Wealth is a relative feeling.

Some people compare their level of wealth to other people.

Some people compare their level of wealth to their previous levels of wealth.

Some people think of wealth in terms of the material possessions they own.

Some people think of wealth in terms of how much money they make.

Some people think of wealth in terms of what they get trade it for.

And some people compare their level of wealth to a number or benchmark that they think will make them feel wealthy.

The weird thing about money is that there can be a big difference between how much you think you need to feel wealthy and how the money actually makes you feel at certain levels of net worth.

A lot of it depends on your personality and emotional make-up.

One of the go-to behavioral finance studies showed that levels of happiness rose until you made roughly $75,000 per year but beyond that your contentment plateaued.

The idea is that once you’re comfortable more money won’t necessarily make you any happier.

A new study from researchers at the Univesity of Pennsylvania looked at this idea from a different angle.

They broke their subjects down into different levels of well-being before looking at how money impacted their happiness.

For instance, the least happy group of people did see their happiness level rise up until they made $100,000 but they experienced no meaningful bump from that point on. You can make a lot of money but if you’re a miserable person more money is not going to make you any less miserable.

However, if you look at those in the median range of emotional well-being, happiness did increase with higher levels of income in a linear fashion.

And the people who scored in the upper echelon of well-being, their happiness actually accelerated as they made more than $100,000.

Basically, people are complicated and so is our relationship with money and happiness.

Of course, income is not the same thing as wealth. Making money is one thing but keeping it is another.

But net worth is all tied up in feelings as well.

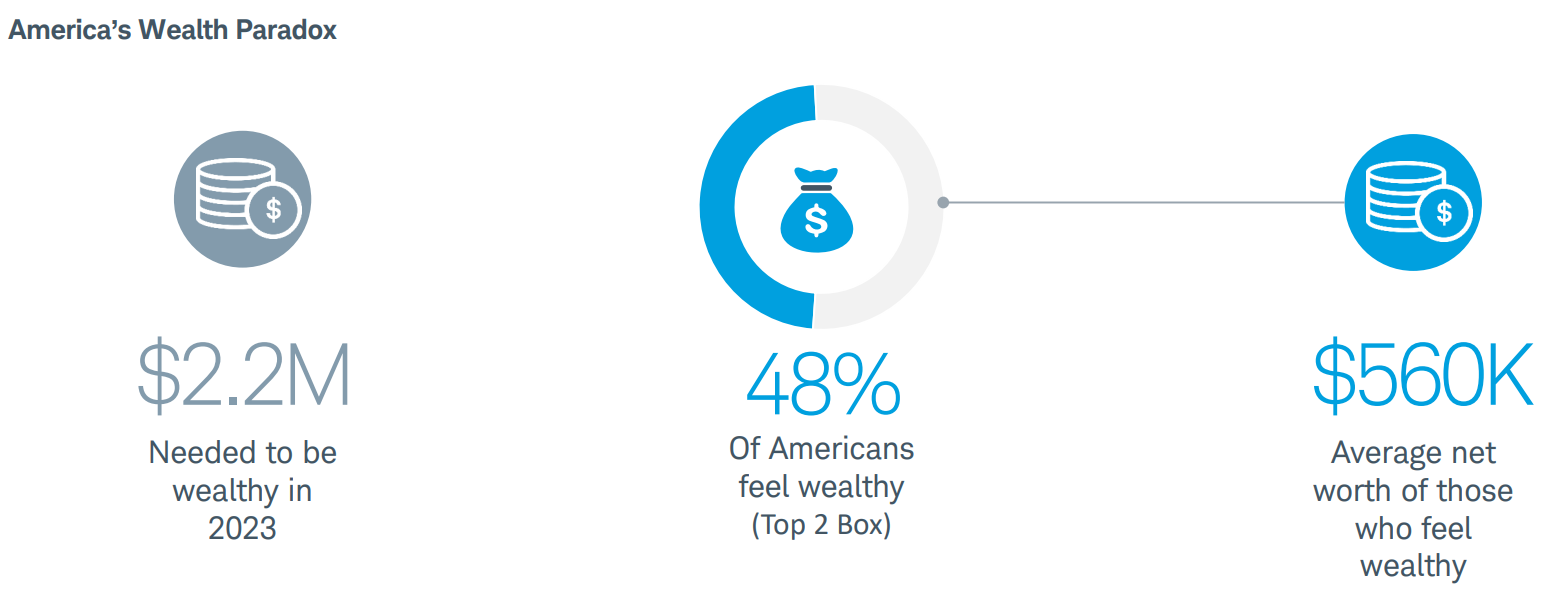

Charles Schwab just released their newest Modern Wealth Survey which asked people how much money it would take to be considered wealthy.

The average answer was $2.2 million.

If we include home equity, having a net worth of $2.2 million would put you in the 94th percentile of households in the United States.

This would mean only 6% of households would make the cut-off to be considered wealthy.

Interestingly enough, although the number to be considered wealthy was $2.2 million, almost half of the respondents to this survey said they already feel wealthy but this group has an average net worth of $560,000.

Maybe most people don’t need as much money as they think?

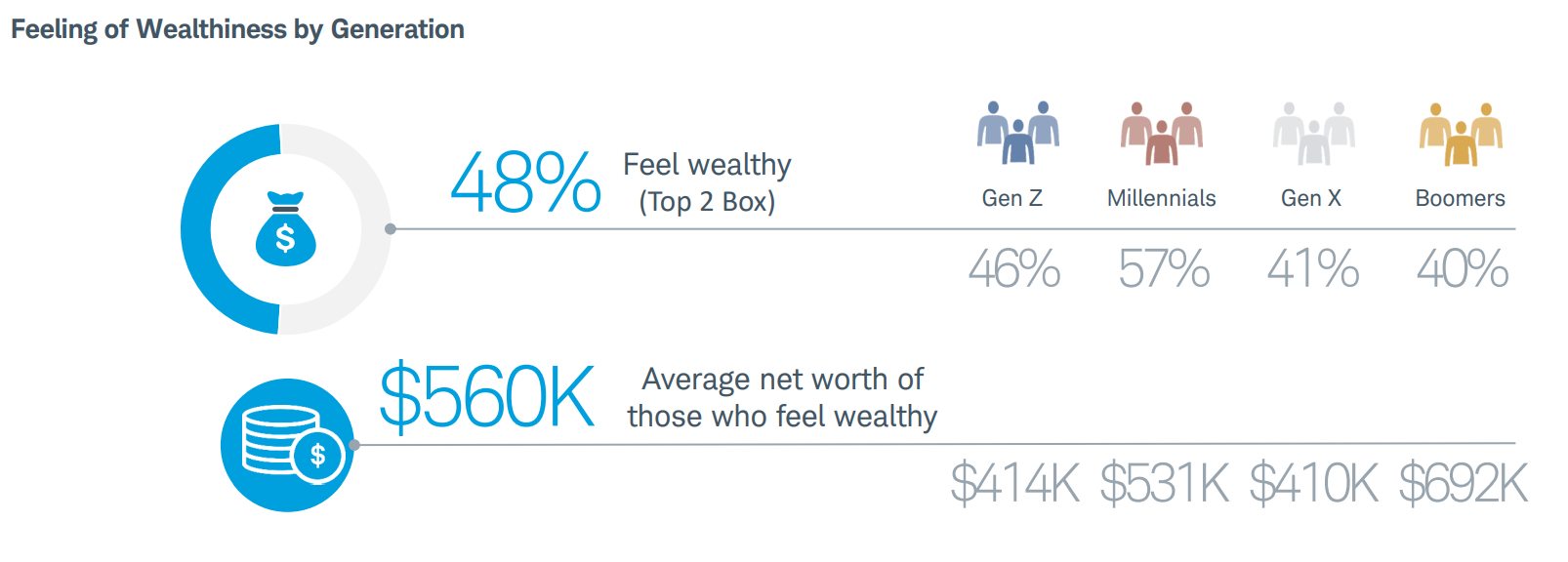

It’s also interesting to look as these results by generation:

Millennials “feel” the most wealthy if we segment things out by generation. That’s surprising to me considering how many stories we see about young people who have fallen behind.

Maybe you can chalk this up to the fact that surveys are inherently unreliable but it’s also possible people just have a complicated relationship with money.

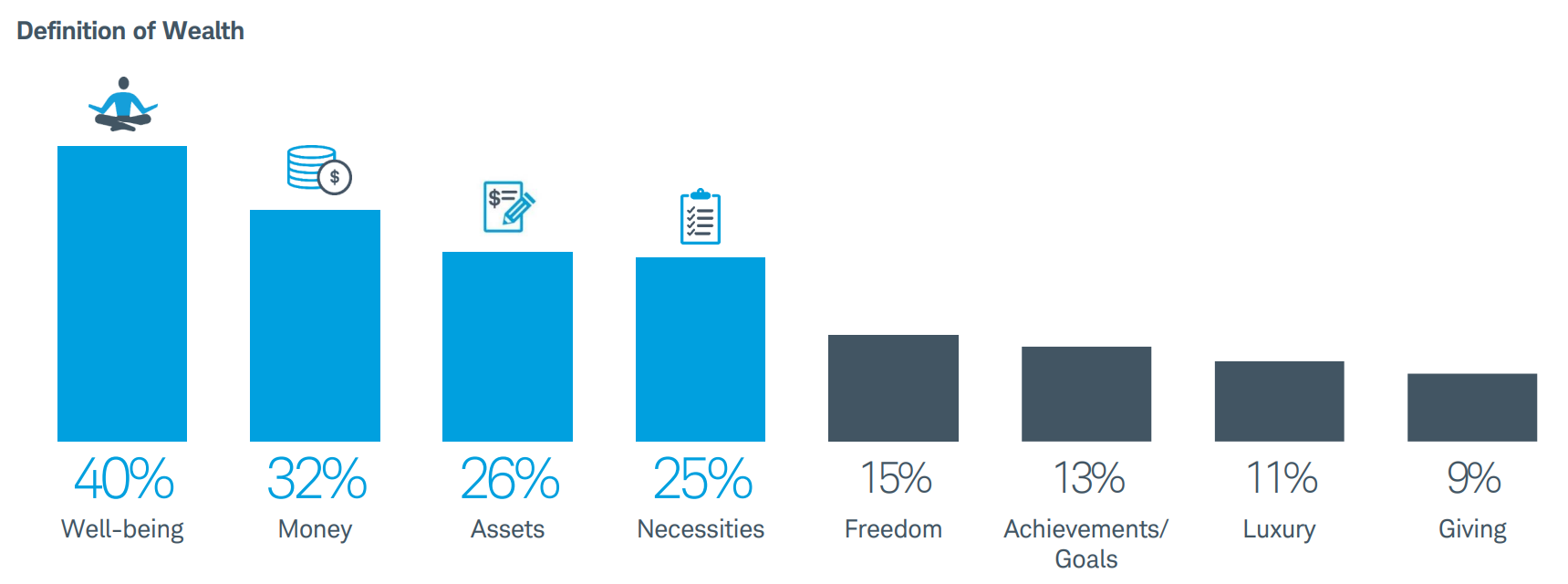

Schwab also asked people how they define wealth:

Just like the income-based study, we’re back to well-being as the most important variable for wealth.

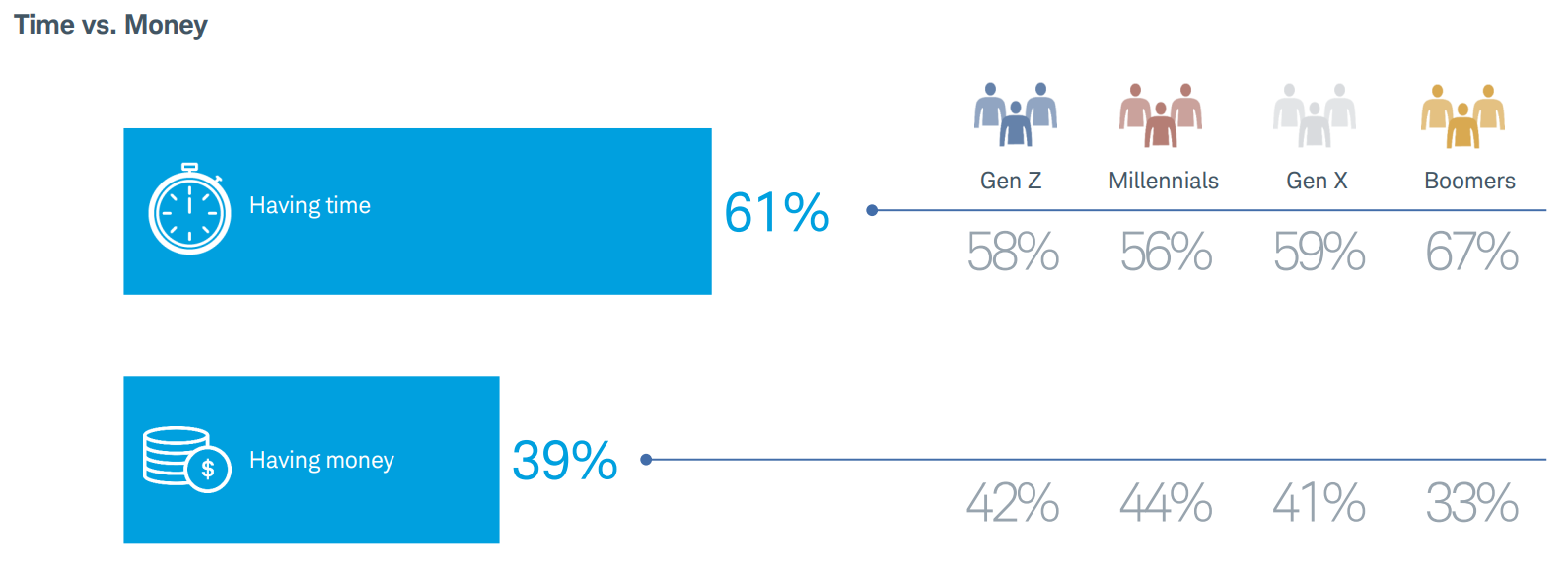

And when asked what being wealthy means to you more people answered time than money:

You can poke holes in academic research papers and surveys if you like.

These things aren’t ironclad by any means.

But I think it’s fair to say that wealth is complicated.

Most people probably don’t know how much money it will take to make themself feel happy when it comes to income or net worth.

Wealth also means different things to different people.

Everything is relative including your paycheck and the market value of your portfolio.

It’s important to understand that your emotional make-up will have a lot to say about how you feel about money and how money will impact your happiness.

I honestly don’t buy the idea that money doesn’t buy happiness.

Money can fix a lot of problems in terms of comfort and convenience.

But your personal preferences and internal wiring will likely have a bigger impact on your relationship with money and happiness than some number.

Further Reading:

If You’re Still Worried You Aren’t Wealthy