John Candy is one of my favorite actors of all-time.

I love Uncle Buck.

I watch Planes, Trains and Automobiles every year on Thanksgiving.

I’ve watched Spaceballs, Stripes, Splash, Brewster’s Millions and Summer Rental multiple times. Then you have his cameos in Home Alone and National Lampoon’s Vacation.

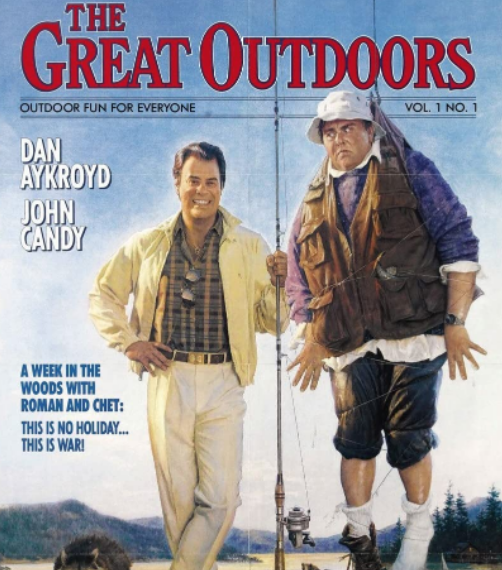

Plus, The Great Outdoors is easily one of the better vacation movies ever made. It’s totally 80s but I love it.

Candy plays the humble, down-to-earth, everyman Chet Ripley while Dan Aykroyd plays his antagonist Roman Craig, a loudmouth, arrogant, big-city guy who happens to be a trader.

There’s a scene early on where the two men are grilling when Aykroyd begins to brag about his 300% profits trading Deutschmarks in just a week.

Candy replies, “Well, easy money is money easily lost.”

Not skipping a beat, Aykroyd snarkily comes back with, “I can’t believe how old-fashioned your thinking is.”

The irony here is it was revealed later in the movie ***spoiler alert*** that Aykroyd’s character had actually gone broke through a series of bad investments.

Chet was slow and steady. Roman was bold and flashy. Chet was risk-averse. Roman took big swings. Chet felt inadequate when looking at Roman’s Mercedes. Roman lost all of his money and had to lean on Chet for a financial lifeline.

I watched The Great Outdoors for maybe the dozenth time this past week and couldn’t help but think about the juxtaposition of the two main characters and the markets these past few years.

Just think about how easy it was to make money following the crash in early-2020.

Jason Zweig discovered in the year following the bottom from March 23, 2020 to March 23, 2021, 96% of U.S. stocks had positive returns. That was the highest percentage of winners over any 12-month period in history.

It was too easy.

Everyone was getting rich investing in stocks, crypto, SPACs, IPOs, collectibles, NFTs, you name it.

Remember headlines like these we were being beaten over the head with:

The problem with these stories is you never hear the other side of it.

The people who got in at the top and lost it all. The people who never rebalanced and completely round-tripped. The speculators who got rich overnight and went broke just as quickly.

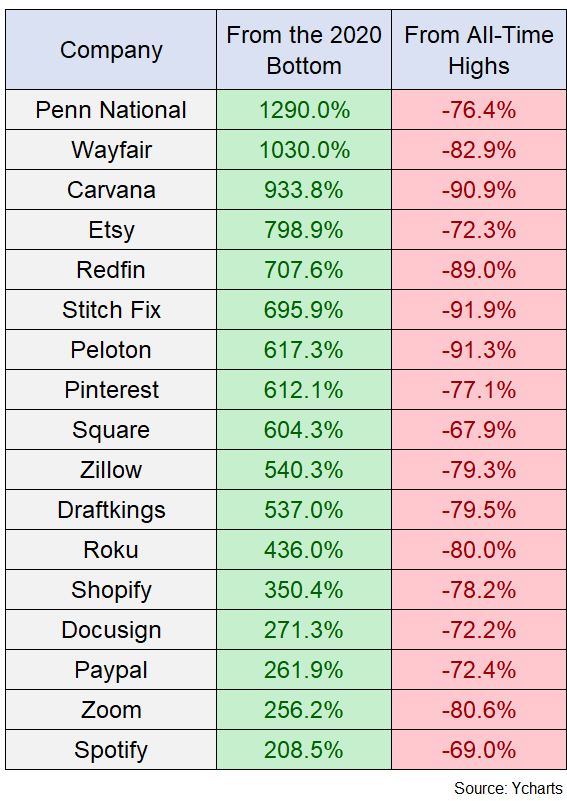

There were people who started buying individual stocks in 2020 for the first time that made multiples of their original investment by simply buying the hottest stocks.

Most of those stocks have now completely given up those gains.

I compiled a list of 2020’s stock darlings to show the insane returns they had from the bottom in March 2020 along with the current drawdowns from the heights of those gains:

This was easy money that was money easily lost.

In January 2021, close to the zenith of the market madness, I wrote a piece called It’s OK to Build Wealth Slowly.

That post wasn’t so much financial advice to others as it was a reminder to myself about the dangers of speculation and FOMO during a bananas market.

We’re all human. It’s understandable that people get caught up with the herd mentality when markets are rocking and it seems like everyone else is making money hand over fist.

It’s no fun to sit in the corner while everyone else is partying but the party always comes to an end no matter how much fun it is.

In the short-term, it’s always tempting to be more like Roman Craig and go for the quick buck.

But over the long-term, the vast majority of people are going to be better off following the slow and steady Chet Ripley approach.

Hard money in the long run is more sustainable than easy money in the short run.

Further Reading:

It’s OK to Build Wealth Slowly