As of Wednesday’s close, NVIDIA had a market cap of $755 billion.

Just one day later, the chipmaker sported a market cap of $939 billion.

That one day gain of $184 billion itself is bigger than the market caps of companies like Nike, Comcast, Disney and Netflix.

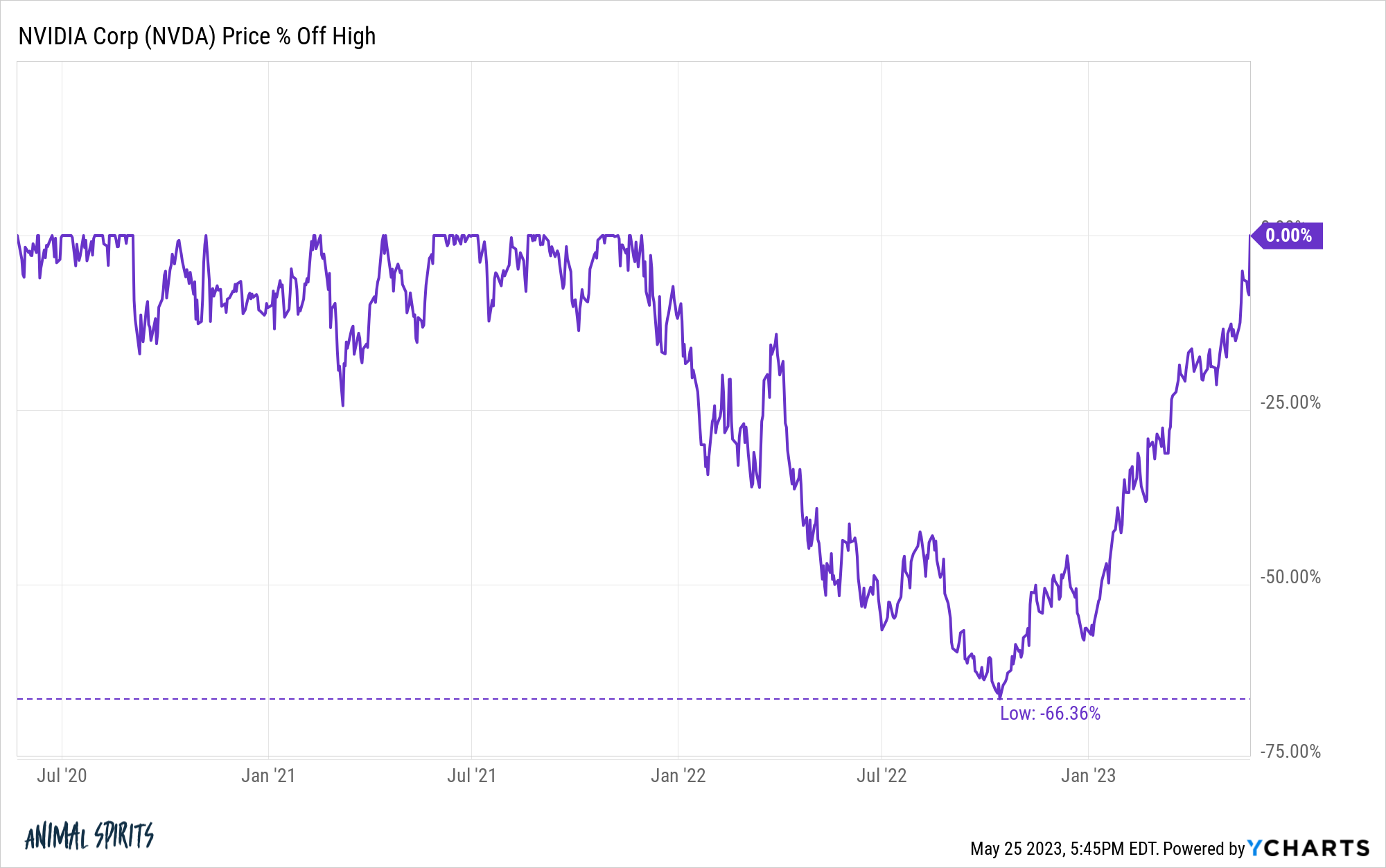

It’s hard to believe this is a stock that had lost two-thirds of its value from all-time highs during the tech wreck last year:

Those losses have all been completely erased following the one day gain of 24% in the stock following a blowout earnings report.

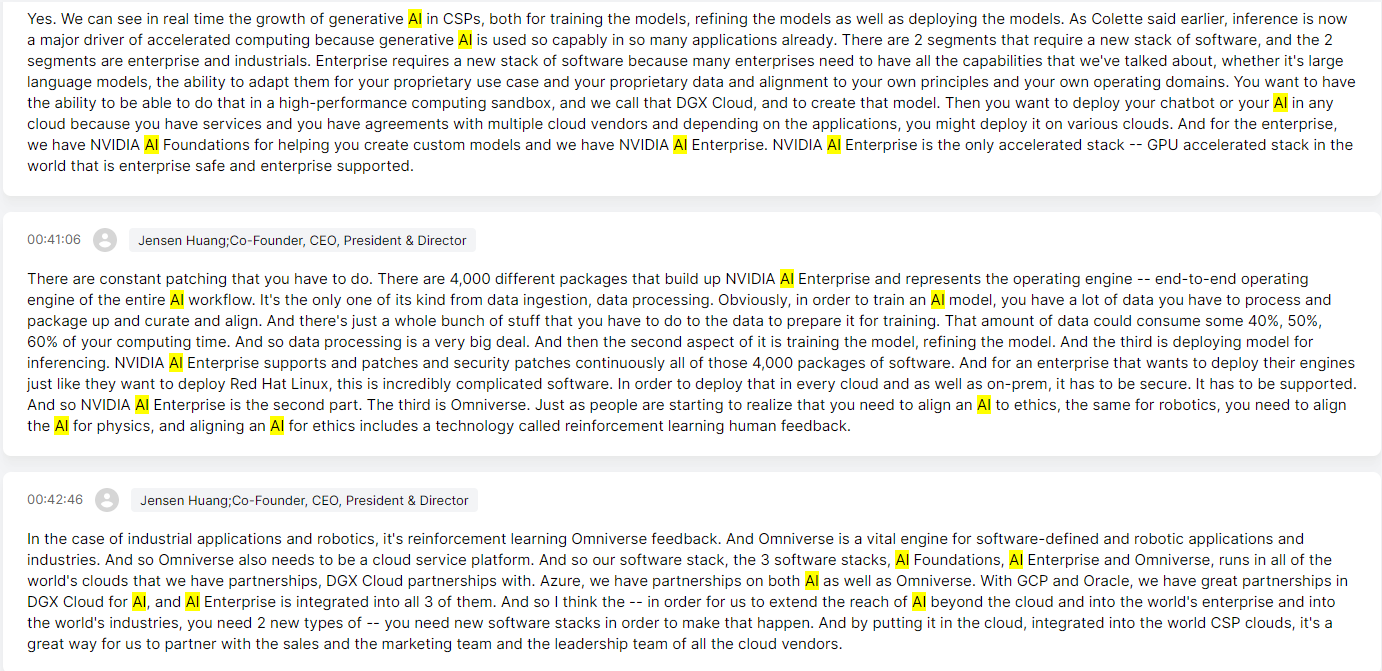

The reason for the ridiculous comeback in NVIDIA’s share price becomes glaringly apparent when you see how many times AI was mentioned during the analyst call:

By my count (with a little help from Quartr), AI was mentioned well over 100x by management and analysts during the call.

The AI boom seems to have come out of nowhere but now that everyone is aware of the potential it’s all we hear about.

One analyst who covers the company noted, “There’s a war going on out there in AI, and Nvidia today is the only arms dealer out there. So as a result we’re seeing this huge jump in revenues.”

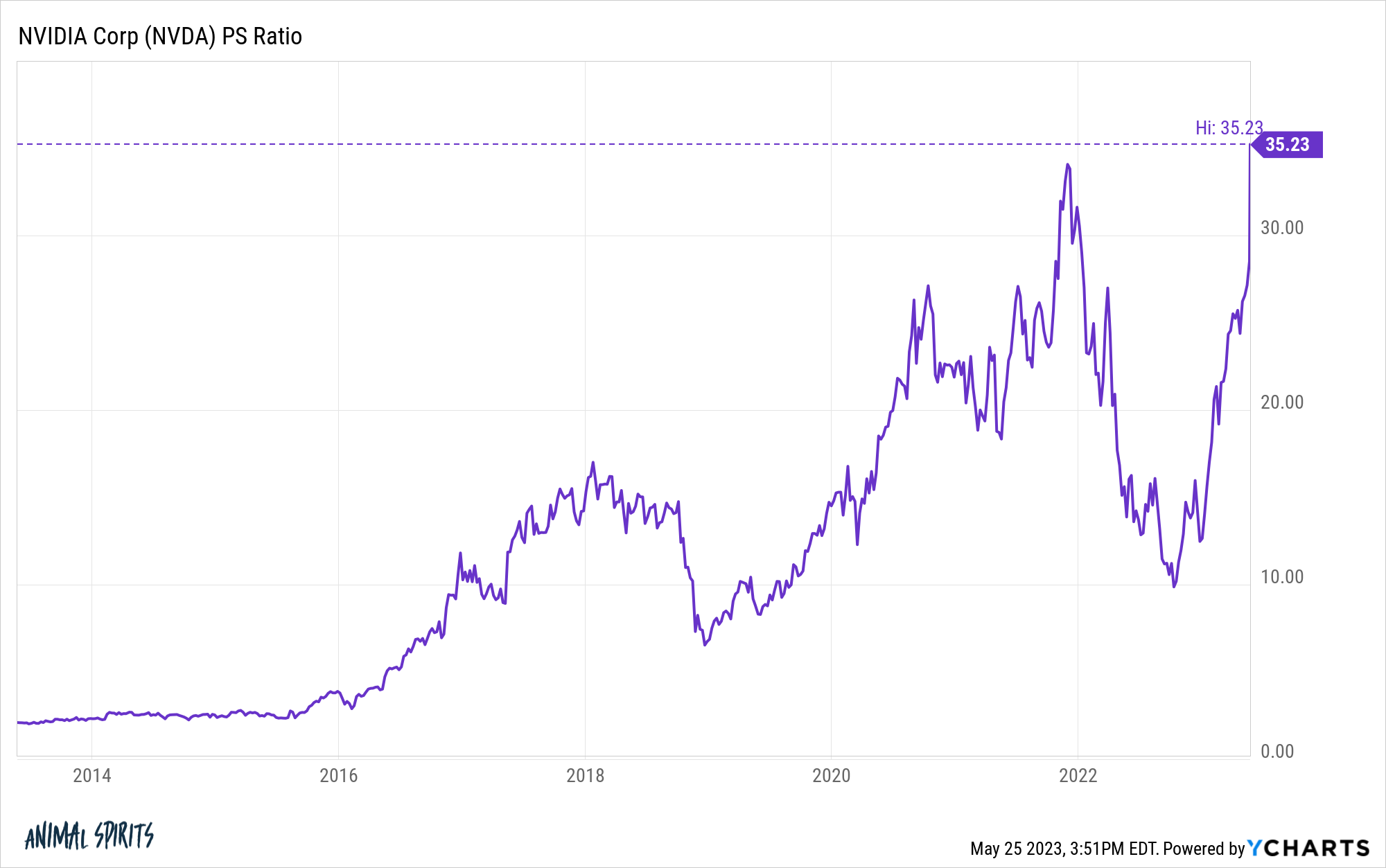

If we use the price-to-sales ratio as a valuation measure here, investors aren’t exactly waiting around for future sales to come in.

Shares now trade at more than 35x sales:

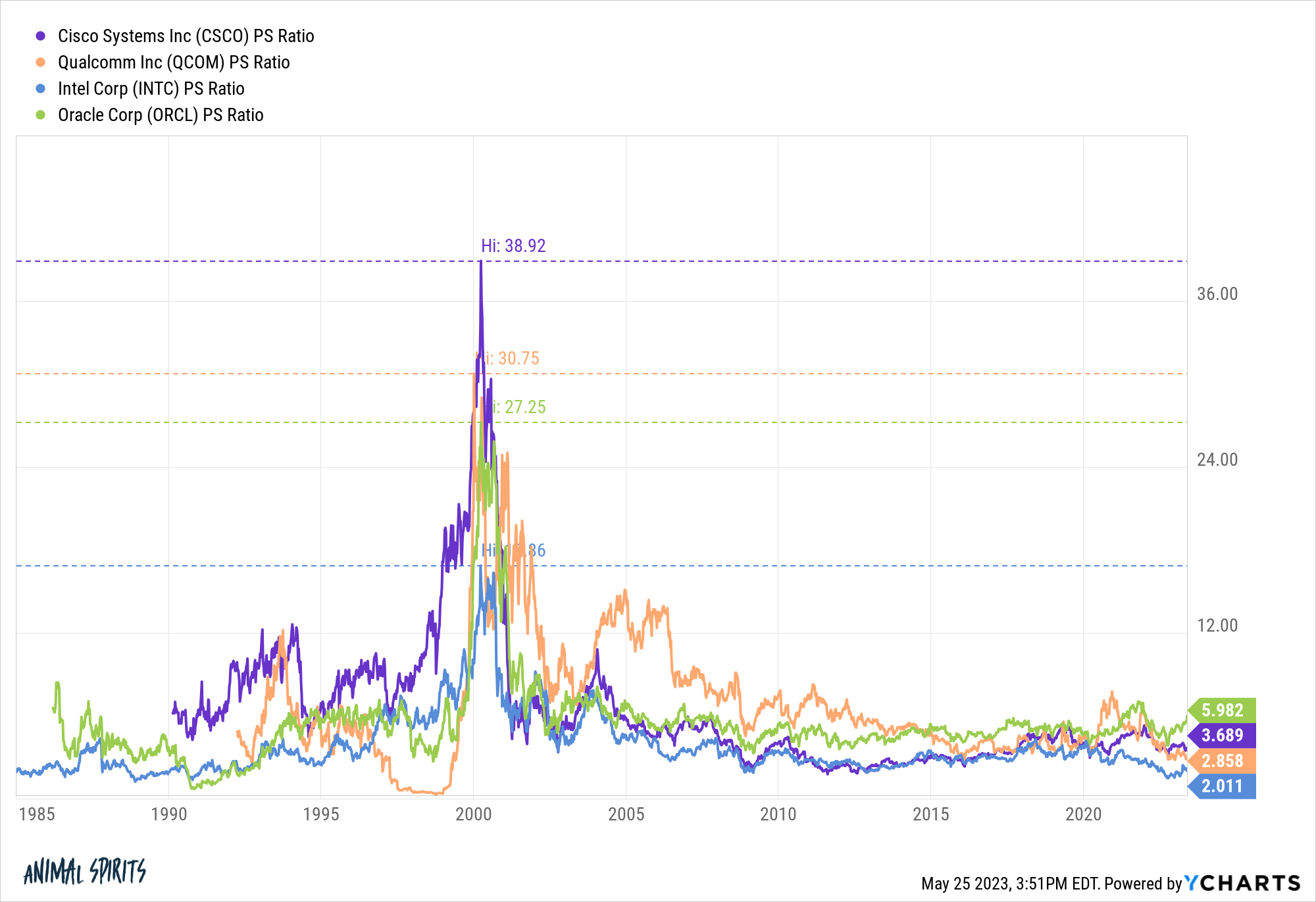

To put this number into perspective, look at the highest P/S ratios for Intel (16.9x), Oracle (27.3x), Cisco (38.9x) and Qualcomm (30.8x) during the height of the dot-com bubble:

To be fair, NVIDIA just reported quarterly sales of more than $7 billion and guided for more than $11 billion for the next quarter.

But it’s clear investors are already beginning to price in the potential gains from AI.

Steve Cohen talked about AI as a bullish catalyst for the stock market at a conference this past week:

Steve Cohen said investors are too worried about a market downturn and that focusing too much on recession odds may cause them to miss the “big wave” of opportunities brought on by artificial intelligence.

“I’m making a prognostication — we’re going up.” said Cohen, founder of hedge fund Point72 Asset Management and owner of the New York Mets, according to people who heard him speak at a private SALT iConnections New York conference event Tuesday at Citi Field. “I’m actually pretty bullish.”

I don’t pretend to be an expert on AI but I have read a few threads about it on Twitter and even a Bill Gates piece:

The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone. It will change the way people work, learn, travel, get health care, and communicate with each other. Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it.

If it makes us even 50% as productive and efficient as some proponents are predicting, it seems inevitable this will lead to a bubble.

We cannot help ourselves when it comes to new and exciting technologies.

The creation of fiat currencies and new types of equity investments led to the South Sea bubble in the 1700s.

The introduction of trains led to the railway mania of the 1800s.

The explosion of new consumer and investment products led to the Roaring 20s.

The advent of the internet led to the dot-com bubble of the 1990s.

Each of these innovations ended up changing the world in many ways. But the speculation that occurred in the early stages of those innovations led to huge booms and painful busts to get there.

There are no guarantees when it comes to the financial markets but human nature is the one constant across all market environments.

If AI really is as transformative as Bill Gates and others believe, it’s hard to see investors reacting to it in a cool and calm manner.

I could be wrong. Maybe it won’t infect the entire market. Maybe there will just be a handful of stocks like NVIDIA that benefit.

But I would be surprised if we don’t get another asset bubble in the coming decade if AI lives up to the hype.

Buckle up.

Michael and I talked about the potential for an AI bubble and much more on this week’s Animal Spirits:

If you like those stylish Animal Spirits Tropical Brothers shirts we’re wearing you can buy one here. Proceeds from every sale go to No Kid Hungry.

Here’s what I’ve been reading lately:

- A new way of thinking about aging (Stanford Business)

- Life cannot be avoided (Monevator)

- The liabilities of success (Dollars & Data)

- How a 401k loan actually works (Belle Curve)

- The value of I don’t know (Capital Allocators)

- Why haven’t housing prices fallen more? (Discipline Funds)

- One last curtain call for Succession (The Ringer)