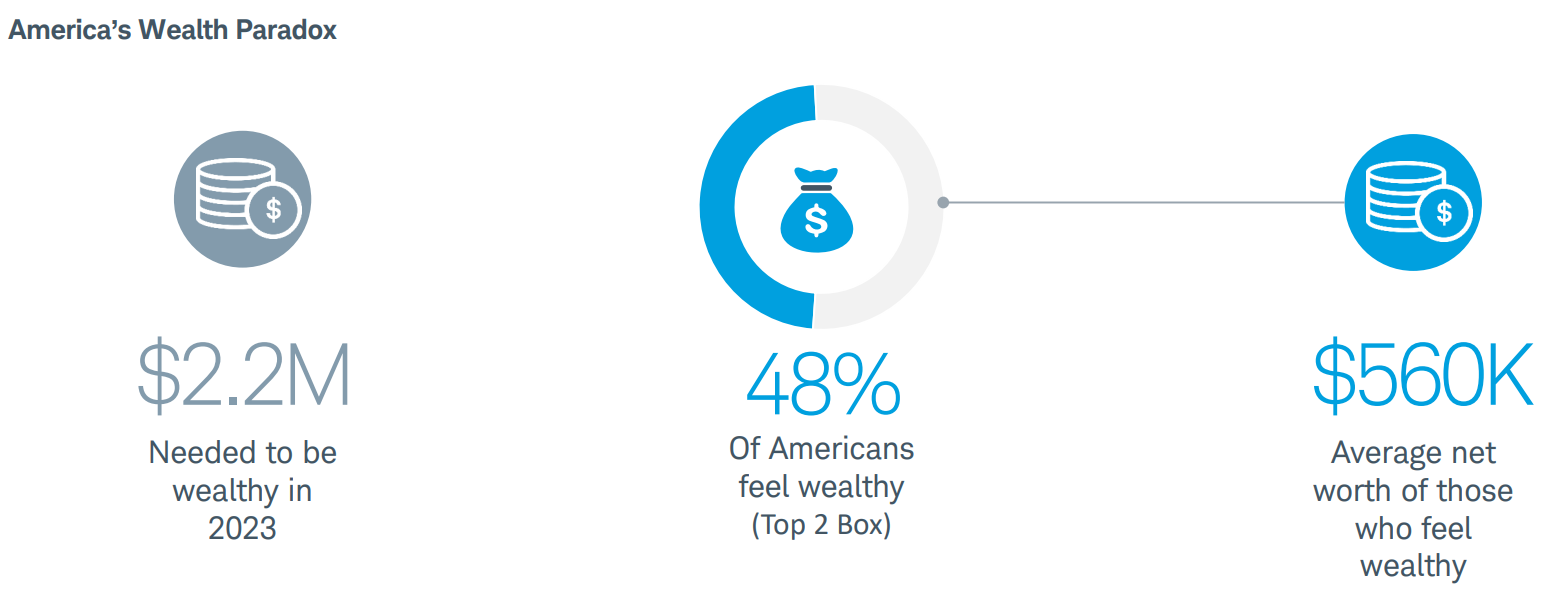

Wealth is a relative feeling. Some people compare their level of wealth to other people. Some people compare their level of wealth to their previous levels of wealth. Some people think of wealth in terms of the material possessions they own. Some people think of wealth in terms of how much money they make. Some…