Is the stock market a Ponzi scheme?

Is the stock market a Ponzi scheme?

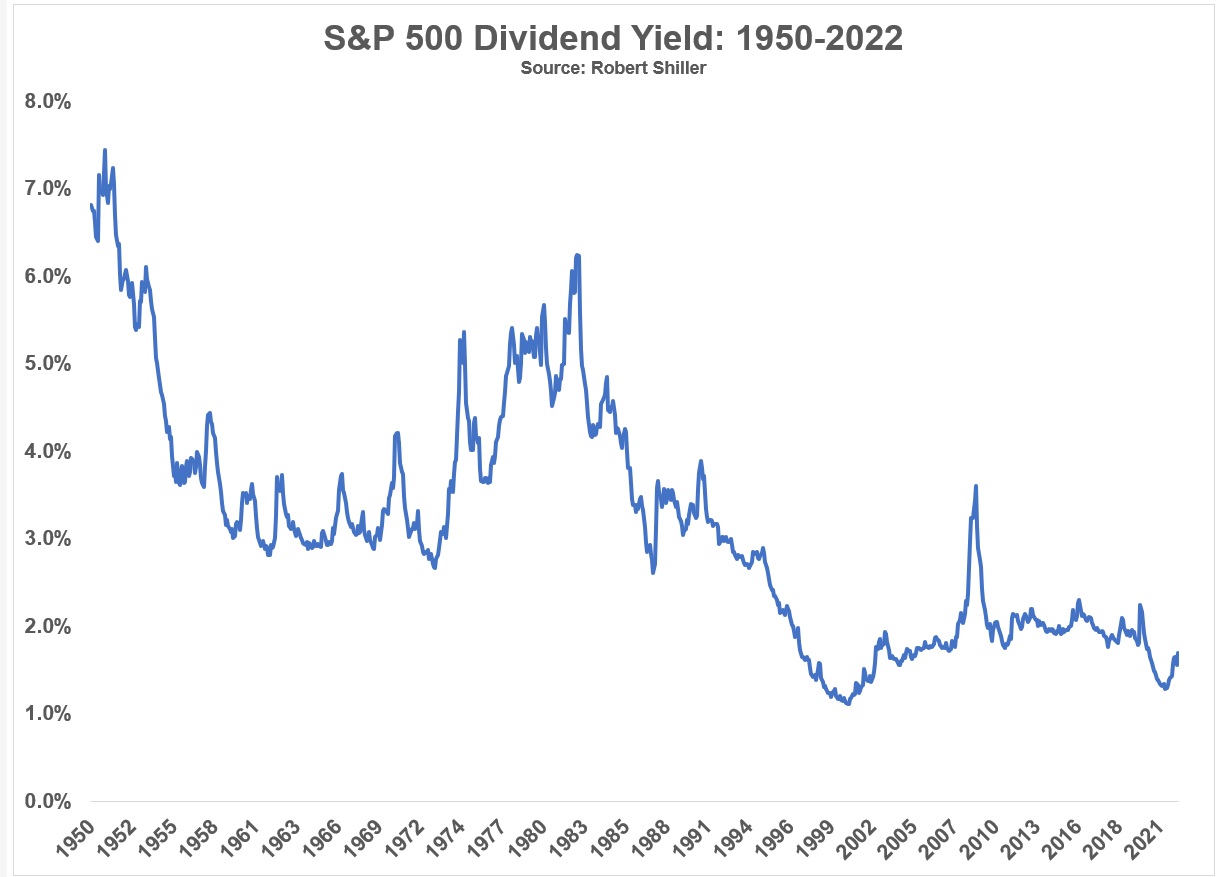

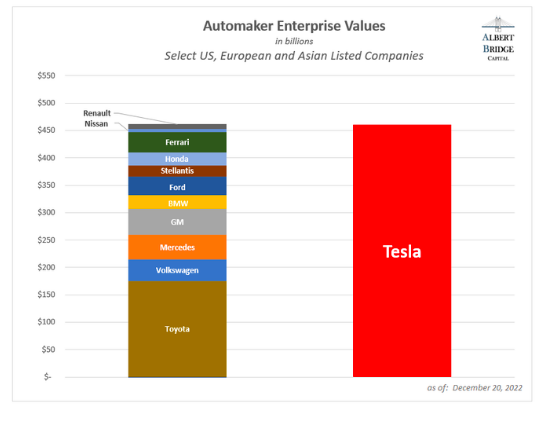

On this week’s show, we discuss the kid premium around the holidays, the most surprising things that happened in 2022, some thoughts on stocks vs. the economy for 2023, why consensus is wrong most of the time, the car industry is all messed up, why housing prices aren’t falling faster, the year of the sequel and much more.

My biggest surprises of the year that was.

On today’s show, we are joined by Pavel Vaynshtok, Managing Director, Global Head of Strategy Indices at S&P Dow Jones Indices to discuss the history of indices, why thematics have gotten so popular, how S&P Dow Jones Indices constructs their indices, and much more!

My favorite books I read in 2022.

What’s the most likely outcome for the economy from here?

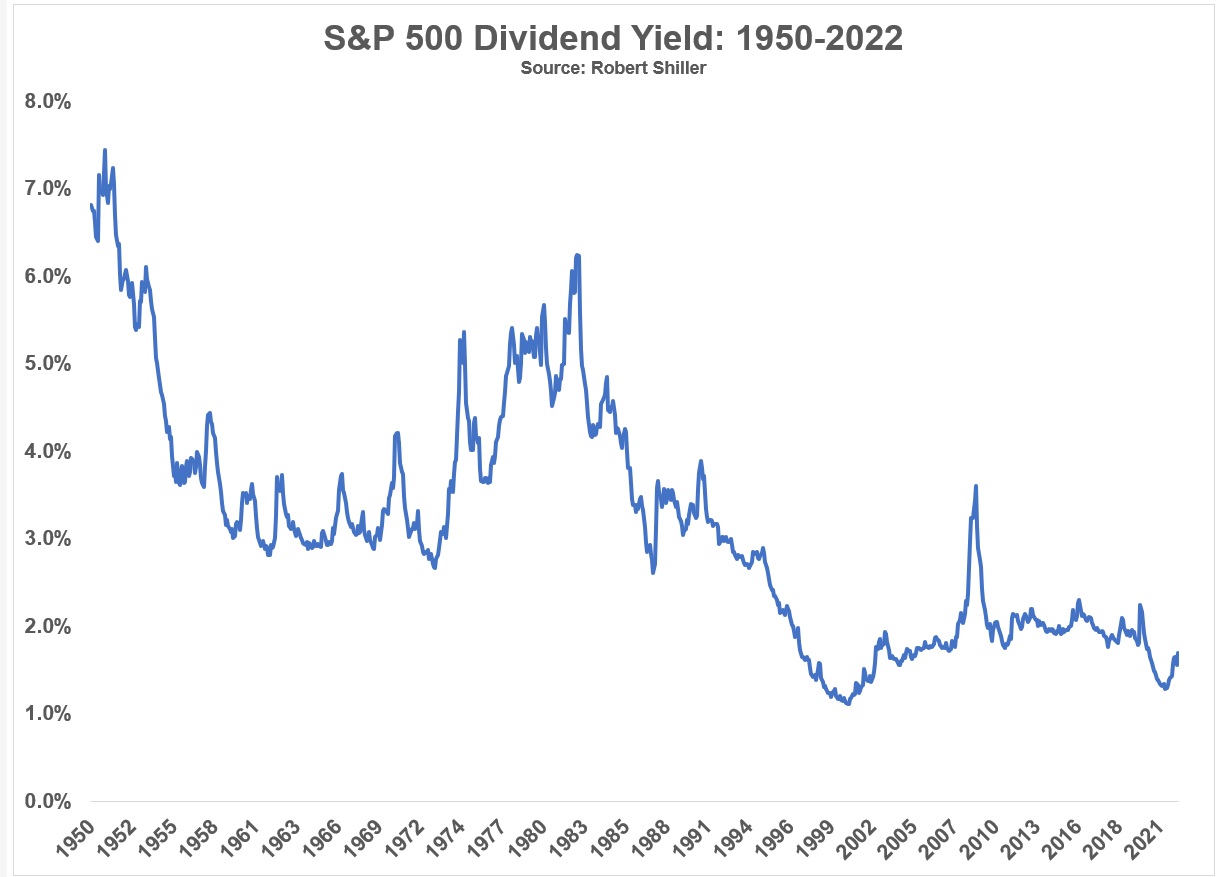

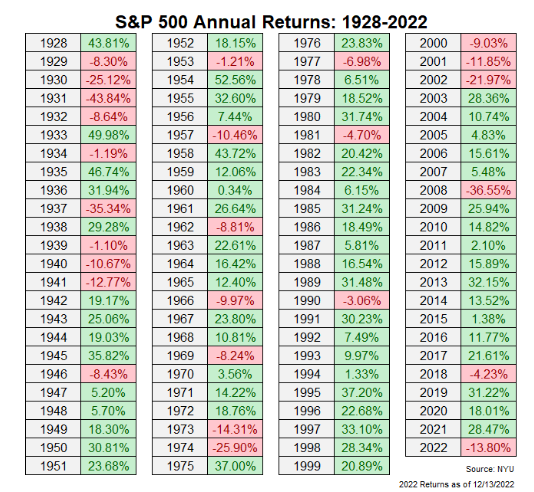

Some thoughts on the stock market in 2023.

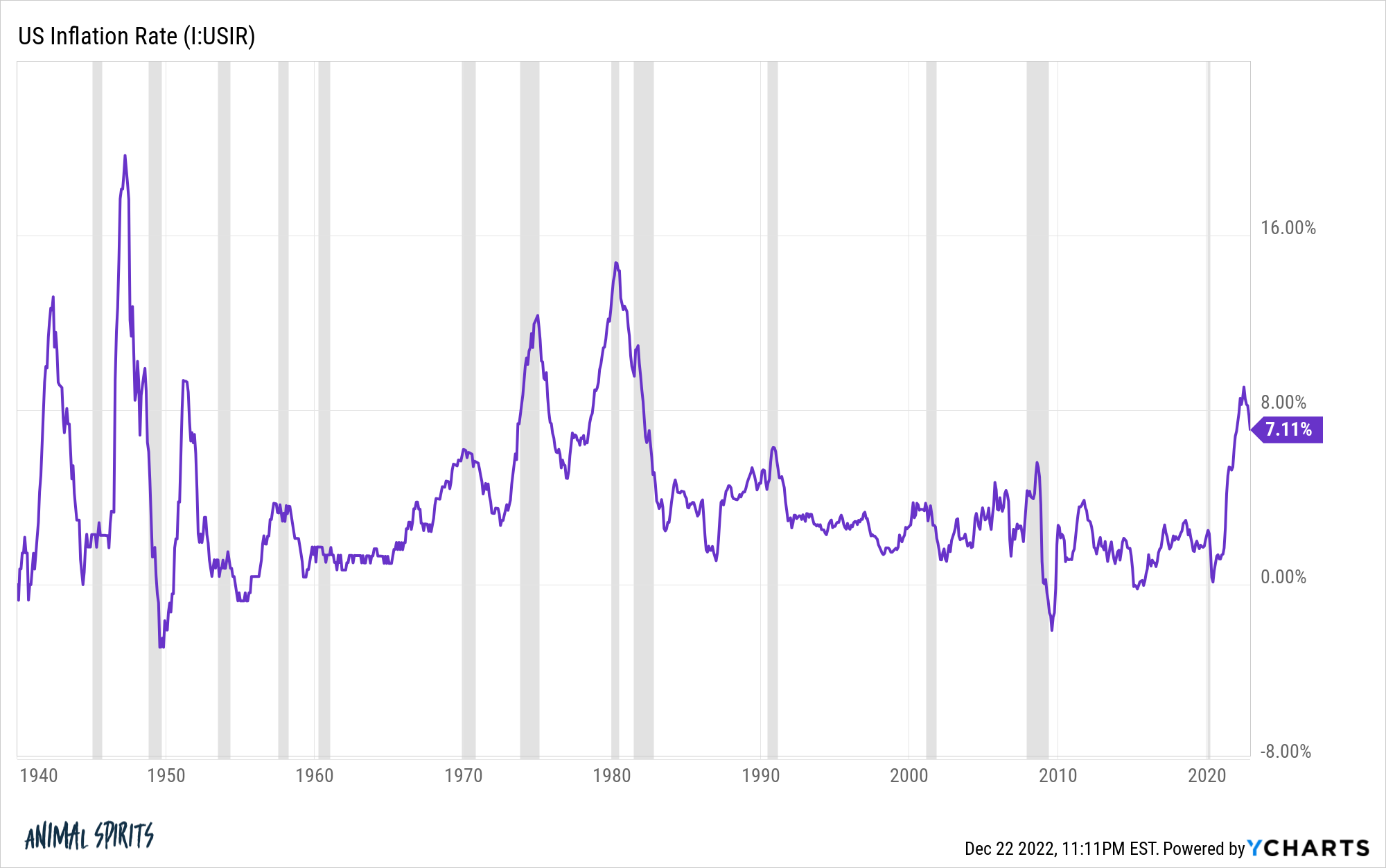

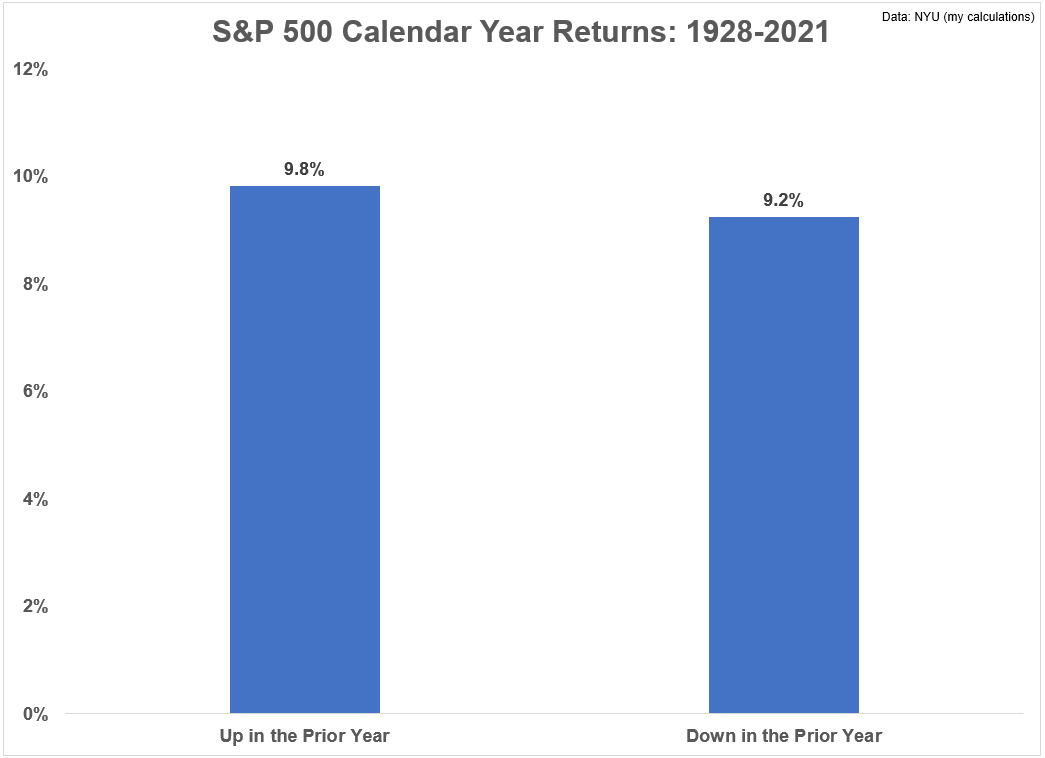

On today’s show, we talk about why the stock market is getting crushed this month, what one year’s returns mean for the next year, why retail investors are still buying tech stocks, 3 scenarios for next year’s market, the Fed’s 2% inflation target, why there will never be a perfect economy, the Avatar sequel and much more.

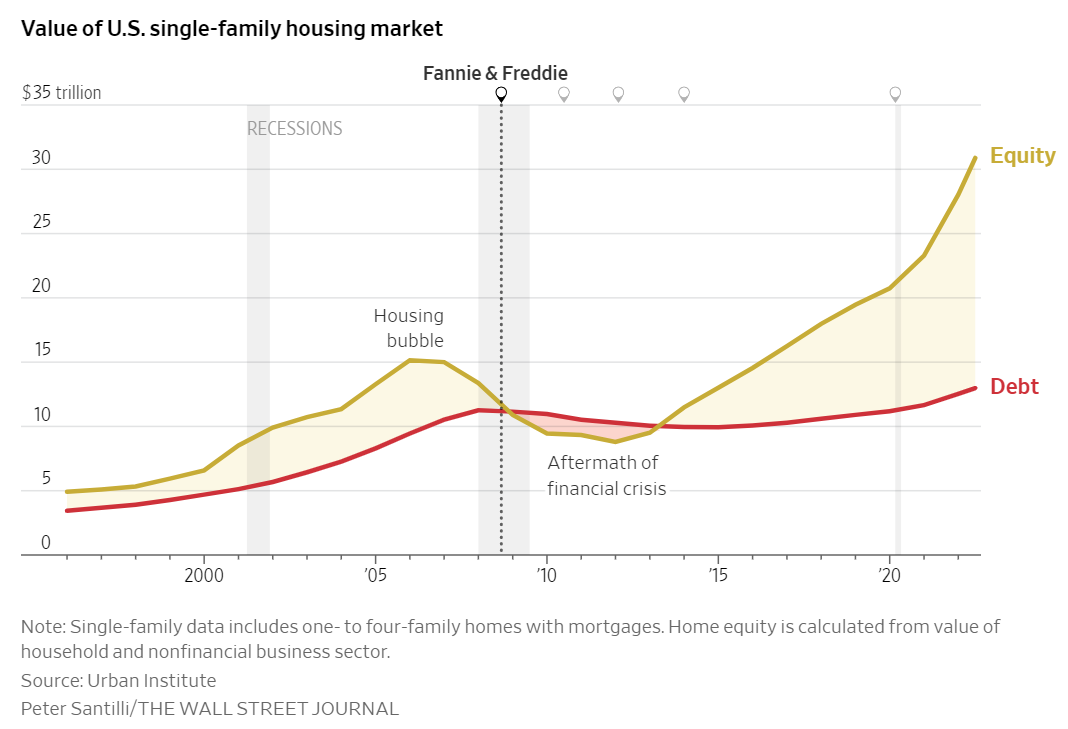

Two housing market booms in the same century.

On today’s show, we are joined by Mark Neuman, Founder and CIO of Constrained Capital to discuss companies orphaned by ESG, how capital is actually getting constrained, politics in investing, Coke & Pepsi vs Alcohol and Tobacco, and much more!