Today’s Talk Your Book is brought to you by Innovator Capital Management

We had Co-Founder and CEO Bruce Bond back on the show to give us an update on buffered ETFs.

On today’s show we discuss:

- How advisors are using the buffer ETFs in this market

- How the known outcome buffers work

- How volatility has affected the upside caps

- Fixed income v buffered ETFs

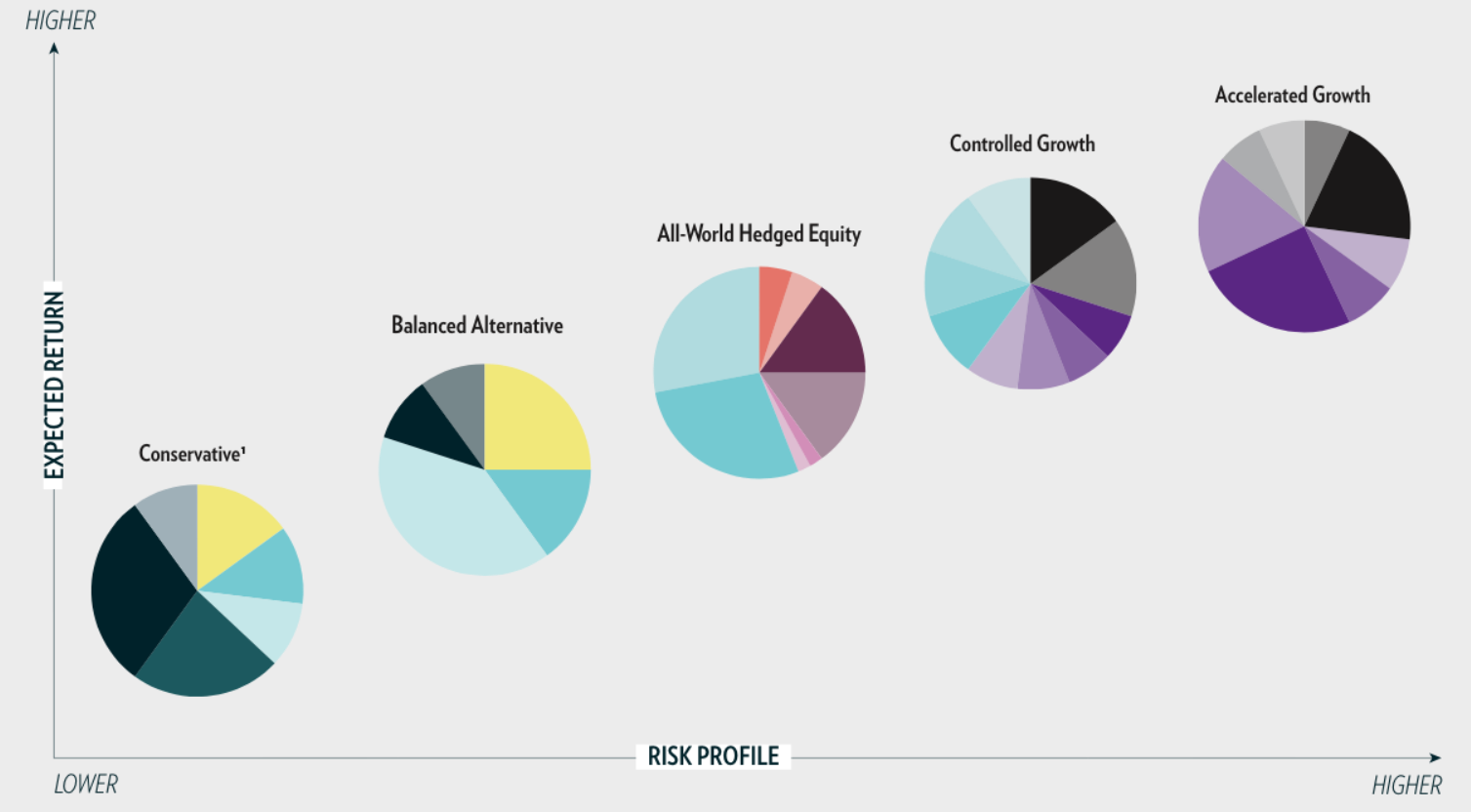

- Innovators new managed product

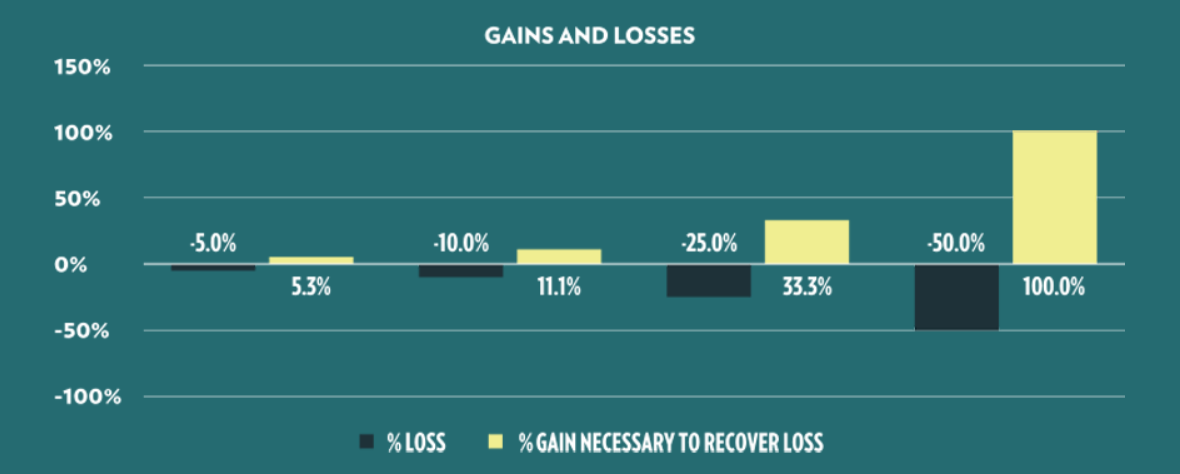

- Floors vs buffers

- How market environments affect caps and buffers

- Using option strategies for income

Listen here:

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. The information provided on this website (including any information that may be accessed through this website) is not directed at any investor or category of investors and is provided solely as general information.