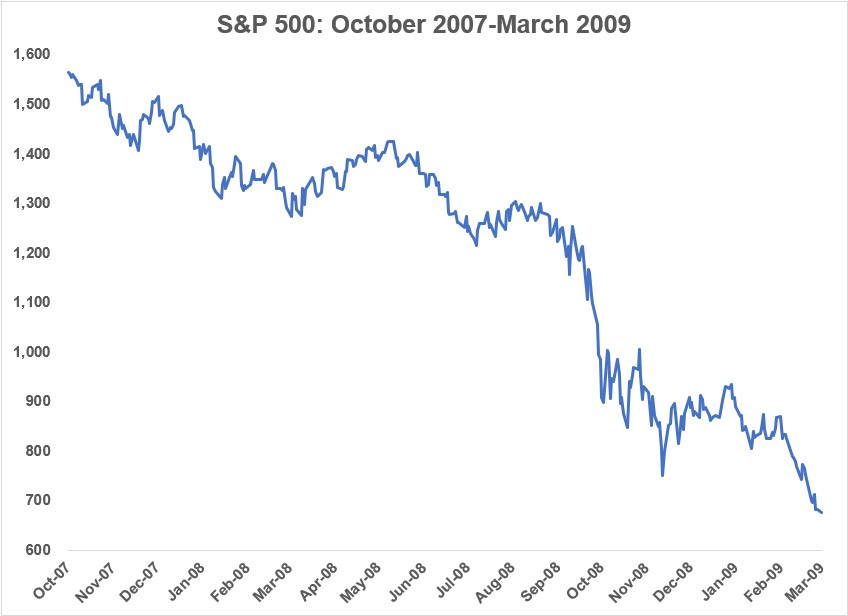

Advice for those who are still sitting in cash since the Great Recession.

Advice for those who are still sitting in cash since the Great Recession.

In the latest Howard Marks memo he discusses his first dealings with negative interest rates with an investment in Europe in 2014: I had my first direct brush with negative interest rates in 2014, when I was making an investment in Spain. The closing was due to take place on Monday, and I wired funds…

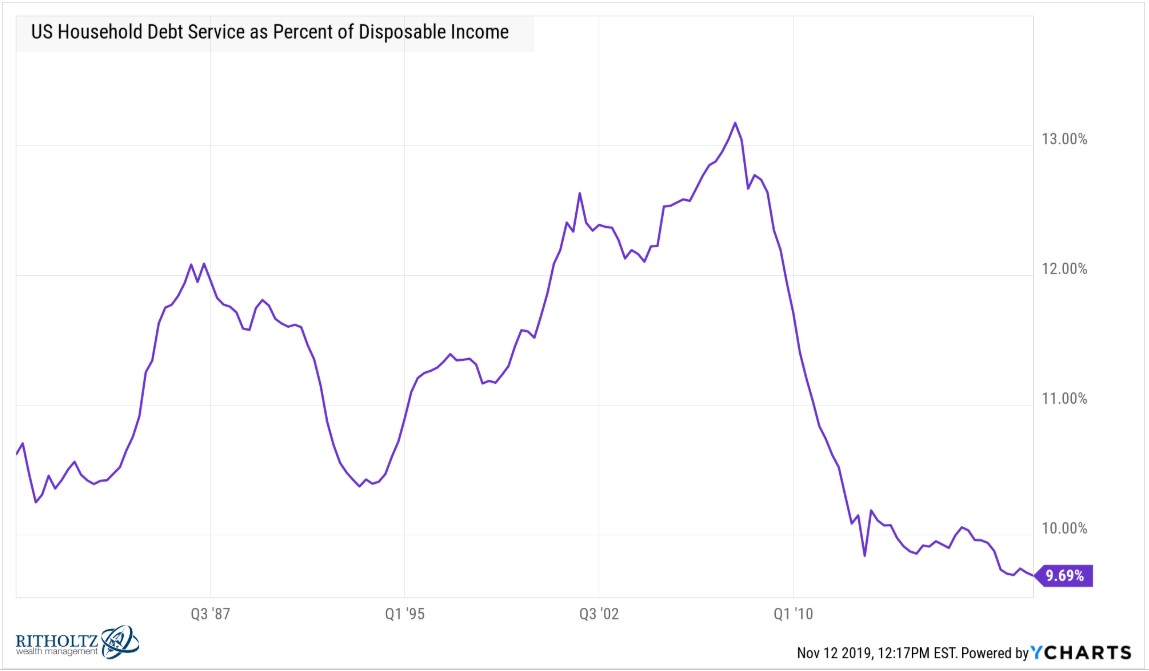

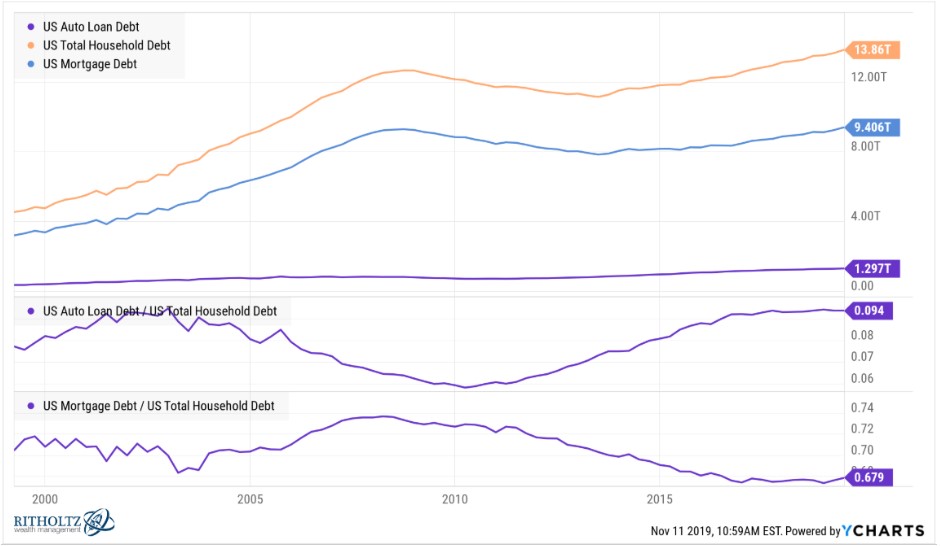

Putting household debt into perspective.

Michael & Ben discuss Disney+, auto loans, Silicon Valley (the show), and much more.

Historically after stocks have a big run-up they continue to rise. But there is a catch…

On this edition of Talk Your Book, we sat down with Dana Cavalea, former strength and conditioning coach with the New York Yankees. We discussed: Why don’t more businesses have their own performance coaches? What happens when you find your dream job at age 23 Managing $300 million in human capital Lessons about work and…

The biggest trends in asset management and how they’re affecting the markets.

Traits shared by the worst investors.

On this Talk Your Book we spoke with the Wall Street Journal’s Greg Zuckerman about his new book The Man Who Solved the Market: How Jim Simons Launched a Quant Revolution. We discussed: Zuckerman’s approach to writing this book Does Medallion have the greatest track record in history? The difference between Ren Tech and high-frequency…

Lessons from Greg Zuckerman’s book on Jim Simons.