A reader asks:

I know no one can predict the future…yada, yada, yada, but just between us – what’s going to happen with the stock market next year? I’m not sure I can handle another year like 2022.

Life would be a lot easier if I knew the answer to this question.

I guess the good news is there really isn’t much connective tissue from one year to the next in terms of one year’s price action impacting the next year.

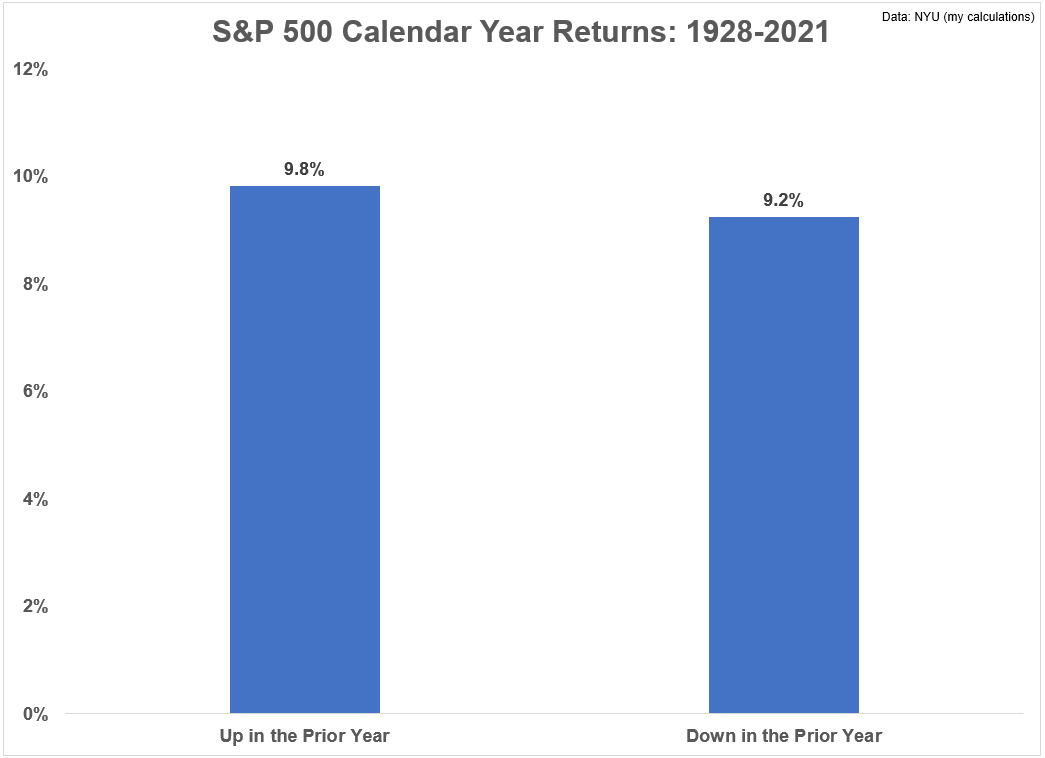

I performed a simple analysis of the average annual returns to show the average annual returns following an up year or a down year for the U.S. stock market going back to 1928.

The results don’t help all that much:

The average return following an up year was 9.8%

The average return following a down year was 9.2%

We could break things down further by just looking at only the worst years since 2022 will fall in that category.

Not including this year, there have been just 11 double-digit down years since 1928 so it’s relatively rare.

If we simply looked at this small sample size I could offer you a positive or negative spin based on these big down years and their subsequent returns.

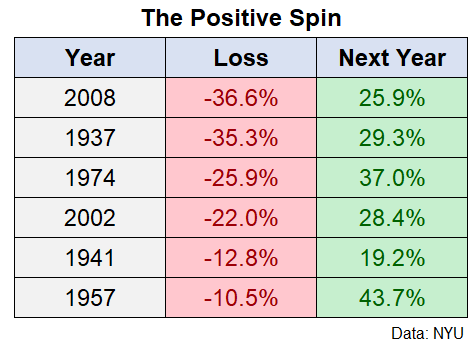

Here’s the positive spin:

More than half of the worst losses of the past were followed by huge gains. Pretty good, right?

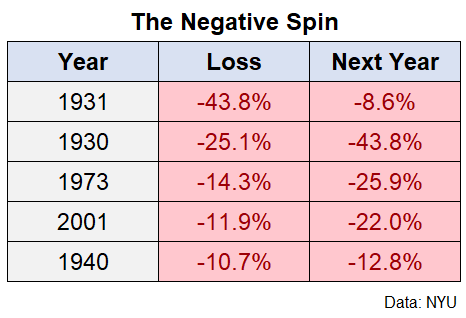

Now here’s the negative spin:

All of the other big down years were followed by further losses, sometimes in excess of the previous year’s decline.

Based on the historical record you should expect to see big losses or big gains next year. Still not much clarity.

Now I’m sure some of you are thinking, but wait Ben:

How many times has the stock market been up when the Fed is in a tightening cycle?

How many times has the stock market been up when inflation remains well above average?

How many times has the stock market been up when it looks like there is such a high probability for a recession?

How many times was the stock market up while the Detroit Lions were in playoff contention?

How many times has the stock market been up when interest rates have risen so precipitously?

All fair points.

My only counterpoint is this — the stock market is inherently unpredictable in the short-term because the world is unpredictable.

How many people at the end of 2019 were forecasting a pandemic in 2020 that would cause lockdowns, millions of people working from home, the worst quarterly GDP print in modern economic history and the biggest government spending response since World War II?

Coming into this year, how many people predicted the dictator in Russia would invade an innocent country causing upheaval in the food and energy markets? Or the highest inflation rate in 4 decades? Or the Federal Reserve actively rooting for the stock market to go down?

This wasn’t on any of the 2022 outlooks I perused.

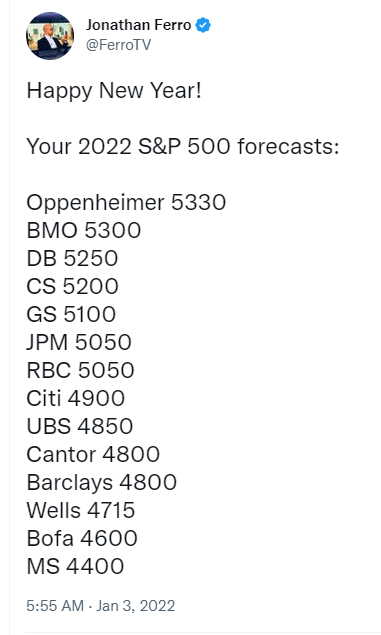

Bloomberg’s Jonathan Ferro posted the year-end 2022 stock market forecasts from all of the big Wall Street at the start of the year:

The range of these 14 forecasts was 4,400 to almost 5,400.

As of this writing, the S&P is trading at less than 3,800.

The point here is not to dunk on Wall Street people who make forecasts. That’s part of their job.

It’s to show how ludicrous it is to think you have the ability to predict what’s going to happen over any one year period.

Sure, someone is bound to get lucky every once and a while with the sheer number of people we have making predictions these days.

But I have no idea what’s going to happen in 2023 and neither does anyone else.

This is the very reason you create an investment plan in the first place. If you knew what was going to happen every year there would be no reason to have a plan in the first place.

The planning process should include setting realistic expectations, playing the probabilities and making course corrections along the way.

Planning should not include making short-term predictions about what’s going to happen in the stock market.

It’s a fool’s errand.

We spoke about this question on the latest Portfolio Rescue:

Bill Sweet helped me empty out our inbox to answer questions on inflation, ETFs, finding a CPA, Roth IRAs, taxes on commodities and more.

Further Reading:

How Often is the Market Down in Consecutive Years