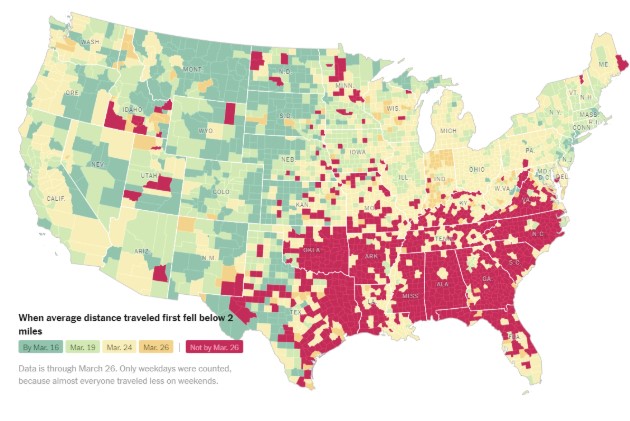

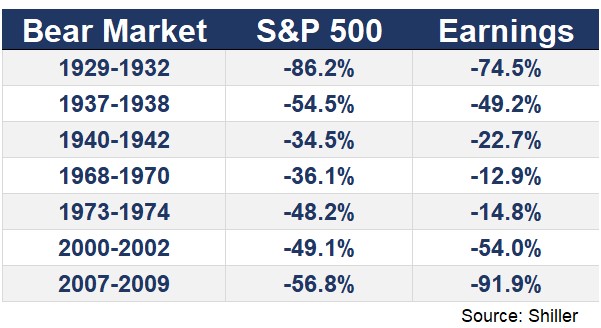

At the lows, the S&P 500 was off roughly 34% from its highs. From those lows it’s now up almost 25%. This is confusing to many investors for a number of reasons: The economy is still effectively shut down for the foreseeable future The unemployment numbers continue to worsen as jobless claims in the past…