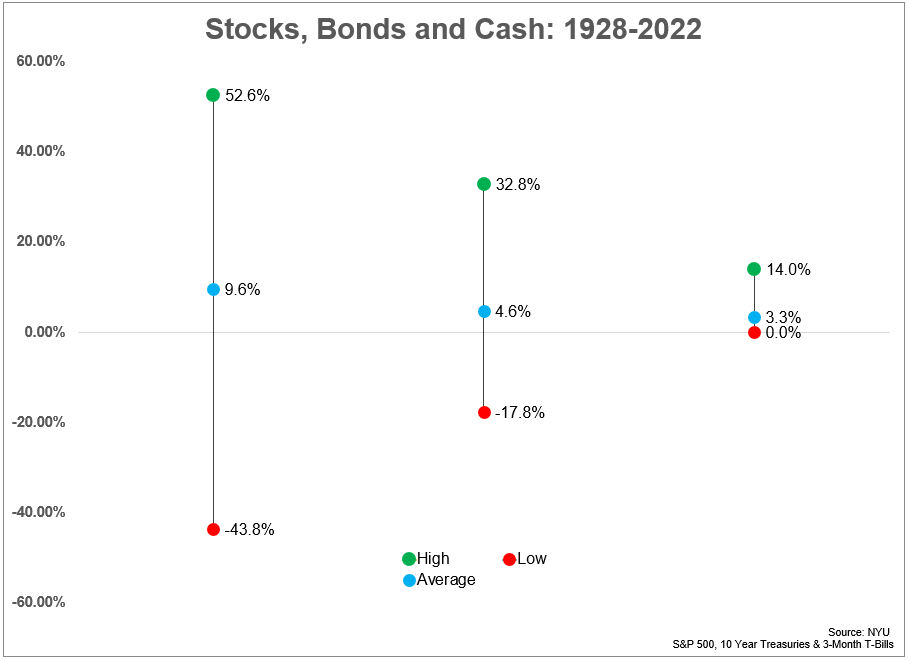

Each year Aswath Damodaran at NYU kindly updates the annual returns for stocks (S&P 500), bonds (10 year Treasuries) and cash (3-month T-bills) going back to 1928. I love this data because stocks, bonds and cash are the building blocks of asset allocation.1 Sure, you can add other asset classes and strategies but those three…