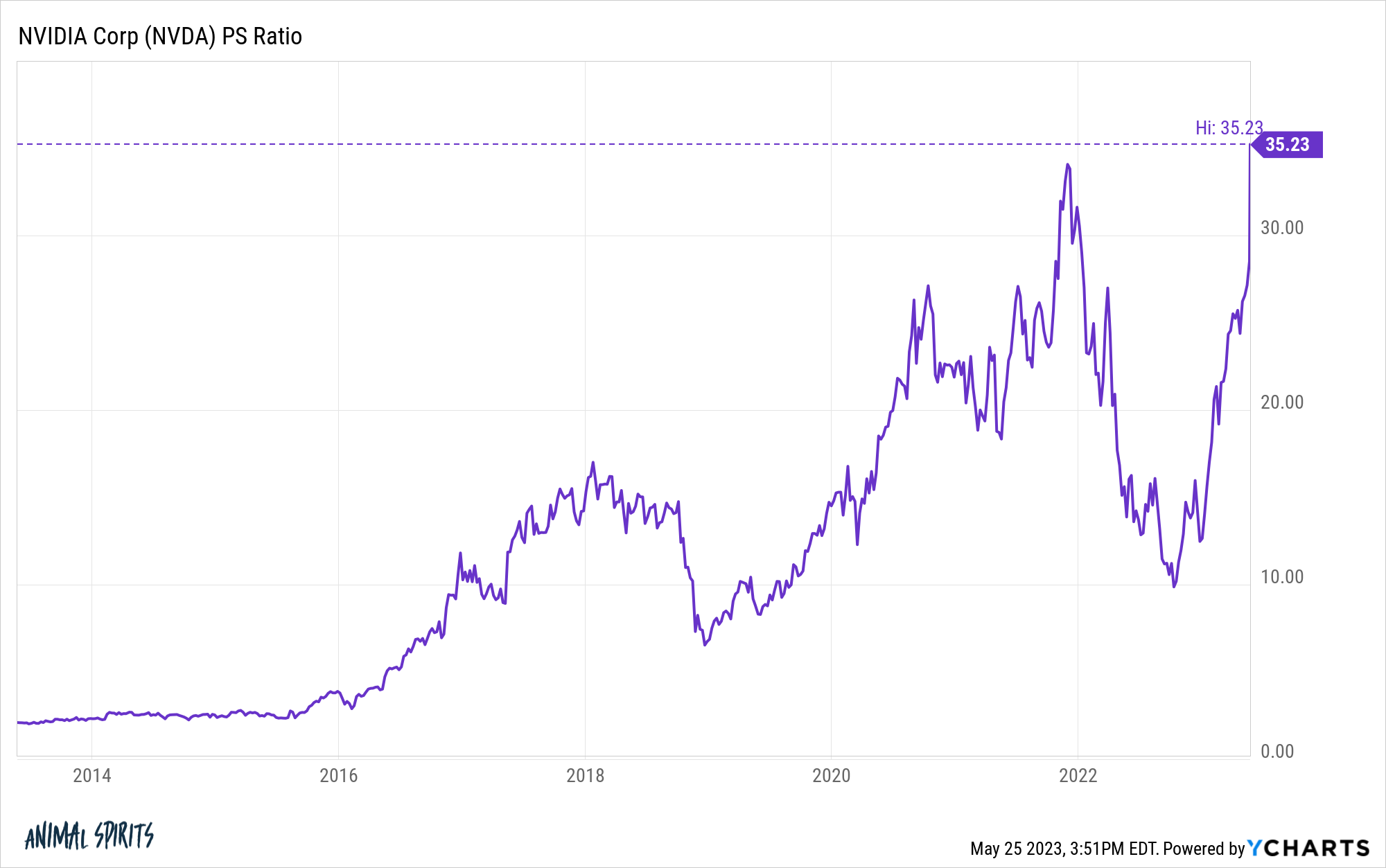

Thinking through the potential market outcomes from an AI boom.

Thinking through the potential market outcomes from an AI boom.

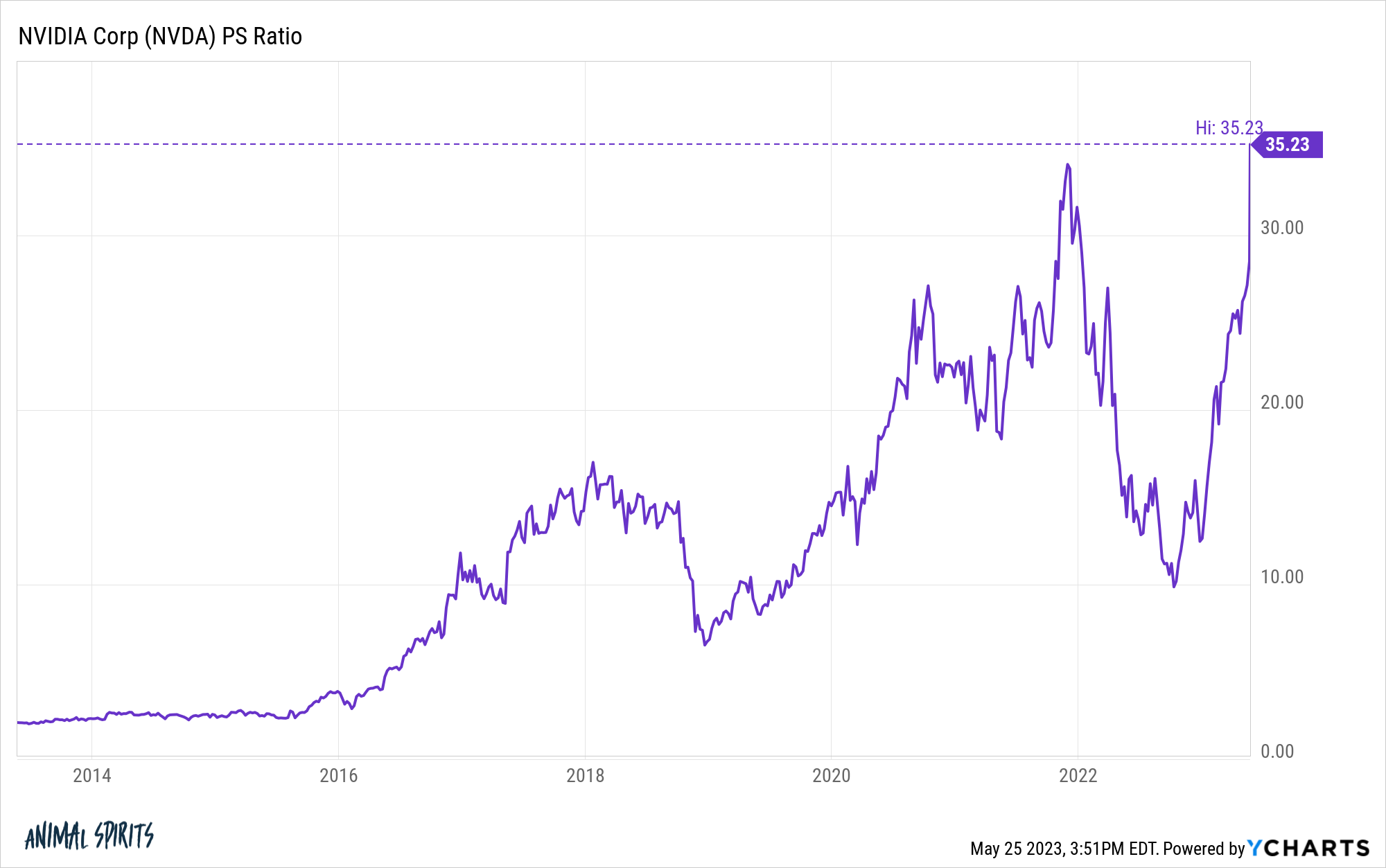

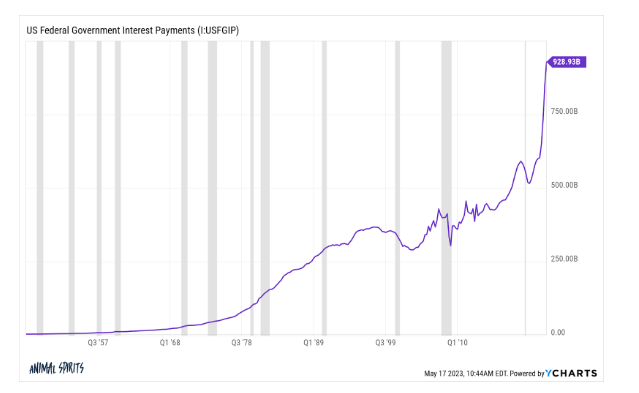

Do international stocks have the same win rates as the U.S. stock market?

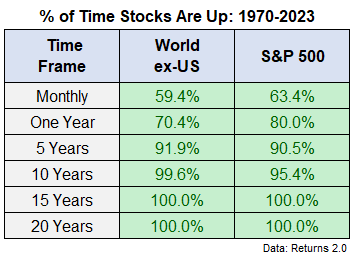

On today’s show, we discuss the now-available Animal Spirits x Tropical Bros shirts, a great year for stocks (so far), Japan and Germany making new decade highs, US Government interest payments at all time highs, a postmortem on iBuyers, the end of the cable bundle, AirBnb for cars, and much more!

An interview with Ramit Sethi about his new Netflix show How to Get Rich.

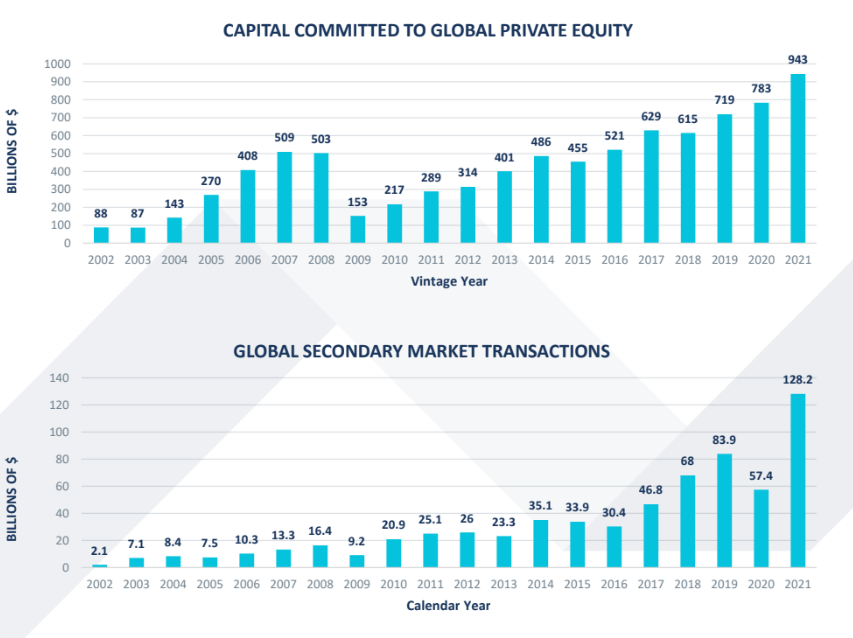

On today’s show, we are joined by Brett Hillard, CIO of GLASfunds to discuss advisor pain points when investing in alts, the fund manager due diligence process, how interest rates affect the alternatives market, and much more!

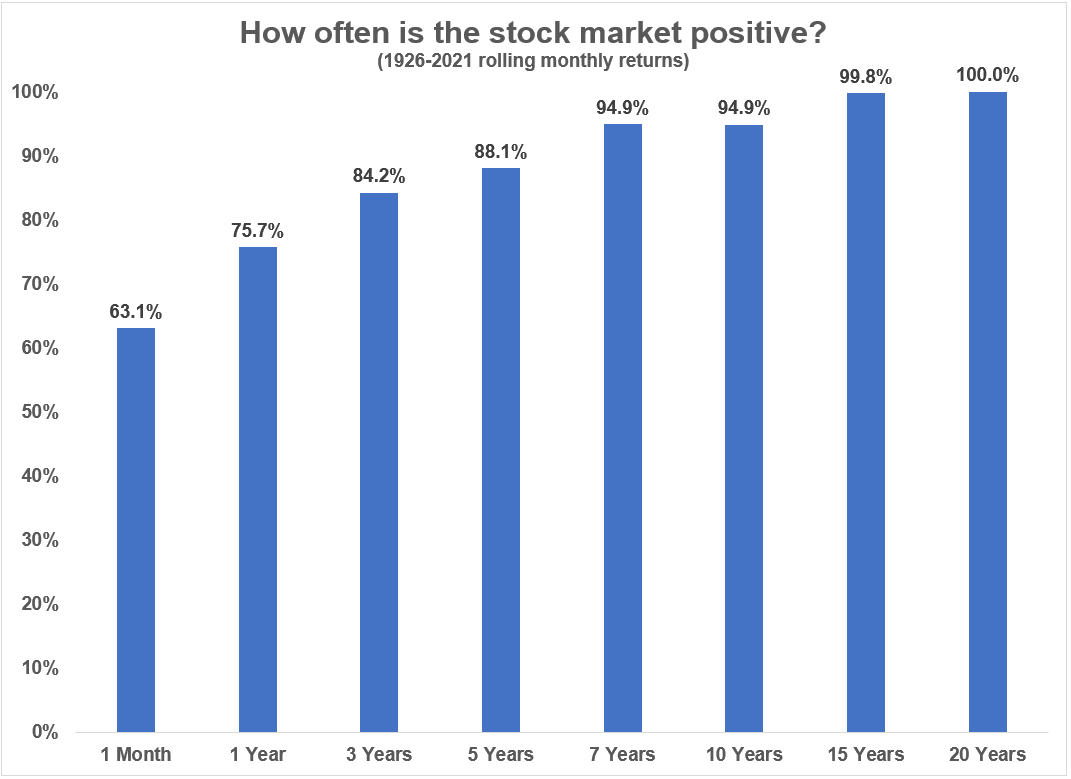

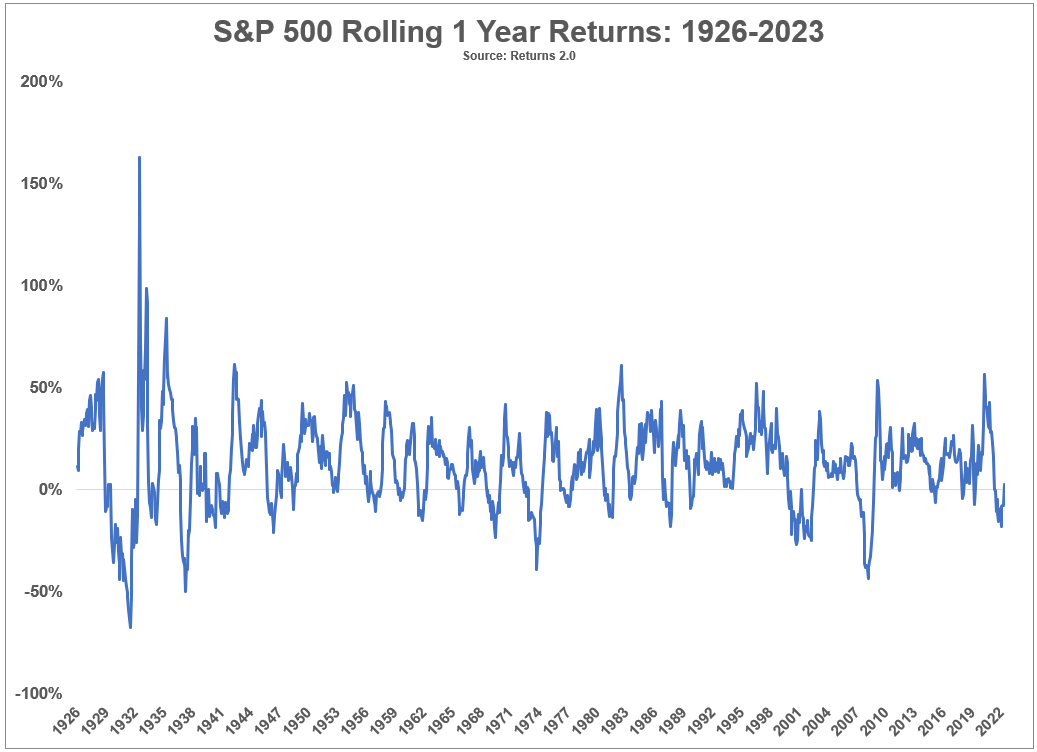

How often does the stock market crash?

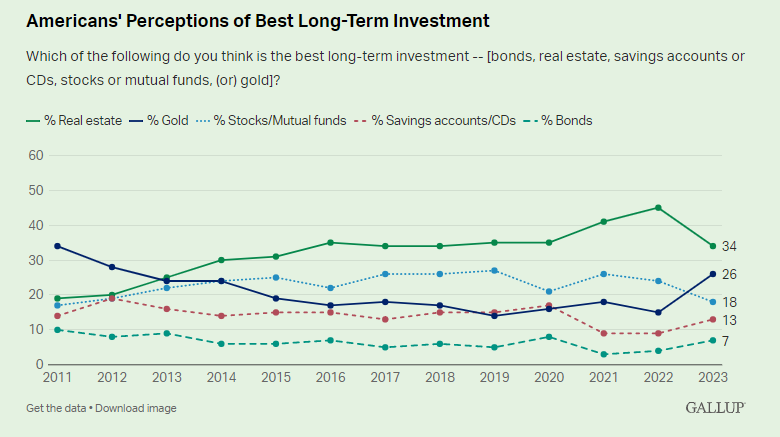

Better long-term investment: stocks, gold or real estate?

How worries about a government default could impact stocks and bonds.

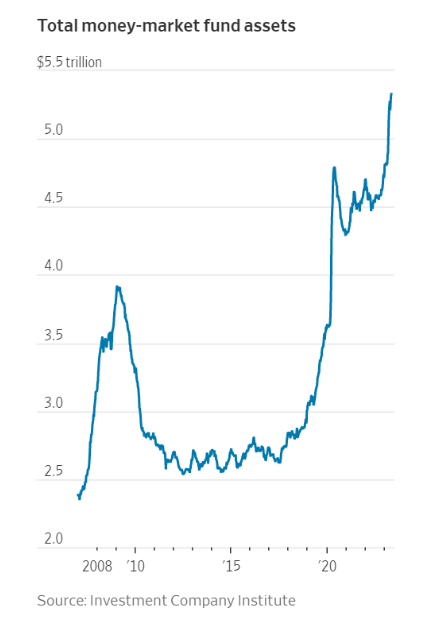

On today’s show, we discuss debt ceiling drama, the best long-term investment, money market funds, catching a falling knife, 24 hour trading, why workers are happier than ever, the greatest wealth transfer in history, why wealth inequality will get worse, the best new movie we’ve seen in a long time and much more.

If everything is so bad why are most people happy?