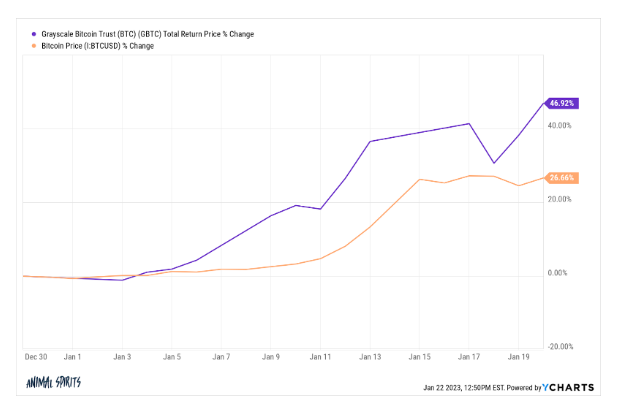

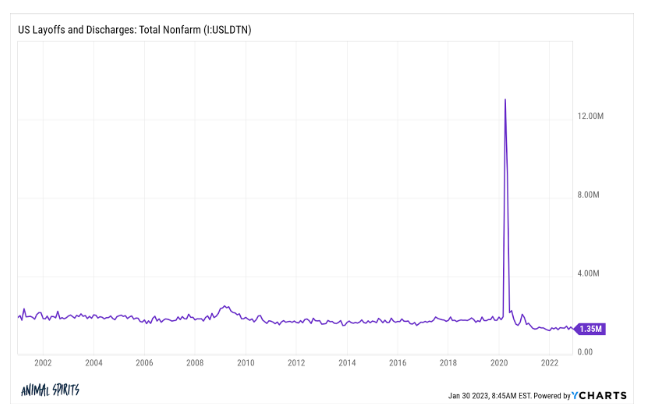

On today’s show, we discuss the stock and bond market rallies in 2023, why certain investors are so pessimistic all the time, housing market activity bottoming, the most hated economic expansion of all-time, context around tech layoffs, consumer spending is slowing, Michael’s first resume and much more.