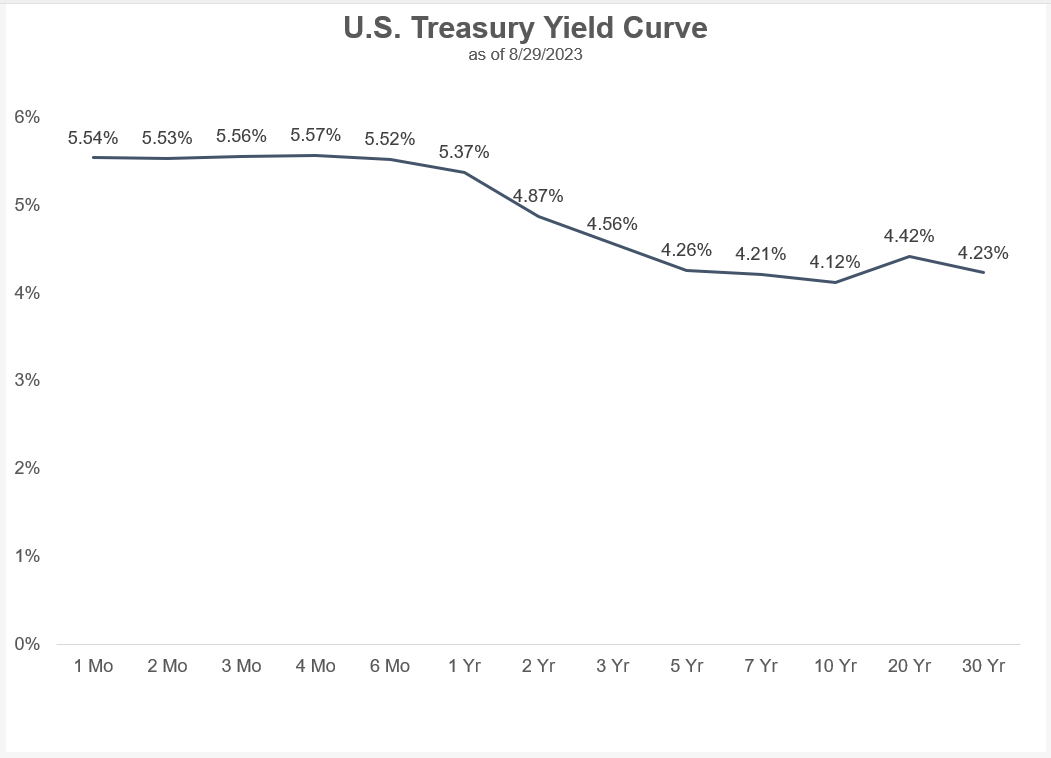

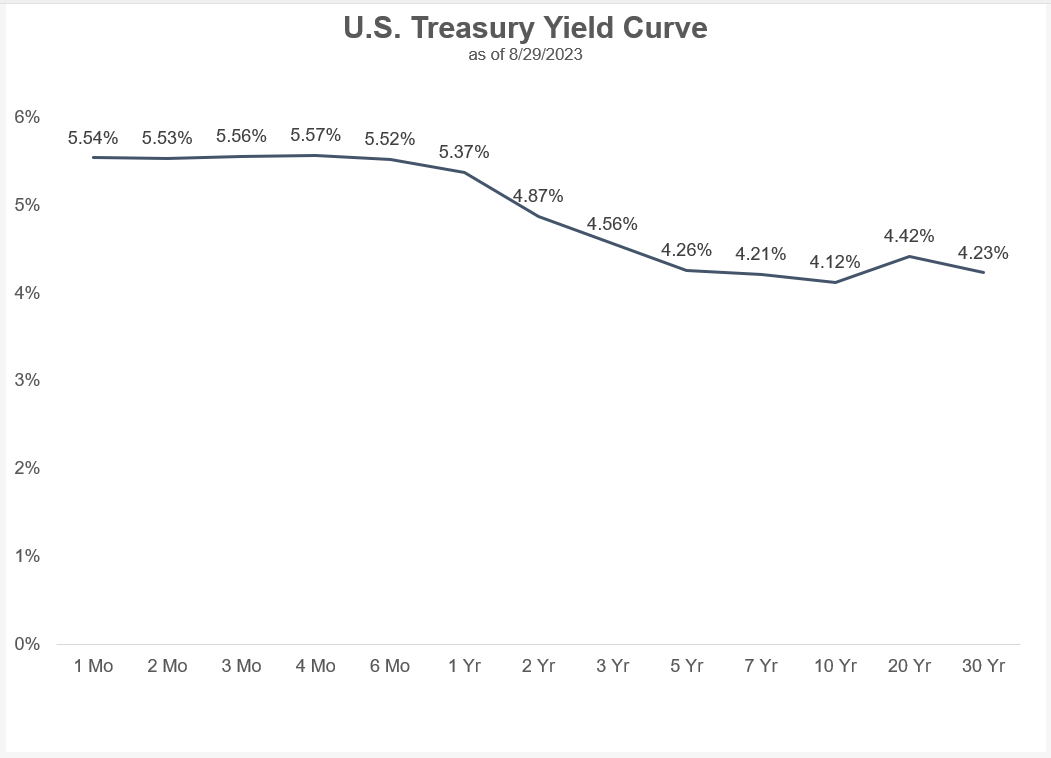

Yields have finally gotten to the point where bonds look attractive again.

Yields have finally gotten to the point where bonds look attractive again.

On Today’s Show we discuss:

– The outlook for the 60/40 portfolio

– Dollar cost averaging into a bear market

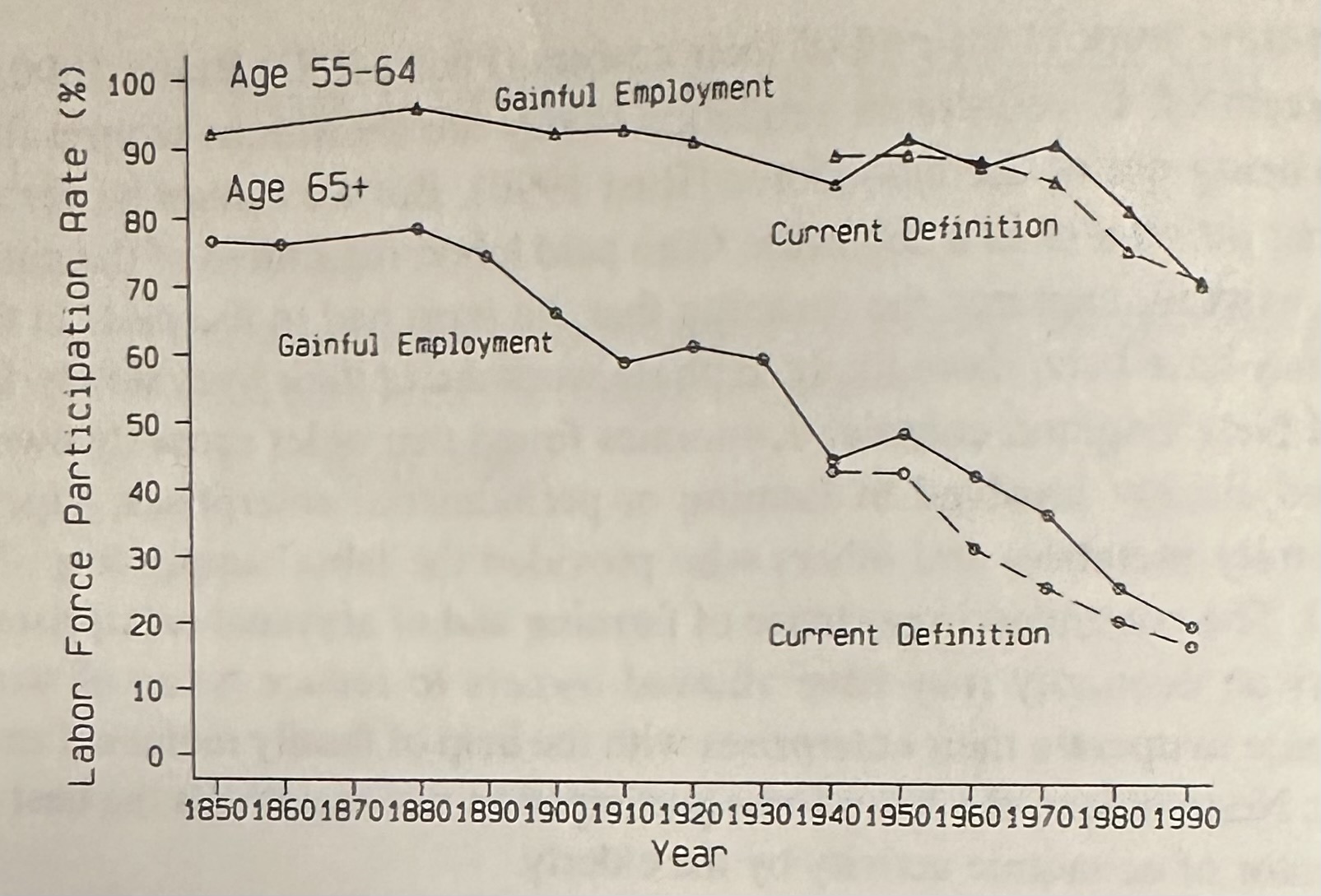

– The evolution of retirement

– The best age for making good financial decisions

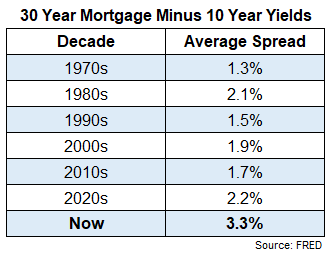

– The Fed cannot fix the housing market

– How HGTV ruined housing prices

– Hedging climate change risk, and more!

Why retirement is still a relatively new concept.

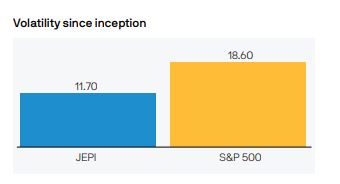

On today’s show, we had Hamilton Reiner, MD, PM, and Head of US Equity Derivatives at J.P. Morgan Asset Management to discuss:

– How $JEPI is constructed

– How volatility affects yield

– Why $JEPI has been so popular, and much more!

Inflation is falling so why are mortgage rates still so high?

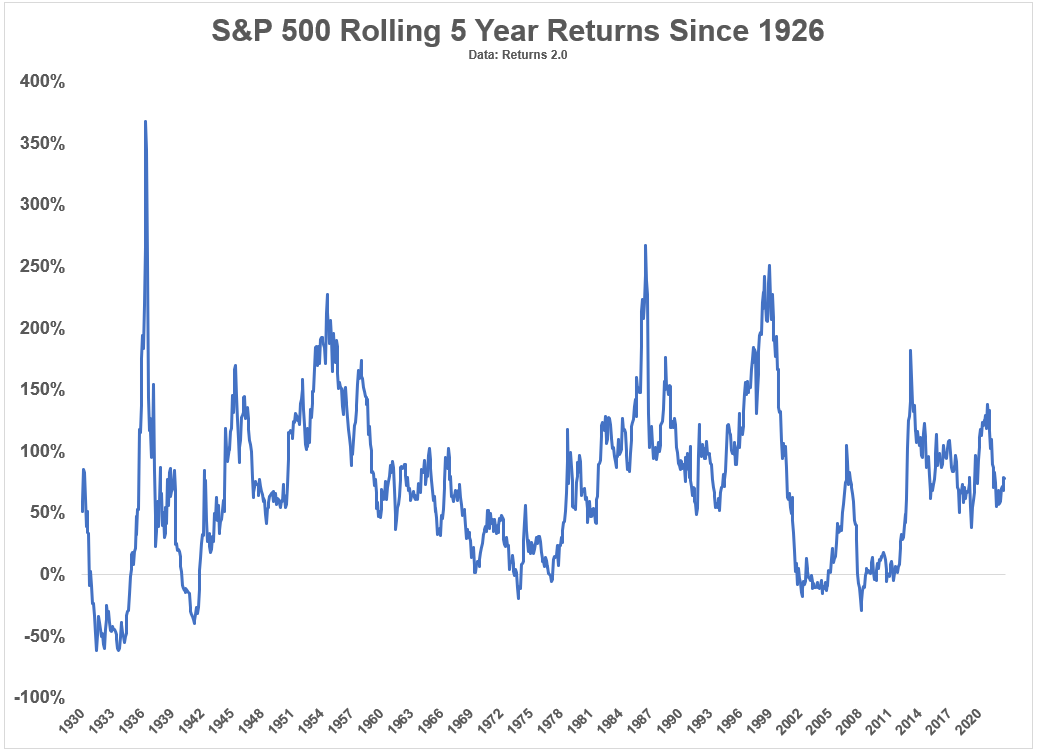

Baby boomers are by far one of the wealthiest generations the world has ever seen. The fact that there are more than 70 million people in this demographic helps but it’s also true that this is one of the luckiest generations in history when it comes to returns on financial assets. These are the total…

Is 5 years a long enough time horizon for investing in the stock market?

On today’s show, we discuss:

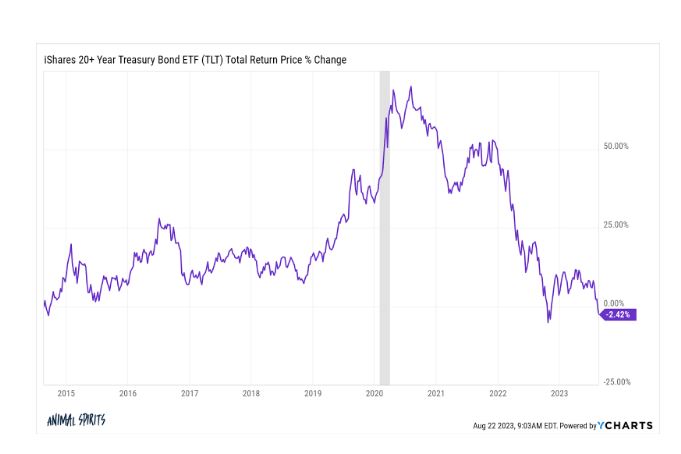

– If bonds are more attractive than stocks right now

– A lost decade for bonds

– Michael Burry’s predictions

– Why the economy is so hard to predict right now

– The latest Netflix documentaries, and much more!

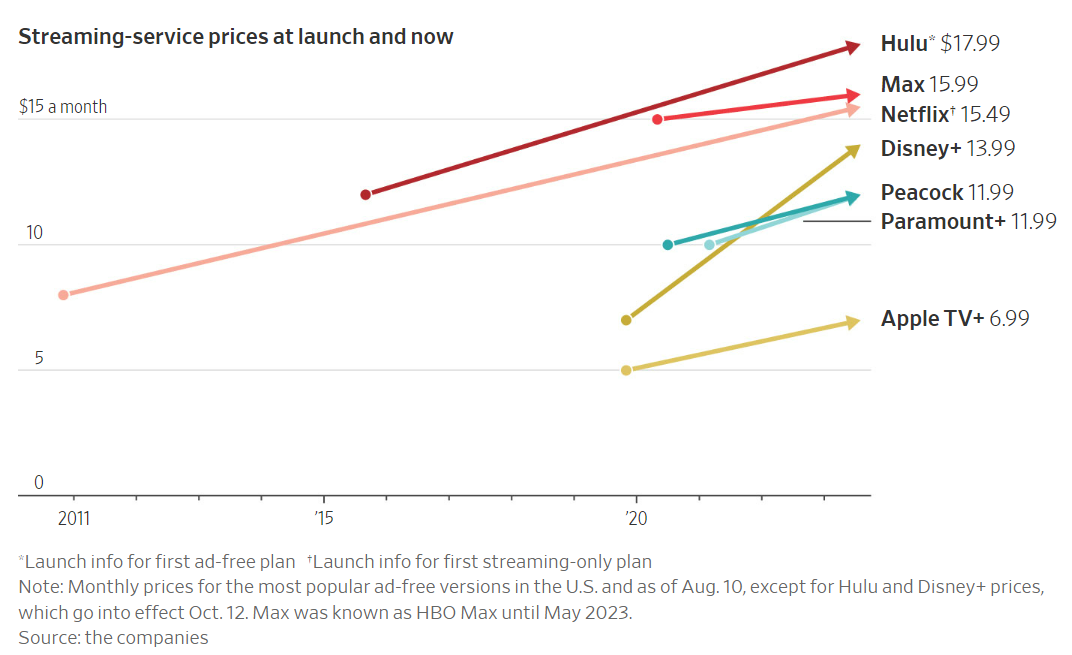

Are streaming services actually underpriced?

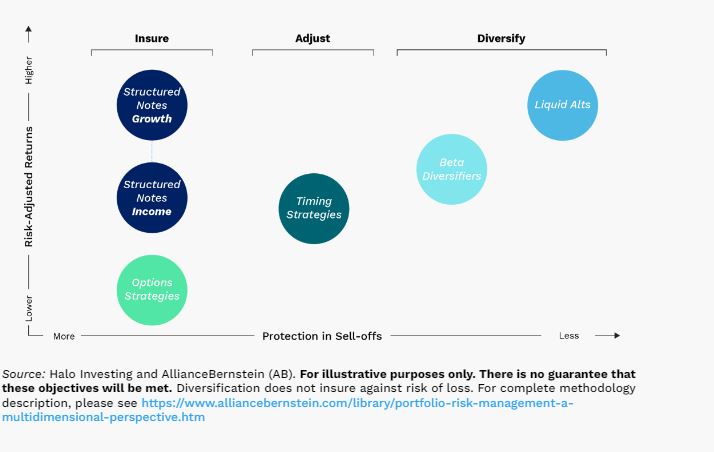

On today’s show, we had Matt Radgowski, CEO of Halo Investing to discuss:

– Customizing your own assets

– Utilizing notes as a hedge

– Latest innovations in defined outcome products, and much more!