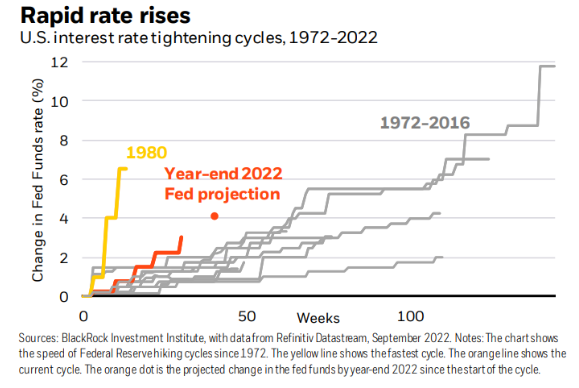

On today’s show, we discuss is the Fed making a huge mistake, why it’s so difficult to predict the economy, why it’s so easy to be bearish right now, breaking the housing market, why we’ve turned on Jerome Powell, the bullish case for a 60/40 portfolio and much more.