Why inflation matters more to the stock market than interest rates.

Why inflation matters more to the stock market than interest rates.

Life planning vs. financial planning.

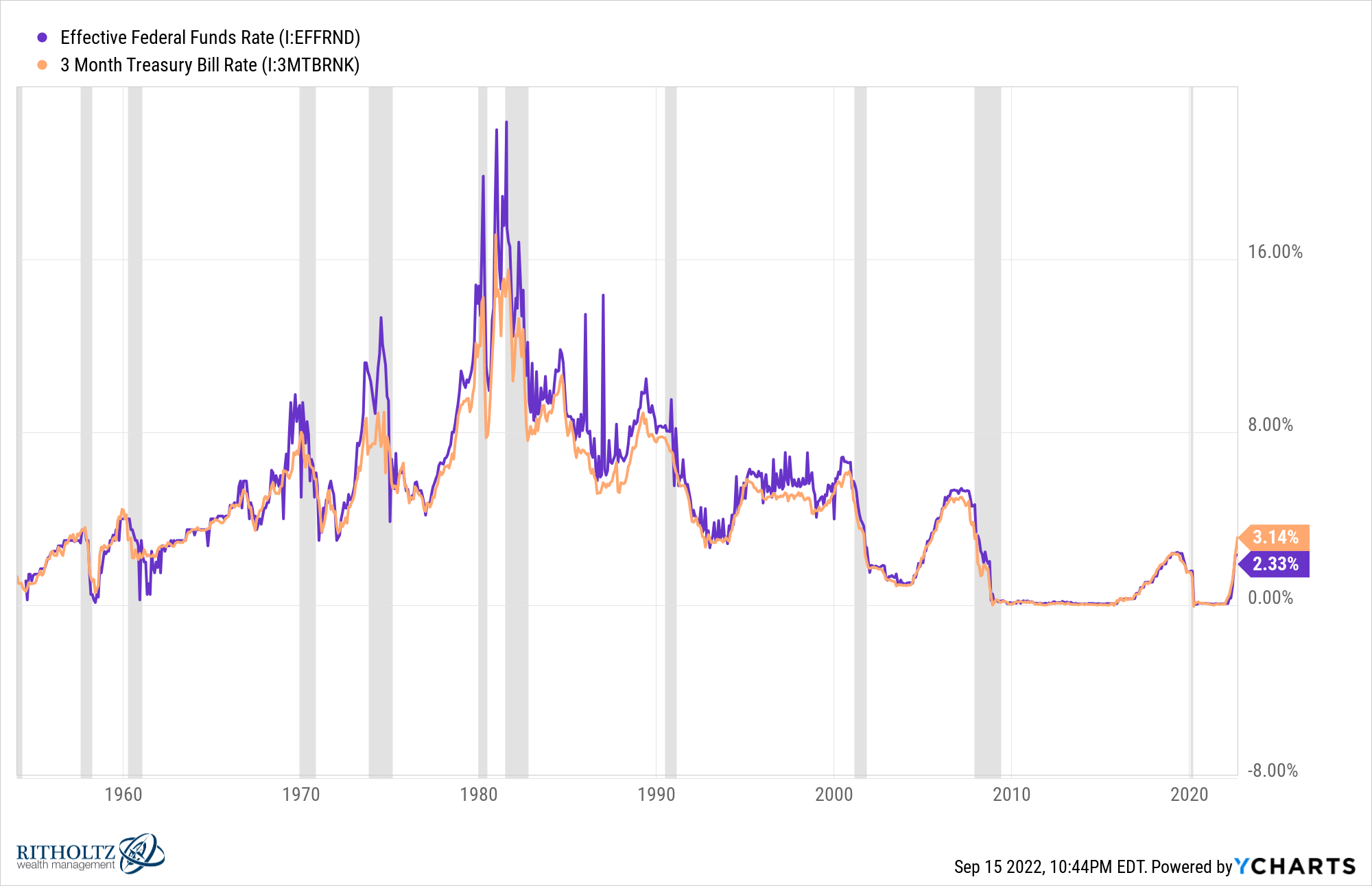

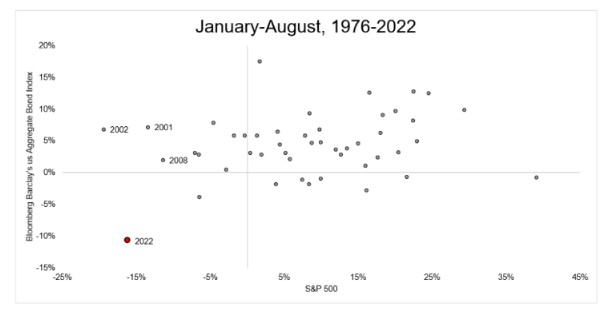

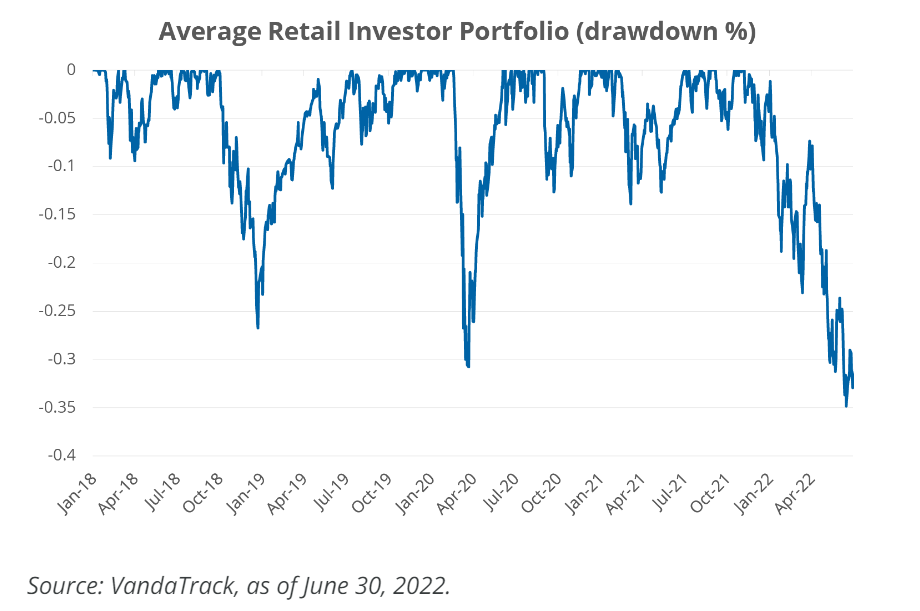

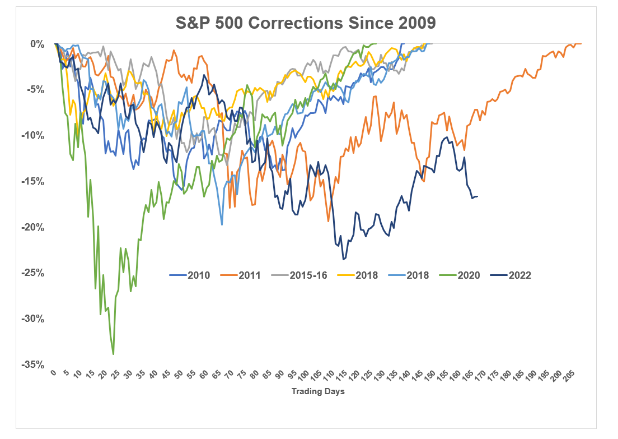

On today’s show, we discuss the worst first 8 months ever, the illiquidity premium, Q2 earnings, The Robinhood Investor Index, and much more!

Why our brains default to the negative side of things.

On today’s show, we had David Mazza, Head of Product at Direxion to talk about the use cases and risks of investing in single stock, leveraged, and inverse ETFs.

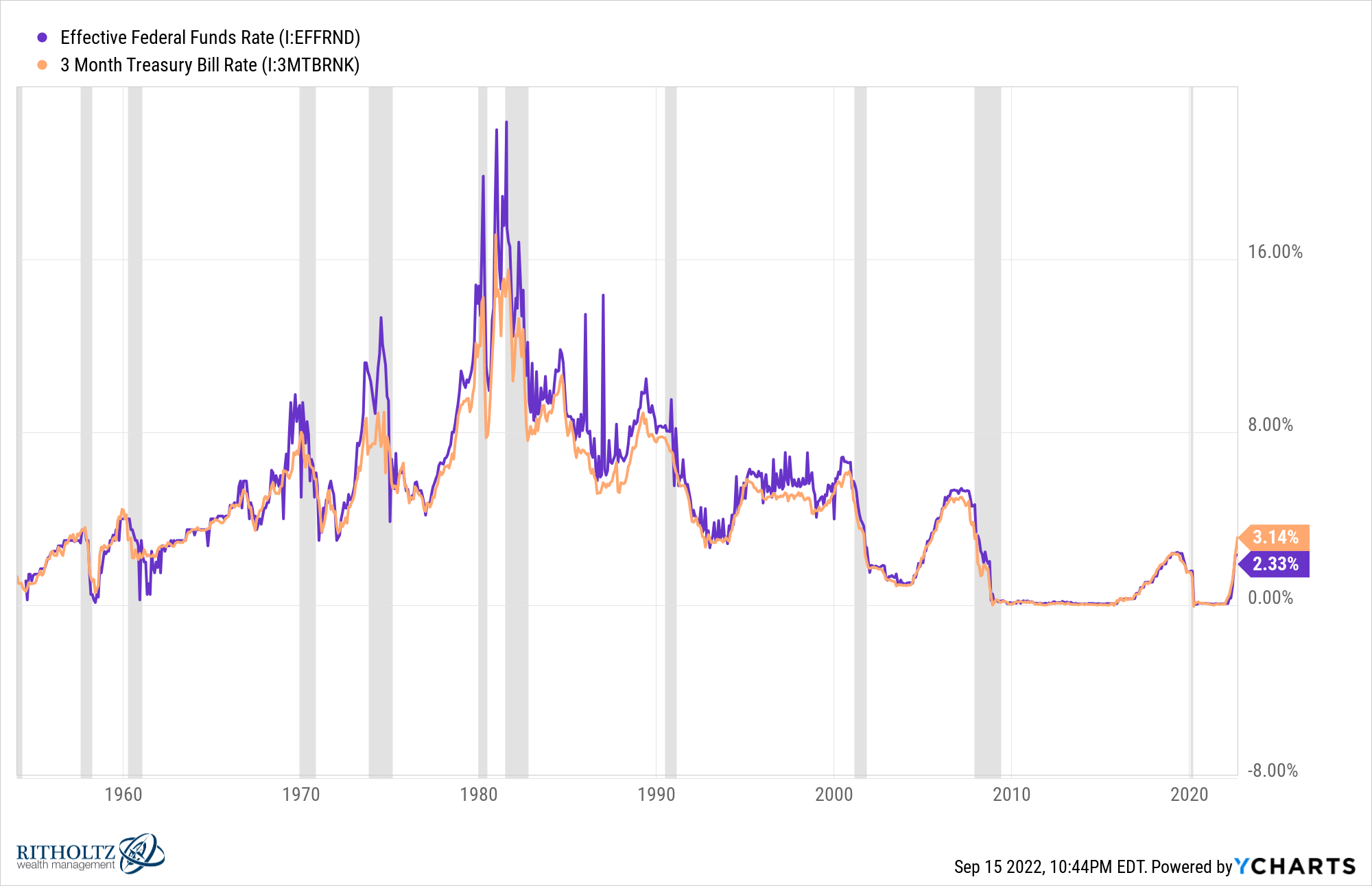

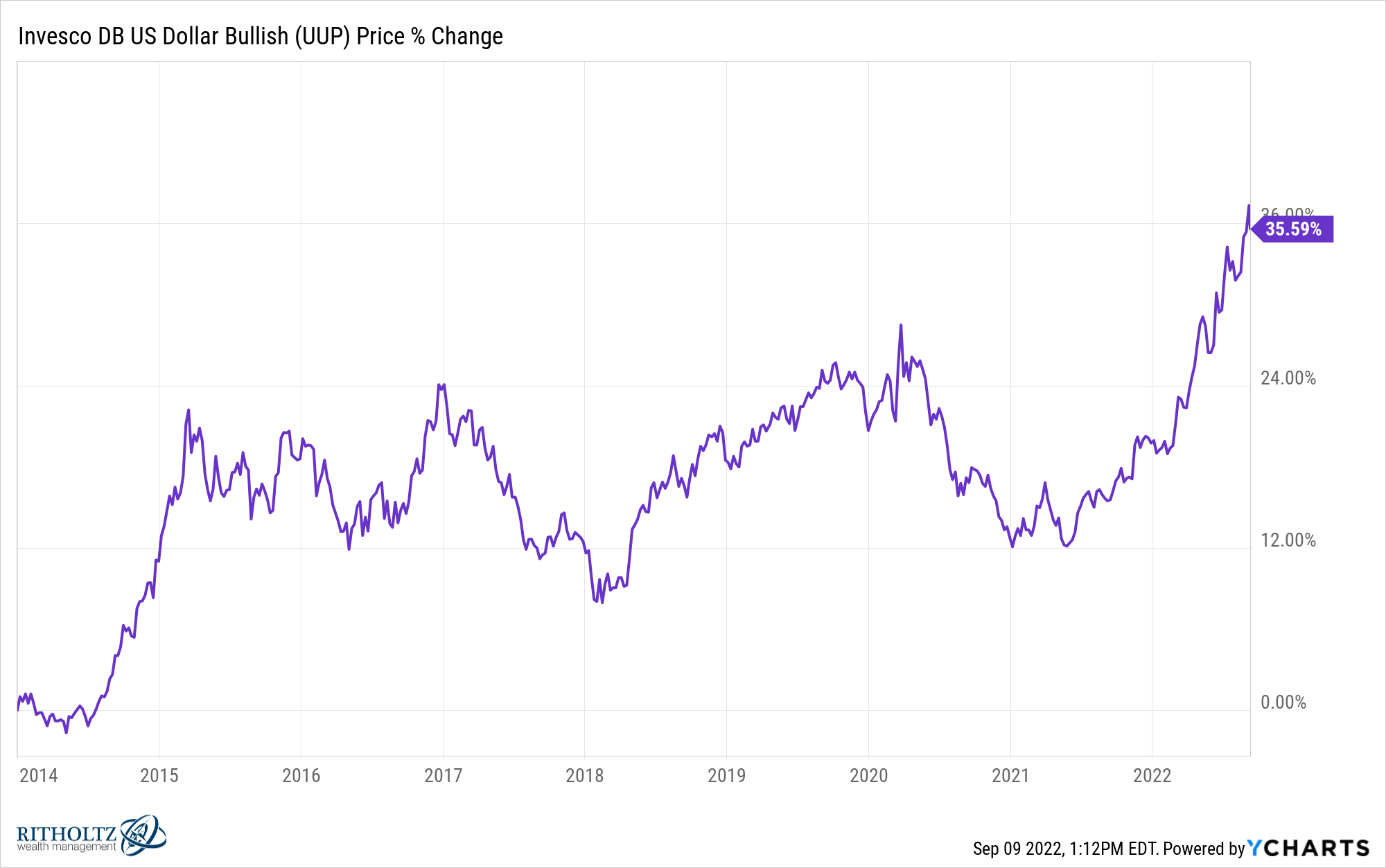

Following the Great Financial Crisis of 2008 a number of macro doom-and-gloomers began predicting a collapse of the U.S. dollar. The Fed was “printing” trillions of dollars. Interest rates had never been that low before. It was an appealing narrative if you were someone stuck in the negative feedback loop of the biggest economic crash…

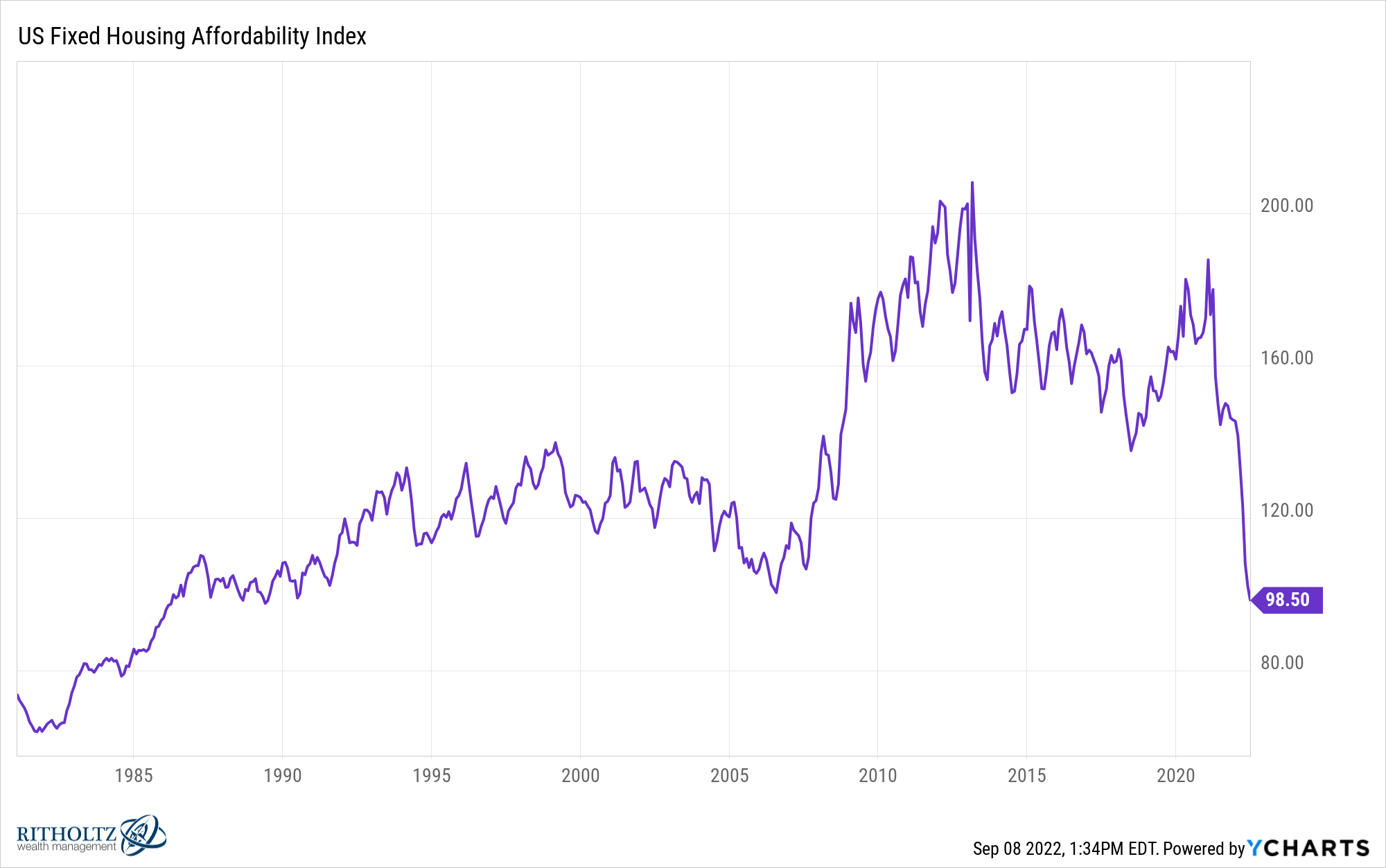

Why lots of people are out of luck with the hight cost of housing.

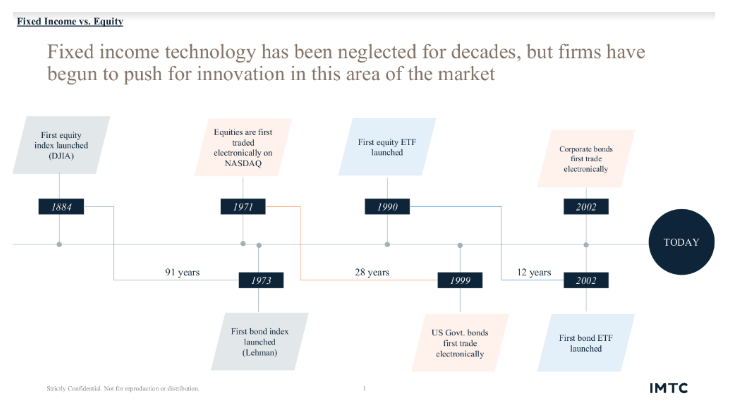

On today’s Talk Your Book, we spoke to Russell Feldman from IMTC on innovating the fixed income investment process, differences between trading stocks vs. bonds, risk management within fixed income, and much more.

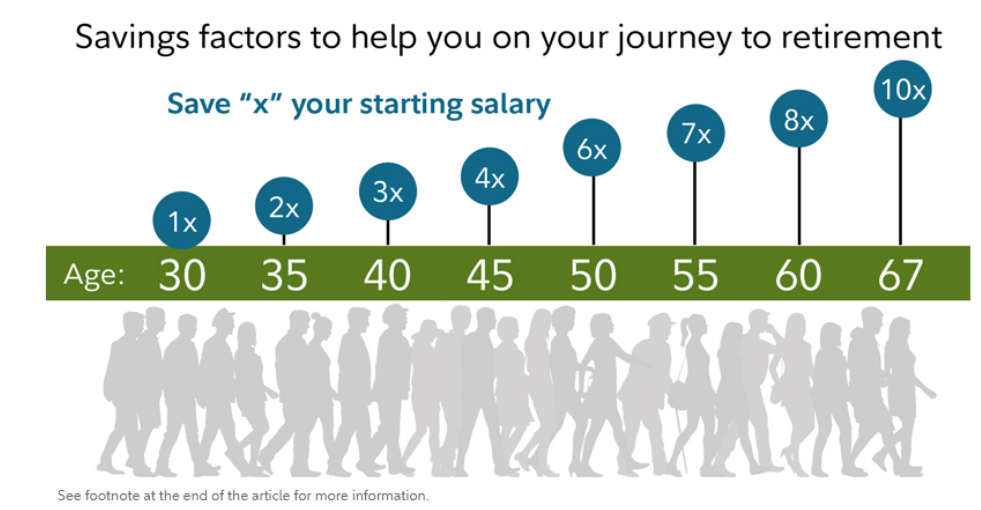

When it’s OK for your savings rate to drop.

On today’s show, we discuss Jeremy Grantham’s super bubble call, how “don’t fight the Fed” has evolved, why all opinions are extreme today, how the bottom 50% are making the biggest financial progress, how the Fed screwed up the housing market and much more.