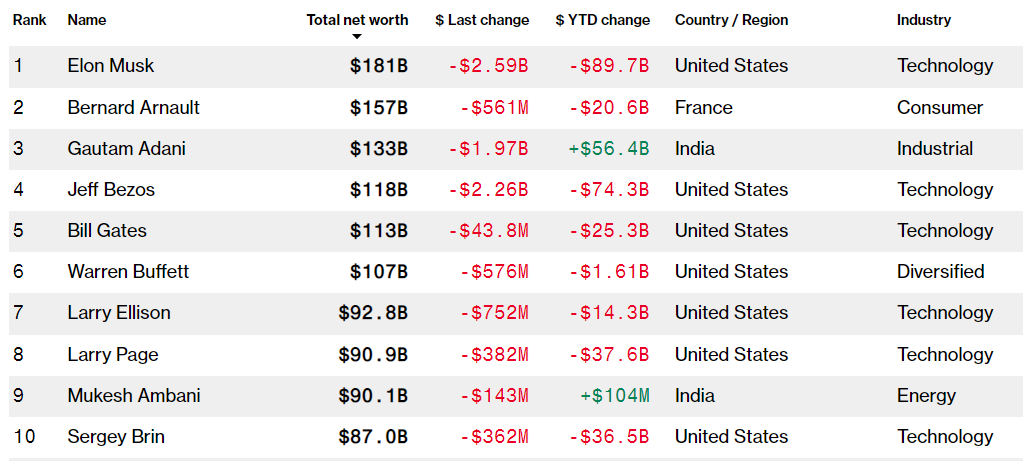

Scott Galloway once said, “It’s never been easier to become a billionaire, or harder to become a millionaire.” I’m not sure I agree but it does seem like more people want to become a billionaire these days. I honestly don’t think it’s worth it. More money in your life is obviously better than less money but…

Finance topics that get people heated.

On today’s show we discuss inflation is finally falling, will the stock market wait for the Fed’s all-clear, the FTX saga, how SBF fooled everyone, what comes next for crypto, why streaming stocks are struggling, 5 years of Animal Spirits and much more.

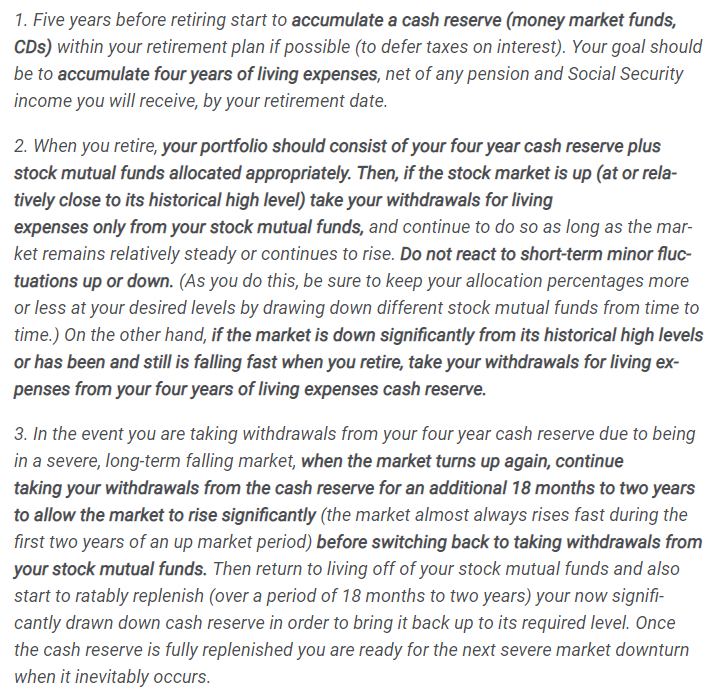

Why successful investing should be like watching paint dry.

On today’s show, we have Bruce Bond, CEO of Innovator ETFs give us an update on the buffered ETFs, how buffers and caps behave during high-volatility environments, how advisors are using these products, and much more!

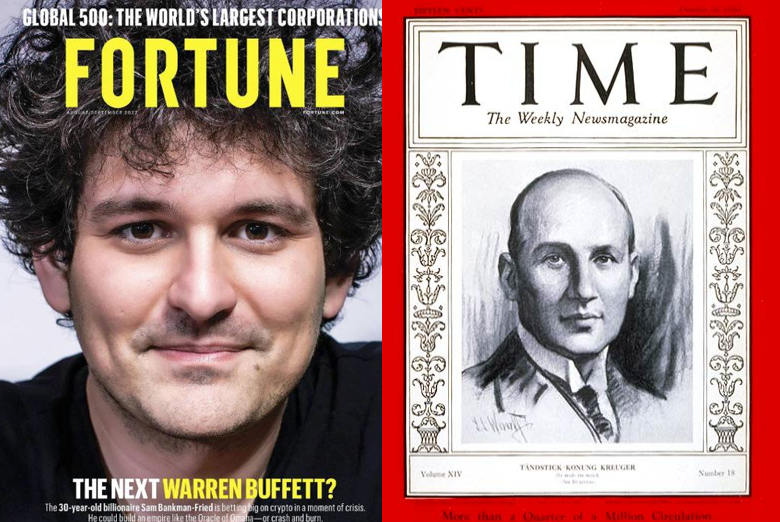

The similarities between Ivar Kreuger and Sam Bankman Fried.

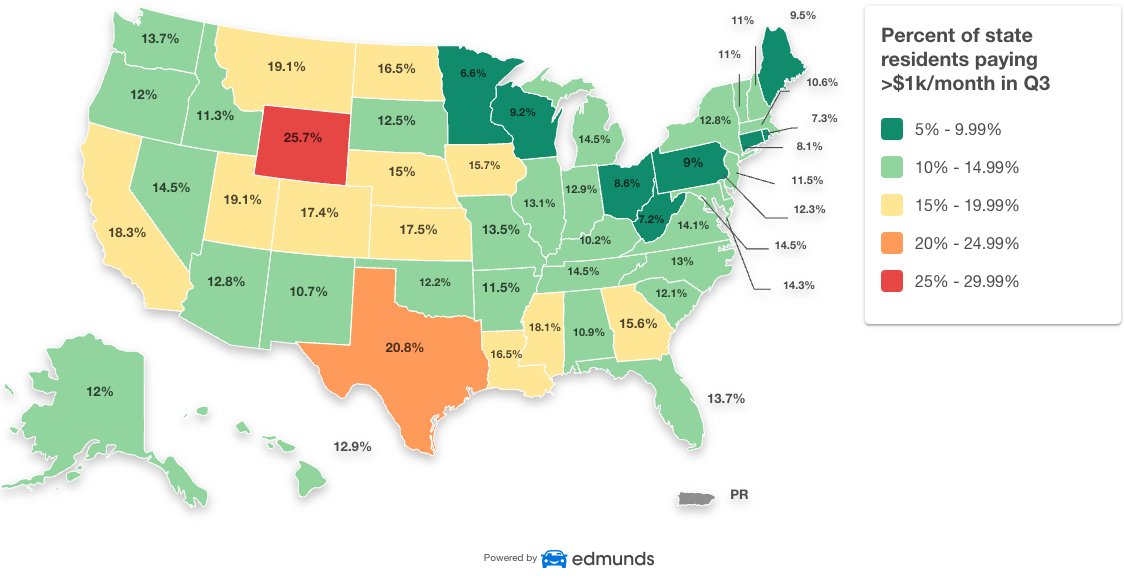

Why housing and transportation are the most important parts of your budget.

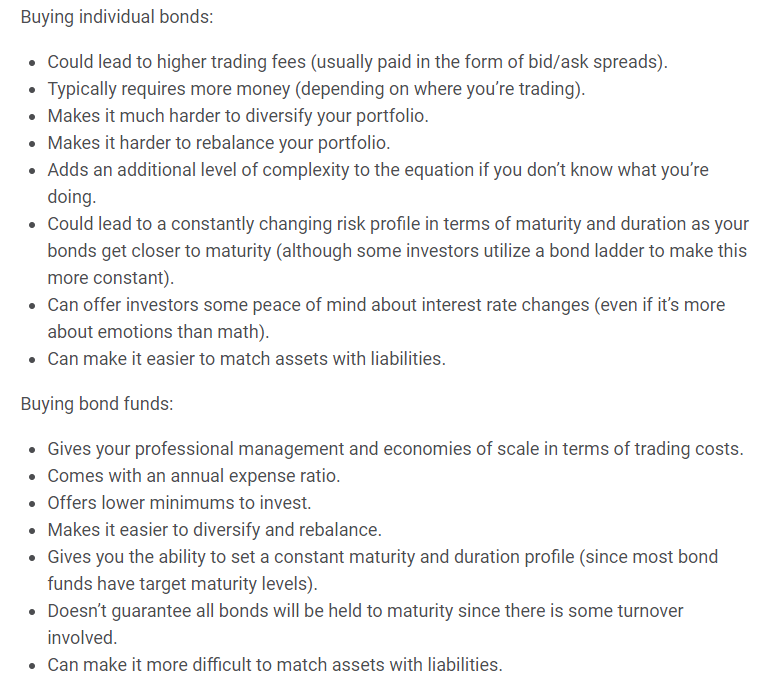

Asset allocation selection is an art, not a science.