People were skeptical of Google when it IPO’d. Amazon’s own employees didn’t think Prime would be a success. Good ideas are often only known in hindsight.

People were skeptical of Google when it IPO’d. Amazon’s own employees didn’t think Prime would be a success. Good ideas are often only known in hindsight.

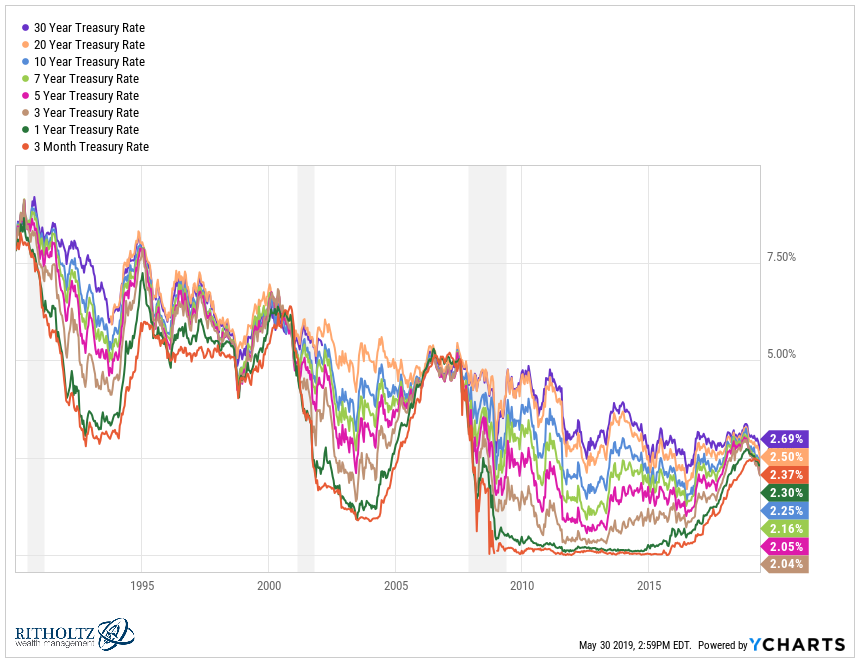

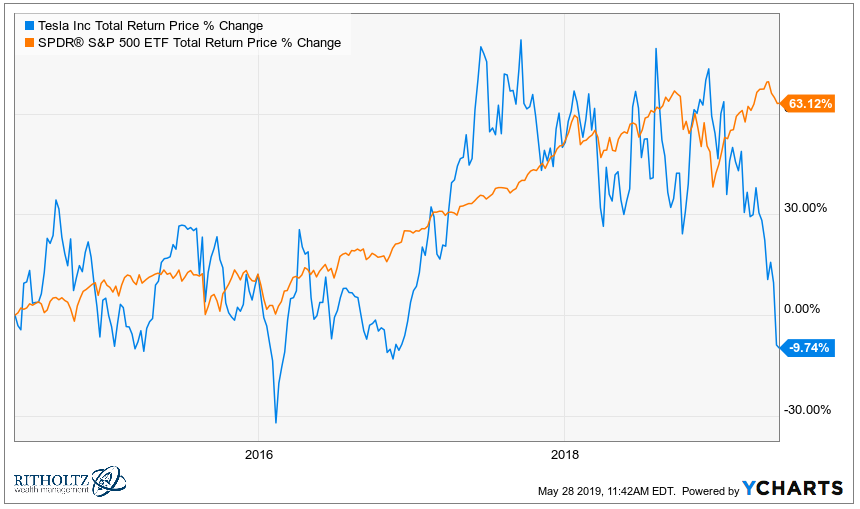

This week’s Animal Spirits with Michael & Ben is sponsored by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: The pogo stick indicator. The poor performance of alternative funds. Tariff impacts on Chipotle. Is the bond market really that smart? Can yields be used to…

Is the bond market really smarter than the stock market? Are bond investors really going to tell us when the next economic downturn is coming?

On this edition of Re-Kindled, Michael and Ben dive into the classic book Where Are the Customers’ Yachts? to see how well Fred Schwed’s book has held up.

The S&P 500 has experienced a correction of at least 5% or worse in 65 out of the past 70 years. Corrections are the price of adsmission in stocks.

From the Federal Reserve, this is a history of inflation, deflation, asset prices, national income, booms, busts, recessions and depressions from 1775-1943.

Credit cards can be your best friend or your worst enemy. But there are other benefits that come from credit cards you may not be aware of.

Ben Carlson & Michael Batnick discuss Tesla’s unraveling, what happens during the next recession, why fixed costs matter more than variable costs, what Michael learned from creating a financial plan and much more.

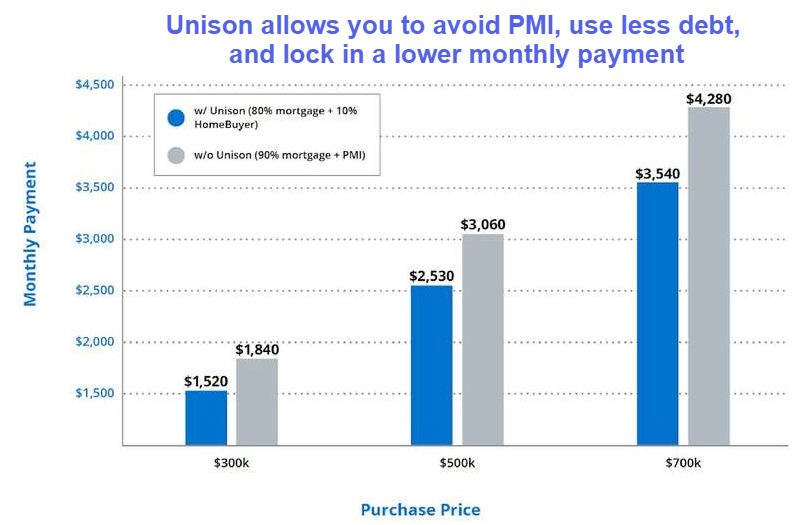

A home is the biggest purchase most people ever make in their lives but it involves a ton of risk. Here’s a potential solution to hedge those risks.

Today’s Animal Spirits: Talk Your Book is presented by Unison: We discuss: The hardest part of buying a home for most people. How long it takes to save for a down payment. The average loan-to-value for mortgages. Why the middle class may need to tap into their home equity for retirement. Residential real estate as…