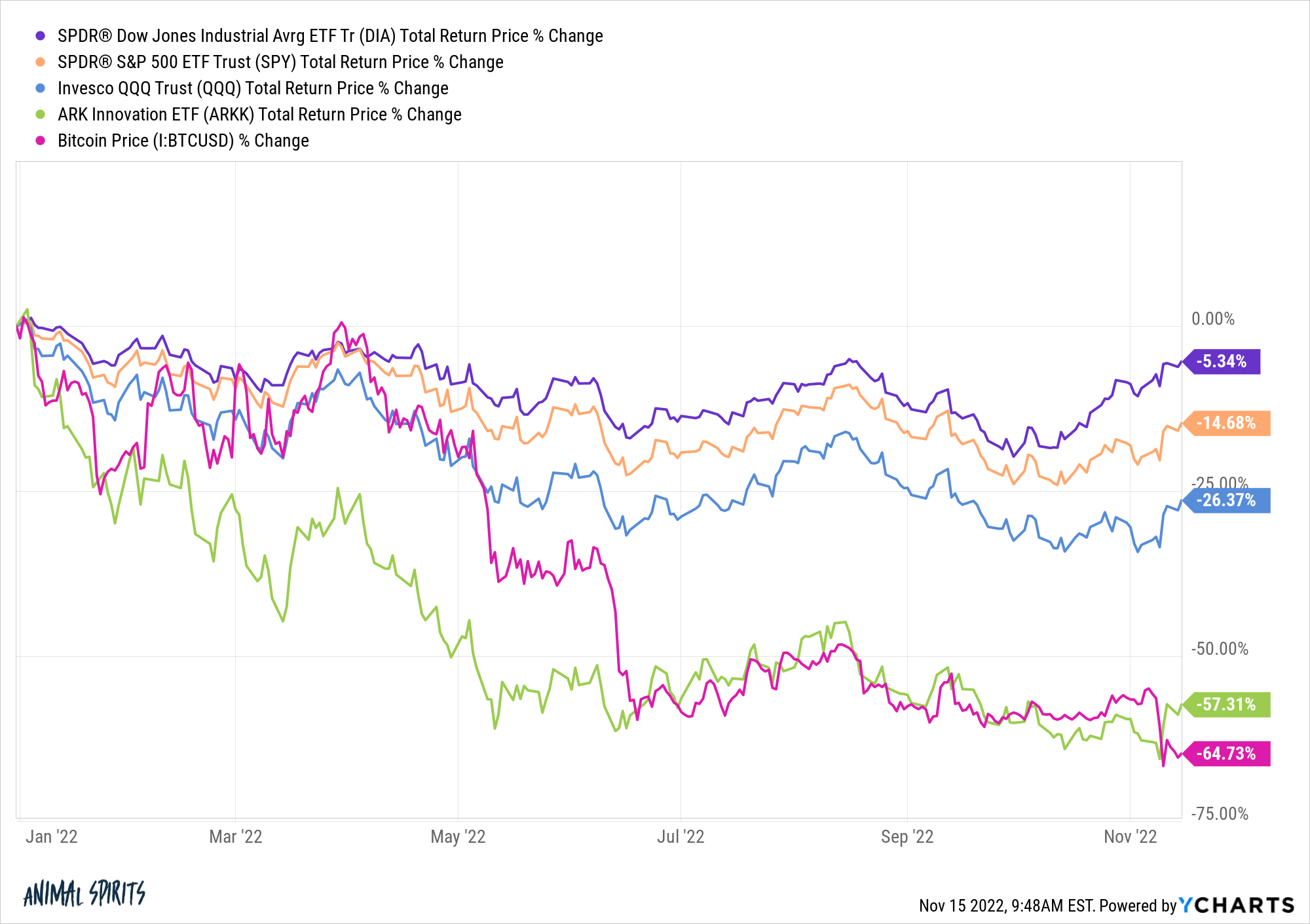

Boring is better this year in the markets.

The more exciting your portfolio, the worse your performance is in this bear market.

Those old stodgy blue chip stocks in the Dow that pay dividends and have stable cash flows are crushing the innovation-led stocks that have more potential than profits in 2022.

This is in stark contrast to the FOMO days of 2020 and 2021 when it felt like the only place to put your money was the most intoxicating of investments.

French philosopher Blaise Pascal once wrote, “All of humanity’s problems stem from man’s inability to sit quietly in a room alone.”

The investor play on words here would be: “All portfolio problems stem from investor’s inability to stick with a boring old asset allocation.”

Successful investing should be boring. It should be long-term in nature. It requires patience and discipline and the ability to ignore the madness of the crowds.

But you can’t brag about boring to your friends and co-workers. No one writes glowing profiles about normal people who diligently save and invest their hard-earned money, keep fees to a minimum and stay the course.

That’s not sexy.

Sexy is SPACs, meme stocks, IPOs and life-changing amounts of money in a short period of time.

Why wait decades to build wealth when you witnessed someone else do it overnight?

I’m not trying to be a scold here.

Of course it’s easier to extol the virtues of a more monotonous investing style now that all of the speculative junk has crashed.

Although, at the height of the meme stock/Robinhood/day-trading/crypto speculative boom in early-2021, I did write a piece called It’s OK to Build Wealth Slowly.

I wish I could tell you that post was some brilliant market timing call or contrarian sentiment indicator but that’s not what it was at all. That post was a self-reminder to keep my wits about me at a time when it felt like everyone else was making easy money.

My portfolio is pretty dull. The majority of our net worth resides in index funds and low-cost ETFs. We also have a decent chunk of our net worth tied up in real estate.

You’re never going to get rich overnight investing in index funds or housing.

But index funds don’t have an ego.

They’re never going to return your money to spend more time with their family.

Index funds won’t see their performance impacted by going through a nasty divorce.

They won’t commit fraud against you or gate your withdrawals or transfer your money from one company to the next to cover losses made from idiotic mistakes.

You’re never going to get caught up in a Ponzi Scheme investing in a total stock market index fund.

Don’t get me wrong, I don’t mind adding a little excitement to the mix to scratch an itch.

I’ve gone out further on the risk curve with a portion of my investments over the years. I’ve invested in real estate, a handful of alternative investment platforms, some fintech start-ups and crypto.1

But I only invest in those other asset classes after my 401k has been maxed out. And some money goes into our emergency savings account. And my SEP-IRA is funded. And the 529 plans and automated investment accounts for the kids are covered. And after I put money into a taxable brokerage account.

It’s only after all of those boring, responsible buckets are filled up that I’ll take some extra risk with any sort of investments outside of the mundane.

A high savings rate combined with a bunch of boring, low-cost, tax-efficient investments is the margin of safety I needed before ever even considering a riskier investment profile.

Everyone has a different appetite for risk. And even the boring stuff can get blown up from time to time. The stock market is obviously not immune to large losses.

But one of my biggest takeaways after nearly 20 years of working in the markets is survival is an underrated quality for success.

I’ve seen many portfolio managers, funds, fad investments and strategies blow up over the years.

There is something to be said for diligently following a strategy that is durable enough to survive many different kinds of market environments.

I don’t think it’s possible for 99% of the investing population to be exclusively invested in exciting stuff all the time.

Exciting stuff doesn’t always work. Nothing does.

You need the boring stuff as a ballast in your portfolio because the boring stuff always comes back in style.

When the boring stuff doesn’t work it usually means underperformance.

When the exciting stuff doesn’t work, you can lose all of your money.

Further Reading:

It’s OK to Build Wealth Slowly

1I’ll share some more thoughts on crypto on Animal Spirits and in a blog post later in the week.