The economic recovery following the Covid-induced recession in early-2020 has climbed the proverbial wall of worry.

We’ve experienced the strongest labor market in a generation but the vibes have been off for a while now.

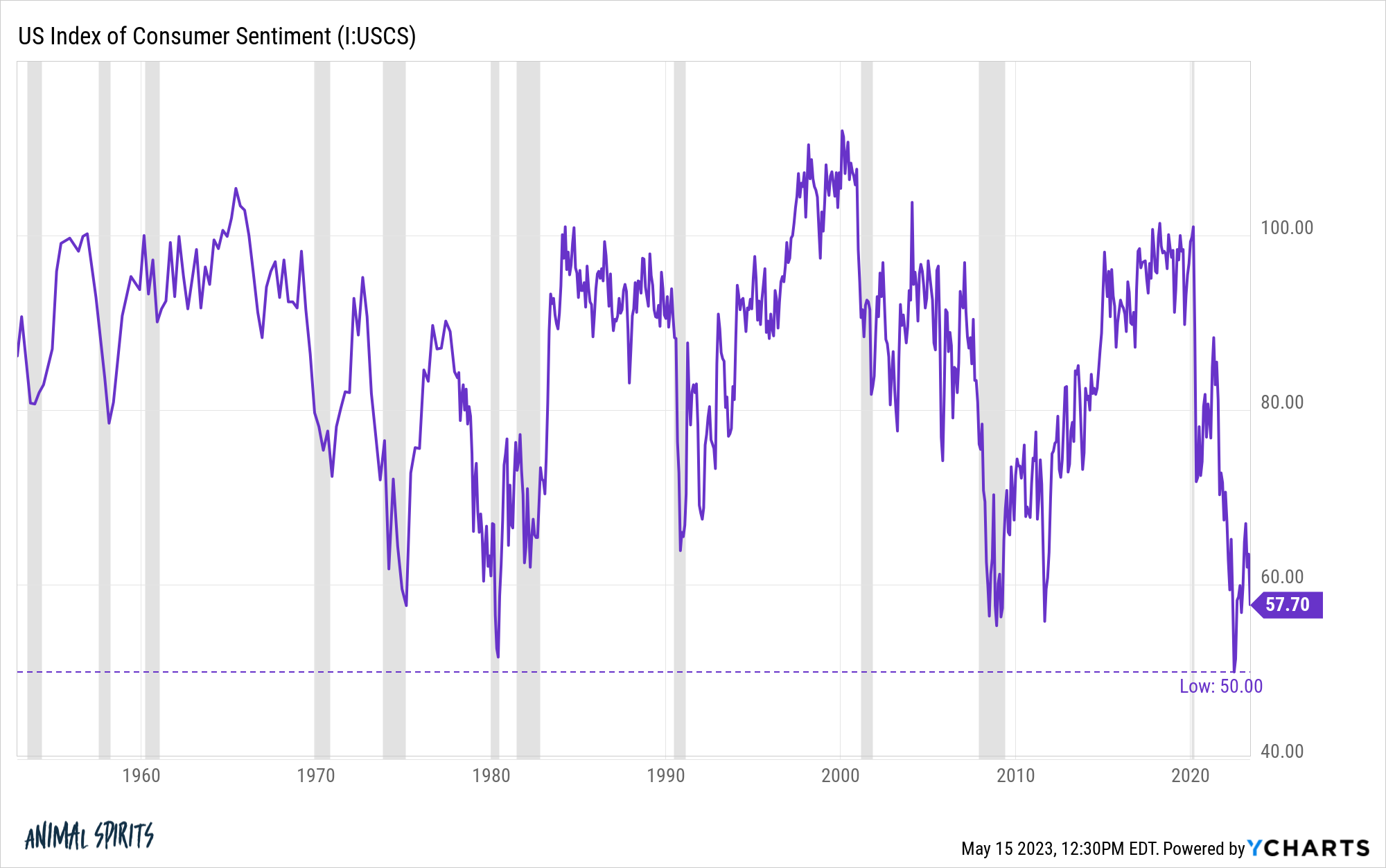

Last summer the University of Michigan index of consumer sentiment hit its lowest level on record:

That’s lower than it was during the 2008 financial crisis, lower than it was in the early-1980s when inflation was nearly 15% at the peak and lower than it was in the 1970s which was one of the most challenging decades we’ve ever faced economically speaking.

We’re off the lows but sentiment readings remain near levels last seen in 2011 and 2008.

Consumers are spending money but they don’t seem all that thrilled about it.

Inflation certainly plays a role here. People really hate upside volatility in price levels.

But it’s bizarre to see sentiment this low with the unemployment rate at its lowest level since 1969. Especially when it seems like people are relatively happy right now in other areas.

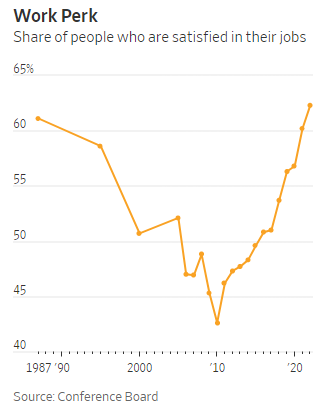

The Wall Street Journal shared data last week that shows workers are happier with their work situation than they’ve been in decades:

Rising pay helps but the happiest workers are those who switched roles during the pandemic and/or found a company that would allow them to work remotely for at least part of their schedule.

It seems we’ve reached a place where most people are happy with their own situation but assume everything else is all screwed up.

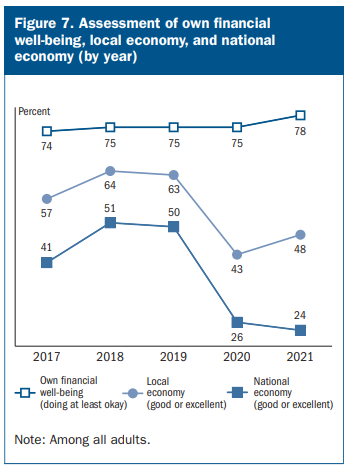

The Federal Reserve’s latest report on the economic well-being of Americans bears this out:

Most people report feeling good about their own financial situation but are worried about the economy at the local and national levels.

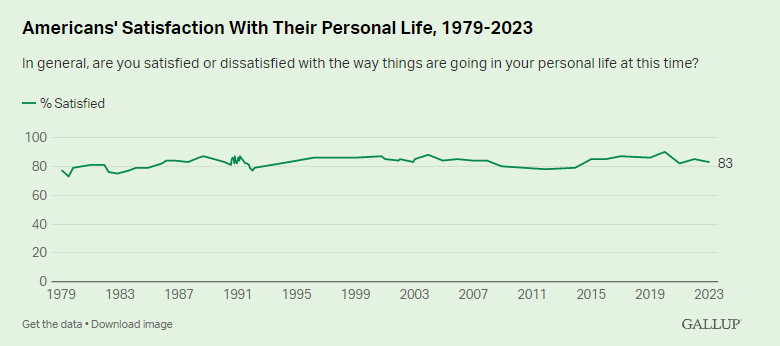

Gallup has another survey that looks at satisfaction from a variety of factors related to your personal life:

Most people seem pretty satisfied with their own circumstances.

These results are surprisingly constant over the years as well:

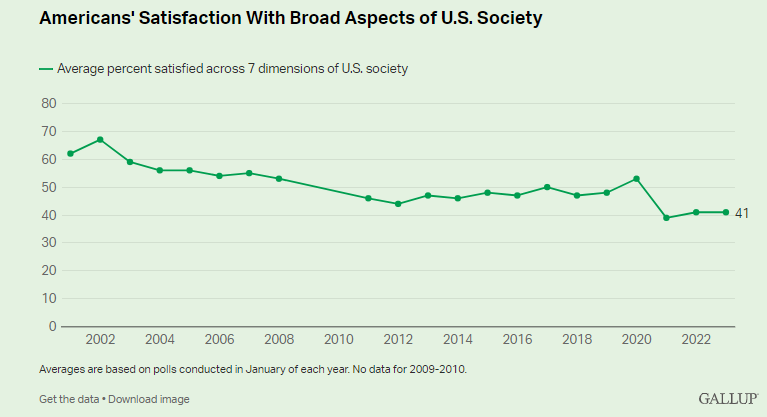

But when it comes to the country as a whole, Americans are not nearly as optimistic:

The trend has been moving down for a while now but it’s crashed since the start of the pandemic.

I’m fine but everything else is terrible seems to be the default assumption for most people these days.

The pandemic has obviously had an impact on how people generally feel about the state of the world and not in a good way.

But it is weird that most people seem satisfied with their life in general but assume everyone else must be miserable.

Why is this the case?

Part of it could be survey error.

I honestly don’t know how they find people to take these surveys. Maybe it’s like a Yelp or Amazon review where you only get the extremes — they either love it or hate it.

We also live in a world where our negativity bias is constantly being put to the test.

Our brains haven’t evolved to handle the deluge of bad news we now receive on a regular basis. Before 24/7 news, social media and alerts on our smartphones, most people simply weren’t aware of all the bad stuff occurring in the world.

Things aren’t perfect these days but the bad stuff gets far more attention from the news organizations and social media.1

Even if bad stuff still occurs, the world is getting better every day but most people assume it’s getting worse. Point out 5 ways the world is getting better over the long-run and people can easily come up with 50 ways it will get worse in the short-run.

Part of the problem is it will always seem like there are more ways for things to go wrong than right with the world at large.

This makes it much harder to use sentiment indicators as a financial signal.

Everyone can say they are bearish because it sounds like a more intelligent argument but if you still have the majority of your money in risk assets, you’re just a paper bear.

Actions are more important than words when it comes to gauging sentiment.

Further Reading:

50 Ways the World is Getting Better

1I don’t place all of the blame on these organizations either. We’re the ones who continue consuming this content.